modules 31 to 35

... by deflation can only go so far. Liquidity trap is when cutting interest rates cannot occur due to nominal rates close to 0%. ...

... by deflation can only go so far. Liquidity trap is when cutting interest rates cannot occur due to nominal rates close to 0%. ...

CHAPTER 2

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

Kingfisher Annual Report and Accounts 2006/07

... achievable. By the end of the year, two new stores and nine revamped stores were trading in the new format. B&Q plans to convert all the remaining large stores to this format over the next four years, with a further 25 conversions planned for 2007/08. In France, Castorama continued its revitalisatio ...

... achievable. By the end of the year, two new stores and nine revamped stores were trading in the new format. B&Q plans to convert all the remaining large stores to this format over the next four years, with a further 25 conversions planned for 2007/08. In France, Castorama continued its revitalisatio ...

Chapter 15

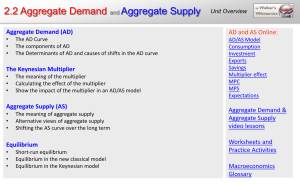

... investment shifts the AE curve upward by $0.5 trillion from AE0 to AE1. 2. Equilibrium expenditure increases by $2 trillion from $9 trillion to $11 trillion. 3. The increase in equilibrium expenditure is 4 times the increase in investment, so the multiplier is 4. ...

... investment shifts the AE curve upward by $0.5 trillion from AE0 to AE1. 2. Equilibrium expenditure increases by $2 trillion from $9 trillion to $11 trillion. 3. The increase in equilibrium expenditure is 4 times the increase in investment, so the multiplier is 4. ...

Chapter 30

... investment shifts the AE curve upward by $0.5 trillion from AE0 to AE1. 2. Equilibrium expenditure increases by $2 trillion from $9 trillion to $11 trillion. 3. The increase in equilibrium expenditure is 4 times the increase in investment, so the multiplier is 4. ...

... investment shifts the AE curve upward by $0.5 trillion from AE0 to AE1. 2. Equilibrium expenditure increases by $2 trillion from $9 trillion to $11 trillion. 3. The increase in equilibrium expenditure is 4 times the increase in investment, so the multiplier is 4. ...

NBER WORKING PAPER SERIES PUBLIC DEBT MANAGEMENT IN BRAZIL Francesco Giavazzi Alessandro Missale

... This paper derives the optimal composition of the Brazilian public debt by looking at the relative impact of the risk and cost of alternative debt instruments on the probability of missing the stabilization target. This allows to price risk against the expected cost of debt service and thus to find ...

... This paper derives the optimal composition of the Brazilian public debt by looking at the relative impact of the risk and cost of alternative debt instruments on the probability of missing the stabilization target. This allows to price risk against the expected cost of debt service and thus to find ...

Measuring National Well-being: Life in the UK, 2012

... ‘Better policies for better lives’ were words used by the OECD to describe the importance of going beyond GDP when measuring progress and national well-being. The snapshot of life in the UK presented is only based on a small selection of headline indicators. There is more to do to fully understand n ...

... ‘Better policies for better lives’ were words used by the OECD to describe the importance of going beyond GDP when measuring progress and national well-being. The snapshot of life in the UK presented is only based on a small selection of headline indicators. There is more to do to fully understand n ...

(Ab)Use of Omega?

... has some severe drawbacks. In fact, it might conduct investors to misleading rankings of risky assets, even in an extremely simplified framework such as the Gaussian one.3 The main ideas that we present hereafter are: 1) the Omega measure is biased in some cases due to the importance of the mean ret ...

... has some severe drawbacks. In fact, it might conduct investors to misleading rankings of risky assets, even in an extremely simplified framework such as the Gaussian one.3 The main ideas that we present hereafter are: 1) the Omega measure is biased in some cases due to the importance of the mean ret ...

EMERGE as a stronger company in

... of the year. In fact, our financial results for the full-year 2014 represented our best annual performance since 2008 – when the “Great Recession” began. For the full-year 2014, AK Steel’s revenues reached approximately $6.5 billion on shipments of about 6.1 million tons. Our average selling price f ...

... of the year. In fact, our financial results for the full-year 2014 represented our best annual performance since 2008 – when the “Great Recession” began. For the full-year 2014, AK Steel’s revenues reached approximately $6.5 billion on shipments of about 6.1 million tons. Our average selling price f ...

OECD Economic Surveys SWITZERLAND

... international standards, some worrying trends are emerging. As the government extended support to short-time work (employees working fewer hours while the government tops up their pay) to include businesses having difficulties resulting from the discontinuation of the exchange rate ceiling, firms do ...

... international standards, some worrying trends are emerging. As the government extended support to short-time work (employees working fewer hours while the government tops up their pay) to include businesses having difficulties resulting from the discontinuation of the exchange rate ceiling, firms do ...

Alternative Investment Funds 2015 - Skadden, Arps, Slate, Meagher

... the Advisers Act is desirable for many non-U.S. investment advisers. 1.2.2 Private Fund Adviser Exemption The Private Fund Adviser Exemption provides an exemption for investment advisers to private funds only with less than $150 million in assets under management in the United States. For investmen ...

... the Advisers Act is desirable for many non-U.S. investment advisers. 1.2.2 Private Fund Adviser Exemption The Private Fund Adviser Exemption provides an exemption for investment advisers to private funds only with less than $150 million in assets under management in the United States. For investmen ...

Over/Under-Reaction of Stock Markets

... One of the interesting findings documented in Table IV is that the relative strength strategy produces positive returns in 96% (24 out of 25) of the Aprils. The large (3.33%) and consistently positive April returns may be related to the fact that corporations must transfer money to their pension ...

... One of the interesting findings documented in Table IV is that the relative strength strategy produces positive returns in 96% (24 out of 25) of the Aprils. The large (3.33%) and consistently positive April returns may be related to the fact that corporations must transfer money to their pension ...

Document

... produced in that country become more attractive to foreign consumers. Likewise, domestic consumers find imports less attractive as they now appear relatively more expensive, so the net expenditures on exports rises as price level falls. The opposite results from an increase in the price level, which ...

... produced in that country become more attractive to foreign consumers. Likewise, domestic consumers find imports less attractive as they now appear relatively more expensive, so the net expenditures on exports rises as price level falls. The opposite results from an increase in the price level, which ...

open-end credit under -truth-in- lending

... the time of each "transaction." Further, each merchant could be required to make the disclosures in question, simply by belonging to a particular bank credit card plan.24 20. For most open-end credit plans, this means that a disclosure must be made of both a monthly and annual rate. For example, a c ...

... the time of each "transaction." Further, each merchant could be required to make the disclosures in question, simply by belonging to a particular bank credit card plan.24 20. For most open-end credit plans, this means that a disclosure must be made of both a monthly and annual rate. For example, a c ...

2014 ANNUAL REPORT Financial and Corporate Responsibility

... industry and demonstrate both our technology leadership and the value of our long-term investment strategy. Including the new family of GTF engines, we have more than 50 engine and aerospace systems entering service over the next few years, collectively representing more than $900 billion of potenti ...

... industry and demonstrate both our technology leadership and the value of our long-term investment strategy. Including the new family of GTF engines, we have more than 50 engine and aerospace systems entering service over the next few years, collectively representing more than $900 billion of potenti ...

Determination of Optimal Foreign Exchange Reserves in Nigeria

... financial crisis. The empirical result shows that the volatility of foreign institutional investment, shortterm debt to reserves and the fiscal deficit to GDP significantly explains the variations in risk premium. The study suggests that international reserves in India are higher than the estimated ...

... financial crisis. The empirical result shows that the volatility of foreign institutional investment, shortterm debt to reserves and the fiscal deficit to GDP significantly explains the variations in risk premium. The study suggests that international reserves in India are higher than the estimated ...

Price level targeting, the zero bound on the nominal interest rate and

... In the aftermath of the recent financial crisis, central banks in many advanced economies lowered their policy interest rates to record lows and resorted to unconventional monetary tools to counter rapidly deteriorating economic outlooks. In the ensuing global recession, millions of jobs were lost; ...

... In the aftermath of the recent financial crisis, central banks in many advanced economies lowered their policy interest rates to record lows and resorted to unconventional monetary tools to counter rapidly deteriorating economic outlooks. In the ensuing global recession, millions of jobs were lost; ...

Economics of Money, Banking, and Financial Markets, 8e

... 46) The spread between the interest rates on Baa corporate bonds and U.S. government bonds is very large during the Great Depression years 1930 -1933. Explain this difference using the bond supply and demand analysis. Answer: During the Great Depression many businesses failed. The default risk for ...

... 46) The spread between the interest rates on Baa corporate bonds and U.S. government bonds is very large during the Great Depression years 1930 -1933. Explain this difference using the bond supply and demand analysis. Answer: During the Great Depression many businesses failed. The default risk for ...

Dynamics between government debt and budget deficits in the

... favoring the sustainability of the fiscal policy in the United States and some support for the sustainability of the United Kingdom. Arestis, Cipollini and Fattouh (2004) find that large budget deficits in the United States are sustainable in the long run as policy makers will intervene to reduce pe ...

... favoring the sustainability of the fiscal policy in the United States and some support for the sustainability of the United Kingdom. Arestis, Cipollini and Fattouh (2004) find that large budget deficits in the United States are sustainable in the long run as policy makers will intervene to reduce pe ...

Chapter 11: Saving, Capital Accumulation, and Output

... When capital and output are low, investment exceeds depreciation, and capital increases. When capital and output are high, investment is less than depreciation and capital decreases. At low levels of K/N, the “extra bang for the extra buck” invested is large, larger than what is being taken away b ...

... When capital and output are low, investment exceeds depreciation, and capital increases. When capital and output are high, investment is less than depreciation and capital decreases. At low levels of K/N, the “extra bang for the extra buck” invested is large, larger than what is being taken away b ...

Working paper - Addressing informality in Egypt

... Informal employment may also be determined via ‘triangulation’ – for example, by calculating the difference between employment figures reported in population censuses and those recorded in labour force surveys (Schneider and Enste, 2000). ...

... Informal employment may also be determined via ‘triangulation’ – for example, by calculating the difference between employment figures reported in population censuses and those recorded in labour force surveys (Schneider and Enste, 2000). ...

Combining Monetary and Fiscal Policy in an SVAR for a Small Open

... news variable based on expected present values of government spending caused by military events as reported in news media. On the other hand, Romer and Romer (2010) used narrative records, such as presidential speeches and Congressional reports, to document the timing of legislative changes to U.S. ...

... news variable based on expected present values of government spending caused by military events as reported in news media. On the other hand, Romer and Romer (2010) used narrative records, such as presidential speeches and Congressional reports, to document the timing of legislative changes to U.S. ...

Is It Time for an Infrastructure Push?

... have larger output effects than one that is budget neutral, with both options delivering similar declines in the public-debt-to-GDP ratio. This should not, however, be interpreted as a blanket recommendation for a debt-financed public investment increase in all advanced economies, as adverse market ...

... have larger output effects than one that is budget neutral, with both options delivering similar declines in the public-debt-to-GDP ratio. This should not, however, be interpreted as a blanket recommendation for a debt-financed public investment increase in all advanced economies, as adverse market ...

monetary policy rules and macroeconomic stability: evidence and

... the estimated rule for the pre-Volcker period permits greater macroeconomic instability than does the Volcker-Greenspan rule. It does so in two distinct respects. First, the pre-Volcker rule leaves open the possibility of bursts of ination and output that result from self-fullling changes in expec ...

... the estimated rule for the pre-Volcker period permits greater macroeconomic instability than does the Volcker-Greenspan rule. It does so in two distinct respects. First, the pre-Volcker rule leaves open the possibility of bursts of ination and output that result from self-fullling changes in expec ...