Macroeconomic policy

... build a new school or road Uncertain multiplier. The multiplier value is uncertain. The multiplier effect has time lags Tax changes affect incentives Increasing income and corporation tax rates diminishes the incentive to work, and so reduce aggregate supply. Fiscal policy affects supply side policy ...

... build a new school or road Uncertain multiplier. The multiplier value is uncertain. The multiplier effect has time lags Tax changes affect incentives Increasing income and corporation tax rates diminishes the incentive to work, and so reduce aggregate supply. Fiscal policy affects supply side policy ...

Q1. Although our development of the Keynesian cross in this chapter

... Q2. Suppose that the money demand function is ( M / P) d 1,000 100r where r is the interest rate in percent. The money supply M is 1,000 and the price level P is 2. a. Graph the supply and demand for real money balances. b. What is the equilibrium interest rate? c. Assume that the price level i ...

... Q2. Suppose that the money demand function is ( M / P) d 1,000 100r where r is the interest rate in percent. The money supply M is 1,000 and the price level P is 2. a. Graph the supply and demand for real money balances. b. What is the equilibrium interest rate? c. Assume that the price level i ...

These are some practice questions for CHAPTER 23

... c. lowered by $100 billion times the multiplier. d. lowered by $100 billion divided by the multiplier. 84. Using Figure 23-2, the rotation from AE1 to AE0 is caused by a. higher tax rates. b. lower tax rates. c. higher government spending. d. lower government spending. e. a balanced budget. ...

... c. lowered by $100 billion times the multiplier. d. lowered by $100 billion divided by the multiplier. 84. Using Figure 23-2, the rotation from AE1 to AE0 is caused by a. higher tax rates. b. lower tax rates. c. higher government spending. d. lower government spending. e. a balanced budget. ...

Economic Policy - "Should we talk about the government?"

... Keynesian economic theory Supply-side economics ...

... Keynesian economic theory Supply-side economics ...

Fiscal policy: tax and spending

... Current vs. future consumption Composition of consumption (VAT and market prices, Sin goods) ...

... Current vs. future consumption Composition of consumption (VAT and market prices, Sin goods) ...

Fiscal Policy - Gore High School

... • Any tax cut by the government will stimulate the economy. • Direct tax cuts means consumers have more disposable income leading to an increase in consumption spending. - This could lead to inflationary pressures ...

... • Any tax cut by the government will stimulate the economy. • Direct tax cuts means consumers have more disposable income leading to an increase in consumption spending. - This could lead to inflationary pressures ...

Fiscal Stimulus - Tata Mutual Fund

... • Keynes focused his analysis on factors affecting output and growth in an economy. • He asked, what decides the output in an economy? • He said that output in any economy is decided by people who spend money. • People like you and me who earn money with one hand and spend it with the other ultimate ...

... • Keynes focused his analysis on factors affecting output and growth in an economy. • He asked, what decides the output in an economy? • He said that output in any economy is decided by people who spend money. • People like you and me who earn money with one hand and spend it with the other ultimate ...

Fall 2015 Practice Test #3 - MDC Faculty Web Pages

... A) Congress drags its feet in passing tax increases. B) consumers pay for part of the tax increase by reducing their saving. C) tax changes have more of a direct impact on income than does an equivalent change in government spending. D) fiscal policy is weaker than monetary policy. ...

... A) Congress drags its feet in passing tax increases. B) consumers pay for part of the tax increase by reducing their saving. C) tax changes have more of a direct impact on income than does an equivalent change in government spending. D) fiscal policy is weaker than monetary policy. ...

With the MPC, MPS, and Multipliers

... assume that the Japanese government increases its spending by ¥50 trillion and in order to maintain a balanced budget simultaneously increases taxes by ¥50 trillion. Calculate the effect the ¥50 trillion change in government spending and ¥50 trillion change in taxes on Japanese Aggregate Demand. – S ...

... assume that the Japanese government increases its spending by ¥50 trillion and in order to maintain a balanced budget simultaneously increases taxes by ¥50 trillion. Calculate the effect the ¥50 trillion change in government spending and ¥50 trillion change in taxes on Japanese Aggregate Demand. – S ...

Understanding Fiscal Policy

... businesses, and government; and government actions can make up for changes in the other two. Keynesian economists argue that fiscal policy can be used to fight both recession or depression and inflation. Keynes believed that the government could increase spending during a recession to counteract the ...

... businesses, and government; and government actions can make up for changes in the other two. Keynesian economists argue that fiscal policy can be used to fight both recession or depression and inflation. Keynes believed that the government could increase spending during a recession to counteract the ...

Fiscal Policy

... The multiplier effect (HL) • Congress must be careful with the amount of taxes/spending adjusted, as it could create a multiplying (“snowball”) effect: – If the gov’t puts $10 billion into the economy, that money will affect GDP more than $10 bill. It may affect by $10.5 or even $12 billion, depend ...

... The multiplier effect (HL) • Congress must be careful with the amount of taxes/spending adjusted, as it could create a multiplying (“snowball”) effect: – If the gov’t puts $10 billion into the economy, that money will affect GDP more than $10 bill. It may affect by $10.5 or even $12 billion, depend ...

economics and politics.ppt

... Fiscal policy is the domain of the president and Congress. Fiscal policy has been criticized as being (1) too political (2) too slow ...

... Fiscal policy is the domain of the president and Congress. Fiscal policy has been criticized as being (1) too political (2) too slow ...

Aggregate Demand

... • Demand in the macroeconomy comes from four general sources, and we have already seen these components when we describe how total production is measured in the economy. • GDPr=C+I+G+(X-M) ...

... • Demand in the macroeconomy comes from four general sources, and we have already seen these components when we describe how total production is measured in the economy. • GDPr=C+I+G+(X-M) ...

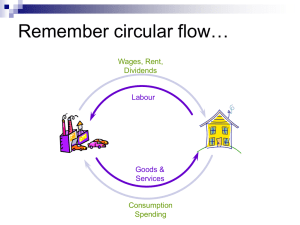

Answers to Questions in Economics for Business

... GDP will rise if aggregate expenditure exceeds GDP (see Figure 29.2). This will occur if injections exceed withdrawals. A budget deficit means that government expenditure (an injection) exceeds taxation (a withdrawal). Whether total injections exceed total withdrawals, however, depends on the size o ...

... GDP will rise if aggregate expenditure exceeds GDP (see Figure 29.2). This will occur if injections exceed withdrawals. A budget deficit means that government expenditure (an injection) exceeds taxation (a withdrawal). Whether total injections exceed total withdrawals, however, depends on the size o ...

ECN202 Practice Questions: 1960s

... or another depression. To achieve this end there were a number of policy moves that followed the peace. Which of the following was not one of the post WWII developments. a. the Cold War "heated up" with uprisings in eastern Europe b. many of countries in Africa and Asia that were part of Europe's co ...

... or another depression. To achieve this end there were a number of policy moves that followed the peace. Which of the following was not one of the post WWII developments. a. the Cold War "heated up" with uprisings in eastern Europe b. many of countries in Africa and Asia that were part of Europe's co ...

Quiz 1: Fall 2011

... consumption, however, depends on the price level P, perhaps because people hold their wealth in money and feel poorer when prices go up, decreasing real consumption even if their real incomes are unchanged. (Why precisely aggregate consumption depends on the price level is not important for this que ...

... consumption, however, depends on the price level P, perhaps because people hold their wealth in money and feel poorer when prices go up, decreasing real consumption even if their real incomes are unchanged. (Why precisely aggregate consumption depends on the price level is not important for this que ...

Aggregate-Demand

... Slopes downward & to the right: 1. a general fall in prices increases the real value of wealth so increases AD (we can afford to buy more!) 2. It also lowers the prices of our goods compared to other countries leading to increased exports. ...

... Slopes downward & to the right: 1. a general fall in prices increases the real value of wealth so increases AD (we can afford to buy more!) 2. It also lowers the prices of our goods compared to other countries leading to increased exports. ...

Chapter 27 Key Question Solutions

... The MPC is directly (positively) related to the size of the multiplier. The MPS is inversely (negatively) related to the size of the multiplier. The multiplier values for the MPS values: undefined, 2.5, 1.67, 1. The multiplier values for the MPC values: undefined, 10, 3 (approx. actually 3.03), 2, 0 ...

... The MPC is directly (positively) related to the size of the multiplier. The MPS is inversely (negatively) related to the size of the multiplier. The multiplier values for the MPS values: undefined, 2.5, 1.67, 1. The multiplier values for the MPC values: undefined, 10, 3 (approx. actually 3.03), 2, 0 ...

Macro Chapter 11- presentation 2 Built

... is decided on and when it goes into place • Ex- planning for roads, dams etc. ...

... is decided on and when it goes into place • Ex- planning for roads, dams etc. ...

MACRO ECONOMIC GOVERNMENT ECONOMIC POLICY

... The Rational expectations theory is similar --> people believe budget deficits will increase prices in future --> cut back on spending and investment ...

... The Rational expectations theory is similar --> people believe budget deficits will increase prices in future --> cut back on spending and investment ...

Fiscal Policy1 Fiscal policy refers to changes in government

... investment and consumption. Recall from our discussion of economic growth that investment is a key determinate of long run macroeconomic performance. Economists thus worry that crowding out is a long run effect. This analysis raises a key question. Can’t the Fed just keep interest rates low and thus ...

... investment and consumption. Recall from our discussion of economic growth that investment is a key determinate of long run macroeconomic performance. Economists thus worry that crowding out is a long run effect. This analysis raises a key question. Can’t the Fed just keep interest rates low and thus ...