File

... • Gov borrows in the “Loanable Funds” Mkt by selling gov’t bonds & other securities • This drives up the price of borrowing (i) making it more expensive for Ig to occur • Gov borrowing has “crowded out” business spending lowering GDP (output) in the long run (less capital stock = less future output) ...

... • Gov borrows in the “Loanable Funds” Mkt by selling gov’t bonds & other securities • This drives up the price of borrowing (i) making it more expensive for Ig to occur • Gov borrowing has “crowded out” business spending lowering GDP (output) in the long run (less capital stock = less future output) ...

Document

... investment interact with the multiplier to propel the economy to an inflationary boom. • The theory suggests that a market-directed economy, left to its own devices, will tend to fluctuate between economic recession and ...

... investment interact with the multiplier to propel the economy to an inflationary boom. • The theory suggests that a market-directed economy, left to its own devices, will tend to fluctuate between economic recession and ...

Debt_PPT-1192wvq

... Source: Roscoe, Mike. “What does $200 trillion off debt really mean for the global economy?” Positive Money.3 Feb. 2015. Web. 12 May 2016. ...

... Source: Roscoe, Mike. “What does $200 trillion off debt really mean for the global economy?” Positive Money.3 Feb. 2015. Web. 12 May 2016. ...

Name: Unit 4 FRQ Review Per: _____ Question 1 Assume the

... Now assume that instead of taking no policy action, the government implements an investment tax break for business. How will this effect demand for investment? Show on a loanable funds graph what happens to the real interest rate. ...

... Now assume that instead of taking no policy action, the government implements an investment tax break for business. How will this effect demand for investment? Show on a loanable funds graph what happens to the real interest rate. ...

What Is Fiscal Policy

... the total level of demand in an economy. It was proposed by the 19th century economist David Ricardo (April 18, 1772 – September 11, 1823). In simple terms, the theory can be described as follows. Governments may either finance their spending by taxing current taxpayers, or they may borrow money. H ...

... the total level of demand in an economy. It was proposed by the 19th century economist David Ricardo (April 18, 1772 – September 11, 1823). In simple terms, the theory can be described as follows. Governments may either finance their spending by taxing current taxpayers, or they may borrow money. H ...

Lesson 12-1 Fiscal Policy Government and the Economy

... An automatic stabilizer is any government program that tends to reduce fluctuations in GDP automatically. An automatic stabilizer tends to increase GDP when it is falling and reduce GDP when it is rising. Automatic stabilizers have increased in importance over time. Increases in income taxes and une ...

... An automatic stabilizer is any government program that tends to reduce fluctuations in GDP automatically. An automatic stabilizer tends to increase GDP when it is falling and reduce GDP when it is rising. Automatic stabilizers have increased in importance over time. Increases in income taxes and une ...

Professor`s Name

... that depending on the MPC. In the case of the tax multiplier the initial change in taxes does not directly affect real GDP, that is only affected when the change in disposable income affects spending, and the size of that effect depends on the MPC. In effect each multiplier is the result of infinite ...

... that depending on the MPC. In the case of the tax multiplier the initial change in taxes does not directly affect real GDP, that is only affected when the change in disposable income affects spending, and the size of that effect depends on the MPC. In effect each multiplier is the result of infinite ...

The Art and Science of Economics

... Two differences between the government-purchase multiplier and the simple tax multiplier The government-purchase multiplier is positive an increase in government purchases leads to an increase in real GDP demanded. The net tax multiplier is negative an increase in net taxes leads to a decrease i ...

... Two differences between the government-purchase multiplier and the simple tax multiplier The government-purchase multiplier is positive an increase in government purchases leads to an increase in real GDP demanded. The net tax multiplier is negative an increase in net taxes leads to a decrease i ...

Rt Hon George Osborne MP HM Treasury 1 Horse Guards Road

... by reducing their saving or increasing their borrowing, so additional resources directed to them would likely have little effect on consumer spending. In contrast, lower-income families are more likely to be liquidity-constrained and to be forced to cut back their consumption in hard times. If these ...

... by reducing their saving or increasing their borrowing, so additional resources directed to them would likely have little effect on consumer spending. In contrast, lower-income families are more likely to be liquidity-constrained and to be forced to cut back their consumption in hard times. If these ...

Economics Assessment Matching: Board of Governors A. Consists of

... Amounts that the government allows taxpayers to subtract from their taxable income. How well the people in general are doing. The general rise in prices that often accompanies economic booms. Economic downturn, or a period of economic contraction when the pace of economic activity and level of econo ...

... Amounts that the government allows taxpayers to subtract from their taxable income. How well the people in general are doing. The general rise in prices that often accompanies economic booms. Economic downturn, or a period of economic contraction when the pace of economic activity and level of econo ...

Document

... • A shift in the AD curve is caused by a change in variables such as consumption and export at any given price level. • The multiplier increases any impact on aggregate demand and national income of changes in an injection to the circular flow. ...

... • A shift in the AD curve is caused by a change in variables such as consumption and export at any given price level. • The multiplier increases any impact on aggregate demand and national income of changes in an injection to the circular flow. ...

12 Revision – National income, circular flow, multiplier

... larger increase in national income. This is explained by the multiplier effect. Government spending and business investment are injections into the circular flow of income and any injections are multiplied through the economy as ...

... larger increase in national income. This is explained by the multiplier effect. Government spending and business investment are injections into the circular flow of income and any injections are multiplied through the economy as ...

Disposable income

... • Primarily determined by Disposable Income • Direct relationship – as DI increases, so does consumption. • Saving is what’s left over, what’s not spent. • Households spend a higher percentage of a small disposable income than of a large disposable income. Important – This is all IN THE AGGREGATE. I ...

... • Primarily determined by Disposable Income • Direct relationship – as DI increases, so does consumption. • Saving is what’s left over, what’s not spent. • Households spend a higher percentage of a small disposable income than of a large disposable income. Important – This is all IN THE AGGREGATE. I ...

Part7

... The Expenditure Multiplier in an open economy Q: for an open economy, imports are considered a leakage from the economy. Would the effect of the expenditure multiplier in the open economy be smaller or bigger than ...

... The Expenditure Multiplier in an open economy Q: for an open economy, imports are considered a leakage from the economy. Would the effect of the expenditure multiplier in the open economy be smaller or bigger than ...

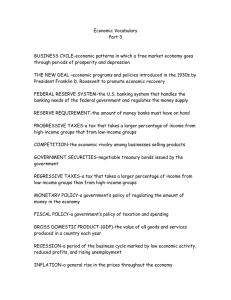

Economic Vocabulary

... banking needs of the federal government and regulates the money supply RESERVE REQUIREMENT-the amount of money banks must have on hand PROGRESSIVE TAXES-a tax that takes a larger percentage of income from high-income groups that from low-income groups COMPETITION-the economic rivalry among businesse ...

... banking needs of the federal government and regulates the money supply RESERVE REQUIREMENT-the amount of money banks must have on hand PROGRESSIVE TAXES-a tax that takes a larger percentage of income from high-income groups that from low-income groups COMPETITION-the economic rivalry among businesse ...

Chapter 20: The Government and Fiscal Policy

... It is the most potent weapon to raise the consumption and to increase the economic growth. Increased government expenditure will open new job opportunities in the economy, which means creation of demand for goods and services. It can lead to pump priming, which means increase in private expenditure ...

... It is the most potent weapon to raise the consumption and to increase the economic growth. Increased government expenditure will open new job opportunities in the economy, which means creation of demand for goods and services. It can lead to pump priming, which means increase in private expenditure ...

CONSUMPTION FUNCTION - UNT College of Arts and Sciences

... consumption that is not related to income (it is the amount of Cons. when income is 0). MPC - marginal propensity to consume (it is change in C / change in Y) MPS - marginal propensity to save (it is the change in saving / change in Y) ...

... consumption that is not related to income (it is the amount of Cons. when income is 0). MPC - marginal propensity to consume (it is change in C / change in Y) MPS - marginal propensity to save (it is the change in saving / change in Y) ...

AD - Pasadena ISD

... • Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level • The relationship between the price level and the level of Real GDP is inverse – See graph ...

... • Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level • The relationship between the price level and the level of Real GDP is inverse – See graph ...

Aggregate Demand

... • Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level • The relationship between the price level and the level of Real GDP is inverse – See graph ...

... • Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level • The relationship between the price level and the level of Real GDP is inverse – See graph ...

Principles of Macroeconomics, Case/Fair/Oster, 11e

... Planned aggregate expenditure (AE) is the sum of consumption spending by households (C), planned investment by business firms (I), and government purchases of goods and services (G). ...

... Planned aggregate expenditure (AE) is the sum of consumption spending by households (C), planned investment by business firms (I), and government purchases of goods and services (G). ...

Ireland

... FDI accompanied by increases in domestic investment Focus on improving education in 1980’s resulted in more efficient workforce Housing boom detracted from technological investment ...

... FDI accompanied by increases in domestic investment Focus on improving education in 1980’s resulted in more efficient workforce Housing boom detracted from technological investment ...