* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Part7

Survey

Document related concepts

Transcript

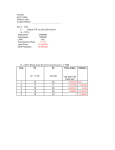

الجزء السابع أثر المضاعف والسياسة المالية The multiplier effect and Fiscal Policy 1 The Multiplier effect Recall: from the Silver Moon economy data we were able to determine the equilibrium level For two sectors: e Y = 500 m. When government expenditure were added (100 m) e For three sectors with no taxes: = 700 m. Y i.e, an increase in DG = 100 2 e an increase in D Y= 200 e Y Y(AS) Ye AE2(C+I+G) AE1(c+I ) AE DG = 100 3 500 450 400 350 300 250 200 150 100 50 0 0 100 200 300 400 500 600 700 DY= 200 Y Note an increase in DY > DG (DI) or DY / DG > 1 This is called the multiplier effect Multiplier effect: Chain reaction of an initial change in income and spending that leads to a greater change in final income and spending. سلسلة من االرتفاع (التغير) في الدخل واإلنفاق الناجمة عن االرتفاع (التغير) في دخل:مضاعف االتنفاق .أو انفاق أولى Change in GDP The expenditure multiplier = )(مضاعف اإلنفاق initial change in spending (AE) 4 Expenditure Multiplier in a closed economy: (a) with no taxes: Example 1: For the Silver Moon economy (MPC = 0.5), we added investment expenditure by $ 100 m. This increased spending created an equal income in the economy = $100 m. This income is partly consumed ($ 50 m) and partly saved ($50 m) according to MPC & MPS. The new consumption expenditure will create a new chain of income in the economy as follows: ( االرتفاع في اإلنفاقMPC = 0 .5 في اقتصاد دولة القمر الفضى (حيث . مليون خلق دخال جديدا في االقتصاد بنفس المقدار100 االستثمارى بمقدار . مليون) وادخار النصف اآلخر50 هذا الدخل الجديد يتم استهالك نصفه (أي : مليون) سيخلق سلسلة من الدخول كما يلي50( اإلنفاق االستهالكى 5 Round 1 2 DY 100 50 DC 50 25 DS 50 3 25 12.5 12.5 4 12.5 6.25 6.25 5 6.25 3.125 3.125 200 100 100 25 Note: In this example total income has multiplied by 2. $ 100 m is a direct increase in AE and the other $100 m is indirect induced additional spending. 6 Example 2: If for an other economy MPS = 0.25, and the government increased its spending by DG= $100 m. This initial increase will DY= $100 m, leading to a chain reaction as follows: DS 25 Round 1 2 DY 100 75 DC 75 56.25 18.75 3 56.25 42.2 14 400 300 100 Note: In this example total income has multiplied by 4. $ 100 m is a direct increase in AE and the other $300 m is indirect induced additional spending. 7 Note 1: The multiplier effect increases as MPS decreases (or as MPC increases ) Why ? DY M = Note 2: See appendix 8 DAE = 1 MPS Appendix Recall, at equilibrium for a simple two sectors economy: Y e= DY 1 DI DY DY DI M 9 C + I = DC + DI DC DI = + DY DY DC = 1= 1 - MPC DY 1 1 = = 1 - MPC MPS 1 = MPS MPC Expenditure Multiplier (M) 10 0.9 5 0.8 4 0.75 3 0.67 0. 5 10 2 Examples : 1 – If an increase in autonomous consumption by $50 m leads to an increase in total income by $250 m. What is the value of MPC? DY 1 M = = Da MPS 1 250 = = 5 = MPS 50 1 MPS = 5 4 MPC = 5 11 Examples : 2 – If C = 100 + 0.8 Y I1 = 100 I2 = 200 DY = ? 1 M = MPS 12 1 0.2 = DY = M X DY = 5 X 100 = 5 DI = 500 The Tax Multiplier effect Recall: from the Silver Moon economy data For three sectors with no taxes: e Y = 700 m. When government applied a fixed tax of 100 m e For three sectors with fixed taxes: Y = 600 m. Note the increase in taxes have not reduced DY by a multiplier = 2 (though MPC = 0.5) 13 The Multiplier in a closed economy: (b) with taxes: MT D Ye MPC = = DT MPS Note 1: MT < MI,G at all values of MPS ( the impact of DG > DT on equilibrium income) why? Note 2: See appendix 14 Appendix 1 At T1 : Y1 = (a - bT1 + I + G) 1- b 1 e At T2 : Y2 = (a – bT2 + I + G) 1- b 1 e DY = ( – bT2 + bT1) 1- b e DYe = DYe = DY = DT 15 -b (T2 - T1) 1- b -b (DT) 1- b -b 1- b MPC = MPS The Expenditure Multiplier in an open economy Q: for an open economy, imports are considered a leakage from the economy. Would the effect of the expenditure multiplier in the open economy be smaller or bigger than in the case of a closed economy? MO 16 D Ye = = D AE 1 MPS + MPM The GDP gap and Fiscal policy Recall, the economy maybe below its potential output (GDP) even at a state of an equilibrium income. AS (LR) P AS(SR) AD 17 Y e Y f Q 5 4 f 3 Y e 2 Y 1 0 0 2 4 6 8 10 12 14 16 First: If Ye < Yf there exists a deflationary gap ( )فجوة ركودية This gap may be estimated by two methods: (1) GDP gap : Yf - Ye or (2) Expenditure gap : AE - AS at full employment Q: What policies a government can apply to reduce this gap? 18 AE Ye Y f AS AE Expenditure Gap (deflationary gap) 0 0 GDP Gap 19 Y There are many policies a government can apply to reduce the deflationary gap or to generally change the real GDP and the price level. One of these policies is the Fiscal Policy. Fiscal policy: Changes in government spending (on goods & services and transfer payment) and taxes designed to influence real GDP and the price level. Government spending and taxes are tools of the fiscal policy. التغير في االنفاق الحكومي (على السلع والخدمات و:السياسة المالية المدفوعات التحويلية ) باإلضافة للضرائب بهدف التأثير على الناتج المحلى ان االنفاق الحكومي والضرائب تعتبر أدوات.الحقيقي و مستوى األسعار .السياسة المالية 20 If an economy is facing a deflationary gap, the government can increase its spending and/or reduce taxes : expansionary fiscal policy ()سياسة مالية توسعية Note: In this case a budget deficit may occur ( تحقق عجز )في الميزانية. Q: What other policies a government can apply to reduce a deflationary gap ? 21 Second: If Ye > Yf there exists an inflationary gap ( )فجوة تضخمية This gap may be estimated by two methods: (1) GDP gap : Yf - Ye or (2) Expenditure gap : AE - AS at full employment 22 Y f AE Ye AS AE Expenditure Gap (inflationary gap) 0 0 GDP Gap 23 Y If an economy is facing an inflationary gap, the government can decrease its spending and/or increase taxes : contractionary fiscal policy ()سياسة مالية انكماشية Note: In this case a budget surplus may occur ()تحقق فائض في الميزانية Q1: What other policies a government can apply to reduce an inflationary gap ? Q2: Can the government affect the GDP gap with a balanced budget ? 24 The Balanced Budget Multiplier effect First: If Ye < Yf ( deflationary gap) The government can increase both DG & DT by the same amount at the same time (DG = DT) Second: If Ye > Yf ( inflationary gap) The government can reduce both DG & DT by the same amount at the same time (DG = DT) Q: Recall, that DG & DT have the opposite effect on AD, would not an equal change in DG & DT leave AD unaffected? 25 Recall, changing DG & DT will stimulate further changes in income and spending according to the multipliers MG & MT. Recall, the impact of MG > MT M BB = MG = + 1 1- b 26 (Why?) MT - b 1- b = 1 = DY DG = DT Note: M BB = DY/ (DG=DT) = 1 always at all values of MPC ! Note: DG = DT (Same direction) equal change in DY What are the obstacles facing implementing fiscal policy? ما هي الصعوبات التي يمكن ان تواجه تطبيق السياسة المالية ؟ 27 Examples: 1 If MPC = 0.5 Ye = $700m YF = $1000m What is the required change in: (1) DG (2) DT to eliminate the GDP gap? Answers 28 MG = 2 DY = DG DY 300 = M = 2 = 150 MT = -1 DT DY 300 = M = -1 = -300 T YF - Ye = 300 Examples: 2 If MPS = 0.25 DYe = ? Answer 29 DG = 200 m MG = 4 DYG = MG MT = -3 DYT = MT X DY = DT = 100 X DG 500 DT = 4 X 200 = 800 = (-3) X (100) = -300 Examples: 3 If MPC = 0.75 DYe = ? DG = 50 DT = -50 Answer 30 MG = 4 MT = -3 DYG = 4 DYT = (-3) X (-50) = 150 DY = 350 X 50 = 200 Examples:4 If MPC = 0.8 DY = ? Answer MG Or 31 DG = 200 DT = 200 (a): MT = 5 = -4 DY = DYG = 5 X 200 = 1000 DYT = (-4) X 200 = -800 200 (b): Since DG = DT MBB = 1 DY = DG = DT = 200