Summary of DeLong-Summers View

... DS assume not only that an output gap today leads to lower future potential output but also that raising output with government spending will reverse this effect. It is not obvious to me that an increase in government spending would create the private investment and skill-building jobs required to r ...

... DS assume not only that an output gap today leads to lower future potential output but also that raising output with government spending will reverse this effect. It is not obvious to me that an increase in government spending would create the private investment and skill-building jobs required to r ...

HW - U3HW3.3 - New Hartford Central Schools

... type of fiscal policies would help move the economy back to potential output? How would your recommended fiscal policy shift the aggregate demand curve? a. A stock market boom increases the value of stocks held by households b. Firms come to believe that a recession in the near future is likely c. A ...

... type of fiscal policies would help move the economy back to potential output? How would your recommended fiscal policy shift the aggregate demand curve? a. A stock market boom increases the value of stocks held by households b. Firms come to believe that a recession in the near future is likely c. A ...

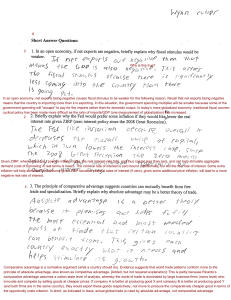

Why is this true? In an open economy, net exports being negative

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

Congress to Pass Bipartisan Budget Act of 2013

... This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This materi ...

... This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This materi ...

Mr. Mayer AP Macroeconomics

... matched with equal size increases in taxes, the change ends up being = to the change in government spending • Why? • 1/MPS + -MPC/MPS = 1- MPC/MPS = MPS/MPS = 1 • The balanced budget multiplier always = 1 ...

... matched with equal size increases in taxes, the change ends up being = to the change in government spending • Why? • 1/MPS + -MPC/MPS = 1- MPC/MPS = MPS/MPS = 1 • The balanced budget multiplier always = 1 ...

Assignment 4 - Queen`s Economics Department

... the actual GDP is $200 billion, the full-employment or cyclically adjusted deficit is: A) $40 billion. B) zero. C) $60 billion. D) $20 billion. 8. The "crowding-out effect" suggests that: A) tax increases are paid primarily out of saving and therefore are not an effective fiscal device. B) increases ...

... the actual GDP is $200 billion, the full-employment or cyclically adjusted deficit is: A) $40 billion. B) zero. C) $60 billion. D) $20 billion. 8. The "crowding-out effect" suggests that: A) tax increases are paid primarily out of saving and therefore are not an effective fiscal device. B) increases ...

What is fiscal policy? - Ms. Edlund`s Social Studies Classes

... 2. According to Keynes, what is the “paradox of thrift”? Do you think it is true? 3. What was Keynes, “big idea”? Do you think it was the right remedy for ending the Great Depression? Why? Do you think it is the right remedy today for ending the Great ...

... 2. According to Keynes, what is the “paradox of thrift”? Do you think it is true? 3. What was Keynes, “big idea”? Do you think it was the right remedy for ending the Great Depression? Why? Do you think it is the right remedy today for ending the Great ...

Ch. 14, Ch. 15

... Believe deficits are unsustainable, pass costs on that will hurt future economic growth, raise interest rates Deficit Doves – believe deficit spending can stimulate economic growth Keynesian economists See no harm in short term deficits, as long as they are used wisely, they could produce futu ...

... Believe deficits are unsustainable, pass costs on that will hurt future economic growth, raise interest rates Deficit Doves – believe deficit spending can stimulate economic growth Keynesian economists See no harm in short term deficits, as long as they are used wisely, they could produce futu ...

Lecture Notes Chapter 9

... --------------------------------------------------------------------------------------How does fiscal policy work? *Marginal Propensity to Consume (MPC) – the fraction of additional income that is spent. *If you receive $100 extra money, and you spend $70 of it, your MPC = _____ *If a country’s inco ...

... --------------------------------------------------------------------------------------How does fiscal policy work? *Marginal Propensity to Consume (MPC) – the fraction of additional income that is spent. *If you receive $100 extra money, and you spend $70 of it, your MPC = _____ *If a country’s inco ...

Chapter 19 APUS Notes

... b. Legislative Branch- Congressional Budget Office (CBO) c. Sales Taxes (tax at point of sale) versus Value Added Taxes (VAT) tax on the increased value of a product at each stage of production and distribution...not just at point of sale. d. Tax expenditures- Loss of tax revenue due to deducts on t ...

... b. Legislative Branch- Congressional Budget Office (CBO) c. Sales Taxes (tax at point of sale) versus Value Added Taxes (VAT) tax on the increased value of a product at each stage of production and distribution...not just at point of sale. d. Tax expenditures- Loss of tax revenue due to deducts on t ...

key ideas - Spring Branch ISD

... Ln the short run , economists think that equili brium levels of GOP can occur at less than. grealer than or at the full -employment level of GOP, Economists believe that long-run equilibrium can occur only at fu ll employment. In a dynamic aggregate demand and aggregate suppl y model of the economy, ...

... Ln the short run , economists think that equili brium levels of GOP can occur at less than. grealer than or at the full -employment level of GOP, Economists believe that long-run equilibrium can occur only at fu ll employment. In a dynamic aggregate demand and aggregate suppl y model of the economy, ...

Francesco Giavazzi 22 July 2010, VOX.EU

... revenues while reducing the future stream of pension spending. The National Institute for Economic Research has estimated that an across the board two-year increase in the retirement age would reduce long run debt levels in the UK by as much as 40% of GDP. ...

... revenues while reducing the future stream of pension spending. The National Institute for Economic Research has estimated that an across the board two-year increase in the retirement age would reduce long run debt levels in the UK by as much as 40% of GDP. ...

unit 4 review

... Assume that taxes and interest rates remain unchanged when government spending increases, and that both savings and consumer spending increase when income increases. The ultimate effect on real GDP of a $100 million increase in government purchases of goods and services will be a. b. c. d. ...

... Assume that taxes and interest rates remain unchanged when government spending increases, and that both savings and consumer spending increase when income increases. The ultimate effect on real GDP of a $100 million increase in government purchases of goods and services will be a. b. c. d. ...

Lecture No. 3: AGREGATE DEMAND

... FISCAL POLICY IN THE MULTIPLIER MODEL • ∆ GDP = 1/MPS * ∆G r • ∆ GDP = MPC/MPS * ∆T ...

... FISCAL POLICY IN THE MULTIPLIER MODEL • ∆ GDP = 1/MPS * ∆G r • ∆ GDP = MPC/MPS * ∆T ...

unit 5 econ.

... In order to be stable, the economy needs: 1. Economic growth (increasing GDP) 2. Full employment (unemployment under 6%) 3. Price Stability (if prices rise, they do so by only 4% or less) ...

... In order to be stable, the economy needs: 1. Economic growth (increasing GDP) 2. Full employment (unemployment under 6%) 3. Price Stability (if prices rise, they do so by only 4% or less) ...

As you can see from both the table and the graph, the original

... Autonomous spending: The components of aggregate expenditure that are not influenced by real GDP. In English, autonomous spending refers to investment, government purchases, exports (recall that imports are dependent upon national income) and autonomous consumption. Autonomous consumption is the lev ...

... Autonomous spending: The components of aggregate expenditure that are not influenced by real GDP. In English, autonomous spending refers to investment, government purchases, exports (recall that imports are dependent upon national income) and autonomous consumption. Autonomous consumption is the lev ...

Fiscal Policy Chapter 11

... • Recognition Lag—The it takes for policy makers to realize economic problems • Administrative Lag—The time it takes to decide on a particular policy • Operational Lag—The time it takes for a given policy to impact the economy ...

... • Recognition Lag—The it takes for policy makers to realize economic problems • Administrative Lag—The time it takes to decide on a particular policy • Operational Lag—The time it takes for a given policy to impact the economy ...

Warm-Up - Cloudfront.net

... Warm Up: True or False (If FALSE, make it into a true statement by changing the word(s) in yellow) ...

... Warm Up: True or False (If FALSE, make it into a true statement by changing the word(s) in yellow) ...