National Income and Price Determination Mr. Bordelon Review

... 6. Crowding out. Government borrowing from banks which in turn drives up interest rates. Government becomes banks’ biggest customer, crowding out businesses and customers from lenders. (Keep this? It’s going to come up but in Financial Sector?) 7. Automatic stabilizers. Automatic stabilizers are spe ...

... 6. Crowding out. Government borrowing from banks which in turn drives up interest rates. Government becomes banks’ biggest customer, crowding out businesses and customers from lenders. (Keep this? It’s going to come up but in Financial Sector?) 7. Automatic stabilizers. Automatic stabilizers are spe ...

Mr. Mayer AP Macroeconomics

... reduction in personal income taxes is required than the $100 billion increase in government spending. One point is earned for explaining that households do not spend all of the initial increase in disposable income caused by a tax reduction, or that the tax multiplier is smaller than the government ...

... reduction in personal income taxes is required than the $100 billion increase in government spending. One point is earned for explaining that households do not spend all of the initial increase in disposable income caused by a tax reduction, or that the tax multiplier is smaller than the government ...

Macro 3.6- Fiscal Policy and the Multiplier

... The Role of Consumers in the Economy Consumption is the most important part of the economy. Consumers will spend a certain amount no matter what, regardless of their income. This is called autonomous consumption. This is usually to pay for necessities. Consumer spending is made up of autonomous spe ...

... The Role of Consumers in the Economy Consumption is the most important part of the economy. Consumers will spend a certain amount no matter what, regardless of their income. This is called autonomous consumption. This is usually to pay for necessities. Consumer spending is made up of autonomous spe ...

eco history

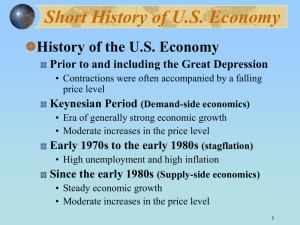

... Short History of U.S. Economy History of the U.S. Economy Prior to and including the Great Depression • Contractions were often accompanied by a falling price level Keynesian Period (Demand-side economics) • Era of generally strong economic growth • Moderate increases in the price level Early 1970s ...

... Short History of U.S. Economy History of the U.S. Economy Prior to and including the Great Depression • Contractions were often accompanied by a falling price level Keynesian Period (Demand-side economics) • Era of generally strong economic growth • Moderate increases in the price level Early 1970s ...

Chapter 16 Government and the Economy

... – The buying and selling of government securities • Reserve requirements – The amount of liquid assets and ready cash that banks are required to hold to meet depositors’ demands ...

... – The buying and selling of government securities • Reserve requirements – The amount of liquid assets and ready cash that banks are required to hold to meet depositors’ demands ...

The Multiplier Long Run Economic Growth

... Ignores the role of CONFIDENCE. Economy might be growing, but do businesses think it will be sustained? Investment decisions are large and complex, made well before changes in the economic conditions Exogenous factors just as influential ‘No more boom and bust’ – Governments can smooth out t ...

... Ignores the role of CONFIDENCE. Economy might be growing, but do businesses think it will be sustained? Investment decisions are large and complex, made well before changes in the economic conditions Exogenous factors just as influential ‘No more boom and bust’ – Governments can smooth out t ...

Fiscal and Monetary Policy

... Government can use expansionary fiscal policy to decrease the unemployment rate. This is how it works: • A high unemployment rate is the result of people not spending enough money in the economy. • If the government increases spending or reduces taxes, or both, consumers will have more money to spen ...

... Government can use expansionary fiscal policy to decrease the unemployment rate. This is how it works: • A high unemployment rate is the result of people not spending enough money in the economy. • If the government increases spending or reduces taxes, or both, consumers will have more money to spen ...

Investment Spending - Avon Community School Corporation

... Political Business Cycle—politicians’ goal is to get reelected; assumption that voters take economic conditions into consideration when voting; Incumbents want to cut taxes and spend in their own districts; continued expansion of economy after the election may push us into inflationary territory; ...

... Political Business Cycle—politicians’ goal is to get reelected; assumption that voters take economic conditions into consideration when voting; Incumbents want to cut taxes and spend in their own districts; continued expansion of economy after the election may push us into inflationary territory; ...

econ-final-review-2016

... 35. A political system in which the government owns all resources and production factors is known as? 36. A political system based on the belief that wealth should be evenly distributed is known as? 37. The economic belief that government should not intervene in the marketplace is known as? 38. When ...

... 35. A political system in which the government owns all resources and production factors is known as? 36. A political system based on the belief that wealth should be evenly distributed is known as? 37. The economic belief that government should not intervene in the marketplace is known as? 38. When ...

Miami Dade College ECO 2013 Section 2 Principles of

... 12. The $787 billion stimulus package passed in the United States in 2009 focused more on spending than on taxes partly because: A) increased spending leads to a larger increase in GDP than the same reduction in taxes. B) increased spending leads to a smaller increase in GDP than the same reduction ...

... 12. The $787 billion stimulus package passed in the United States in 2009 focused more on spending than on taxes partly because: A) increased spending leads to a larger increase in GDP than the same reduction in taxes. B) increased spending leads to a smaller increase in GDP than the same reduction ...

Macro - Unit 5

... APE/Honors Economics – Test Study Questions – Macro – Unit 5 10. If Congress and the Federal Reserve both wished to encourage growth of productive capacity in an economy already close to full employment, it would be most appropriate to A. Increase interest rates by buying bonds on the open market ...

... APE/Honors Economics – Test Study Questions – Macro – Unit 5 10. If Congress and the Federal Reserve both wished to encourage growth of productive capacity in an economy already close to full employment, it would be most appropriate to A. Increase interest rates by buying bonds on the open market ...

week_5_assignment

... Chapter 13: Fiscal Policy, Deficits, and Debts 1. Expansionary fiscal policy can be achieved with an increase in (government spending, taxes) _______, a decrease in (government spending, taxes) _______, or a combination of the two; contractionary fiscal policy can be achieved by a decrease in (gover ...

... Chapter 13: Fiscal Policy, Deficits, and Debts 1. Expansionary fiscal policy can be achieved with an increase in (government spending, taxes) _______, a decrease in (government spending, taxes) _______, or a combination of the two; contractionary fiscal policy can be achieved by a decrease in (gover ...

Chapter 30

... deficits, but since the debt was growing more slowly than the economy, the debt/GDP ratio was declining over this time. In the 2008–2009 recession, the debt/GDP ratio rose sharply. ...

... deficits, but since the debt was growing more slowly than the economy, the debt/GDP ratio was declining over this time. In the 2008–2009 recession, the debt/GDP ratio rose sharply. ...

Document

... In the Classical Economics, a recessionary gap is only temporary. Because the surplus in the labor market will depress the wage rate Then cost of production falls Price of products will also fall. Through wealth effect, consumption will go up In the income-expenditure diagram, the AE schedule will s ...

... In the Classical Economics, a recessionary gap is only temporary. Because the surplus in the labor market will depress the wage rate Then cost of production falls Price of products will also fall. Through wealth effect, consumption will go up In the income-expenditure diagram, the AE schedule will s ...

Document

... increase in transfer payments increases autonomous spending and output; The multiplier of transfer payments is smaller than that of government purchase. ...

... increase in transfer payments increases autonomous spending and output; The multiplier of transfer payments is smaller than that of government purchase. ...

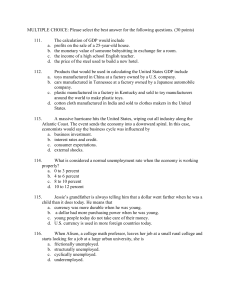

MULTIPLE CHOICE: Please select the best answer for the following

... people earn wages? a. so that people do not realize exactly how much tax they are paying b. so that the money can be put aside until it is needed c. so that the government can pay bills as they come due d. so that taxpayers can qualify for refunds of excess taxes ...

... people earn wages? a. so that people do not realize exactly how much tax they are paying b. so that the money can be put aside until it is needed c. so that the government can pay bills as they come due d. so that taxpayers can qualify for refunds of excess taxes ...

National Income and Price Determination: Fiscal Policy and the

... 10 x $50 billion = $500 billion positive AD shift to the right. ...

... 10 x $50 billion = $500 billion positive AD shift to the right. ...

Chapter 8

... • Quantitative easing low interest rates • High corporate taxes • Double taxation on money earned in foreign countries • Interest earned on reserves held at the Fed • Large fines paid to Treasury by big banks • Interest on national debt • Expectation of lower prices • Lengthy and detailed laws ...

... • Quantitative easing low interest rates • High corporate taxes • Double taxation on money earned in foreign countries • Interest earned on reserves held at the Fed • Large fines paid to Treasury by big banks • Interest on national debt • Expectation of lower prices • Lengthy and detailed laws ...

Christina D - The University of Chicago Booth School of Business

... This discussion of what the bill is intended to do leads naturally to the more important question of whether it will actually accomplish the President’s goal. This involves two issues. One concerns the effects of a typical fiscal change. What will a quintessential increase in government spending or ...

... This discussion of what the bill is intended to do leads naturally to the more important question of whether it will actually accomplish the President’s goal. This involves two issues. One concerns the effects of a typical fiscal change. What will a quintessential increase in government spending or ...

Power Point - The University of Chicago Booth School of Business

... - Need to account for the fact that slack resources have some value. ...

... - Need to account for the fact that slack resources have some value. ...

The Economy - Outwood Post 16 Centre Worksop

... demand higher wages, higher cost of raw materials. ...

... demand higher wages, higher cost of raw materials. ...