UK Monetary Policy

... • However, some MPC members worry about second-round effects, where above-target inflation triggers strong earnings growth, pushing inflation higher in turn. ...

... • However, some MPC members worry about second-round effects, where above-target inflation triggers strong earnings growth, pushing inflation higher in turn. ...

Chapter 18_The Multiplier Effect and Crowding Out

... Answer to Question 6: There are several possible sources of crowding out. First, higher government spending may be financed by higher taxes which reduce private consumption spending. Second, higher government spending may be financed by borrowing (issuing government bonds) which reduces spending on ...

... Answer to Question 6: There are several possible sources of crowding out. First, higher government spending may be financed by higher taxes which reduce private consumption spending. Second, higher government spending may be financed by borrowing (issuing government bonds) which reduces spending on ...

Slide 1

... compared with the quantity of goods and services available for purchase. The government can slow inflation by reducing the amount that it spends. As a result of the decrease in total spending, firms initially sell fewer goods. To reduce unwanted inventory, firms lower prices. ...

... compared with the quantity of goods and services available for purchase. The government can slow inflation by reducing the amount that it spends. As a result of the decrease in total spending, firms initially sell fewer goods. To reduce unwanted inventory, firms lower prices. ...

Document

... debt but does not take into account offsetting assets that are acquired. Sales of assets count as receipts and reduce the deficit for the year of sale but do not take into account offsetting declines in the value of assets held. The national debt does not reflect future obligations to spend that are ...

... debt but does not take into account offsetting assets that are acquired. Sales of assets count as receipts and reduce the deficit for the year of sale but do not take into account offsetting declines in the value of assets held. The national debt does not reflect future obligations to spend that are ...

Notes on Economics

... An economic theory stating that active government intervention in the marketplace and monetary policy is the best method of ensuring economic growth and stability. A supporter of Keynesian economics believes it is the government's job to smooth out the bumps in business cycles. Intervention would co ...

... An economic theory stating that active government intervention in the marketplace and monetary policy is the best method of ensuring economic growth and stability. A supporter of Keynesian economics believes it is the government's job to smooth out the bumps in business cycles. Intervention would co ...

Recovery from the Great Depression

... These statements are inconsistent with the data. Franklin D. Roosevelt became president of the United States in March 1933. Promptly he introduced four key policy initiatives: (1) suspend the Gold Standard, which allowed the Fed to expand money supply; (2) restore confidence in the financial sect ...

... These statements are inconsistent with the data. Franklin D. Roosevelt became president of the United States in March 1933. Promptly he introduced four key policy initiatives: (1) suspend the Gold Standard, which allowed the Fed to expand money supply; (2) restore confidence in the financial sect ...

government spending multiplier

... Transfer payments tend to go down automatically during an expansion. Inflation often picks up when the economy is expanding. This can lead the government to spend more than it had planned to spend. Any change in the interest rate changes government interest payments. 28 of 39 ...

... Transfer payments tend to go down automatically during an expansion. Inflation often picks up when the economy is expanding. This can lead the government to spend more than it had planned to spend. Any change in the interest rate changes government interest payments. 28 of 39 ...

Extra Practice on the Multiplier, Consumption and Investment KEY

... Results in a reduction in inventories as producers sell items from their inventories to satisfy their short-term increase in demand. This is negative unplanned inventory investment: it reduces the value of producers’ inventories. b. A sharp rise in the cost of business borrowing A rise in the cost o ...

... Results in a reduction in inventories as producers sell items from their inventories to satisfy their short-term increase in demand. This is negative unplanned inventory investment: it reduces the value of producers’ inventories. b. A sharp rise in the cost of business borrowing A rise in the cost o ...

Study Guide Exam 2 Understand GDP and its accounting The

... Understand the AD AS macroeconomic model: You will need a full understanding of the basic macroeconomic model including how changes affect real GDP and the price level. How are the changes in AD/AS graphically diagramed? This is an important part to this course module and will be weighted accordingl ...

... Understand the AD AS macroeconomic model: You will need a full understanding of the basic macroeconomic model including how changes affect real GDP and the price level. How are the changes in AD/AS graphically diagramed? This is an important part to this course module and will be weighted accordingl ...

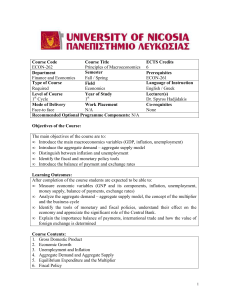

ECON-262 Principles of Macroeconomics

... • Distinguish between inflation and unemployment • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflatio ...

... • Distinguish between inflation and unemployment • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflatio ...

Europe 2020 presentation

... start to build a political consensus around what is important, realistic and practicable. The EU increasingly takes second place to national interests for many Member States. Germany has shown itself reluctant to bail out weaker economies. ...

... start to build a political consensus around what is important, realistic and practicable. The EU increasingly takes second place to national interests for many Member States. Germany has shown itself reluctant to bail out weaker economies. ...

money multiplier used in monetary policy calculated by 1/reserve ratio

... money multiplier used in monetary policy calculated by ...

... money multiplier used in monetary policy calculated by ...

Fiscal and Monetary Policy

... aggregate demand and aggregate supply to avoid prices inflation. Another objective of fiscal policy is to encourage investment, fiscal policy affects the rate of investment in the public sector which in return will affect the rate of investment in the private sector. Other objectives of fiscal polic ...

... aggregate demand and aggregate supply to avoid prices inflation. Another objective of fiscal policy is to encourage investment, fiscal policy affects the rate of investment in the public sector which in return will affect the rate of investment in the private sector. Other objectives of fiscal polic ...

Texbook Problems on Fiscal Policy

... b. Fiscal policy. Given that the full employment level of GDP is $ 200, what fiscal policy could the government follow? Since Keynesian equilibrium GDP is $ 50 below full employment (problem a), and the multiplier is $ 5, an increase in government spending of $ 10 would return Nurd to full employmen ...

... b. Fiscal policy. Given that the full employment level of GDP is $ 200, what fiscal policy could the government follow? Since Keynesian equilibrium GDP is $ 50 below full employment (problem a), and the multiplier is $ 5, an increase in government spending of $ 10 would return Nurd to full employmen ...

Fiscal Policy

... budget deficit increases. • If the change in G and the change in T are the same, the deficit would not grow. • How would this affect AD? – Since the effect of a change in G is greater than the effect of a change in T, AD would shift by the size of the change. – The balanced budget multiplier, theref ...

... budget deficit increases. • If the change in G and the change in T are the same, the deficit would not grow. • How would this affect AD? – Since the effect of a change in G is greater than the effect of a change in T, AD would shift by the size of the change. – The balanced budget multiplier, theref ...

8-9

... - Describe the components of the demand and their behavior: Investment, government expenditure and consumption. ...

... - Describe the components of the demand and their behavior: Investment, government expenditure and consumption. ...

Ch11

... Role of Fiscal Policy In the Keynesian system, it is obvious that in response to changes in C, I, and NX, government can counter them by changing G or T. If NX+I fell by 100, how much G should change to keep Y constant? If NX+I fell by 100, how much T should change to keep Y constant? ...

... Role of Fiscal Policy In the Keynesian system, it is obvious that in response to changes in C, I, and NX, government can counter them by changing G or T. If NX+I fell by 100, how much G should change to keep Y constant? If NX+I fell by 100, how much T should change to keep Y constant? ...

Slide 1

... MORE INVESTMENT DEMAND (SHIFT CURVE TO THE RIGHT) a. ACQUISITION, MAINTENANCE, AND OPERATING COSTS MAY CHANGE b. BUSINESS TAXES MAY CHANGE c. TECHNOLOGY MAY CHANGE d. STOCK OF CAPITAL GOODS ON HAND WILL AFFECT NEW INVESTMENT e. EXPECTATIONS CAN CHANGE THE VIEW OF EXPECTED PROFITS F. INVESTMENT IS A ...

... MORE INVESTMENT DEMAND (SHIFT CURVE TO THE RIGHT) a. ACQUISITION, MAINTENANCE, AND OPERATING COSTS MAY CHANGE b. BUSINESS TAXES MAY CHANGE c. TECHNOLOGY MAY CHANGE d. STOCK OF CAPITAL GOODS ON HAND WILL AFFECT NEW INVESTMENT e. EXPECTATIONS CAN CHANGE THE VIEW OF EXPECTED PROFITS F. INVESTMENT IS A ...

Dr. Yetkiner ( ),

... Important Remark: One must note that there is no change in the multiplier in this exercise. In some questions, the multiplier itself may be subject to change. In that case, the solution procedure would be a bit complicated. ...

... Important Remark: One must note that there is no change in the multiplier in this exercise. In some questions, the multiplier itself may be subject to change. In that case, the solution procedure would be a bit complicated. ...

Macroeconomics: Fiscal Policy

... during a surplus period as revenues from taxes will be high (and temporary tax cuts can be retired), there will be less transfer payments (EI), & government expenditure can be reduced. This is called countercyclical fiscal policy. In the long term (over a period of years), the government’s budget s ...

... during a surplus period as revenues from taxes will be high (and temporary tax cuts can be retired), there will be less transfer payments (EI), & government expenditure can be reduced. This is called countercyclical fiscal policy. In the long term (over a period of years), the government’s budget s ...