Economics 285 Chris Georges Help For Practice

... Notice that, with the proportional tax, increases in government purchases will now automatically be partly tax financed. As the extra government spending raises output Y , net tax revenues t Y will automatically rise. However, this automatic increase in tax revenues will be smaller than the increase ...

... Notice that, with the proportional tax, increases in government purchases will now automatically be partly tax financed. As the extra government spending raises output Y , net tax revenues t Y will automatically rise. However, this automatic increase in tax revenues will be smaller than the increase ...

COURSE: INTRODUCTION TO MACROECONOMIC (ECO 121

... The basic objective of this course is to thoroughly familiarize the students with a working knowledge of Macro Economics. To build a thorough understanding of the different perceptions of Macroeconomic policies that have changed radically in the past few years. We will be discussing both the old and ...

... The basic objective of this course is to thoroughly familiarize the students with a working knowledge of Macro Economics. To build a thorough understanding of the different perceptions of Macroeconomic policies that have changed radically in the past few years. We will be discussing both the old and ...

BD104_fme_lnt_004_Ma..

... Fiscal policy may fail to achieve its intended objectives if households expect future reversals of policy. Eg. Tax cuts. If taxpayers believe the tax reduction is temporary, they may save a large portion of their tax saving, reasoning that rates will return to their previous level in the future. ...

... Fiscal policy may fail to achieve its intended objectives if households expect future reversals of policy. Eg. Tax cuts. If taxpayers believe the tax reduction is temporary, they may save a large portion of their tax saving, reasoning that rates will return to their previous level in the future. ...

Sample exam, page

... 30. A politically liberal economist who favored expanded government would recommend: A) tax cuts during recession and reductions in government spending during inflation. B) tax increases during recession and tax cuts during inflation. C) tax cuts during recession and tax increases during inflation. ...

... 30. A politically liberal economist who favored expanded government would recommend: A) tax cuts during recession and reductions in government spending during inflation. B) tax increases during recession and tax cuts during inflation. C) tax cuts during recession and tax increases during inflation. ...

Top 15 Holders of US Gov`t Bonds

... demand side policies – seek to improve the economy AD curve towards ______________ equilibrium by shifting the _____ -- monetary & fiscal policy supply side policies – seek to improve the economy by LRAS curve out – (1) tax subsidies for shifting the _______ investment, (2) encourage R&D, (3) encour ...

... demand side policies – seek to improve the economy AD curve towards ______________ equilibrium by shifting the _____ -- monetary & fiscal policy supply side policies – seek to improve the economy by LRAS curve out – (1) tax subsidies for shifting the _______ investment, (2) encourage R&D, (3) encour ...

Monetary policy

... automatically increase with the cost of living • The American free enterprise system imposes the biggest restraint on controlling the economy • The billions of economic choices made by consumers and businesses are more important in their impact than are government policies • The federal government o ...

... automatically increase with the cost of living • The American free enterprise system imposes the biggest restraint on controlling the economy • The billions of economic choices made by consumers and businesses are more important in their impact than are government policies • The federal government o ...

Federal Budget and Economic Policy

... facilitate exchanges of cash, checks, and credit; it regulates member banks; and it uses monetary policies to fight inflation and deflation. Discount Rate- the interest on loans given by the Fed to member banks. Reserve Requirement- the proportion of money that the Fed requires member banks hold in ...

... facilitate exchanges of cash, checks, and credit; it regulates member banks; and it uses monetary policies to fight inflation and deflation. Discount Rate- the interest on loans given by the Fed to member banks. Reserve Requirement- the proportion of money that the Fed requires member banks hold in ...

Keynesian Economics

... money. These formulas will culminate in the idea of a multiplier effect: that based on the amount people spend, a government insertion of spending will actually have a greater multiplied effect than the amount they spend. Due to this, the government will also be able to balance its budget. Keynes be ...

... money. These formulas will culminate in the idea of a multiplier effect: that based on the amount people spend, a government insertion of spending will actually have a greater multiplied effect than the amount they spend. Due to this, the government will also be able to balance its budget. Keynes be ...

Answers to the above Grand Synthesis PROB FOR 101

... 9) Let us assume that Belgand has reached FEWPS by only using "fiscal policy". So the interest rate is still 6%. A government advisory board urges a new policy to stimulate growth and labor productivity by investing 200 (million Belmarks) in modern plant and equipment. What specific changes in taxes ...

... 9) Let us assume that Belgand has reached FEWPS by only using "fiscal policy". So the interest rate is still 6%. A government advisory board urges a new policy to stimulate growth and labor productivity by investing 200 (million Belmarks) in modern plant and equipment. What specific changes in taxes ...

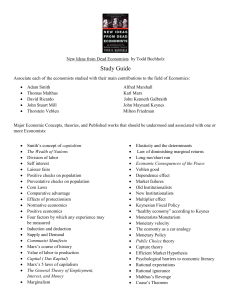

Study Guide - Cobb Learning

... Normative economics Positive economics Four factors by which any experience may be measured Induction and deduction Supply and Demand Communist Manifesto Marx’s course of history Value of labor to production Capital ( Das Kapital) Marx’s 5 laws of capitalism The General Theory of Employment, Interes ...

... Normative economics Positive economics Four factors by which any experience may be measured Induction and deduction Supply and Demand Communist Manifesto Marx’s course of history Value of labor to production Capital ( Das Kapital) Marx’s 5 laws of capitalism The General Theory of Employment, Interes ...

Is Stimulative Fiscal Policy More Effective at the Zero Lower Bound?

... consumption is negative and lower in magnitude than the immediate increase in government spending since economic theory suggests that households will smooth the hit to consumption over many periods. Therefore, the total increase in output must be less than the increase in government spending. Accoun ...

... consumption is negative and lower in magnitude than the immediate increase in government spending since economic theory suggests that households will smooth the hit to consumption over many periods. Therefore, the total increase in output must be less than the increase in government spending. Accoun ...

fiscal policy worksheet

... combination of the two. 4. If fiscal policy is to have a countercyclical effect, if probably will be necessary for the Federal government to incur a budget (surplus, deficit) _______________ during a recession and a budget ________________ during inflation. 5. If government has a balanced-budget req ...

... combination of the two. 4. If fiscal policy is to have a countercyclical effect, if probably will be necessary for the Federal government to incur a budget (surplus, deficit) _______________ during a recession and a budget ________________ during inflation. 5. If government has a balanced-budget req ...

Aggregate Expenditures: The multiplier, net exports and government

... are directly related The size of the MPS & the multiplier are inversely related Spending Multiplier M = 1 / MPS or ...

... are directly related The size of the MPS & the multiplier are inversely related Spending Multiplier M = 1 / MPS or ...

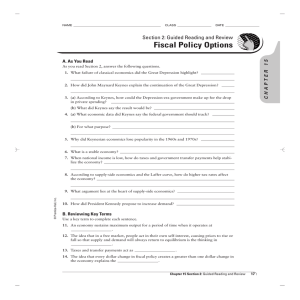

Fiscal Policy Options Section 2: Guided Reading and Review CHAPTER 15

... 6. What is a stable economy? 7. When national income is low, how do taxes and government transfer payments help stabilize the economy? ...

... 6. What is a stable economy? 7. When national income is low, how do taxes and government transfer payments help stabilize the economy? ...

Forecasting

... Your economic data is as following: GDP = 4000 Full employment GDP = 3600 Consumption = 3000 Autonomous Investment = 600 Government Spending = 400 (the budget is balanced) Inflation rate of 15%. 1. Show your economy on the business cycle model? ...

... Your economic data is as following: GDP = 4000 Full employment GDP = 3600 Consumption = 3000 Autonomous Investment = 600 Government Spending = 400 (the budget is balanced) Inflation rate of 15%. 1. Show your economy on the business cycle model? ...

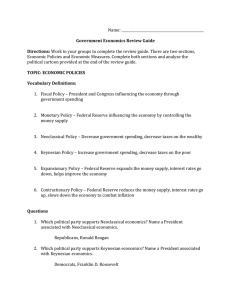

Name: _________________________________________________ Government Economics Review Guide

... Name: _________________________________________________ Government Economics Review Guide Directions: Work in your groups to complete the review guide. There are two sections, Economic Policies and Economic Measures. Complete both sections and analyze the political cartoon provided at the end of the ...

... Name: _________________________________________________ Government Economics Review Guide Directions: Work in your groups to complete the review guide. There are two sections, Economic Policies and Economic Measures. Complete both sections and analyze the political cartoon provided at the end of the ...

CMC 2 Expenditure model

... to households. And foreigners buy and sell products from and to U.S. citizens. So these four sectors, households, businesses, government and foreigners purchase U.S. goods and services. The sum of all of ...

... to households. And foreigners buy and sell products from and to U.S. citizens. So these four sectors, households, businesses, government and foreigners purchase U.S. goods and services. The sum of all of ...

The MPC and the Multipliers

... Once the process has played itself out, the economy’s equilibrium income will be higher by some multiple of the initial investment spending. ...

... Once the process has played itself out, the economy’s equilibrium income will be higher by some multiple of the initial investment spending. ...

Review Questions for Midterm #1

... reducing the wealth of many people and the Federal Reserve responded with a policy change that lowered the money supply. Show the change in equilibrium output on an IS-LM graph showing both changes. 8) Using an IS-LM graph show the “crowding out” effect of an increase in government spending. Would t ...

... reducing the wealth of many people and the Federal Reserve responded with a policy change that lowered the money supply. Show the change in equilibrium output on an IS-LM graph showing both changes. 8) Using an IS-LM graph show the “crowding out” effect of an increase in government spending. Would t ...

Fiscal Policy Power Point

... automatically adjust during times of war, severe drought, depression, etc. For example: Economic slump would lead to lower prices; people would begin buying again; and the economy would recover. The Great Depression would test this theory of self-adjustment. ...

... automatically adjust during times of war, severe drought, depression, etc. For example: Economic slump would lead to lower prices; people would begin buying again; and the economy would recover. The Great Depression would test this theory of self-adjustment. ...

Role of Government - Federal Reserve Bank of Dallas

... Contractionary fiscal policy • Response to inflation (economy is operating above full employment and prices are rising) • Seeks to reduce production (and consumption) – Directly (expenditures ↓) – Indirectly (taxes ↑ to discourage household or investment spending) ...

... Contractionary fiscal policy • Response to inflation (economy is operating above full employment and prices are rising) • Seeks to reduce production (and consumption) – Directly (expenditures ↓) – Indirectly (taxes ↑ to discourage household or investment spending) ...