Fiscal policy - WorkBank247.com

... MONETARY AND FISCAL POLICY IN AN OPEN ECONOMY • The effects of government policies are often ...

... MONETARY AND FISCAL POLICY IN AN OPEN ECONOMY • The effects of government policies are often ...

How Friedman and Schwartz became monetarists

... Present Monetary Policy” he sounded much more like a quantity theorist. He wrote: With a rise of over 8 percent in demand deposits, it is little wonder that personal income rose about 10 percent, wholesale prices about 11 percent, cost of living by nearly 6 percent. It is no accident that these figu ...

... Present Monetary Policy” he sounded much more like a quantity theorist. He wrote: With a rise of over 8 percent in demand deposits, it is little wonder that personal income rose about 10 percent, wholesale prices about 11 percent, cost of living by nearly 6 percent. It is no accident that these figu ...

Efficient policy rule for Inflation Targeting in Colombia

... Around the world monetary authorities meet periodically to determine whether the monetary policy stance is consistent with their short and mid term targets. Those meetings revolves around the change in the tactics or strategies in order to meet the targets. In the early nineties central bankers of m ...

... Around the world monetary authorities meet periodically to determine whether the monetary policy stance is consistent with their short and mid term targets. Those meetings revolves around the change in the tactics or strategies in order to meet the targets. In the early nineties central bankers of m ...

increase

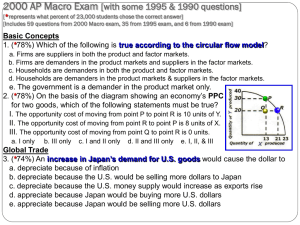

... d. a decrease in the required reserve ratio b. increase in exports e. an open market sale of bonds by the Fed c. a decrease in savings by consumers 20. (58%) Which of the following would cause a rightward shift of the AS curve? a. an increase in interest rates b. a tax increase of 50 cents per gallo ...

... d. a decrease in the required reserve ratio b. increase in exports e. an open market sale of bonds by the Fed c. a decrease in savings by consumers 20. (58%) Which of the following would cause a rightward shift of the AS curve? a. an increase in interest rates b. a tax increase of 50 cents per gallo ...

This PDF is a selection from a published volume from

... projection on two factors extracted from our large panel produces forecasts of the GDP growth rate and inflation comparable with the Greenbook forecasts and a forecast of the federal funds rate up to two quarters ahead, which is in line with that of the future market. Our analysis extends the foreca ...

... projection on two factors extracted from our large panel produces forecasts of the GDP growth rate and inflation comparable with the Greenbook forecasts and a forecast of the federal funds rate up to two quarters ahead, which is in line with that of the future market. Our analysis extends the foreca ...

NBER WORKING PAPER SERIES OPTIMAL OPERATIONAL MONETARY POLICY IN THE CHRISTIANO-EICHENBAUM-EVANS MODEL

... will also be so for an economy where the instruments necessary to engineer the nondistorted steady state are unavailable. For these reasons, we refrain from making the efficient-steadystate assumption and instead work with a model whose steady state is distorted. Departing from a model whose steady s ...

... will also be so for an economy where the instruments necessary to engineer the nondistorted steady state are unavailable. For these reasons, we refrain from making the efficient-steadystate assumption and instead work with a model whose steady state is distorted. Departing from a model whose steady s ...

Chapter 15: Modern Macro - From Short-Run to Long-Run

... course at Towson University. They are not guaranteed to be error-free. Comments and corrections are greatly appreciated. They are derived from c slides from online resources provided by Pearson the Powerpoint Addison-Wesley. The URL is: http://www.pearsonhighered.com/osullivan/ ...

... course at Towson University. They are not guaranteed to be error-free. Comments and corrections are greatly appreciated. They are derived from c slides from online resources provided by Pearson the Powerpoint Addison-Wesley. The URL is: http://www.pearsonhighered.com/osullivan/ ...

12 INFLATION, JOBS, AND THE BUSINESS CYCLE*

... Moving along the short-run Phillips curve the expected inflation rate and natural unemployment rate do not change. Along a short-run Phillips curve, higher inflation is associated with lower unemployment. The short-run Phillips curve is related to the short-run aggregate supply curve. A surprise i ...

... Moving along the short-run Phillips curve the expected inflation rate and natural unemployment rate do not change. Along a short-run Phillips curve, higher inflation is associated with lower unemployment. The short-run Phillips curve is related to the short-run aggregate supply curve. A surprise i ...

A Primer on Economics: `X` Marks the Spot

... cannot be physically measured Bentham assumed they can be reified, i.e., an abstraction made concrete, in this case of happiness made money. The presence of money brings pleasure; its absence pain. The willingness to pay in monetary terms is taken as the measure of the happiness a consumer believes ...

... cannot be physically measured Bentham assumed they can be reified, i.e., an abstraction made concrete, in this case of happiness made money. The presence of money brings pleasure; its absence pain. The willingness to pay in monetary terms is taken as the measure of the happiness a consumer believes ...

The Effects of Unconventional and Conventional U.S. Monetary

... rate surprises in the pre-crisis period. This suggests that monetary policy has the same bang-perunit of surprise as previously and that the exchange channel of monetary policy is still working as effectively as in the past. Our paper adds to a growing and active literature on the effects of unconve ...

... rate surprises in the pre-crisis period. This suggests that monetary policy has the same bang-perunit of surprise as previously and that the exchange channel of monetary policy is still working as effectively as in the past. Our paper adds to a growing and active literature on the effects of unconve ...

Chapter 9 The IS-LM/AD

... (a) increases output, national saving, and investment, but not the real interest rate. (b) increases output, national saving, and the real interest rate, but not investment. (c) increases the real interest rate, investment, and output, but not national saving. (d) increases output, national saving, ...

... (a) increases output, national saving, and investment, but not the real interest rate. (b) increases output, national saving, and the real interest rate, but not investment. (c) increases the real interest rate, investment, and output, but not national saving. (d) increases output, national saving, ...

Investing for the Future

... 1. Put and Take Account When you get a paycheck you will put it in an account. Put and Take accounts = Checking and Savings This is where your emergency fund goes. Why is it called Put and Take? Because you EASILY put money in and EASILY take money out. = Liquid Personal Finance CH 11 Investing in ...

... 1. Put and Take Account When you get a paycheck you will put it in an account. Put and Take accounts = Checking and Savings This is where your emergency fund goes. Why is it called Put and Take? Because you EASILY put money in and EASILY take money out. = Liquid Personal Finance CH 11 Investing in ...

NBER WORKING PAPER SERIES CHOOSING THE FEDERAL RESERVE CHAIR: LESSONS FROM HISTORY

... (Minutes, 1/26/37, p. 3). Policymakers also felt that “the increase in reserve requirements was fully justified in order to put the System in position to exercise credit control through open market operations whenever such action appeared to be necessary” (3/15/37, p. 9; see also 1/26/37, pp. 5-7). ...

... (Minutes, 1/26/37, p. 3). Policymakers also felt that “the increase in reserve requirements was fully justified in order to put the System in position to exercise credit control through open market operations whenever such action appeared to be necessary” (3/15/37, p. 9; see also 1/26/37, pp. 5-7). ...

P a g e 1

... collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized institutions in the euro area belong to institutional protection schemes and are hence closely interlinked - and often they are also in protection schemes ...

... collectively as associations of savings banks and cooperative banks. That is particularly true when you consider that many small and medium-sized institutions in the euro area belong to institutional protection schemes and are hence closely interlinked - and often they are also in protection schemes ...

Chapter 7

... shifts rightward… … and when aggregate demand decreases, the AD curve shifts leftward. ...

... shifts rightward… … and when aggregate demand decreases, the AD curve shifts leftward. ...

Financial Stability, the Trilemma, and International Reserves

... Over the past decade, the international reserves held by monetary authorities have risen to very high levels relative to national outputs. More rapid reserve accumulation, primarily attributable to relatively poor countries, is thought to have affected the global patterns of exchange rates, of capit ...

... Over the past decade, the international reserves held by monetary authorities have risen to very high levels relative to national outputs. More rapid reserve accumulation, primarily attributable to relatively poor countries, is thought to have affected the global patterns of exchange rates, of capit ...

Inflation Targeting and Inflation Prospects in Canada

... 3.2 Zero bound on interest rates • No one will lend money at negative nominal interest if cash is costless to carry over time • The power to lower short-term interest rates to fight deflation and recession is limited when nominal rates are low on average • Potentially persuasive argument against ta ...

... 3.2 Zero bound on interest rates • No one will lend money at negative nominal interest if cash is costless to carry over time • The power to lower short-term interest rates to fight deflation and recession is limited when nominal rates are low on average • Potentially persuasive argument against ta ...