FINALTERM EXAMINATION ECO401- Economics (Session

... Question No: 26 ( Marks: 1 ) - Please choose one Which of the following is NOT a reason of downward slope of aggregate demand curve? ► The exchange-rate effect. ► The wealth effect. ► The classical dichotomy / monetary neutrality effects. ► The interest-rate effect. Question No: 27 ( Marks: 1 ) - Pl ...

... Question No: 26 ( Marks: 1 ) - Please choose one Which of the following is NOT a reason of downward slope of aggregate demand curve? ► The exchange-rate effect. ► The wealth effect. ► The classical dichotomy / monetary neutrality effects. ► The interest-rate effect. Question No: 27 ( Marks: 1 ) - Pl ...

The Case for a Long-Run Inflation Target of Four Percent

... As the U.S. recession spread around the world, many other central banks reduced interest rates to 1% or less, including the European Central Bank. With policymakers unable to cut rates much farther, unemployment rose in much of the world and stayed high. Some central banks, including the Fed and ECB ...

... As the U.S. recession spread around the world, many other central banks reduced interest rates to 1% or less, including the European Central Bank. With policymakers unable to cut rates much farther, unemployment rose in much of the world and stayed high. Some central banks, including the Fed and ECB ...

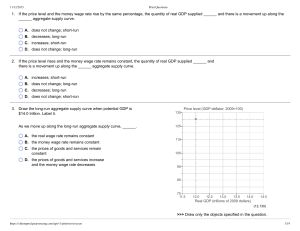

QUIZ 5: Macro – Fall 2014 Name: _ANSWERS____ Section

... Quiz assumptions (READ!): Use the models developed in class with our standard assumptions. ...

... Quiz assumptions (READ!): Use the models developed in class with our standard assumptions. ...

NBER WORKING PAPER SERIES Jesús Fernández-Villaverde

... Besides using our estimation to interpret the recent monetary policy history of the U.S., we will follow Sims and Zha’s (2006) call to connect estimated changes to historical events (we are also inspired by Cogley and Sargent, 2002 and 2005). In particular, we will discuss how our estimation results ...

... Besides using our estimation to interpret the recent monetary policy history of the U.S., we will follow Sims and Zha’s (2006) call to connect estimated changes to historical events (we are also inspired by Cogley and Sargent, 2002 and 2005). In particular, we will discuss how our estimation results ...

Aggregate Supply and Demand

... makes households feel wealthier, C rises, the AD curve shifts right. ...

... makes households feel wealthier, C rises, the AD curve shifts right. ...

A Primer on Inflation

... businesses, and government difficult. Eventually, inflation may strain a country’s social fabric as each group in society competes with other groups to ensure its wages are keeping up with the rising level of prices. The social and economic costs of inflation have made authorities more concerned wit ...

... businesses, and government difficult. Eventually, inflation may strain a country’s social fabric as each group in society competes with other groups to ensure its wages are keeping up with the rising level of prices. The social and economic costs of inflation have made authorities more concerned wit ...

NBER WORKING PAPER SERIES MONETARY POLICY MATTER? A NEW TEST IN

... as banks worked to restore their excess reserves. Thus, according to Friedman and Schwartz, the Federal Reserve inadvertently caused a major monetary contraction because it misunderstood the motives of bankers. Furthermore, they believe that the unfamiliarity of reserve requirements as a policy inst ...

... as banks worked to restore their excess reserves. Thus, according to Friedman and Schwartz, the Federal Reserve inadvertently caused a major monetary contraction because it misunderstood the motives of bankers. Furthermore, they believe that the unfamiliarity of reserve requirements as a policy inst ...

Economics 101 Homework Assignments Spring

... rapid rate (hyperinflation) while prices in the United States were hardly rising at all. Second, for a variety of reasons, those who had made portfolio investments in Russia decided to take their money elsewhere. This means that they demanded that the loans they had made in Russia be paid off. When ...

... rapid rate (hyperinflation) while prices in the United States were hardly rising at all. Second, for a variety of reasons, those who had made portfolio investments in Russia decided to take their money elsewhere. This means that they demanded that the loans they had made in Russia be paid off. When ...

apers g P orkin al Bank W

... sector. Residential property prices were subsequently weak or fell in the 1990s, following the US recession in 1990-1991 and the episode of high interest rates in many European countries after the turmoil in the European exchange rate mechanism (ERM) in 1992-93 which was triggered by the adoption of ...

... sector. Residential property prices were subsequently weak or fell in the 1990s, following the US recession in 1990-1991 and the episode of high interest rates in many European countries after the turmoil in the European exchange rate mechanism (ERM) in 1992-93 which was triggered by the adoption of ...

A Dynamic Model of Aggregate Demand and Aggregate Supply

... • The dynamic model of aggregate demand and aggregate supply (DAD-DAS) determines both – real GDP (Y), and – the inflation rate (π) ...

... • The dynamic model of aggregate demand and aggregate supply (DAD-DAS) determines both – real GDP (Y), and – the inflation rate (π) ...

A Rehabilitation of Monetary Policy in the 1950`s

... An examination of the data on free reserves and interest rates con rms the key role of interest rates in policy-making. For most periods, free reserves and the federal funds rate move together closely, but in opposite directions. The main exception occurs in 1956, when both series rise considerably ...

... An examination of the data on free reserves and interest rates con rms the key role of interest rates in policy-making. For most periods, free reserves and the federal funds rate move together closely, but in opposite directions. The main exception occurs in 1956, when both series rise considerably ...

Lecture 6 - Universität Bamberg

... Lehrstuhl für Volkswirtschaftslehre, insbesondere Integration Europäischer Arbeitsmärkte Universität Bamberg | [email protected] | www.uni-bamberg.de/sowi/bruecker ...

... Lehrstuhl für Volkswirtschaftslehre, insbesondere Integration Europäischer Arbeitsmärkte Universität Bamberg | [email protected] | www.uni-bamberg.de/sowi/bruecker ...

1 Introduction

... The Reserve Bank of New Zealand Act 1989 specifies that the primary function of the Reserve Bank shall be to deliver “stability in the general level of prices.” The Act says that the Minister of Finance and the Governor of the Reserve Bank shall together have a separate agreement setting out specific ...

... The Reserve Bank of New Zealand Act 1989 specifies that the primary function of the Reserve Bank shall be to deliver “stability in the general level of prices.” The Act says that the Minister of Finance and the Governor of the Reserve Bank shall together have a separate agreement setting out specific ...