ECON 4110

... D) a decrease in the interest rate makes lenders more willing and able to supply more funds. 18) The demand curve for loanable funds slopes down because. A) a decrease in the interest rate makes borrowers more willing and able to demand more funds. B) at lower bond prices more loanable funds will be ...

... D) a decrease in the interest rate makes lenders more willing and able to supply more funds. 18) The demand curve for loanable funds slopes down because. A) a decrease in the interest rate makes borrowers more willing and able to demand more funds. B) at lower bond prices more loanable funds will be ...

Test Chapter 8 Spring `14

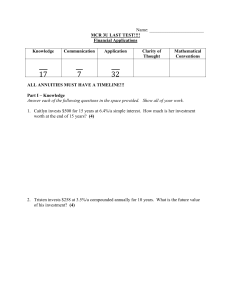

... Answer each of the following questions in the space provided. Be sure to use full sentences. 1. Kevin and Louis both want to have $10 000 in 20 years. Kevin can invest at 5%/a compounded annually and Louis can invest at 4.8%/a compounded monthly. WITHOUT doing any calculations explain who has to inv ...

... Answer each of the following questions in the space provided. Be sure to use full sentences. 1. Kevin and Louis both want to have $10 000 in 20 years. Kevin can invest at 5%/a compounded annually and Louis can invest at 4.8%/a compounded monthly. WITHOUT doing any calculations explain who has to inv ...

Best Credit Data Bond Analytics Calculation Methodology Created by

... Option-Adjusted Spread (OAS) Definition Option-adjusted spread (OAS) is the spread relative to a risk-free interest rate, usually measured in basis points (bp), which equates the theoretical present value of a series of uncertain cash flows of an instrument to its current market price. OAS can be v ...

... Option-Adjusted Spread (OAS) Definition Option-adjusted spread (OAS) is the spread relative to a risk-free interest rate, usually measured in basis points (bp), which equates the theoretical present value of a series of uncertain cash flows of an instrument to its current market price. OAS can be v ...

The Equity Risk Premium

... derives from basic economic theory, which says earnings, whether paid out as dividends or retained for investment, are the ultimate source of value for shareholders. In 1998, the earnings yield on the S&P 500 fell below 4 percent for the first time in postwar history. Under Siegel’s argument, this ...

... derives from basic economic theory, which says earnings, whether paid out as dividends or retained for investment, are the ultimate source of value for shareholders. In 1998, the earnings yield on the S&P 500 fell below 4 percent for the first time in postwar history. Under Siegel’s argument, this ...

Input Demand: The Capital Market and the Investment Decision

... projects. Financial institutions facilitate the transfer of savings from households to the investment of firms. • Households earn income when they supply their savings to the capital market. This income comes in two forms: ...

... projects. Financial institutions facilitate the transfer of savings from households to the investment of firms. • Households earn income when they supply their savings to the capital market. This income comes in two forms: ...

aia-qb

... (4) A fund manager has to payout $1 million at the end of 10 years. Current yields are 5%. Two bonds are available to immunise the position : - a 5 year zero coupon bond - a level perpetuity (a) Calculate the investment required in the two bonds to completely immunise the position. (b) What is the p ...

... (4) A fund manager has to payout $1 million at the end of 10 years. Current yields are 5%. Two bonds are available to immunise the position : - a 5 year zero coupon bond - a level perpetuity (a) Calculate the investment required in the two bonds to completely immunise the position. (b) What is the p ...

rate_note

... value, which states that the present value at time 0 of cash–inflow equals the present value at time 0 of cash–outflow. In other words, we are interested in determining the rate that will equate the present values of cash–inflow and cash–outflow. It is a simple idea, which requires great knowledge i ...

... value, which states that the present value at time 0 of cash–inflow equals the present value at time 0 of cash–outflow. In other words, we are interested in determining the rate that will equate the present values of cash–inflow and cash–outflow. It is a simple idea, which requires great knowledge i ...

Institute of Actuaries of India INDICATIVE SOLUTIONS November 2012 Examinations

... The indicative solution has been written by the Examiners with the aim of helping candidates. The solutions given are only indicative. It is realized that there could be other points as valid answers and examiner have given credit for any alternative approach or interpretation which they consider to ...

... The indicative solution has been written by the Examiners with the aim of helping candidates. The solutions given are only indicative. It is realized that there could be other points as valid answers and examiner have given credit for any alternative approach or interpretation which they consider to ...

Valuation: Introduction

... The 2020 Brazil bond, denominated in US dollars, has a spread of 0.74% over the US treasury bond rate. Riskfree rate in $R = 9.18% - 0.74% = 8.44% Approach 2: The CDS Spread The CDS spread for Brazil on January 1, 2013 was 1.42%. Riskfree rate in $R = 9.18% - 1.42% = 7.76% Approach 3: The Ra ...

... The 2020 Brazil bond, denominated in US dollars, has a spread of 0.74% over the US treasury bond rate. Riskfree rate in $R = 9.18% - 0.74% = 8.44% Approach 2: The CDS Spread The CDS spread for Brazil on January 1, 2013 was 1.42%. Riskfree rate in $R = 9.18% - 1.42% = 7.76% Approach 3: The Ra ...

PPT

... • Exploration necessary for discoveries of commercially exploitable resources • Either own account or contracted out • All costs incurred in exploration treated as GFCF of intellectual property (not natural resource): capitalization of knowledge • COFC necessary in calculation of RR • Costs of decom ...

... • Exploration necessary for discoveries of commercially exploitable resources • Either own account or contracted out • All costs incurred in exploration treated as GFCF of intellectual property (not natural resource): capitalization of knowledge • COFC necessary in calculation of RR • Costs of decom ...

J. Maloney William No.

... will affect the optimal capital stock. We term this the technical effect and have shown it is present regardless of whether the risk is systematic or ...

... will affect the optimal capital stock. We term this the technical effect and have shown it is present regardless of whether the risk is systematic or ...

K - Binus Repository

... Valuation of Preferred Stock • Owner of preferred stock receives a promise to pay a stated dividend, usually quarterly, for perpetuity • Since payments are only made after the firm meets its bond interest payments, there is more uncertainty of returns • Tax treatment of dividends paid to corporatio ...

... Valuation of Preferred Stock • Owner of preferred stock receives a promise to pay a stated dividend, usually quarterly, for perpetuity • Since payments are only made after the firm meets its bond interest payments, there is more uncertainty of returns • Tax treatment of dividends paid to corporatio ...

Capital Budgeting in Projects

... • Example: a case predicts net cash flow of $20 M if marketing program implemented • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - whic ...

... • Example: a case predicts net cash flow of $20 M if marketing program implemented • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - whic ...

1 - CSUN.edu

... transaction/information costs, (2) circumvent legal/institutional barriers, and (3) benefit from the expertise of professional fund managers. 1. Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago. You had invested 10,000 euros to buy Microsoft sha ...

... transaction/information costs, (2) circumvent legal/institutional barriers, and (3) benefit from the expertise of professional fund managers. 1. Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago. You had invested 10,000 euros to buy Microsoft sha ...

MODIGLIANI-MILLER PROPOSTIONS

... MODIGLIANI-MILLER PROPOSITIONS M-M Proposition 1: In competitive, transaction costless, information efficient markets, with no taxes, the market value of the firm (i.e., market value of all of its securities) is independent of the firm’s capital structure. That is, VU = VL (see definition below) [Br ...

... MODIGLIANI-MILLER PROPOSITIONS M-M Proposition 1: In competitive, transaction costless, information efficient markets, with no taxes, the market value of the firm (i.e., market value of all of its securities) is independent of the firm’s capital structure. That is, VU = VL (see definition below) [Br ...

Engineering Economics - Inside Mines

... The financial cost of capital is based on the assumption that financing is unlimited and the company can always pay off loans or buy stock back, so the financial cost of capital rate of return is the average cost of debt after tax (remember interest is tax deductible) and the cost of equity (what th ...

... The financial cost of capital is based on the assumption that financing is unlimited and the company can always pay off loans or buy stock back, so the financial cost of capital rate of return is the average cost of debt after tax (remember interest is tax deductible) and the cost of equity (what th ...

Managerial Economics

... • Accounts for risk of not knowing future profits • The larger the risk, the higher the risk premium, & the lower the firm’s value ...

... • Accounts for risk of not knowing future profits • The larger the risk, the higher the risk premium, & the lower the firm’s value ...