Tax-adjusted discount rates with investor taxes and risky

... weighted average cost of capital by plugging equity and debt betas into the CAPM. From that one can infer RA and perhaps calculate new RL ’s for a different leverage ratios. In this section, we derive the formula for the asset beta that is consistent with (11). We also explore the numerical difference ...

... weighted average cost of capital by plugging equity and debt betas into the CAPM. From that one can infer RA and perhaps calculate new RL ’s for a different leverage ratios. In this section, we derive the formula for the asset beta that is consistent with (11). We also explore the numerical difference ...

20 Dec 15 AGNC stock price appreciation in 2016

... $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 million of TBA dollar roll income; $140 million of net mark-to-market gains on TBA mortgage positions; and $19 million of ...

... $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 million of TBA dollar roll income; $140 million of net mark-to-market gains on TBA mortgage positions; and $19 million of ...

Determination of Rate of Return

... rate. For the purpose of determining expected rate of return using CAPM, Pakistan based market return, which is actually the average return at Pakistan Stock Exchange (PSX), can be assumed. However, the PSX is not mature market or big enough and don’t offer long term historical return patterns to f ...

... rate. For the purpose of determining expected rate of return using CAPM, Pakistan based market return, which is actually the average return at Pakistan Stock Exchange (PSX), can be assumed. However, the PSX is not mature market or big enough and don’t offer long term historical return patterns to f ...

Cost of Capital - North Carolina Petroleum & Convenience Marketers

... practice”. It is not in the domain knowledge sphere of most accountants and CEOs but requires their buy-in! ...

... practice”. It is not in the domain knowledge sphere of most accountants and CEOs but requires their buy-in! ...

use the following information for the next two problems

... Stennett Corp.’s CFO has proposed that the company issue new debt and use the proceeds to buy back common stock. Which of the following are likely to occur if this proposal is adopted? (Assume that the proposal would have no effect on the company’s operating income.) a. b. c. d. ...

... Stennett Corp.’s CFO has proposed that the company issue new debt and use the proceeds to buy back common stock. Which of the following are likely to occur if this proposal is adopted? (Assume that the proposal would have no effect on the company’s operating income.) a. b. c. d. ...

Download Document

... Treasury bonds, the expected cash flows are essentially certain, while for another investment such as a “start-up” technology company, the future cash flows (earnings) expectation would be that earnings will grow in the future, but that expectation will be highly uncertain. Financial theory says tha ...

... Treasury bonds, the expected cash flows are essentially certain, while for another investment such as a “start-up” technology company, the future cash flows (earnings) expectation would be that earnings will grow in the future, but that expectation will be highly uncertain. Financial theory says tha ...

Building Evaluations Using MSB`s BVS Software Fact Sheet

... Value Basis vs. Replacement Cost vs. Reconstruction Cost MS/B believes that the more comprehensive Reconstruction Cost value basis is a better representation of what a carrier may expect to pay following a loss, and therefore the most reliable valuation method for determining Insurance to Value at p ...

... Value Basis vs. Replacement Cost vs. Reconstruction Cost MS/B believes that the more comprehensive Reconstruction Cost value basis is a better representation of what a carrier may expect to pay following a loss, and therefore the most reliable valuation method for determining Insurance to Value at p ...

OVERVIEW Value_Investing_Slides

... 1) Look Intelligently for Value Opportunities (low P/E, M/B) • Mr. Market is not Crazy about Everything • This is the first step not to be confused with Value Investing 2) Know What You Know ...

... 1) Look Intelligently for Value Opportunities (low P/E, M/B) • Mr. Market is not Crazy about Everything • This is the first step not to be confused with Value Investing 2) Know What You Know ...

Monetary Value Estimation: An Illustration

... Nonindustrial markets such as academic institutions and government laboratories estimate economic value in a similar fashion. Their reference value is also the $30 price of the EnSyn test kit; however, the most pricesensitive among them simply have lab assistants — essentially free student labor — m ...

... Nonindustrial markets such as academic institutions and government laboratories estimate economic value in a similar fashion. Their reference value is also the $30 price of the EnSyn test kit; however, the most pricesensitive among them simply have lab assistants — essentially free student labor — m ...

How do you assess multi-asset funds?

... potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the use of derivatives, or investments where the investor does not own the underlying asset, but instead makes a bet on the direction of the price movement of the underlying asset. Exampl ...

... potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the use of derivatives, or investments where the investor does not own the underlying asset, but instead makes a bet on the direction of the price movement of the underlying asset. Exampl ...

Half Year Sept 07 £`m

... doorstep delivery service ‘milk&more’ • Strong performance from St Hubert, as first step into Europe, with market share gains in France • Clover performance improving following product recall in May ...

... doorstep delivery service ‘milk&more’ • Strong performance from St Hubert, as first step into Europe, with market share gains in France • Clover performance improving following product recall in May ...

Derivatives and Risk Management

... Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

... Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

Sanlam Investment Management Value Fund Class A1

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

FINAL EXAM—REVIEW SHEET (This sheet, while not all inclusive

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

Discussion of "The Leverage Cycle" by John Geanakoplos

... leveraged investors. These alternative approaches (as well as my example above) have two possible advantages over Geanakoplos’s more explicitly micro-founded approach. First, the active investors with warped incentives are very reminiscent of the banks and financial intermediaries who operate with r ...

... leveraged investors. These alternative approaches (as well as my example above) have two possible advantages over Geanakoplos’s more explicitly micro-founded approach. First, the active investors with warped incentives are very reminiscent of the banks and financial intermediaries who operate with r ...

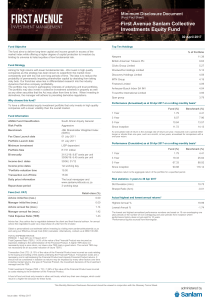

First Avenue Sanlam Collective Investments Equity Fund

... All reasonable steps have been taken to ensure the information on this MDD is accurate. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent profe ...

... All reasonable steps have been taken to ensure the information on this MDD is accurate. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent profe ...

Slide 1

... Question: It is fair to ask, how can something with no intrinsic value be an asset? Answer: Fiat money has value simply by virtue of the fact that people believe it has value! Fiat money maintains its value only so long as people believe that other people will accept it in exchange for commodities. ...

... Question: It is fair to ask, how can something with no intrinsic value be an asset? Answer: Fiat money has value simply by virtue of the fact that people believe it has value! Fiat money maintains its value only so long as people believe that other people will accept it in exchange for commodities. ...

Presentation of paper (in PowerPoint)

... Derivatives Compared to Other Financial Instruments Trillion US$, notional principal (as percent of U.S. GDP) ...

... Derivatives Compared to Other Financial Instruments Trillion US$, notional principal (as percent of U.S. GDP) ...

pubP-FDI

... • While better fundamentals (including higher FDI) lead to an increase in domestic stock market activity, more of this activity is expected to occur abroad as better fundamentals also spur the migration in capital raising, listing, and trading • Firm perspective – As firms from emerging markets cont ...

... • While better fundamentals (including higher FDI) lead to an increase in domestic stock market activity, more of this activity is expected to occur abroad as better fundamentals also spur the migration in capital raising, listing, and trading • Firm perspective – As firms from emerging markets cont ...

ECONOMIOC ANALYSIS OF THE COPPER MINING INDUSDRY OF

... A sale analysis is an investigation of a market that is used to forecast the next sales, according to past experiences and prediction of future conditions. Sale analysis is vital when perfect competition prevails in a market, whereas it is not so important in cases of a monopoly producer. ...

... A sale analysis is an investigation of a market that is used to forecast the next sales, according to past experiences and prediction of future conditions. Sale analysis is vital when perfect competition prevails in a market, whereas it is not so important in cases of a monopoly producer. ...