Lesson 13 key - Bakersfield College

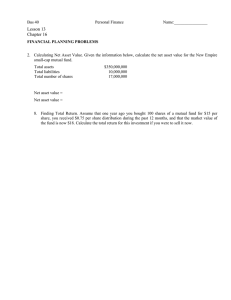

... share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now. ...

... share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now. ...

Economics 471 Lecture 2 Elementary Probability, Portfolio Theory

... In this lecture we review some basic concepts of probability including expectation, variance, covariance and correlation, and incidentally reveal how to get rich in the stock market. Suppose you buy an asset today at price p0 , it might be 100 shares of IBM stock or a painting by Matisse. A month fr ...

... In this lecture we review some basic concepts of probability including expectation, variance, covariance and correlation, and incidentally reveal how to get rich in the stock market. Suppose you buy an asset today at price p0 , it might be 100 shares of IBM stock or a painting by Matisse. A month fr ...

DENZIO L IKUNGWA - Institute of Bankers in Malawi

... "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information. According to the EMH, this means that stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalu ...

... "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information. According to the EMH, this means that stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalu ...

Newsletter April 2010 - PNM Financial Management

... their own way. We must not forget that over 50% of earnings from FTSE 100 companies are now derived overseas. This goes some way to explaining stock markets lack of interest in the election. ...

... their own way. We must not forget that over 50% of earnings from FTSE 100 companies are now derived overseas. This goes some way to explaining stock markets lack of interest in the election. ...

capital investment

... Another shortfall to NPV is if the risk of the project (or future cash outflow) is higher than the risk of the average investment for the company. Consider the above example where the outflow is associated with a great deal of uncertainty about the cost (such as decommissioning a nuclear power plant ...

... Another shortfall to NPV is if the risk of the project (or future cash outflow) is higher than the risk of the average investment for the company. Consider the above example where the outflow is associated with a great deal of uncertainty about the cost (such as decommissioning a nuclear power plant ...

Ch. 15: Financial Markets

... Ch. 15: Financial Markets • Financial markets – link borrowers and lenders. – determine interest rates, stock prices, bond prices, etc. ...

... Ch. 15: Financial Markets • Financial markets – link borrowers and lenders. – determine interest rates, stock prices, bond prices, etc. ...

US marinas set to become `asset class`

... upland area and limited services with a full service facility that has extensive upland area and notable repair and maintenance buildings can result in a very misleading conclusion. The income approach converts the anticipated benefits (dollar income of amenities) to be derived from the ownership of ...

... upland area and limited services with a full service facility that has extensive upland area and notable repair and maintenance buildings can result in a very misleading conclusion. The income approach converts the anticipated benefits (dollar income of amenities) to be derived from the ownership of ...

what would you do with a million dollars?

... UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below optimal. The Dow lost 5.6% during January 2014 due to weakness in emerging markets, t ...

... UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below optimal. The Dow lost 5.6% during January 2014 due to weakness in emerging markets, t ...

Glossary - Budget.gov.au

... transaction. The fair value can be affected by the conditions of the sale, market conditions and the intentions of the asset holder. ...

... transaction. The fair value can be affected by the conditions of the sale, market conditions and the intentions of the asset holder. ...

Long-Term Debt and Lease Financing

... • Analyzing long-term debt. • Bond yield and prices. • Refunding the obligation upon decline in interest rates. • Innovative bond forms. • Long-term lease obligations and its ...

... • Analyzing long-term debt. • Bond yield and prices. • Refunding the obligation upon decline in interest rates. • Innovative bond forms. • Long-term lease obligations and its ...

cost of capital

... Based upon NPV, we would accept Project C. But if Project C were riskfree, then by accepting it, we would reduce the risk of the company overall. If the risk of the company is reduced, then the company’s cost of capital should fall. Thus, while it looks like we would be losing money by accepting Pro ...

... Based upon NPV, we would accept Project C. But if Project C were riskfree, then by accepting it, we would reduce the risk of the company overall. If the risk of the company is reduced, then the company’s cost of capital should fall. Thus, while it looks like we would be losing money by accepting Pro ...

Capital Market Indices - Morgan Stanley Locator

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or oth ...

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or oth ...

Institute of Actuaries of India MARKING SCHEDULE October 2009 EXAMINATION

... floor and sale of a cap. The bank receives cash if rates fall below the floor rate, but will have to pay cash if rates rise. c. The benefit of a reverse collar over a floor, or collar over a cap, is that it costs less in terms of the upfront premium. Of course, the buyer of a collar or reverse colla ...

... floor and sale of a cap. The bank receives cash if rates fall below the floor rate, but will have to pay cash if rates rise. c. The benefit of a reverse collar over a floor, or collar over a cap, is that it costs less in terms of the upfront premium. Of course, the buyer of a collar or reverse colla ...

Week 4 assignment

... see the impact of increasing inventory levels to 30 and 40 percent of the next quarter’s sales on their total investment. “One aspect has remained unchanged, perfect performance is difficult to achieve, with many possibilities of stock outs and other failures which negatively impact performance. In ...

... see the impact of increasing inventory levels to 30 and 40 percent of the next quarter’s sales on their total investment. “One aspect has remained unchanged, perfect performance is difficult to achieve, with many possibilities of stock outs and other failures which negatively impact performance. In ...

KeyBank Quantitative Risk Management Analyst

... Turn to Key for a rewarding career opportunity. Key Risk Management provides the company’s lines of business advanced analytical, advisory, and reporting expertise on risk management strategies and initiatives to minimize losses while accomplishing business goals. About the Rotational Analyst Progra ...

... Turn to Key for a rewarding career opportunity. Key Risk Management provides the company’s lines of business advanced analytical, advisory, and reporting expertise on risk management strategies and initiatives to minimize losses while accomplishing business goals. About the Rotational Analyst Progra ...

Intro to Banking 4

... Does this make sense? If investors demand higher yields this implies they need to be compensated for higher expected and unexpected risks Issuers of discount instruments can not change repayment Investors need to buy those instruments at lower prices to generate their higher required returns ...

... Does this make sense? If investors demand higher yields this implies they need to be compensated for higher expected and unexpected risks Issuers of discount instruments can not change repayment Investors need to buy those instruments at lower prices to generate their higher required returns ...

Chapter 5

... these assets are wasting (declining in value over time), they will be amortized over time as an expense. Goodwill, on the other hand, requires special consideration, particularly due to recent changes in accounting for goodwill. Goodwill is generally not recognized as an asset unless it results from ...

... these assets are wasting (declining in value over time), they will be amortized over time as an expense. Goodwill, on the other hand, requires special consideration, particularly due to recent changes in accounting for goodwill. Goodwill is generally not recognized as an asset unless it results from ...

Chapter 6

... The reasons for the failure of many diversification efforts. How corporations can use related diversification to achieve synergistic benefits through economies of scope and market power. How corporations can use unrelated diversification to attain synergistic benefits trough corporate restructuring, ...

... The reasons for the failure of many diversification efforts. How corporations can use related diversification to achieve synergistic benefits through economies of scope and market power. How corporations can use unrelated diversification to attain synergistic benefits trough corporate restructuring, ...

1 - BrainMass

... debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the following statements is most correct? a. The tax preference theory states that, all els ...

... debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the following statements is most correct? a. The tax preference theory states that, all els ...

Chapter 14 - Capital Markets

... For nominal bonds, the risk is in higher inflation rates. For these bonds, the risk is in possible changes in government policy toward them. ...

... For nominal bonds, the risk is in higher inflation rates. For these bonds, the risk is in possible changes in government policy toward them. ...