ThrIvenT LArge CAP vALue PorTfoLIo

... that compare the stock’s price to the company’s earnings and growth trends. The portfolio management team seeks to invest in stocks that they believe are undervalued, which may be because the company is out of favor or has been temporarily overlooked. Large companies are generally considered to be m ...

... that compare the stock’s price to the company’s earnings and growth trends. The portfolio management team seeks to invest in stocks that they believe are undervalued, which may be because the company is out of favor or has been temporarily overlooked. Large companies are generally considered to be m ...

First Bankers` Banc Securities, Inc.

... Subsequent to initial recognition, the Company may remeasure the carrying value of assets and liabilities measured on a nonrecurring basis to fair value. Adjustments to fair value usually result when certain assets are impaired. Such assets are written down from their carrying amounts to their fair ...

... Subsequent to initial recognition, the Company may remeasure the carrying value of assets and liabilities measured on a nonrecurring basis to fair value. Adjustments to fair value usually result when certain assets are impaired. Such assets are written down from their carrying amounts to their fair ...

A Framework for the use of Discount Rates in Actuarial Work

... Discount rates are used to calculate the present value of future cash flows. Actuaries face many types of financial problems. But many problems can be characterised as an analysis of a series of future cash flows, or a comparison between different sets of future cash flows. For example, will a serie ...

... Discount rates are used to calculate the present value of future cash flows. Actuaries face many types of financial problems. But many problems can be characterised as an analysis of a series of future cash flows, or a comparison between different sets of future cash flows. For example, will a serie ...

Royce Opportunity Fund

... All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee o ...

... All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee o ...

The Economy and Financial Markets November 15, 2007

... High yield/junk bonds are not investment grade securities, involve substantial risks and generally should be part of the diversified portfolio of sophisticated investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the sm ...

... High yield/junk bonds are not investment grade securities, involve substantial risks and generally should be part of the diversified portfolio of sophisticated investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the sm ...

Stock investment analysis report

... healthcare unit or governmental hospital rather than Sime darby private healthcare unit. And for housing, fuels changed, in the future, perhaps, less consumers than before are going to buy cars and property such as apartment. As if, our sales will decrease, many potential face to high cost of house ...

... healthcare unit or governmental hospital rather than Sime darby private healthcare unit. And for housing, fuels changed, in the future, perhaps, less consumers than before are going to buy cars and property such as apartment. As if, our sales will decrease, many potential face to high cost of house ...

Chapter 3 - Cambridge University Press

... The t-ratios are given in the final row above, and are in italics. They are calculated by dividing the coefficient estimate by its standard error. The relevant value from the t-tables is for a 2-sided test with 5% rejection overall. T-k = 195; tcrit = 1.97. The null hypothesis is rejected at the 5% ...

... The t-ratios are given in the final row above, and are in italics. They are calculated by dividing the coefficient estimate by its standard error. The relevant value from the t-tables is for a 2-sided test with 5% rejection overall. T-k = 195; tcrit = 1.97. The null hypothesis is rejected at the 5% ...

Presentation

... Profit margins and company earnings What assets are available The company’s capital structure How much debt, how much equity ...

... Profit margins and company earnings What assets are available The company’s capital structure How much debt, how much equity ...

? WHY ARE STOCKS SO RISKY Introduction

... and stockholders’ expectations of future earnings can push the average rate of appreciation of equity well away from its historical average. At the same time, the volatility of earnings often changes significantly for intervals spanning many years. As a result of these shifts, investors cannot relia ...

... and stockholders’ expectations of future earnings can push the average rate of appreciation of equity well away from its historical average. At the same time, the volatility of earnings often changes significantly for intervals spanning many years. As a result of these shifts, investors cannot relia ...

Session 3: Bond Valuation

... Book value is the value of an asset shown on a firm's balance sheet which is determined by its historical cost rather than its current worth. Liquidation value is the amount that could be realized if an asset is sold individually and not as part of a going concern. Market value is the observed value ...

... Book value is the value of an asset shown on a firm's balance sheet which is determined by its historical cost rather than its current worth. Liquidation value is the amount that could be realized if an asset is sold individually and not as part of a going concern. Market value is the observed value ...

Valuation of Raised Breeding Livestock

... Oklahoma State University, in compliance with Title VI and VII of the Civil Rights Act of 1964, Executive Order 11246 as amended, and Title IX of the Education Amendments of 1972 (Higher Education Act), the Americans with Disabilities Act of 1990, and other federal and state laws and regulations, do ...

... Oklahoma State University, in compliance with Title VI and VII of the Civil Rights Act of 1964, Executive Order 11246 as amended, and Title IX of the Education Amendments of 1972 (Higher Education Act), the Americans with Disabilities Act of 1990, and other federal and state laws and regulations, do ...

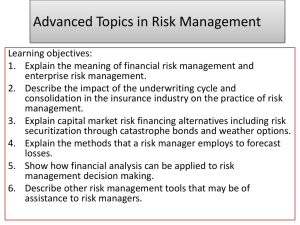

Advanced Topics in Risk Management

... budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a company should undertake. Only those projects that benefit the organization financially should be accepted. If not enough capital is available to undertake ...

... budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a company should undertake. Only those projects that benefit the organization financially should be accepted. If not enough capital is available to undertake ...

magna retirement savings plans stable value fund

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...