Document

... Two possible systems for fixing the exchange rates: • Reserve currency standard – Central banks peg the prices of their currencies in terms of a reserve currency. – The currency central banks hold in their international reserves. ...

... Two possible systems for fixing the exchange rates: • Reserve currency standard – Central banks peg the prices of their currencies in terms of a reserve currency. – The currency central banks hold in their international reserves. ...

tu-91-116 economics of european integration - MyCourses

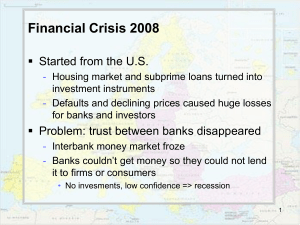

... Slow growth and negative growth (partly due to financial crisis) has worsened the situation in countires with large debt to begin with - Financial crisis affected banks and govenrments needed to support them ...

... Slow growth and negative growth (partly due to financial crisis) has worsened the situation in countires with large debt to begin with - Financial crisis affected banks and govenrments needed to support them ...

The effects of currency appreciation on share

... There are a few reasons why such a study on China is important. The Chinese case provides a unique case study. First, the recent opening of the Chinese stock markets to foreign investors and liberalising of its currency provides an opportunity to examine the impact of financial liberalization on the ...

... There are a few reasons why such a study on China is important. The Chinese case provides a unique case study. First, the recent opening of the Chinese stock markets to foreign investors and liberalising of its currency provides an opportunity to examine the impact of financial liberalization on the ...

Regional Symposium: Policies and Environment Conducive to

... the region like the euro is for the euro zone economies. Economies would not be prevented from having exchange rate arrangements considered to be necessary or desirable for their own economies' monetary or other economic conditions. Their domestic currencies would adjust against the APECCU according ...

... the region like the euro is for the euro zone economies. Economies would not be prevented from having exchange rate arrangements considered to be necessary or desirable for their own economies' monetary or other economic conditions. Their domestic currencies would adjust against the APECCU according ...

commentary - Nvest Wealth Strategies

... aggressively consuming commodities and raw materials. Those prices are rising rapidly as products are rigorously manufactured with cheap labor rates; meanwhile items these economies don’t need experience falling prices (due to declining demand; industrial developed country wage rates are falling and ...

... aggressively consuming commodities and raw materials. Those prices are rising rapidly as products are rigorously manufactured with cheap labor rates; meanwhile items these economies don’t need experience falling prices (due to declining demand; industrial developed country wage rates are falling and ...

1. Economics is best defined as (A) prices and quantities. (B

... 35. Assuming Ricardian equivalence holds, if taxes are increased, then (A) economic growth must accelerate. (B) private saving must increase. (C) private saving must decrease. (D) private saving must remain unchanged. 36. At the full employment level of output (A) unemployment is zero. (B) there is ...

... 35. Assuming Ricardian equivalence holds, if taxes are increased, then (A) economic growth must accelerate. (B) private saving must increase. (C) private saving must decrease. (D) private saving must remain unchanged. 36. At the full employment level of output (A) unemployment is zero. (B) there is ...

Infrastructure Financing in the Asia-Pacific •

... Private Finance for Infrastructure Development • Deepening Equity and Bond Markets in Asia: Asian developing countries have been deepening domestic bond ...

... Private Finance for Infrastructure Development • Deepening Equity and Bond Markets in Asia: Asian developing countries have been deepening domestic bond ...

class11

... Movement of capital causes change exchange rates Interest rate volatility exchange rate volatility ...

... Movement of capital causes change exchange rates Interest rate volatility exchange rate volatility ...

Rebalancing the Global Economy

... Second, the capital balance. It is directly linked to changes in reserve assets. Capital flows caused by the private sector are recorded in the capital balance; those, which depend on policy decisions, are recorded as changes in foreign exchange reserves of the central bank. If a country imports mor ...

... Second, the capital balance. It is directly linked to changes in reserve assets. Capital flows caused by the private sector are recorded in the capital balance; those, which depend on policy decisions, are recorded as changes in foreign exchange reserves of the central bank. If a country imports mor ...

14.02 Principles of Macroeconomics Problem Set 5 Solutions Fall 2004

... At point A, Y0 < YN, so u0 > uN. This means that the economy is not performing at its capacity. So, people expect the price level to decrease in the near future. When Pe decreases, W decreases since the wage setting relation tells us that W = Pe F(u,z). A decrease in W decreases P since the price se ...

... At point A, Y0 < YN, so u0 > uN. This means that the economy is not performing at its capacity. So, people expect the price level to decrease in the near future. When Pe decreases, W decreases since the wage setting relation tells us that W = Pe F(u,z). A decrease in W decreases P since the price se ...

Econ8009 International Monetary Economics

... it must be the case that wealth jumps as well. Since the path of earnings before and after the tax change is known with certainty in advance, the only way for wealth to jump is for there to be a discrete jump in the long run interest rate. ...

... it must be the case that wealth jumps as well. Since the path of earnings before and after the tax change is known with certainty in advance, the only way for wealth to jump is for there to be a discrete jump in the long run interest rate. ...

Estonia: A Macroeconomic Enquiry

... foreign markets and imports to Estonia more expensive. This should increase Estonian exports and decrease imports, decreasing the current account deficit. The Central Bank could devalue the currency up to 15% of the value of the euro without jeopardizing the future adoption of the euro in Estonia. H ...

... foreign markets and imports to Estonia more expensive. This should increase Estonian exports and decrease imports, decreasing the current account deficit. The Central Bank could devalue the currency up to 15% of the value of the euro without jeopardizing the future adoption of the euro in Estonia. H ...

Costs and prices - Bank of England

... (a) The swathes contain a range of estimates based on three different levels of aggregation. These are: headline CPI, twelve main divisions and 39 main groups. All estimates exclude the estimated impact of changes in VAT. X-12 is used to seasonally adjust these headline, division and group indices s ...

... (a) The swathes contain a range of estimates based on three different levels of aggregation. These are: headline CPI, twelve main divisions and 39 main groups. All estimates exclude the estimated impact of changes in VAT. X-12 is used to seasonally adjust these headline, division and group indices s ...

Monetary Response of China, South Korea, and Singapore to the

... were more of a conservative kind. However, this assumption turned out to be completely wrong. Since September 2008, international financial and economic crisis has spilled over to Asia severely impacting regional economies [9]. The global recession was transmitted to China, Korea, and Singapore main ...

... were more of a conservative kind. However, this assumption turned out to be completely wrong. Since September 2008, international financial and economic crisis has spilled over to Asia severely impacting regional economies [9]. The global recession was transmitted to China, Korea, and Singapore main ...

Q3 2016 commentary

... Several bouts of runaway inflation and the severe recessions that followed have made officials wary of testing that boundary today, despite little evidence of inflationary pressures. Fed Chairwoman Janet Yellen has expressed sympathy for both camps, and stated earlier this year that the Fed could b ...

... Several bouts of runaway inflation and the severe recessions that followed have made officials wary of testing that boundary today, despite little evidence of inflationary pressures. Fed Chairwoman Janet Yellen has expressed sympathy for both camps, and stated earlier this year that the Fed could b ...

Some issues for the future 2 Evolution of controls prior to

... “… with the wisdom of hindsight it is clear that in 1982/3 the monetary authorities were too optimistic about the financial strength of the rand and certainly insufficiently sensitive to the international market perceptions of the basic weaknesses of the rand, the high liquidity of the country’s for ...

... “… with the wisdom of hindsight it is clear that in 1982/3 the monetary authorities were too optimistic about the financial strength of the rand and certainly insufficiently sensitive to the international market perceptions of the basic weaknesses of the rand, the high liquidity of the country’s for ...

Carbaugh, International Economics 9e, Chapter 13

... Low short term rates lead to less demand for the currency and depreciation High rates lead to greater demand for the currency and appreciation ...

... Low short term rates lead to less demand for the currency and depreciation High rates lead to greater demand for the currency and appreciation ...

selection from a published volume from the of Economic Research

... Jeanne shows that when the government restricts private capital flows, reserve accumulation can keep the real exchange rate undervalued. Jeanne finds that the empirical implications of the model are broadly consistent with Chinese data from the last decade. In “Taylor Rule Exchange Rate Forecasting ...

... Jeanne shows that when the government restricts private capital flows, reserve accumulation can keep the real exchange rate undervalued. Jeanne finds that the empirical implications of the model are broadly consistent with Chinese data from the last decade. In “Taylor Rule Exchange Rate Forecasting ...

Consider the following economy:

... 2. Foreign imports increase as output increases, the foreign currency depreciates (due to the drop in the relative real interest rate) and the domestic currency appreciates. 3. The domestic IS curve shifts down as NX decrease (domestic goods are relatively more expensive). 4. Foreign price levels in ...

... 2. Foreign imports increase as output increases, the foreign currency depreciates (due to the drop in the relative real interest rate) and the domestic currency appreciates. 3. The domestic IS curve shifts down as NX decrease (domestic goods are relatively more expensive). 4. Foreign price levels in ...

mmi13 Rathke 19073232 en

... that monetary policy would from then on be aimed at stabilizing the internal price level. Because of Sweden’s subsequent excellent economic performance, the alleged adoption of price-level targeting has since been repeatedly invoked as a new model, with some monetary economists even acknowledging it ...

... that monetary policy would from then on be aimed at stabilizing the internal price level. Because of Sweden’s subsequent excellent economic performance, the alleged adoption of price-level targeting has since been repeatedly invoked as a new model, with some monetary economists even acknowledging it ...

S R F ?

... two standard errors away from the conditional mean. Interestingly, when 2008 data is used, the estimated undervaluation is on the order of only 10 per cent. Of note is their conclusion that ‘these results are not informative with regard to the question of how a change in the RMB/USD exchange rate wo ...

... two standard errors away from the conditional mean. Interestingly, when 2008 data is used, the estimated undervaluation is on the order of only 10 per cent. Of note is their conclusion that ‘these results are not informative with regard to the question of how a change in the RMB/USD exchange rate wo ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... fixed in nominal terms and so accordingly are prices. In this model, depreciation brings about an equiproportionate gain in competitiveness or loss in the terms of trade. The new direction of research considers explicitly an industrialorganization pricing approach as part of the macroeconomic model. ...

... fixed in nominal terms and so accordingly are prices. In this model, depreciation brings about an equiproportionate gain in competitiveness or loss in the terms of trade. The new direction of research considers explicitly an industrialorganization pricing approach as part of the macroeconomic model. ...

4. Financial crises

... by the central bank inflation the internal unequilibrium can not be reconciled with the fixed exchange rate Fiscla expansion increasing internal demand for imports +inflation balance of payment deficit devaulation pressure decrease of reserves speculative attack currency crisis ...

... by the central bank inflation the internal unequilibrium can not be reconciled with the fixed exchange rate Fiscla expansion increasing internal demand for imports +inflation balance of payment deficit devaulation pressure decrease of reserves speculative attack currency crisis ...

Trade Protectionism: A Balancing (of Payments)

... could choose to implement policies that increase the national savings rate or make decisions which force capital flows to reverse. A country could also choose to devalue its currency to improve the current account deficit. When U.S. policymakers accused China of "currency manipulation" several years ...

... could choose to implement policies that increase the national savings rate or make decisions which force capital flows to reverse. A country could also choose to devalue its currency to improve the current account deficit. When U.S. policymakers accused China of "currency manipulation" several years ...