The Black Market Trade Exchange

... The Reuters report mentions that some branches of the cartels didn't rely on small domestic banks to handle the tsunami of cash but rather the Mexican operations of HSBC, one of the world's largest6 international banks. The Reuters report paints a grim picture about HSBC Mexico's level of antimoney ...

... The Reuters report mentions that some branches of the cartels didn't rely on small domestic banks to handle the tsunami of cash but rather the Mexican operations of HSBC, one of the world's largest6 international banks. The Reuters report paints a grim picture about HSBC Mexico's level of antimoney ...

June 17, 2016

... of its major peers after Governor Kuroda and his board chose to continue to gauge the economic impact of their negative interest-rate policy. The dollar extended its losses that have made it the worstperforming currency this year behind the pound after the Federal Reserve kept interest rates steady ...

... of its major peers after Governor Kuroda and his board chose to continue to gauge the economic impact of their negative interest-rate policy. The dollar extended its losses that have made it the worstperforming currency this year behind the pound after the Federal Reserve kept interest rates steady ...

prices and exchange rates: purchasing power parity

... signed, PPP holds and no change is expected in the exchange rate of prices before the August 1 date when delivery is due. So PPP holds for "expected values." If the exchange rate equals ¥95=$1, then PPP will appear not to hold at the time of delivery. But this will be a spurious deviation. Deviation ...

... signed, PPP holds and no change is expected in the exchange rate of prices before the August 1 date when delivery is due. So PPP holds for "expected values." If the exchange rate equals ¥95=$1, then PPP will appear not to hold at the time of delivery. But this will be a spurious deviation. Deviation ...

Asian Regional Policy Coordination introduction Dong He COmmenTaRy

... rate adjustments are the most appropriate vehicle for dealing with such imbalances. This presumption is the second shortcoming of the coordination failure argument. While real exchange rate adjustments typically accompany current account adjustments, it is generally believed that changes in nominal ...

... rate adjustments are the most appropriate vehicle for dealing with such imbalances. This presumption is the second shortcoming of the coordination failure argument. While real exchange rate adjustments typically accompany current account adjustments, it is generally believed that changes in nominal ...

How to find exit

... against excessive risks and prevent financial bubbles. The reaching of its growth limits by the prevailing technological order and insufficient conditions for the rise of a new order, including the lack of investment for broader implementation of underlying technologies are also an important factor ...

... against excessive risks and prevent financial bubbles. The reaching of its growth limits by the prevailing technological order and insufficient conditions for the rise of a new order, including the lack of investment for broader implementation of underlying technologies are also an important factor ...

Download pdf | 34 KB |

... so corporate borrowers in the first quarter of this year face an interest rate on one year loans 8% lower in real terms than in 2002. So corporates are benefiting by about 1% of GDP from a transfer from households. Banks are also benefiting. The average spread on loans in the banking system has rise ...

... so corporate borrowers in the first quarter of this year face an interest rate on one year loans 8% lower in real terms than in 2002. So corporates are benefiting by about 1% of GDP from a transfer from households. Banks are also benefiting. The average spread on loans in the banking system has rise ...

... deficit by 1.8% and 2.4% of GDP, respectively, in 2014. Smaller local authority surpluses and the deteriorating balance sheet of the oil stabilization fund account for the worsening of the non-financial public sector balance in 2014 relative to the previous year. The central government deficit was s ...

Interrelations between monetary

... balance sheet have not reflected the changes in assets structure (substitution of foreign assets with credit to government). It is not possible to continue such a policy mix. Considering the current level of gross foreign assets and liabilities in foreign currencies the aim of foreign reserve accumu ...

... balance sheet have not reflected the changes in assets structure (substitution of foreign assets with credit to government). It is not possible to continue such a policy mix. Considering the current level of gross foreign assets and liabilities in foreign currencies the aim of foreign reserve accumu ...

Prospectus Defense - AIPRG -- Armenian International

... Non-Government Those opposing Gov. policies ...

... Non-Government Those opposing Gov. policies ...

National Saving, Domestic Investment, Net Capital Outflow and Net

... LF market: the interest rate adjusts to balance supply for loanable funds (from national saving) and demand for loanable funds (from domestic investment and net capital outflow). In the market for foreign-currency exchange, – the real exchange rate adjusts to balance the supply of dollars (for n ...

... LF market: the interest rate adjusts to balance supply for loanable funds (from national saving) and demand for loanable funds (from domestic investment and net capital outflow). In the market for foreign-currency exchange, – the real exchange rate adjusts to balance the supply of dollars (for n ...

newsletter

... the so-called market ‘dogs’ – mining companies and other cyclical businesses going through incredibly tough times, which will not last forever, but which are trading at very low prices as a result. It is in these market environments that a value investor’s temperament and mettle are tested – particu ...

... the so-called market ‘dogs’ – mining companies and other cyclical businesses going through incredibly tough times, which will not last forever, but which are trading at very low prices as a result. It is in these market environments that a value investor’s temperament and mettle are tested – particu ...

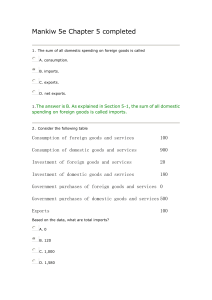

Mankiw 5e Chapter 5 completed

... interest rate it faces is given by the world interest rate, since its financial markets are too small to influence it. ...

... interest rate it faces is given by the world interest rate, since its financial markets are too small to influence it. ...

Chris Diaz Commentary - Snowden Lane Partners

... Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call Janus at 877.33JANUS (52687) or download the file from janus.com/info. Read it carefully befor ...

... Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call Janus at 877.33JANUS (52687) or download the file from janus.com/info. Read it carefully befor ...

NOTES ON EXCHANGE RATES AND COMMODITY PRICES

... Prices of internationally traded connnodities have been markedly volatile over the last two decades. As Maizels (1992) demonstrates, the world market price of sugar, for example, varied between 2.5 and 41 U.S. cents per pound in the 1980s, and coffee ranged between 60 and 303 U.S. cents per pound ov ...

... Prices of internationally traded connnodities have been markedly volatile over the last two decades. As Maizels (1992) demonstrates, the world market price of sugar, for example, varied between 2.5 and 41 U.S. cents per pound in the 1980s, and coffee ranged between 60 and 303 U.S. cents per pound ov ...

2017 market predictions. Find out what to expect

... By their very nature, geopolitical risks can be unpredictable. However we should be vigilant in monitoring those things that we believe could have impact on the equity or fixed income markets. While there are many risks, we have highlighted a few that we feel have the probability to be most impactfu ...

... By their very nature, geopolitical risks can be unpredictable. However we should be vigilant in monitoring those things that we believe could have impact on the equity or fixed income markets. While there are many risks, we have highlighted a few that we feel have the probability to be most impactfu ...

PDF Download

... their fixed exchange rate regimes came after the outbreak of the global financial crisis in 2008. The countries were hit simultaneously by three severe disruptions. Firstly, the countries experienced sudden stops as net capital inflows ceased, leading to current account surpluses in 2009 in all thre ...

... their fixed exchange rate regimes came after the outbreak of the global financial crisis in 2008. The countries were hit simultaneously by three severe disruptions. Firstly, the countries experienced sudden stops as net capital inflows ceased, leading to current account surpluses in 2009 in all thre ...

Chapter 2

... Money Markets—a collection of markets with no formal organization or location, each trading distinctly different financial instruments. Financial instruments sold in money markets have very short maturities, usually overnight to 180 days, are highly marketable in that they can be easily converted in ...

... Money Markets—a collection of markets with no formal organization or location, each trading distinctly different financial instruments. Financial instruments sold in money markets have very short maturities, usually overnight to 180 days, are highly marketable in that they can be easily converted in ...

Health Insurance Exchanges: Goals and Strategies SCI Annual

... Choice of state-wide, subsidiary exchanges across state, or multi-state Requires an exchange in the individual and small group markets – Exchanges may be combined – Markets may be combined ...

... Choice of state-wide, subsidiary exchanges across state, or multi-state Requires an exchange in the individual and small group markets – Exchanges may be combined – Markets may be combined ...

A Study of the Real Interest Rate Differential Mode and

... expected. The models (both the RID and short-term nominal interest rate differential) have not however been robust in towards the end of 2011. While it could be easy to compel ourselves to see positive correlations (which don’t exist/exist for alternative reasons) in the period studied, the reality ...

... expected. The models (both the RID and short-term nominal interest rate differential) have not however been robust in towards the end of 2011. While it could be easy to compel ourselves to see positive correlations (which don’t exist/exist for alternative reasons) in the period studied, the reality ...