The Harrod-Balassa-Samuelson Effect: A Survey of

... factors on price levels, but also the effects of the demand side (government spending, preferences, etc.) on long-term relative price levels between countries. Jose De Gregorio, Alberto Giovannini and Holger Wolf (1994) built on Rogoff's original (1992) model. They relaxed the extreme assumption of ...

... factors on price levels, but also the effects of the demand side (government spending, preferences, etc.) on long-term relative price levels between countries. Jose De Gregorio, Alberto Giovannini and Holger Wolf (1994) built on Rogoff's original (1992) model. They relaxed the extreme assumption of ...

The behaviour of the real exchange rate

... RER is reverting back to its PPP equilibrium, albeit slowly, this implies that PPP should, at least, be seen as a long term anchor for determining the RER equilibrium value, although it may not be holding at each point in time. However, if the deviations from the PPP are permanent, this suggests the ...

... RER is reverting back to its PPP equilibrium, albeit slowly, this implies that PPP should, at least, be seen as a long term anchor for determining the RER equilibrium value, although it may not be holding at each point in time. However, if the deviations from the PPP are permanent, this suggests the ...

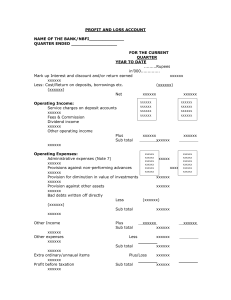

profit and loss account - State Bank of Pakistan

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

Causes and Consequences of Margin Levels in Futures Markets

... that the optimal margin-to-volatility ratio is constant across contracts and across time. If futures returns are not normally distributed, Longin (1999) shows that the optimal margin level depends on the tail parameter of the distribution of extreme returns, such that return distributions with fatt ...

... that the optimal margin-to-volatility ratio is constant across contracts and across time. If futures returns are not normally distributed, Longin (1999) shows that the optimal margin level depends on the tail parameter of the distribution of extreme returns, such that return distributions with fatt ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... accounting standards (SEC 2007d). Our results, based on the data from the most two recent years before the elimination of the reconciliation requirement, suggest that U.S. investors in general use the earnings reconciliation from IFRS to U.S. GAAP in their trading decision and hence may not complete ...

... accounting standards (SEC 2007d). Our results, based on the data from the most two recent years before the elimination of the reconciliation requirement, suggest that U.S. investors in general use the earnings reconciliation from IFRS to U.S. GAAP in their trading decision and hence may not complete ...

Why do foreign firms leave US equity markets?

... exchange listings were affected adversely by SOX at all seems to depend on the benchmark used. For some benchmarks, there is a negative wealth effect of SOX for foreign listed firms as well as for deregistering firms, but for other benchmarks there is no such effect. A reasonable assessment of the ...

... exchange listings were affected adversely by SOX at all seems to depend on the benchmark used. For some benchmarks, there is a negative wealth effect of SOX for foreign listed firms as well as for deregistering firms, but for other benchmarks there is no such effect. A reasonable assessment of the ...

Increasing US real interest rates

... investment. Government, institutional and private investors invest in gold for a number of reasons, of which the main reason is to hedge against inflation (Kolluri, 1981). Gold appears to act as safe-haven in times of political or financial turmoil (Baur and McDermott, 2010). Gold is often seen as a ...

... investment. Government, institutional and private investors invest in gold for a number of reasons, of which the main reason is to hedge against inflation (Kolluri, 1981). Gold appears to act as safe-haven in times of political or financial turmoil (Baur and McDermott, 2010). Gold is often seen as a ...

Economic Outlook Database Inventory

... 1.2.5. Scale, units, currency, base years Constant prices (or volume) and current prices data are expressed in units (they are not in thousands, millions or billions). Most data are expressed at local currency, sometimes also in US dollars. For country aggregates, different rules apply. See Annex 6 ...

... 1.2.5. Scale, units, currency, base years Constant prices (or volume) and current prices data are expressed in units (they are not in thousands, millions or billions). Most data are expressed at local currency, sometimes also in US dollars. For country aggregates, different rules apply. See Annex 6 ...

The International Monetary Fund: 70 Years of Reinvention

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

Does Inflation Uncertainty Increase with Inflation?

... found that countries with high inflation also had more variable inflation. He interpreted the greater variability as an indication of greater uncertainty. Since Okun’s initial work, over 20 empirical papers have been published on inflation uncertainty. The greatest flurry of activity occurred in the ...

... found that countries with high inflation also had more variable inflation. He interpreted the greater variability as an indication of greater uncertainty. Since Okun’s initial work, over 20 empirical papers have been published on inflation uncertainty. The greatest flurry of activity occurred in the ...

PDF Download

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

c Copyright by Amrita Dhar May 2016

... emerging markets. This nonlinear model captures switches between different regimes and characterizes average flows in each regime. I use a three state Markov-switching model allowing the mean of the magnitude of the flows to switch between states of “extreme,” “high,” and “low” flows for each countr ...

... emerging markets. This nonlinear model captures switches between different regimes and characterizes average flows in each regime. I use a three state Markov-switching model allowing the mean of the magnitude of the flows to switch between states of “extreme,” “high,” and “low” flows for each countr ...

general agreement on tariffs and trade

... 121). Regarding the estimates of dumping margins presented to the Panel, Brazil argued that one set of data was only a chronologically re-arranged data provided by the EC in this case, and the other set was merely an illustration of how attempts to correct for the situation which arose due to the fr ...

... 121). Regarding the estimates of dumping margins presented to the Panel, Brazil argued that one set of data was only a chronologically re-arranged data provided by the EC in this case, and the other set was merely an illustration of how attempts to correct for the situation which arose due to the fr ...

Transition Report 1999

... A second pattern that has emerged in the first decade of transition is an inherent imbalance in reforms, which is a characteristic even of more advanced transition economies. Some aspects of a market economy can and have been created quickly, in particular through market liberalisation and privatisa ...

... A second pattern that has emerged in the first decade of transition is an inherent imbalance in reforms, which is a characteristic even of more advanced transition economies. Some aspects of a market economy can and have been created quickly, in particular through market liberalisation and privatisa ...

Transition report 1999

... A second pattern that has emerged in the first decade of transition is an inherent imbalance in reforms, which is a characteristic even of more advanced transition economies. Some aspects of a market economy can and have been created quickly, in particular through market liberalisation and privatisa ...

... A second pattern that has emerged in the first decade of transition is an inherent imbalance in reforms, which is a characteristic even of more advanced transition economies. Some aspects of a market economy can and have been created quickly, in particular through market liberalisation and privatisa ...

Exchange Rate Regime, Fiscal Foresight and the Effectiveness of

... to be most effective in stimulating the economy and private economic activity. Second, they show that the stimulating effect is more signifiant when monetary policy in constrained by a zero lower bound. In particular, the fiscal multiplier may significantly exceed unity under a maintained accommodat ...

... to be most effective in stimulating the economy and private economic activity. Second, they show that the stimulating effect is more signifiant when monetary policy in constrained by a zero lower bound. In particular, the fiscal multiplier may significantly exceed unity under a maintained accommodat ...

- Haftina

... Kai Guo is Director at the People’s Bank of China. He has a Ph.D. in economics from Harvard University and an MA in economics from Peking University. His area of research includes international finance, macroeconomics, development economics (with an emphasis on the Chinese economy), and economic gro ...

... Kai Guo is Director at the People’s Bank of China. He has a Ph.D. in economics from Harvard University and an MA in economics from Peking University. His area of research includes international finance, macroeconomics, development economics (with an emphasis on the Chinese economy), and economic gro ...

Liang, Haitao - welcome - The City University of New York

... A large number of studies emphasize FDI determinants but ignore the income distribution on the results, which biases the estimates. I correct for heterogeneity due to income distribution by using the Blundell-Bond System GMM (Generalized Method of Moments), which controls for endogeneity problem as ...

... A large number of studies emphasize FDI determinants but ignore the income distribution on the results, which biases the estimates. I correct for heterogeneity due to income distribution by using the Blundell-Bond System GMM (Generalized Method of Moments), which controls for endogeneity problem as ...

On Target? The International Experience with Achieving

... market inflation targeting adopters has declined from US$11,400 in 1997 (Czech Republic and Israel) to US$1,500 in 2002 (Peru and the Philippines). In addition, a number of emerging market countries (e.g., Turkey, Romania, and Botswana) are moving toward full-fledged inflation targeting. Full-fledge ...

... market inflation targeting adopters has declined from US$11,400 in 1997 (Czech Republic and Israel) to US$1,500 in 2002 (Peru and the Philippines). In addition, a number of emerging market countries (e.g., Turkey, Romania, and Botswana) are moving toward full-fledged inflation targeting. Full-fledge ...

Section 2

... the APEC region. While relatively little can be done about physical distance (beyond improving transportation channels), APEC economic policymakers can facilitate intraregional investment flows by investing in superior telecommunications capabilities and other trade and investment facilitations meas ...

... the APEC region. While relatively little can be done about physical distance (beyond improving transportation channels), APEC economic policymakers can facilitate intraregional investment flows by investing in superior telecommunications capabilities and other trade and investment facilitations meas ...

The long history of financial boom-bust cycles in Iceland Part II

... combined variability of the individual cycles. We find that not all of our financial variables contribute to this aggregate financial cycle, but the ones that do attain roughly equal weights. This aggregate cycle is found to capture more than 60% of the variability of the aggregate financial data ov ...

... combined variability of the individual cycles. We find that not all of our financial variables contribute to this aggregate financial cycle, but the ones that do attain roughly equal weights. This aggregate cycle is found to capture more than 60% of the variability of the aggregate financial data ov ...