Commentary by Skylands Capital LLC, Sub-Investment

... Specifically, some countries are dangerously dependent on oil to support their economies. The Russian ruble has already lost nearly half of its value against the U.S. dollar over the past 6 months. Accordingly, Russian companies with dollar or euro-denominated debt will have difficulty servicing the ...

... Specifically, some countries are dangerously dependent on oil to support their economies. The Russian ruble has already lost nearly half of its value against the U.S. dollar over the past 6 months. Accordingly, Russian companies with dollar or euro-denominated debt will have difficulty servicing the ...

Cavallari-del05 1175933 de

... goods produced in di erent locations as imperfect substitutes. The assumption captures the fact that once goods reach the sales market, they incorporate a substantial local marketing input and pass through non-competitive retailing networks. Second, I consider two types of firms: national firms, tha ...

... goods produced in di erent locations as imperfect substitutes. The assumption captures the fact that once goods reach the sales market, they incorporate a substantial local marketing input and pass through non-competitive retailing networks. Second, I consider two types of firms: national firms, tha ...

MONETARY AND EXCHANGE RATE POLICIES IN COLOMBIA

... “The only way [the FED and the Bank of England] affect inflation is by changing the amount of high-powered money…… The difference between the two approaches is in the way they choose to describe their operations to the public, not in the actual operating procedures”. Milton Friedman (2002) “Intervi ...

... “The only way [the FED and the Bank of England] affect inflation is by changing the amount of high-powered money…… The difference between the two approaches is in the way they choose to describe their operations to the public, not in the actual operating procedures”. Milton Friedman (2002) “Intervi ...

Open Economy Macroeconomics

... Cross Rates • Note that most currency prices are related to the dollar. For example, the British pound sells for $1.93/GBP • We can use any two dollar exchange rates to find the “cross rates” (non-dollar exchange rates) • For example, if the exchange rate for Japanese yen is Y109.62/$, then the pri ...

... Cross Rates • Note that most currency prices are related to the dollar. For example, the British pound sells for $1.93/GBP • We can use any two dollar exchange rates to find the “cross rates” (non-dollar exchange rates) • For example, if the exchange rate for Japanese yen is Y109.62/$, then the pri ...

Prices and Wages in Transitions to a Market Economy

... Washington: Council of Economic Advisers, 1962. ...

... Washington: Council of Economic Advisers, 1962. ...

Global Economy Watch export challenge February 2016

... We help you understand how big economic, demographic, social, and environmental changes affect your organisation by setting out scenarios that identify growth opportunities and risks on a global, regional, national and local level. We help make strategic and tactical operational, pricing and investm ...

... We help you understand how big economic, demographic, social, and environmental changes affect your organisation by setting out scenarios that identify growth opportunities and risks on a global, regional, national and local level. We help make strategic and tactical operational, pricing and investm ...

Chapter 4 Instructor`s Manual

... Solution: The expected return on investment projects sets an upper limit on the interest rate firms are willing to pay on borrowed funds. Unless a project earns more than the firm’s cost of capital (i.e., the interest rate), it will be rejected. 2. How does a consumer’s time preference for consumpti ...

... Solution: The expected return on investment projects sets an upper limit on the interest rate firms are willing to pay on borrowed funds. Unless a project earns more than the firm’s cost of capital (i.e., the interest rate), it will be rejected. 2. How does a consumer’s time preference for consumpti ...

Exchange rates

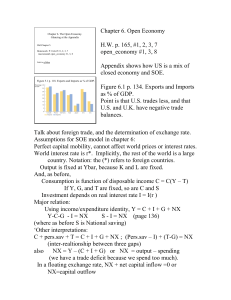

... Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly, the rest of the world is a large country. Notation: the (*) refers to foreign count ...

... Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly, the rest of the world is a large country. Notation: the (*) refers to foreign count ...

Ch. 21

... United Kingdom 1. Targets M3 and later M0 2. Problems of M as monetary indicator Japan 1. Forecasts M2 + CDs 2. Innovation and deregulation makes less useful as monetary indicator 3. High money growth 1987-1989: “bubble economy,” then tight money policy Germany and Switzerland 1. Not monetarist rigi ...

... United Kingdom 1. Targets M3 and later M0 2. Problems of M as monetary indicator Japan 1. Forecasts M2 + CDs 2. Innovation and deregulation makes less useful as monetary indicator 3. High money growth 1987-1989: “bubble economy,” then tight money policy Germany and Switzerland 1. Not monetarist rigi ...

International accounting ch6 Foreign Currency

... 1, 20X5 by investing £450,000 in exchange for all of the subsidiary’s no-par common stock. The British subsidiary, Searle Corporation, purchased real property on April 1, 20X5 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to a building. The building is depreciated ove ...

... 1, 20X5 by investing £450,000 in exchange for all of the subsidiary’s no-par common stock. The British subsidiary, Searle Corporation, purchased real property on April 1, 20X5 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to a building. The building is depreciated ove ...

Ch. 13 – Open

... Every international transaction involves the exchange of an asset for a good or service, so net exports equal net capital outflow. ...

... Every international transaction involves the exchange of an asset for a good or service, so net exports equal net capital outflow. ...

reasury Initiatives

... The government has liberalised the ECB policy and a large number of corporates, buoyed by a rock solid rupee, accessed the international capital markets heavily, for equity and debt ...

... The government has liberalised the ECB policy and a large number of corporates, buoyed by a rock solid rupee, accessed the international capital markets heavily, for equity and debt ...

NBER WORKING PAPER SERIES ON THE RENMINBI: THE CHOICE BETWEEN ADJUSTMENT

... relationship suggest that the real value of the renminbi is (and has for some time been) low -- not just low compared to the U.S. dollar or other rich countries, but substantially below even the equilibrium value for a country at China’s stage of development. Second, although history shows that fore ...

... relationship suggest that the real value of the renminbi is (and has for some time been) low -- not just low compared to the U.S. dollar or other rich countries, but substantially below even the equilibrium value for a country at China’s stage of development. Second, although history shows that fore ...

RVI117Gerchunoff_Machinea_en.pdf

... Canada and New Zealand. When, in mid-1928, the United States Federal Reserve raised interest rates to quell what appeared to be an unsustainable domestic economic boom, there were two interconnected repercussions that, with time, would become well known and recurrent: capital began to emigrate north ...

... Canada and New Zealand. When, in mid-1928, the United States Federal Reserve raised interest rates to quell what appeared to be an unsustainable domestic economic boom, there were two interconnected repercussions that, with time, would become well known and recurrent: capital began to emigrate north ...

Chapter 17

... ! Two possible systems for fixing the exchange rates: • Reserve currency standard – Central banks peg the prices of their currencies in terms of a reserve currency. – The currency central banks hold in their international reserves. ...

... ! Two possible systems for fixing the exchange rates: • Reserve currency standard – Central banks peg the prices of their currencies in terms of a reserve currency. – The currency central banks hold in their international reserves. ...

Edition 2 - 2017 - VZD Capital Management

... One of the biggest surprises this year may be how staid the markets have remained regardless of news, global events and economic data. Many feared that the presidential change, including the tweeting and political rhetoric during the campaign, could have a major impact on the market’s performance. W ...

... One of the biggest surprises this year may be how staid the markets have remained regardless of news, global events and economic data. Many feared that the presidential change, including the tweeting and political rhetoric during the campaign, could have a major impact on the market’s performance. W ...

Citizenship in the World

... These are international rules that have been practiced so long that courts regard them as unwritten laws. Most customary laws are based on Western culture and ideas. The laws are difficult to enforce because many non-western nations are not likely to agree to the terms of laws that differ from their ...

... These are international rules that have been practiced so long that courts regard them as unwritten laws. Most customary laws are based on Western culture and ideas. The laws are difficult to enforce because many non-western nations are not likely to agree to the terms of laws that differ from their ...

Linking interbank payment systems across borders and currencies

... Where the international ‘‘schemes’’ are also ahead of domestic alternatives is in the other important factor in cross-border interoperability between ACHs: efficient settlement. A core element of the international card value proposition is the provision of inter-operable payments around the world. A ...

... Where the international ‘‘schemes’’ are also ahead of domestic alternatives is in the other important factor in cross-border interoperability between ACHs: efficient settlement. A core element of the international card value proposition is the provision of inter-operable payments around the world. A ...

The Yen Exchange Rate and Net Foreign Assets

... exports will lead to a 1% real appreciation in the long run. Assuming a growth adjusted real return of 2.5% on net foreign assets, the estimated coefficient implies that the sum of the price elasticities of real exports and imports should be 1.25, broadly consistent with the estimates for Japan foun ...

... exports will lead to a 1% real appreciation in the long run. Assuming a growth adjusted real return of 2.5% on net foreign assets, the estimated coefficient implies that the sum of the price elasticities of real exports and imports should be 1.25, broadly consistent with the estimates for Japan foun ...

NBER WORKING PAPER SERIES MONETARY POLICY: DOMESTIC TARGETS AND INTERNATIONAL CONSTRAINTS

... involving specific pairs of assets. In evaluating these transactions it might be useful to explore the broader spectrum of possible policies. Figure 1 summarizes the various patrerns of domestic and foreign monetary policies and foreign ...

... involving specific pairs of assets. In evaluating these transactions it might be useful to explore the broader spectrum of possible policies. Figure 1 summarizes the various patrerns of domestic and foreign monetary policies and foreign ...

Andrew Schultz - May 2016 Market Commentary I was recently in

... fool’s game. Why were so many people bearish on Stocks? There are, I believe, a few reasons for this as well: 1. We are in uncharted waters. Interests rates in the U.S. have never been this low for this long before. 2. The manufacturing of earning by borrowing money on the cheap to buy back stock or ...

... fool’s game. Why were so many people bearish on Stocks? There are, I believe, a few reasons for this as well: 1. We are in uncharted waters. Interests rates in the U.S. have never been this low for this long before. 2. The manufacturing of earning by borrowing money on the cheap to buy back stock or ...

view - Ferguson Wellman

... With the unemployment rate having fallen to 4.7 percent and headline inflation now above the Fed’s 2 percent objective, the U.S. central bank has again raised short-term interest rates. Presuming the U.S. economy continues to make progress, we anticipate two more quarter-point rate hikes by year-end ...

... With the unemployment rate having fallen to 4.7 percent and headline inflation now above the Fed’s 2 percent objective, the U.S. central bank has again raised short-term interest rates. Presuming the U.S. economy continues to make progress, we anticipate two more quarter-point rate hikes by year-end ...

France: Economy on probation US: Labour market India: Interest

... India: Interest rate cut Last week, the Reserve Bank of India (RBI, central bank) again cut the key policy interest rate (repo) by 25bps. This was the third cut of 25bps so far this year. The RBI’s action reflects an easing in headline and core inflationary pressures against a background of weaker e ...

... India: Interest rate cut Last week, the Reserve Bank of India (RBI, central bank) again cut the key policy interest rate (repo) by 25bps. This was the third cut of 25bps so far this year. The RBI’s action reflects an easing in headline and core inflationary pressures against a background of weaker e ...