U.S. Government and Federal Agency Securities

... subject to federal taxes. Corporations and individuals are taxed differently at the state level. For individuals, all Federal Home Loan Bank and Federal Farm Credit Bank bonds are exempt from state and local taxes. Corporations may be exempt from taxes at the state and local level, subject to blue s ...

... subject to federal taxes. Corporations and individuals are taxed differently at the state level. For individuals, all Federal Home Loan Bank and Federal Farm Credit Bank bonds are exempt from state and local taxes. Corporations may be exempt from taxes at the state and local level, subject to blue s ...

Another Great Recession Possible?

... Their demand for high yielding assets was met nicely by the supply of MBS with the U.S. label and inflated ratings. These MBS carried high yields because they are based on loans to sub-prime borrowers who had to pay higher interest rates on their loans. Financial economist Hyman P. Minsky, whose kn ...

... Their demand for high yielding assets was met nicely by the supply of MBS with the U.S. label and inflated ratings. These MBS carried high yields because they are based on loans to sub-prime borrowers who had to pay higher interest rates on their loans. Financial economist Hyman P. Minsky, whose kn ...

Slices - personal.kent.edu

... • Residential and commercial mortgages have become a major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt ex ...

... • Residential and commercial mortgages have become a major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt ex ...

IAU Plan - ImamFaisal.com

... four madhahab. Some scholars said it was Riba, but this is not correct. b- This permissibility is stipulated with three conditions: The two parties have to agree upon only one of the two options. No third party is allowed to finance. No late fees are allowed. ...

... four madhahab. Some scholars said it was Riba, but this is not correct. b- This permissibility is stipulated with three conditions: The two parties have to agree upon only one of the two options. No third party is allowed to finance. No late fees are allowed. ...

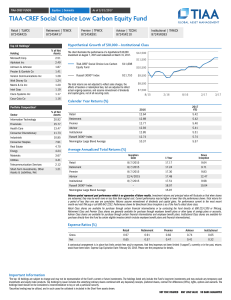

TIAA-CREF Social Choice Low Carbon Equity Fund

... ESG criteria exclude securities of certain issuers for nonfinancial reasons, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The Fund’s investment will have special emphasis on companies with low current carbon emissions and limited exposure to fossil f ...

... ESG criteria exclude securities of certain issuers for nonfinancial reasons, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The Fund’s investment will have special emphasis on companies with low current carbon emissions and limited exposure to fossil f ...

IMT

... • An independent, unbiased and objective opinion on risk • To draw their credit risk policies and assess the risk premium offered by the market on the basis of credit ratings • To effectively monitor and manage investments in debt instruments ...

... • An independent, unbiased and objective opinion on risk • To draw their credit risk policies and assess the risk premium offered by the market on the basis of credit ratings • To effectively monitor and manage investments in debt instruments ...

MidCap Financial Launches Commercial Finance Company with

... that will focus on middle market lending to the healthcare industry, today announced its formation and funding with over $500 million in equity commitments. MidCap's investors are Thomas H. Lee's Lee Equity Partners LLC, Genstar Capital LLC and Moelis Capital Partners. MidCap also has a substantial ...

... that will focus on middle market lending to the healthcare industry, today announced its formation and funding with over $500 million in equity commitments. MidCap's investors are Thomas H. Lee's Lee Equity Partners LLC, Genstar Capital LLC and Moelis Capital Partners. MidCap also has a substantial ...

Can an old bull learn new tricks? (March 2017)

... Copyright 2016 GLC. You may not reproduce, distribute, or otherwise use any of this article without the prior written consent of GLC Asset Management Group Ltd. The views expressed in this commentary are those of GLC Asset Management Group Ltd. (GLC) as at the date of publication and are subject to ...

... Copyright 2016 GLC. You may not reproduce, distribute, or otherwise use any of this article without the prior written consent of GLC Asset Management Group Ltd. The views expressed in this commentary are those of GLC Asset Management Group Ltd. (GLC) as at the date of publication and are subject to ...

The European Capital Markets Union

... public entities and corporations. Over the past twenty years, there has been a significant shift into ‘alternative’ investments such as real estate, private equity, and hedge funds as well as a liability-driven shift into (longer duration) fixed income. ...

... public entities and corporations. Over the past twenty years, there has been a significant shift into ‘alternative’ investments such as real estate, private equity, and hedge funds as well as a liability-driven shift into (longer duration) fixed income. ...

Revision: Sources of finance

... This is a facility provided by a bank when the balance of your current account goes into negative figures. It is for an agreed amount and an agreed period of time and if this is exceeded then high costs will occur. ...

... This is a facility provided by a bank when the balance of your current account goes into negative figures. It is for an agreed amount and an agreed period of time and if this is exceeded then high costs will occur. ...

SVB FInancial Group Announces Selected

... This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and can be identified by the use of words such as “becoming,” “may,” “will, “ “should,” “predict ...

... This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and can be identified by the use of words such as “becoming,” “may,” “will, “ “should,” “predict ...

Financial Results

... Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory service ...

... Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory service ...

Chapter 6

... Let us examine each of the five mechanisms by which securitization enhances efficiency. First, it promotes diversification or risk-spreading. As we saw in Chapter 5, selecting assets whose payoffs are unrelated spreads risks. So owning a security that provides a claim on a tiny portion of the paymen ...

... Let us examine each of the five mechanisms by which securitization enhances efficiency. First, it promotes diversification or risk-spreading. As we saw in Chapter 5, selecting assets whose payoffs are unrelated spreads risks. So owning a security that provides a claim on a tiny portion of the paymen ...

Credit Balance Handling Policy

... A credit balance occurs whenever the amount of funding applied to a student’s account exceeds the student’s charges in a term/semester. To ensure consistent and accurate financial records, Saint Joseph’s College (the College) reconciles all credit balances on an account within 21 business days. A Ti ...

... A credit balance occurs whenever the amount of funding applied to a student’s account exceeds the student’s charges in a term/semester. To ensure consistent and accurate financial records, Saint Joseph’s College (the College) reconciles all credit balances on an account within 21 business days. A Ti ...

Evaluating Consumer Loans

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

Module Saving, Investment, and the Financial System

... to Mr. Jones for a loan, Ms. Sanchez for another loan, the Johnson family for another… Or the firm could find a firm that specializes in providing these funds: a bank. The bank, and other financial services companies, is able to make it easier, and less costly, for firms to engage in financial trans ...

... to Mr. Jones for a loan, Ms. Sanchez for another loan, the Johnson family for another… Or the firm could find a firm that specializes in providing these funds: a bank. The bank, and other financial services companies, is able to make it easier, and less costly, for firms to engage in financial trans ...

Kazimierz Dolny konferencja

... OMX Iceland 15 closing prices during the five trading weeks from September 29, 2008 to October 31, 2008. ...

... OMX Iceland 15 closing prices during the five trading weeks from September 29, 2008 to October 31, 2008. ...

No such thing as a free lunch, even with private REITs

... their money. They may have to give 30 days’ notice or longer, and might have to pay redemption fees if they withdraw their funds before a set period. On the other hand, investors can’t always get into a private REIT when they want to. Some private REITs will close themselves to new investors when th ...

... their money. They may have to give 30 days’ notice or longer, and might have to pay redemption fees if they withdraw their funds before a set period. On the other hand, investors can’t always get into a private REIT when they want to. Some private REITs will close themselves to new investors when th ...

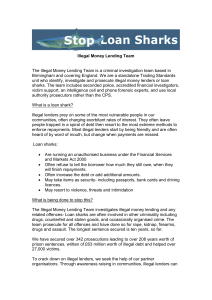

Illegal Money Lending Team information

... people trapped in a spiral of debt then resort to the most extreme methods to enforce repayments. Most illegal lenders start by being friendly and are often heard of by word of mouth, but change when payments are missed. Loan sharks: ...

... people trapped in a spiral of debt then resort to the most extreme methods to enforce repayments. Most illegal lenders start by being friendly and are often heard of by word of mouth, but change when payments are missed. Loan sharks: ...

Growth rate

... $40 bil of MBS per month) and Operation Twist will keep long-term interest rates low through 2013. Banks/CUs are weighing the marginal risk (credit/interest rate) versus marginal return (additional YOA) of alternative assets to boost NIMs. Aggressive loan pricing will lower YOAs. Repricing of maturi ...

... $40 bil of MBS per month) and Operation Twist will keep long-term interest rates low through 2013. Banks/CUs are weighing the marginal risk (credit/interest rate) versus marginal return (additional YOA) of alternative assets to boost NIMs. Aggressive loan pricing will lower YOAs. Repricing of maturi ...