Green bonds - Squarespace

... accuracy, completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. Before entering into any transaction you should take steps to that you understand the transaction and have made an independent assessment of the ...

... accuracy, completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. Before entering into any transaction you should take steps to that you understand the transaction and have made an independent assessment of the ...

Growth in Agricultural Loan Market Share for

... their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may access such as loan participation with correspondent b ...

... their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may access such as loan participation with correspondent b ...

Commercial Mortgage_Private RE Debt Strategies_Global.indd

... high correlation with total returns for bonds, since the price appreciation and depreciation measures for each of those fixed income asset classes are driven largely by the overall level of interest rates. To gauge the excess value provided by commercial mortgage investments over bond investments, p ...

... high correlation with total returns for bonds, since the price appreciation and depreciation measures for each of those fixed income asset classes are driven largely by the overall level of interest rates. To gauge the excess value provided by commercial mortgage investments over bond investments, p ...

Delta Dental of South Dakota Foundation Dentist Loan Repayment

... Dakota, are eligible to apply. Loan balances must be part of the original student loan, i.e., not combined with other personal loans. Applicants must be willing to serve the required service obligation, agree to be credentialed by DDSD and participate in the SD Medicaid program. Applicants must also ...

... Dakota, are eligible to apply. Loan balances must be part of the original student loan, i.e., not combined with other personal loans. Applicants must be willing to serve the required service obligation, agree to be credentialed by DDSD and participate in the SD Medicaid program. Applicants must also ...

Goff 2008 Financial Crisis Slides

... Non-mortgage commercial loans a big part of the story Amplified by “moral hazard” Implied or explicit guarantees to banking/financial system contributed to too much risk-taking, too much debt (TBTF) ...

... Non-mortgage commercial loans a big part of the story Amplified by “moral hazard” Implied or explicit guarantees to banking/financial system contributed to too much risk-taking, too much debt (TBTF) ...

Global Economic Crisis Global Economic Crisis

... Reserve the power to limit interest rates paid on deposits and to make the banking system more stable by limiting the amount of competition between banks. The drafters of the bill feared that if commercial banks competed for deposits, they would ultimately engage in destructive competitive behavior. ...

... Reserve the power to limit interest rates paid on deposits and to make the banking system more stable by limiting the amount of competition between banks. The drafters of the bill feared that if commercial banks competed for deposits, they would ultimately engage in destructive competitive behavior. ...

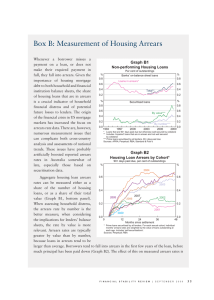

Box B: Measurement of Housing Arrears Graph B1

... ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well covered by collateral. Data from authorised deposit-taking institutions (ADIs) record both past-due and impaired loans on their balance sheets; in contrast, data on securitised loans only cover ...

... ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well covered by collateral. Data from authorised deposit-taking institutions (ADIs) record both past-due and impaired loans on their balance sheets; in contrast, data on securitised loans only cover ...

India Capital Market Update

... includes a complex of institutions and mechanism which affects includes a complex of institutions and mechanism which affects the generation of savings and their transfers to those who will invest. It may be said to be made of all those channels through which savings become available for investments ...

... includes a complex of institutions and mechanism which affects includes a complex of institutions and mechanism which affects the generation of savings and their transfers to those who will invest. It may be said to be made of all those channels through which savings become available for investments ...

US Equities

... other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do ...

... other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do ...

Playing Defense for 2003: A Tale of Two Markets

... weakness is no longer normal and expectable. At that point, investors may defensively view this as Market B and not risk a more severe decline that could test or even break the October low. To be sure, given the roughly four-year cyclical swings under consideration, we are dealing with a small sampl ...

... weakness is no longer normal and expectable. At that point, investors may defensively view this as Market B and not risk a more severe decline that could test or even break the October low. To be sure, given the roughly four-year cyclical swings under consideration, we are dealing with a small sampl ...

Monthly Column Anchored on a drifting seabed Imagine you are

... price is too high and you must adjust downwards but your brain still has to make a sensible adjustment from that crazy starting price, regardless of how fanciful it is. Of course, the stall-holder is hoping that you do not make a sufficient correction from this initial number, so that you still end ...

... price is too high and you must adjust downwards but your brain still has to make a sensible adjustment from that crazy starting price, regardless of how fanciful it is. Of course, the stall-holder is hoping that you do not make a sufficient correction from this initial number, so that you still end ...

US Private Placements: SEC Adopts Relaxed Marketing

... offerings to qualified institutional buyers (QIBs),2 and the verification requirements for Rule 506 offerings do not apply in this context. However, Rule 144A requires the issuer and anyone acting on its behalf, such as a dealer, to reasonably believe that all purchasers are QIBs, and there is an ex ...

... offerings to qualified institutional buyers (QIBs),2 and the verification requirements for Rule 506 offerings do not apply in this context. However, Rule 144A requires the issuer and anyone acting on its behalf, such as a dealer, to reasonably believe that all purchasers are QIBs, and there is an ex ...

1. dia - eUABIR: Home

... – 6 banks with about 6-10% Hungarian market share, subsidiaries of banking groups of the European Union, – The remaining market share is divided between small- and mid sized banks, also subsidiaries of foreign banks, specialising in a segment – Most banks are universal banks, but the market size of ...

... – 6 banks with about 6-10% Hungarian market share, subsidiaries of banking groups of the European Union, – The remaining market share is divided between small- and mid sized banks, also subsidiaries of foreign banks, specialising in a segment – Most banks are universal banks, but the market size of ...

Ryerson University Work Study Plan (UWSP) Funded

... Ontario is the last province you resided in for 12 consecutive months without being a full-time post secondary student, or Your spouse/partner has resided in Ontario for at least 12 consecutive months immediately before the last day of the month in which classes began for your most recent period ...

... Ontario is the last province you resided in for 12 consecutive months without being a full-time post secondary student, or Your spouse/partner has resided in Ontario for at least 12 consecutive months immediately before the last day of the month in which classes began for your most recent period ...

Chap 3

... debt securities a fee for assessing default risk. (Exhibit 3.1). b. Accuracy of Credit Ratings - The ratings issued by the agencies are useful indicators of default risk but they are opinions, not guarantees. c. Oversight of Credit Rating Agencies - The Financial Reform Act of 2010 established an Of ...

... debt securities a fee for assessing default risk. (Exhibit 3.1). b. Accuracy of Credit Ratings - The ratings issued by the agencies are useful indicators of default risk but they are opinions, not guarantees. c. Oversight of Credit Rating Agencies - The Financial Reform Act of 2010 established an Of ...

What is Credit- Teacher Guide

... (Goods and services can cost more when purchased on credit. When people buy things on credit, the interest and fees they must pay amount to a deduction from the money they might otherwise use to buy things they currently want. Also, people sometimes borrow too much. That is, they use too much credit ...

... (Goods and services can cost more when purchased on credit. When people buy things on credit, the interest and fees they must pay amount to a deduction from the money they might otherwise use to buy things they currently want. Also, people sometimes borrow too much. That is, they use too much credit ...

How predictable is the future?

... Daniel Kahneman’s excellent book, ‘Thinking Fast and Slow’, is a double edged sword for anyone in the investment industry. Kahneman does little for the ego of fund managers who believe they possess some rare combination of skill and intuition which allows them to deliver consistently superior result ...

... Daniel Kahneman’s excellent book, ‘Thinking Fast and Slow’, is a double edged sword for anyone in the investment industry. Kahneman does little for the ego of fund managers who believe they possess some rare combination of skill and intuition which allows them to deliver consistently superior result ...

issue of PNAS the results of her research

... of assets and liabilities to cash flow and income, attias we can trust the data) for about a year or so, may actutudes toward debt and risk, lender and investor behavally have started to move up. If we look at something ior, and lending standards and controls. These circumlike general merchandise st ...

... of assets and liabilities to cash flow and income, attias we can trust the data) for about a year or so, may actutudes toward debt and risk, lender and investor behavally have started to move up. If we look at something ior, and lending standards and controls. These circumlike general merchandise st ...

A Study on Indian Money Market, Capital Market and Banking

... regarding the matters relating to banking business, were extended to the urban co-operative banks also. Thus, for the first time in 1966, the urban co-operative banks too came within the regulatory purview of the RBI. Legal Framework – Financial Sector in India Umbrella Acts: Reserve Bank of India A ...

... regarding the matters relating to banking business, were extended to the urban co-operative banks also. Thus, for the first time in 1966, the urban co-operative banks too came within the regulatory purview of the RBI. Legal Framework – Financial Sector in India Umbrella Acts: Reserve Bank of India A ...