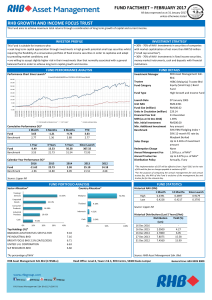

RHB Growth And Income Focus Trust

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

a governança tem que ser exercida de fato

... ease to the Novo Mercado rules. Possibly, the major hurdle is the requirement for common shares only. There is no doubt that companies accessing the Novo Mercado will enhance their visibility, resulting in improved prices. Prof. Antonio Gledson de Carvalho’s study showing the share quotations and li ...

... ease to the Novo Mercado rules. Possibly, the major hurdle is the requirement for common shares only. There is no doubt that companies accessing the Novo Mercado will enhance their visibility, resulting in improved prices. Prof. Antonio Gledson de Carvalho’s study showing the share quotations and li ...

Terms of Sale

... 5 - percent discount for early payment 10 - number of days that the discount is available net 30 - number of days before payment is due ...

... 5 - percent discount for early payment 10 - number of days that the discount is available net 30 - number of days before payment is due ...

Document

... As in the U.S., quality and large caps from developed markets look (relatively) cheap right now. (e.g., price/fair value for SPDR DJ Global Titans = 0.88) Morningstar favorite funds that fit with that theme: Dodge & Cox International (DODFX), Harbor International (HIINX), Vanguard International Valu ...

... As in the U.S., quality and large caps from developed markets look (relatively) cheap right now. (e.g., price/fair value for SPDR DJ Global Titans = 0.88) Morningstar favorite funds that fit with that theme: Dodge & Cox International (DODFX), Harbor International (HIINX), Vanguard International Valu ...

41% - Bank Of India

... Should facilitate operation by ordinary villagers through BCs. Doorstep delivery of basic banking services at affordable cost. ...

... Should facilitate operation by ordinary villagers through BCs. Doorstep delivery of basic banking services at affordable cost. ...

20 June 2017 Swanson: Stocks and Bonds: Two Markets Telling

... markets moved inversely, both anticipating a pickup in economic growth. Equities rose smartly while bond prices fell, pushing yields higher, anticipating that faster growth would eventually lead to an uptick in inflation. But in the last few months, the stock and bond markets have begun to tell very ...

... markets moved inversely, both anticipating a pickup in economic growth. Equities rose smartly while bond prices fell, pushing yields higher, anticipating that faster growth would eventually lead to an uptick in inflation. But in the last few months, the stock and bond markets have begun to tell very ...

Better incentives to service debt

... • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are critical ...

... • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are critical ...

Market Insights - Quarterly outlook

... It potentially puts an implicit floor under any significant ...

... It potentially puts an implicit floor under any significant ...

Credit Rationing by Loan Size in Commercial Loan Markets

... by equations (3) and (4). For any single price different from marginal cost, there is a discriminatory outlay schedule that benefits, or at least does not harm, all borrowers and the lender without side payments.13 In other words, if the borrowers and lender were given a choice between (i) any sing ...

... by equations (3) and (4). For any single price different from marginal cost, there is a discriminatory outlay schedule that benefits, or at least does not harm, all borrowers and the lender without side payments.13 In other words, if the borrowers and lender were given a choice between (i) any sing ...

Solid Capital Market Revenues Lifted US Large Banks

... Underwriting activity, in general, was supported by continued investor optimism and stable capital market activity compared to the previous year. Equity underwriting revenues nearly doubled as low volatility propelled the new issue market whereas debt underwriting (up 51%) benefitted from strong lev ...

... Underwriting activity, in general, was supported by continued investor optimism and stable capital market activity compared to the previous year. Equity underwriting revenues nearly doubled as low volatility propelled the new issue market whereas debt underwriting (up 51%) benefitted from strong lev ...

chapter_06_ - Homework Market

... Federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve Transactions in the federal funds market allow banks with excess reserve balances to lend reserves to banks with deficient reserves These loans are usually made for one day only (‘overnight’) ...

... Federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve Transactions in the federal funds market allow banks with excess reserve balances to lend reserves to banks with deficient reserves These loans are usually made for one day only (‘overnight’) ...

Early stage investment in companies with high growth potential

... company or group of companies; with the possibility of follow-on capital investments up to a maximum investment in any company of $750,000.00, at the discretion of NZVIF. 50/50 matching private investment is required for the Fund to invest. The Fund acts as a direct investor on the same terms as the ...

... company or group of companies; with the possibility of follow-on capital investments up to a maximum investment in any company of $750,000.00, at the discretion of NZVIF. 50/50 matching private investment is required for the Fund to invest. The Fund acts as a direct investor on the same terms as the ...

BsBDH1edchap013WebDisplay

... securities at an agreed-upon offering price The company bears the risk of the issue not being sold The offer may be pulled if there is not enough interest at the offer price and the company does not get the capital and they have still incurred substantial flotation costs Not as common as it us ...

... securities at an agreed-upon offering price The company bears the risk of the issue not being sold The offer may be pulled if there is not enough interest at the offer price and the company does not get the capital and they have still incurred substantial flotation costs Not as common as it us ...

Liquidity Tiering for Higher Yields in the Tax

... short- and intermediate-term requirements. Each tier becomes progressively more aggressive, allowing investors the opportunity to increase their overall return while maintaining a measure of stability and liquidity in historically conservative positions. ...

... short- and intermediate-term requirements. Each tier becomes progressively more aggressive, allowing investors the opportunity to increase their overall return while maintaining a measure of stability and liquidity in historically conservative positions. ...

New Europe Division

... KEY FACTORS FOR A SUSTAINABLE REVENUE STREAM: Market leadership with a substantial market share Entry barrier: internal flexible risk management tool able to cater future customer needs Mastery in risk management recognised by S&P assigning to UBM the same long term credit rating of the grou ...

... KEY FACTORS FOR A SUSTAINABLE REVENUE STREAM: Market leadership with a substantial market share Entry barrier: internal flexible risk management tool able to cater future customer needs Mastery in risk management recognised by S&P assigning to UBM the same long term credit rating of the grou ...

Security Analysis and Portfolio Management

... ◦ Are zero coupon bonds issued at discount to face value and are redeemed at par. ◦ No tax deducted at source ◦ Minimum default risk ◦ Government of India issues three types of treasury bills through auctions, namely, 91-day, 182-day and 364-day. ◦ There are no treasury bills issued by State Governm ...

... ◦ Are zero coupon bonds issued at discount to face value and are redeemed at par. ◦ No tax deducted at source ◦ Minimum default risk ◦ Government of India issues three types of treasury bills through auctions, namely, 91-day, 182-day and 364-day. ◦ There are no treasury bills issued by State Governm ...

DOCX - World bank documents

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

justice foreclosed

... able to get credit were suddenly flooded with highcost loans. As early as 2000, the government concluded that minority borrowers were more likely than comparable white homebuyers to get a subprime loan and those loans would have higher interest rates. By the time the housing bubble burst in 2007, bo ...

... able to get credit were suddenly flooded with highcost loans. As early as 2000, the government concluded that minority borrowers were more likely than comparable white homebuyers to get a subprime loan and those loans would have higher interest rates. By the time the housing bubble burst in 2007, bo ...

The Investment Environment

... business venture would have to either lend money to the business or subject themselves to upside and downside risks. No individual would want to subject himself/herself to unlimited downside risk without a direct say in management. But management skills and possession of wealth don’t necessarily go ...

... business venture would have to either lend money to the business or subject themselves to upside and downside risks. No individual would want to subject himself/herself to unlimited downside risk without a direct say in management. But management skills and possession of wealth don’t necessarily go ...