Ken Lambden - Standing back from the turmoil

... attention be paid to assessing which companies have the right business models and competitive positioning. Fund managers will need to build confidence in the source and sustainability of funding, cash flow and earnings, and will look to ensure that any investment has some margin of safety built in t ...

... attention be paid to assessing which companies have the right business models and competitive positioning. Fund managers will need to build confidence in the source and sustainability of funding, cash flow and earnings, and will look to ensure that any investment has some margin of safety built in t ...

Santander Brasil

... Brazil and its management with respect to its performance, business and future events. Forward looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results ,performance or achievements, and may contain words like "believe", "anticipate", ...

... Brazil and its management with respect to its performance, business and future events. Forward looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results ,performance or achievements, and may contain words like "believe", "anticipate", ...

Emerging markets in 2017

... Investors should also note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this documentation is gathered by Fidelity for its use as an investment manager and may have already been acted upon for its own purposes. ...

... Investors should also note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this documentation is gathered by Fidelity for its use as an investment manager and may have already been acted upon for its own purposes. ...

here

... In past years, we’ve had some concern that valuations in some of the more defensive sectors had become stretched, as they were treated almost like bond proxies. In late 2016, defensives fell back on a relative basis, leaving their valuations slightly more tempting - but their strength in early 2017 ...

... In past years, we’ve had some concern that valuations in some of the more defensive sectors had become stretched, as they were treated almost like bond proxies. In late 2016, defensives fell back on a relative basis, leaving their valuations slightly more tempting - but their strength in early 2017 ...

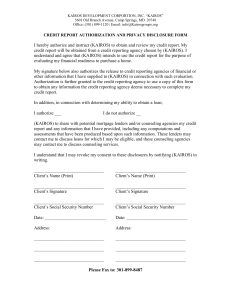

credit report authorization and privacy disclosure form

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

Beginner`s Guide to Bridging Finance

... opportunity to buy these often derelict properties and start their renovation project prior to letting and securing long-term finance or selling for a profit. Bridging loan providers will take into consideration an investor's current property portfolio as well as their potential purchase, making sur ...

... opportunity to buy these often derelict properties and start their renovation project prior to letting and securing long-term finance or selling for a profit. Bridging loan providers will take into consideration an investor's current property portfolio as well as their potential purchase, making sur ...

GFSR Market Update

... June, 2006: Since the release of the April 2006 GFSR, global financial markets have experienced increased volatility and a sharp correction in the price of riskier assets, in particular mature market equities and emerging market assets. Inflationary pressures have resulted in a synchronized tighteni ...

... June, 2006: Since the release of the April 2006 GFSR, global financial markets have experienced increased volatility and a sharp correction in the price of riskier assets, in particular mature market equities and emerging market assets. Inflationary pressures have resulted in a synchronized tighteni ...

08.04.2010 - CEE equity markets move up, Asia is taking a break

... consensus growth and implied valuations (both undervalued at about 10%). Interest rates for both markets should remain unchanged, potentially further into 2010 than we initially thought. ■ Hungary - a possible further rate cut might be an argument for the Hungarian (sound neutral) market. The growth ...

... consensus growth and implied valuations (both undervalued at about 10%). Interest rates for both markets should remain unchanged, potentially further into 2010 than we initially thought. ■ Hungary - a possible further rate cut might be an argument for the Hungarian (sound neutral) market. The growth ...

Chapter 1: ANSWERS TO DO YOU UNDERSTAND

... more liquid asset portfolio. U.S. Government securities have a more active secondary market than other investment securities, so they can be converted to cash quickly. 2. What are credit unions and how do they differ from a commercial bank? Solution: Credit unions are organized as mutuals; banks as ...

... more liquid asset portfolio. U.S. Government securities have a more active secondary market than other investment securities, so they can be converted to cash quickly. 2. What are credit unions and how do they differ from a commercial bank? Solution: Credit unions are organized as mutuals; banks as ...

CREDITO FONDIARIO, A LEADER IN THE ITALIAN CREDIT

... credit management sector, announces an agreement with Intesa Sanpaolo Provis, part of the Intesa Sanpaolo Group, on the acquisition pro soluto of two nonperforming leasing portfolios, comprising credit exposures and underlying assets (mostly instrumental goods and vehicles), with a gross book value ...

... credit management sector, announces an agreement with Intesa Sanpaolo Provis, part of the Intesa Sanpaolo Group, on the acquisition pro soluto of two nonperforming leasing portfolios, comprising credit exposures and underlying assets (mostly instrumental goods and vehicles), with a gross book value ...

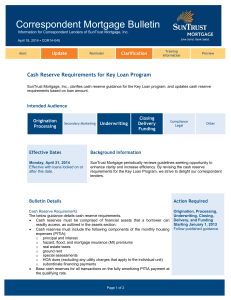

Bulletin COR 14-045: Cash Reserve Requirements

... This information is for use by mortgage professionals only and should not be distributed to or used by consumers or other third parties. This is not for solicitation of sales. Information is accurate as of date of posting and is subject to change without current product details and lending procedure ...

... This information is for use by mortgage professionals only and should not be distributed to or used by consumers or other third parties. This is not for solicitation of sales. Information is accurate as of date of posting and is subject to change without current product details and lending procedure ...

netw rks

... depositors’ money in the stock market. The banks hoped to earn a lot of money _ on the investments when stock prices rose, but stock values dropped instead. When that happened, speculators could not repay their loans, and banks lost money on their investments. In response, banks greatly reduced the ...

... depositors’ money in the stock market. The banks hoped to earn a lot of money _ on the investments when stock prices rose, but stock values dropped instead. When that happened, speculators could not repay their loans, and banks lost money on their investments. In response, banks greatly reduced the ...

In search of Yield - Insight Investment

... regulation are opening up new avenues for cash investors that have historically not been available. By working with asset managers to disintermediate banks, treasurers have been given the opportunity to transact directly with non-bank counterparties, often for the first time. This is particularly pr ...

... regulation are opening up new avenues for cash investors that have historically not been available. By working with asset managers to disintermediate banks, treasurers have been given the opportunity to transact directly with non-bank counterparties, often for the first time. This is particularly pr ...

Complexity of the global economy

... management fees, profit sharing fee and taxes the ROI on such funds would fetch returns similar or lower than equity assets. The same can be invested into equity mutual funds which have more liquidity, tax efficiency, transparency and may result in similar or superior returns. 7. Many High Risk Debt ...

... management fees, profit sharing fee and taxes the ROI on such funds would fetch returns similar or lower than equity assets. The same can be invested into equity mutual funds which have more liquidity, tax efficiency, transparency and may result in similar or superior returns. 7. Many High Risk Debt ...

Current Challenges in Housing and Home Loans: Complicating Factors and

... which had declined to 3.1 percent in late 1987, peaked at 9.1 percent in the second half of 1991. Declining housing prices alone did not cause very elevated foreclosures; it was significantly compounded by an economic shock such as the loss of a job which disrupted the ability of many borrowers to m ...

... which had declined to 3.1 percent in late 1987, peaked at 9.1 percent in the second half of 1991. Declining housing prices alone did not cause very elevated foreclosures; it was significantly compounded by an economic shock such as the loss of a job which disrupted the ability of many borrowers to m ...

Current Negative Gearing Policy

... cards for the Federal Election. What we want to do is keep our customers and anyone out there who is interested in the property market, informed about the current state of the market. Negative gearing has been staked out as an Election battleground by both major parties and this key point of differe ...

... cards for the Federal Election. What we want to do is keep our customers and anyone out there who is interested in the property market, informed about the current state of the market. Negative gearing has been staked out as an Election battleground by both major parties and this key point of differe ...

(DOC file) No 177/2006 amending Rules No 530/2004

... capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 ...

... capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 ...

How Interest Rates Work

... With every loan, there's a risk that the borrower won't be able to pay it back. The higher the risk that the borrower will default (or fail to repay the loan), the higher the interest rate. That's why maintaining a good credit score will help lower the interest rates offered to you by lenders. ...

... With every loan, there's a risk that the borrower won't be able to pay it back. The higher the risk that the borrower will default (or fail to repay the loan), the higher the interest rate. That's why maintaining a good credit score will help lower the interest rates offered to you by lenders. ...

Total real assets

... 1.3 FINANCIAL MARKETS AND THE ECONOMY • Risk Allocation • Investors can choose desired risk level • Bond vs. stock of company • Bank CD vs. company bond • Risk-and-return trade-off ...

... 1.3 FINANCIAL MARKETS AND THE ECONOMY • Risk Allocation • Investors can choose desired risk level • Bond vs. stock of company • Bank CD vs. company bond • Risk-and-return trade-off ...

Document

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

gitman_286618_IM_ch01

... 13. Due to their enormous impact, governments typically regulate financial institutions more than most economic sectors. Banking sector troubles and other factors contributed to the worst economic contraction in U.S. history during the Great Depression. Consequently, it is not surprising that an abo ...

... 13. Due to their enormous impact, governments typically regulate financial institutions more than most economic sectors. Banking sector troubles and other factors contributed to the worst economic contraction in U.S. history during the Great Depression. Consequently, it is not surprising that an abo ...

Africa Is there economic hope

... The best way to eradicate poverty is to deal with the poorest people in the world in terms of a market Innovation to deliver products and services to poorest people • Primarily in cost structures ...

... The best way to eradicate poverty is to deal with the poorest people in the world in terms of a market Innovation to deliver products and services to poorest people • Primarily in cost structures ...

Long-term-Foreign-Exchange-Risk-Management

... Analytical and secretariat work of The Lab has been funded by the UK Department of Energy & Climate Change (DECC), the German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB), and the U.S. Department of State. Climate Policy Initiative serves as The Lab S ...

... Analytical and secretariat work of The Lab has been funded by the UK Department of Energy & Climate Change (DECC), the German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB), and the U.S. Department of State. Climate Policy Initiative serves as The Lab S ...

Factsheet Floating Rate Income Trust USD

... You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling ...

... You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling ...