The_Inefficient_Markets_Argument_for_Passive_Investing

... individual investors is difficult, though this clearly does not dissuade them from active management. Why play a game in which your competitors have an advantage, if you can win more often than not by staying out of the game? The unavoidable conclusion If prices in the stock market are not efficient ...

... individual investors is difficult, though this clearly does not dissuade them from active management. Why play a game in which your competitors have an advantage, if you can win more often than not by staying out of the game? The unavoidable conclusion If prices in the stock market are not efficient ...

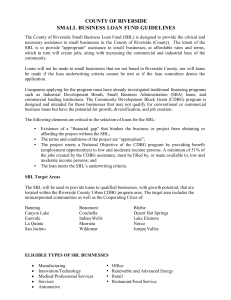

county of riverside small business loan fund guidelines

... All SBF loans shall be fully secured by collateral in order to maintain the SBF Program. No unsecured loans shall be made. The collateral will usually be in the form of liens of the assets financed including fixed assets such as machinery, accounts receivable, inventory, and lease assignments. Liens ...

... All SBF loans shall be fully secured by collateral in order to maintain the SBF Program. No unsecured loans shall be made. The collateral will usually be in the form of liens of the assets financed including fixed assets such as machinery, accounts receivable, inventory, and lease assignments. Liens ...

Asian High Yield Outlook

... This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity Worldwide Investment ...

... This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity Worldwide Investment ...

Module 9

... Valuers advising on matters relating to secured property lending must not undertake suck work unless, as a ...

... Valuers advising on matters relating to secured property lending must not undertake suck work unless, as a ...

Microfinance Institutions in Bosnia, Colombia and Nicaragua: What

... What Did we Observe in 2009 and What to Expect in 2010 Other Trends ...

... What Did we Observe in 2009 and What to Expect in 2010 Other Trends ...

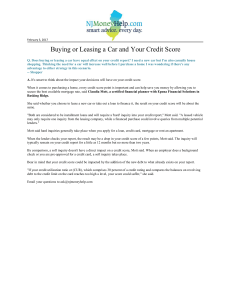

Buying or Leasing a Car and Your Credit Score

... When it comes to purchasing a home, every credit score point is important and can help save you money by allowing you to secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a n ...

... When it comes to purchasing a home, every credit score point is important and can help save you money by allowing you to secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a n ...

Dry Associates Investment Newsletter

... proved over and over again that any time there are price controls, whether on rents, sugar or money, scarcities will emerge. In the case of this legislation, commercial banks are prevented from lending at rates above 14% per annum – that is 4% above the current Central Bank Reference Rate. Fourteen ...

... proved over and over again that any time there are price controls, whether on rents, sugar or money, scarcities will emerge. In the case of this legislation, commercial banks are prevented from lending at rates above 14% per annum – that is 4% above the current Central Bank Reference Rate. Fourteen ...

Source: Barron`s 7/4/2016 - Academy of Preferred Financial Advisors

... performance of any investment. Past performance is no guarantee of future results. The Standard and Poors 500 index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing ...

... performance of any investment. Past performance is no guarantee of future results. The Standard and Poors 500 index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing ...

Economics 434 Financial Markets - SHANTI Pages

... But, what if the bonds are not “independent” • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “ ...

... But, what if the bonds are not “independent” • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “ ...

Wishin` and Hopin` - MFS Investment Management

... camp of those looking for a continued dramatic rise in US Treasury yields. Rates are likely to remain elevated versus 2016, but we expect rates to stay low by historical standards, though not at the extremely low levels of mid-2016. Very wide interest rate differentials between, for example, the US ...

... camp of those looking for a continued dramatic rise in US Treasury yields. Rates are likely to remain elevated versus 2016, but we expect rates to stay low by historical standards, though not at the extremely low levels of mid-2016. Very wide interest rate differentials between, for example, the US ...

A once paper-heavy industry, mortgage is increasingly

... A once paper-heavy industry, mortgage is increasingly trading tangible file folders and heavy filing cabinets for weightless e-documents stored in the vast online cloud and accessible from anywhere. As elusive as these documents may be, they are grounded and guarded in a secure environment to protec ...

... A once paper-heavy industry, mortgage is increasingly trading tangible file folders and heavy filing cabinets for weightless e-documents stored in the vast online cloud and accessible from anywhere. As elusive as these documents may be, they are grounded and guarded in a secure environment to protec ...

Speech to the National Association for Business Economics’ Annual Meeting

... commercial paper that have become illiquid. As a supervisor and regulator of banks, the Fed has long focused on insuring that banks hold adequate capital and that they carefully monitor and manage risks. As a consequence, banks are well-positioned to weather the financial turmoil. The Fed is careful ...

... commercial paper that have become illiquid. As a supervisor and regulator of banks, the Fed has long focused on insuring that banks hold adequate capital and that they carefully monitor and manage risks. As a consequence, banks are well-positioned to weather the financial turmoil. The Fed is careful ...

Martin Feldstein Housing, Housing Finance, and Monetary Policy

... price declines for all risky assets. When those risky assets were held in leveraged accounts or when investors had sold risk insurance through credit derivatives, losses were substantial. KCFED2007.90307 ...

... price declines for all risky assets. When those risky assets were held in leveraged accounts or when investors had sold risk insurance through credit derivatives, losses were substantial. KCFED2007.90307 ...

De-risking pension funds across the board

... Despite low interest rates, companies that have prepared for pensions derisking are going forward with their plans. And, while most recent activity has been muted owing to volatile financial markets and diminished pension funded status, this is an opportune time to transact, with prices having recen ...

... Despite low interest rates, companies that have prepared for pensions derisking are going forward with their plans. And, while most recent activity has been muted owing to volatile financial markets and diminished pension funded status, this is an opportune time to transact, with prices having recen ...

Contracts and Contracting in the Film Industry

... Gap/Supergap lending is a very risky form of capital investment and accordingly the fees and interest charged reflect that level of risk. ...

... Gap/Supergap lending is a very risky form of capital investment and accordingly the fees and interest charged reflect that level of risk. ...

Residential mortgage lending for underserved communities: recent

... offering for traditionally underserved communities and first-time home buyers, allowing them to potentially reach new markets or expand existing ones while earning CRA credit by serving an unmet need. The WBHL℠ program also faces challenges, including barriers to scaling, a unique repayment structur ...

... offering for traditionally underserved communities and first-time home buyers, allowing them to potentially reach new markets or expand existing ones while earning CRA credit by serving an unmet need. The WBHL℠ program also faces challenges, including barriers to scaling, a unique repayment structur ...

The European Contrast Media Market, 2002

... Slow adoption of new products restricting sales Confidence building, since, acceptance of products based on safety and quality record in the marketplace Increasing product range involves high R&D and marketing investment Overcoming market saturation and developing competencies in attractive segments ...

... Slow adoption of new products restricting sales Confidence building, since, acceptance of products based on safety and quality record in the marketplace Increasing product range involves high R&D and marketing investment Overcoming market saturation and developing competencies in attractive segments ...

Contact: Mark Primoff 845-758-7749 primoff@bard

... Whalen describes a Minsky-oriented account of the 2007 credit crunch as starting with the housing boom, which followed the burst of the “dot-com” bubble in 2000. The housing boom was fueled by low interest rates and the proliferation of exotic mortgages, such as interest-only loans and option adjust ...

... Whalen describes a Minsky-oriented account of the 2007 credit crunch as starting with the housing boom, which followed the burst of the “dot-com” bubble in 2000. The housing boom was fueled by low interest rates and the proliferation of exotic mortgages, such as interest-only loans and option adjust ...

Private Equity Demystified

... The PE company makes an investment in order to buy a lot more companies in that sector and put them together to make something big and profitable ...

... The PE company makes an investment in order to buy a lot more companies in that sector and put them together to make something big and profitable ...

MARE - Stock Market- Exit at Your Own Risk Case for Staying

... The Market Analysis, Research and Education (MARE) group, a unit of Fidelity Management & Research Co. (FMRCo.), provides timely analysis on developments in the financial markets. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Past performanc ...

... The Market Analysis, Research and Education (MARE) group, a unit of Fidelity Management & Research Co. (FMRCo.), provides timely analysis on developments in the financial markets. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Past performanc ...

Revenue Recognition Certificates

... Transaction costs are large relative to the small changes in credit and the value of imbedded options & seller may have information ...

... Transaction costs are large relative to the small changes in credit and the value of imbedded options & seller may have information ...

Schuldscheindarlehen - Bundesverband Öffentlicher Banken

... mentation, as well as the fact that exploring a broader investor base does not require an expensive external rating. Higher transaction costs (due to more extensive transparency requirements or an expansion of the regulatory framework, for example) would burden access to this financing instrument fo ...

... mentation, as well as the fact that exploring a broader investor base does not require an expensive external rating. Higher transaction costs (due to more extensive transparency requirements or an expansion of the regulatory framework, for example) would burden access to this financing instrument fo ...