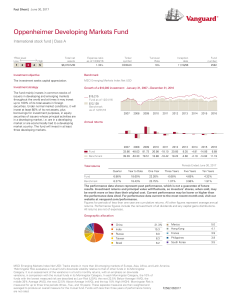

Oppenheimer Developing Markets Fund - Vanguard

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

How innovative financial products affect financial stability

... But the modern financial system is even more complicated than this, making it even harder for the financial authorities to comprehend. Financial innovation has enabled the credit risks of the fund raisers to be spread to outside the financial system and assumed by investors instead, through the use ...

... But the modern financial system is even more complicated than this, making it even harder for the financial authorities to comprehend. Financial innovation has enabled the credit risks of the fund raisers to be spread to outside the financial system and assumed by investors instead, through the use ...

A1 Advanced products for managing the bank`s balance sheet

... 3. Exercise: using a credit derivative achieve an “efficient frontier”, enhancing returns for an acceptable increase in credit risk. 4. Exercise: using a credit derivative as an alternative to standard repo. Afternoon: Credit derivatives structures 2: 1. Credit Linked Note. ...

... 3. Exercise: using a credit derivative achieve an “efficient frontier”, enhancing returns for an acceptable increase in credit risk. 4. Exercise: using a credit derivative as an alternative to standard repo. Afternoon: Credit derivatives structures 2: 1. Credit Linked Note. ...

Chapter 12.1: Bankruptcy

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

Gaining Trust

... debt in those countries to trade at yields below zero. With almost all of the negative-yield debt concentrated in Europe and Japan, investors are flocking to Treasuries, which offer some of the highest yields among industrialized nations. This has caused the yield on the average 10-year security to ...

... debt in those countries to trade at yields below zero. With almost all of the negative-yield debt concentrated in Europe and Japan, investors are flocking to Treasuries, which offer some of the highest yields among industrialized nations. This has caused the yield on the average 10-year security to ...

savings

... In general, the lower the probability of an “event”, the less you will pay in premiums. In general, the larger the number of people in the risk pool, the less you will pay in premiums. ...

... In general, the lower the probability of an “event”, the less you will pay in premiums. In general, the larger the number of people in the risk pool, the less you will pay in premiums. ...

February 9, 2017 150/2017-SAE/GAE 2 Itaú Unibanco Holding

... By the way, it is natural to the Company to seek the highest possible return, using the cost of capital as a reference. Additionally, we present below the calculation schedule of the cost of capital for credit prepared based on information included on slide 9, which is attached to this reply (a calc ...

... By the way, it is natural to the Company to seek the highest possible return, using the cost of capital as a reference. Additionally, we present below the calculation schedule of the cost of capital for credit prepared based on information included on slide 9, which is attached to this reply (a calc ...

The Circular Flow of Finance Financial Intermediaries

... – Mutual fund stockholders receive dividends from their investments – Net Asset Value NAV – Market value of a mutual fund share • Allows for diversification – invested in many companies ...

... – Mutual fund stockholders receive dividends from their investments – Net Asset Value NAV – Market value of a mutual fund share • Allows for diversification – invested in many companies ...

Permira Debt Managers appoints David Hirschmann as Head of

... London, 9 June 2015 – Permira Debt Managers (“PDM”) is pleased to announce the appointment of David Hirschmann as Head of Private Credit to lead the origination and execution of opportunities for PDM’s direct lending funds. David’s appointment follows that of Dan Hatcher in January 2015 to lead UK o ...

... London, 9 June 2015 – Permira Debt Managers (“PDM”) is pleased to announce the appointment of David Hirschmann as Head of Private Credit to lead the origination and execution of opportunities for PDM’s direct lending funds. David’s appointment follows that of Dan Hatcher in January 2015 to lead UK o ...

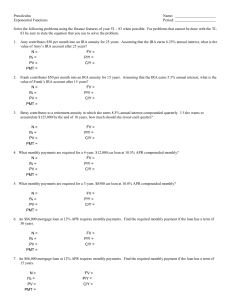

Solve the following problems using the finance

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

Corporation Tax treatment of interest-free loans and other

... IFRS, FRS 101 and FRS 102 while in 2016 small companies will be expected to apply FRS 102 (either in full or under Section 1A). In each case the requirements for financial instruments under the new accounting standards will differ from that under Old UK GAAP (where FRS 26 has not been applied). One ...

... IFRS, FRS 101 and FRS 102 while in 2016 small companies will be expected to apply FRS 102 (either in full or under Section 1A). In each case the requirements for financial instruments under the new accounting standards will differ from that under Old UK GAAP (where FRS 26 has not been applied). One ...

ch12 -

... • BTIRRE= BTIRRP + (BTIRRP – BTIRRD)(D/E) BTIRRE = Before-Tax IRR on equity invested BTIRRP = Before-Tax IRR on total investment in the property BTIRRD = Before-Tax IRR on debt (effective cost including points) D/E =Debt/Equity ratio ...

... • BTIRRE= BTIRRP + (BTIRRP – BTIRRD)(D/E) BTIRRE = Before-Tax IRR on equity invested BTIRRP = Before-Tax IRR on total investment in the property BTIRRD = Before-Tax IRR on debt (effective cost including points) D/E =Debt/Equity ratio ...

Presentation - Ekonomski institut, Zagreb

... Relax controls on capital outflows – eg, for institutional portfolio investors ...

... Relax controls on capital outflows – eg, for institutional portfolio investors ...

Emerging Market Equity: Private Equity, Public Equity, Risks

... Investors with a large minimum commitment amount are: - limited in geographic scope - must exercise care to not flood markets Investors with a modest minimum commitment size can build a ...

... Investors with a large minimum commitment amount are: - limited in geographic scope - must exercise care to not flood markets Investors with a modest minimum commitment size can build a ...

Slovakia Czech Republic

... Army industry was concentrated in more in Slovakia (60 %) Weapons was produced in more than 100 companies and there was employed about 70 000 employees. The boom of Czechoslovak army production was in 1987 it is volume was 29 billion of CSK. Army production represented 3 % of the total production an ...

... Army industry was concentrated in more in Slovakia (60 %) Weapons was produced in more than 100 companies and there was employed about 70 000 employees. The boom of Czechoslovak army production was in 1987 it is volume was 29 billion of CSK. Army production represented 3 % of the total production an ...

KraneShares E Fund China Commercial Paper ETF (ticker: KCNY)

... political, social or economic instability within China which may cause a decline in value. Fluctuations in currency of foreign countries may have an adverse effect on domestic currency values. Emerging markets involve heightened risk related to the same factors as well as increased volatility and lo ...

... political, social or economic instability within China which may cause a decline in value. Fluctuations in currency of foreign countries may have an adverse effect on domestic currency values. Emerging markets involve heightened risk related to the same factors as well as increased volatility and lo ...

Securitisation in Ireland

... harmonise treatment of securitised lending across the euro-area provide information on alternatives to bank finance examine wider issue of credit risk transfer ...

... harmonise treatment of securitised lending across the euro-area provide information on alternatives to bank finance examine wider issue of credit risk transfer ...

Wall Street wants you to ask, “What mutual funds do you recommend?”

... accounts. However, few if any of the administrators, managers, and advisors who watched retirement accounts switch from stable to volatile funds raised questions or protests as to whether this was a good idea. Frankly, the managers and advisors who benefit from funneling dollars into the stock marke ...

... accounts. However, few if any of the administrators, managers, and advisors who watched retirement accounts switch from stable to volatile funds raised questions or protests as to whether this was a good idea. Frankly, the managers and advisors who benefit from funneling dollars into the stock marke ...

PDF

... far more dominant in Iowa than in other district states. In the intervening period, farmers in Iowa have received a comparatively large inflow of SBA loans and government disaster payments. In addition, cash flows to farmers in Iowa have probably responded faster to this year's uptrend in farm price ...

... far more dominant in Iowa than in other district states. In the intervening period, farmers in Iowa have received a comparatively large inflow of SBA loans and government disaster payments. In addition, cash flows to farmers in Iowa have probably responded faster to this year's uptrend in farm price ...

Q1 2017 - Partnervest

... climb 9.1% — the fastest pace since the fourth quarter of 2011 — with per share profits totaling $29.51, according to FactSet Research. Such results would mark the third straight quarter of year-over-year gains after a five-quarter losing streak that ended in mid-2016. Energy stocks led the increase ...

... climb 9.1% — the fastest pace since the fourth quarter of 2011 — with per share profits totaling $29.51, according to FactSet Research. Such results would mark the third straight quarter of year-over-year gains after a five-quarter losing streak that ended in mid-2016. Energy stocks led the increase ...

Basics of Investment

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...