Advising the Behavioral Investor

... was the longest since the Great Depression. Coming out of it, many economists and market prognosticators are forecasting anemic growth at best, and at worst, a “double-dip” scenario in which the country bounces out of one recession directly into another one. In such environments, it’s easy for inves ...

... was the longest since the Great Depression. Coming out of it, many economists and market prognosticators are forecasting anemic growth at best, and at worst, a “double-dip” scenario in which the country bounces out of one recession directly into another one. In such environments, it’s easy for inves ...

how does a pooled vehicle deliver better risk

... net worth market is the inefficiency with which their best manager ideas and investment opportunities are implemented across client portfolios. Assembling an array of mutual funds or separate accounts into a total portfolio and managing it on an ongoing basis can be daunting even for accomplished in ...

... net worth market is the inefficiency with which their best manager ideas and investment opportunities are implemented across client portfolios. Assembling an array of mutual funds or separate accounts into a total portfolio and managing it on an ongoing basis can be daunting even for accomplished in ...

Answer to EOC Problems, Chapter 16:

... Spot loans are loans in which the firm would receive the funds as soon as the bank approved the loan. These days, most business loans are made as firms “take down” (or borrow against) pre-negotiated lines of credit or loan commitments. Banks make loan commitment agreements--contractual commitments t ...

... Spot loans are loans in which the firm would receive the funds as soon as the bank approved the loan. These days, most business loans are made as firms “take down” (or borrow against) pre-negotiated lines of credit or loan commitments. Banks make loan commitment agreements--contractual commitments t ...

Media - Profile Financial Services

... professional assistance. In this series we will look at four interesting asset classes, and ask financial planners which fund managers they trust with their clients' money, and why. We start with equity income, also known as yield stocks: an equity portfolio, but one selected chiefly for the dividen ...

... professional assistance. In this series we will look at four interesting asset classes, and ask financial planners which fund managers they trust with their clients' money, and why. We start with equity income, also known as yield stocks: an equity portfolio, but one selected chiefly for the dividen ...

10-CAPM

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

Document

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

Thank you for the business

... or 2 percent would have a minimal effect on the pool as a whole. Furthermore, when realestate prices were rising, any foreclosed houses could be sold for more than their mortgage value, meaning no loss to the mortgage pool. Below is a chart of the price of BBB credit-rated mortgage-backed securities ...

... or 2 percent would have a minimal effect on the pool as a whole. Furthermore, when realestate prices were rising, any foreclosed houses could be sold for more than their mortgage value, meaning no loss to the mortgage pool. Below is a chart of the price of BBB credit-rated mortgage-backed securities ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration of comments received, and it makes many improvements to the original pr ...

... requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration of comments received, and it makes many improvements to the original pr ...

2nd quarter 2016

... This Presentation has been produced by Komplett Bank ASA (the “Company” or “Komplett Bank”), solely for use at the presentation to investors and is strictly confidential and may not be reproduced or redistributed, in whole or in part, to any other person. To the best of the knowledge of the Company ...

... This Presentation has been produced by Komplett Bank ASA (the “Company” or “Komplett Bank”), solely for use at the presentation to investors and is strictly confidential and may not be reproduced or redistributed, in whole or in part, to any other person. To the best of the knowledge of the Company ...

Research - Savills

... Savills is a leading global real estate service provider listed on the London Stock Exchange. The company established in 1855, has a rich heritage with unrivalled growth. It is a company that leads rather than follows, and now has over 600 offices and associates throughout the Americas, Europe, Asia ...

... Savills is a leading global real estate service provider listed on the London Stock Exchange. The company established in 1855, has a rich heritage with unrivalled growth. It is a company that leads rather than follows, and now has over 600 offices and associates throughout the Americas, Europe, Asia ...

Thank you for joining me. Over the next half hour

... However, over the most recent quarter, the Federal Reserve indicated that it would be moving away from using only the unemployment rate as an indicator. Instead, it would be looking at many indicators, including several measures of the quality of labor, including discouraged workers and workers empl ...

... However, over the most recent quarter, the Federal Reserve indicated that it would be moving away from using only the unemployment rate as an indicator. Instead, it would be looking at many indicators, including several measures of the quality of labor, including discouraged workers and workers empl ...

MA162: Finite mathematics - Financial Mathematics

... Blanch can’t pass up the chance to buy a ranch. She will borrow $400,000. She will pay back this loan by making quarterly payments at the end of each quarter for 30 years. Interest on the loan is 6.2% APR compounded quarterly. Determine the size of Blanch’s quarterly payments. Use the loan formula w ...

... Blanch can’t pass up the chance to buy a ranch. She will borrow $400,000. She will pay back this loan by making quarterly payments at the end of each quarter for 30 years. Interest on the loan is 6.2% APR compounded quarterly. Determine the size of Blanch’s quarterly payments. Use the loan formula w ...

Fund Profile - nab asset management

... Important information: Antares Capital Partners Ltd ABN 85 066 081 114, AFSL 234483 (‘ACP’), is the Responsible Entity of, and the issuer of units in, the Antares High Growth Shares Fund ARSN 090 554 082 (‘the Fund’). An investor should consider the current Product Disclosure Statement and Product G ...

... Important information: Antares Capital Partners Ltd ABN 85 066 081 114, AFSL 234483 (‘ACP’), is the Responsible Entity of, and the issuer of units in, the Antares High Growth Shares Fund ARSN 090 554 082 (‘the Fund’). An investor should consider the current Product Disclosure Statement and Product G ...

Characteristics of Different Types of Loans Commercial Loans

... Repos) Short-term loans secured by government securities that are settled in immediately available funds Identical to Fed Funds except they are collateralized Technically, the RPs entail the sale of securities with a simultaneous agreement to buy them back later at a fixed price plus accrued i ...

... Repos) Short-term loans secured by government securities that are settled in immediately available funds Identical to Fed Funds except they are collateralized Technically, the RPs entail the sale of securities with a simultaneous agreement to buy them back later at a fixed price plus accrued i ...

Trends in Spanish corporate bond issuance

... diminishing average costs for these issuers.2 In order to address this matter, many countries, including Spain, have launched alternative fixed income markets designed to facilitate access to capital markets by medium-sized entities. Small companies, however, remain dependent on bank financing, as t ...

... diminishing average costs for these issuers.2 In order to address this matter, many countries, including Spain, have launched alternative fixed income markets designed to facilitate access to capital markets by medium-sized entities. Small companies, however, remain dependent on bank financing, as t ...

st. james investment company investment adviser`s letter

... not upgrade but continue to use Windows XP, which first appeared in 2001. There is clearly demand for Windows 7 after most businesses passed on upgrading to Vista. Microsoft Office 2010 is the next product in the upgrade cycle queue followed by SharePoint 2010, a p ...

... not upgrade but continue to use Windows XP, which first appeared in 2001. There is clearly demand for Windows 7 after most businesses passed on upgrading to Vista. Microsoft Office 2010 is the next product in the upgrade cycle queue followed by SharePoint 2010, a p ...

Issue in Financial Stability—Activity and Financing in the Vehicle

... end of the third quarter of 2016, the total assets of these two companies alone totaled about NIS 5.9 billion, while their total liabilities were about NIS 4.1 billion, for a leverage rate of about 70 percent. Among the four large publicly-traded leasing companies, total assets were about NIS 17.5 b ...

... end of the third quarter of 2016, the total assets of these two companies alone totaled about NIS 5.9 billion, while their total liabilities were about NIS 4.1 billion, for a leverage rate of about 70 percent. Among the four large publicly-traded leasing companies, total assets were about NIS 17.5 b ...

Long-term investment in Europe The origin of the

... standards, claiming that the business models of intermediaries should be taken into account, especially if made up of long-term assets and liabilities; that the standards should promote procyclical behaviour; and that long-term investment should be encouraged.3 In addition, in terms of corporate gov ...

... standards, claiming that the business models of intermediaries should be taken into account, especially if made up of long-term assets and liabilities; that the standards should promote procyclical behaviour; and that long-term investment should be encouraged.3 In addition, in terms of corporate gov ...

Spring 2017 Bursar Payment Worksheet

... 4. Third Party Payments Expected: (Attach Proper Authorization) (Ex.; DVR, Commission for the Blind, VA, Company Up-Front Payment) ...

... 4. Third Party Payments Expected: (Attach Proper Authorization) (Ex.; DVR, Commission for the Blind, VA, Company Up-Front Payment) ...

New York Real Estate for Salespersons, 5th e

... Many restrictions on high-cost (subprime) loans that are first or junior (second) mortgages Loans covered under New York Law Maximum indebtedness of $300,000 For family or personal reasons Apply to one- to four-unit property that is the ...

... Many restrictions on high-cost (subprime) loans that are first or junior (second) mortgages Loans covered under New York Law Maximum indebtedness of $300,000 For family or personal reasons Apply to one- to four-unit property that is the ...

ch03 - U of L Class Index

... NAV > market price, selling at a discount NAV < market price, selling at a premium If the value of the portfolio remains unchanged, an investor can gain or lose if the discount narrows or widens over time Trade at premiums and discounts across time, and variance is great ...

... NAV > market price, selling at a discount NAV < market price, selling at a premium If the value of the portfolio remains unchanged, an investor can gain or lose if the discount narrows or widens over time Trade at premiums and discounts across time, and variance is great ...

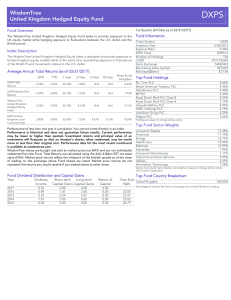

WisdomTree United Kingdom Hedged Equity Fund

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473), or visit wisdomtree.com to view view or download a prospectus. Investors ...

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473), or visit wisdomtree.com to view view or download a prospectus. Investors ...

North Americans go bargain hunting in UK listed sector

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

WCMA ILS Quarterly Press Release Q1 2016

... ILS market sees record setting start to 2016: $2bn in first quarter NEW YORK, 20 April, 2016 — Breaking Q1 2015’s record, the first quarter of 2016 saw new issuance volume of $2.0 billion of non-life capacity, the most of any first quarter in history, according to the latest ILS market update from W ...

... ILS market sees record setting start to 2016: $2bn in first quarter NEW YORK, 20 April, 2016 — Breaking Q1 2015’s record, the first quarter of 2016 saw new issuance volume of $2.0 billion of non-life capacity, the most of any first quarter in history, according to the latest ILS market update from W ...

Document

... The point of view of those institutional investors that publish their voting record - Institutional investors in the US seem to have a more adversarial voting pattern vis-à-vis company managements than in the UK; this might be due to the fewer voting rights given to shareholders by the US regulator ...

... The point of view of those institutional investors that publish their voting record - Institutional investors in the US seem to have a more adversarial voting pattern vis-à-vis company managements than in the UK; this might be due to the fewer voting rights given to shareholders by the US regulator ...