CHAPTER 16, CREDIT IN AMERICA CREDIT

... Closed Ended- Installment Credit Loan is repaid in fixed payment that include principal and interest. Down payment is required APR Annual Percentage rate- Collateral is used with Installment Credit. Installment Cash Loans- Promissory note is a written stating the amount of the loan. Service Credit- ...

... Closed Ended- Installment Credit Loan is repaid in fixed payment that include principal and interest. Down payment is required APR Annual Percentage rate- Collateral is used with Installment Credit. Installment Cash Loans- Promissory note is a written stating the amount of the loan. Service Credit- ...

NN Global Investment Grade Credit - Home

... which has undermined not only credibility, but also approval rates which have been falling significantly undermining political capital necessary to move a pro-growth agenda. The political uncertainty can also translate into weaker business and consumer confidence with negative effects on economic ac ...

... which has undermined not only credibility, but also approval rates which have been falling significantly undermining political capital necessary to move a pro-growth agenda. The political uncertainty can also translate into weaker business and consumer confidence with negative effects on economic ac ...

What effect has quantitative easing had on your share

... an equity risk premium. It is also sometimes called the equity discount rate. 4 Marc Goedhart, Tim Koller, and Zane Williams, “The real cost of equity,” McKinsey on Finance, Autumn 2002. ...

... an equity risk premium. It is also sometimes called the equity discount rate. 4 Marc Goedhart, Tim Koller, and Zane Williams, “The real cost of equity,” McKinsey on Finance, Autumn 2002. ...

Presentation_Fahim

... As financial market complexity and borrower diversity increased over time, investors and regulators have placed greater reliance on the opinions of credit rating agencies. ...

... As financial market complexity and borrower diversity increased over time, investors and regulators have placed greater reliance on the opinions of credit rating agencies. ...

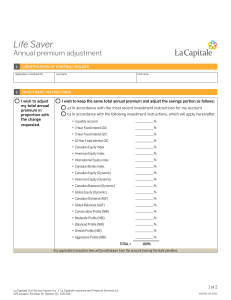

IND001E Life Saver - Annual Premium Adjustment

... Transaction date: Except under certain circumstances, the transaction date for a purchase or redemption shall be the business day on which the form is received at the Insurer’s office, provided that it is completed in full, duly signed and submitted with any required amounts. The Insurer reserves th ...

... Transaction date: Except under certain circumstances, the transaction date for a purchase or redemption shall be the business day on which the form is received at the Insurer’s office, provided that it is completed in full, duly signed and submitted with any required amounts. The Insurer reserves th ...

Pioneers: Better be smart

... indices which weight companies based on their economic footprints of revenues, profits and dividends, rather than aggregate market values. Arnott is also careful to point out that returns from the fundamental strategies have not always been in a straight upward line but they have turned in a cumulat ...

... indices which weight companies based on their economic footprints of revenues, profits and dividends, rather than aggregate market values. Arnott is also careful to point out that returns from the fundamental strategies have not always been in a straight upward line but they have turned in a cumulat ...

group A DSE Siayam FM

... decision of the Board of DSE; The Board of DSE takes the decision regarding listing/nonlisting of the company which must be completed within 75 days from the closure of the subscription. ...

... decision of the Board of DSE; The Board of DSE takes the decision regarding listing/nonlisting of the company which must be completed within 75 days from the closure of the subscription. ...

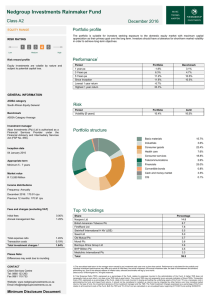

Fact sheets - Nedgroup Investments

... Market volatility, low economic growth as well as local and global political uncertainty (Brexit / US elections) made 2016 a challenging year. In 2017, we can expect more of the same but amid the volatility, there are signs of some stability and better growth for the year ahead. For example, GDP gro ...

... Market volatility, low economic growth as well as local and global political uncertainty (Brexit / US elections) made 2016 a challenging year. In 2017, we can expect more of the same but amid the volatility, there are signs of some stability and better growth for the year ahead. For example, GDP gro ...

Mr. S. Dattagupta, Principal Financial Officer, International Finance

... metros and large cities at affordable prices? 2. Can we take a relook at our building codes? – with technological advancement it is now globally proven that we can reduce construction costs without compromising on any standard=> better affordability across the spectrum and larger number of units pro ...

... metros and large cities at affordable prices? 2. Can we take a relook at our building codes? – with technological advancement it is now globally proven that we can reduce construction costs without compromising on any standard=> better affordability across the spectrum and larger number of units pro ...

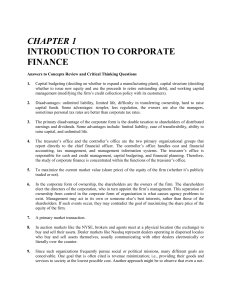

Answers to Concepts Review and Critical Thinking Questions

... stock than they otherwise would. It is important to note that even if the company delists, its stock is still likely traded, but on the over-the-counter market pink sheets rather than on an organized exchange. This adds another cost since the stock is likely less to be liquid now. All else the same, ...

... stock than they otherwise would. It is important to note that even if the company delists, its stock is still likely traded, but on the over-the-counter market pink sheets rather than on an organized exchange. This adds another cost since the stock is likely less to be liquid now. All else the same, ...

European banks` balance sheets strongest for a

... could lead to further declines in interest rates into negative territory, will impair banks’ earnings ability. There also is the technical argument that sovereign wealth funds from China and the Middle East began selling what hitherto had been one of the most resilient sectors, in order to cover los ...

... could lead to further declines in interest rates into negative territory, will impair banks’ earnings ability. There also is the technical argument that sovereign wealth funds from China and the Middle East began selling what hitherto had been one of the most resilient sectors, in order to cover los ...

master.irm - McGraw

... Under the new accounting method, Sears will classify accounts delinquent sooner and take loan losses earlier. Under its old system, many accounts went past the credit-card industry standard of 90 days before Sears classified them as delinquent. What’s more, accounts weren’t charged off until the ove ...

... Under the new accounting method, Sears will classify accounts delinquent sooner and take loan losses earlier. Under its old system, many accounts went past the credit-card industry standard of 90 days before Sears classified them as delinquent. What’s more, accounts weren’t charged off until the ove ...

decision drivers: stock prices versus gdp

... country’s equity market will follow a similar upward path? Or conversely, will a country’s weak economic prospects weigh on its equity market returns? Not necessarily, though many investors tend to see gross domestic product (GDP) as an indicator of the direction of stock prices. It’s a common mispe ...

... country’s equity market will follow a similar upward path? Or conversely, will a country’s weak economic prospects weigh on its equity market returns? Not necessarily, though many investors tend to see gross domestic product (GDP) as an indicator of the direction of stock prices. It’s a common mispe ...

Trump Trade Will Accelerate Historic Credit Bust

... Stansberry writes: “There are three big “tells”: ...

... Stansberry writes: “There are three big “tells”: ...

The U.S. Economy and 12 District Banking: Conditions & Outlook

... Transparency and Forward Guidance: FOMC Statement (10/24/2012) Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without further policy accommodation, economic growth might not be strong enough to gener ...

... Transparency and Forward Guidance: FOMC Statement (10/24/2012) Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without further policy accommodation, economic growth might not be strong enough to gener ...

A Flat Dow for 10 Years

... their effects. The focus is on potential "frictions" -- especially, lack of liquidity and credit -- that can keep the economy from working efficiently. "Economics used to ignore liquidity risk, like Newton's laws ignore friction in physics," says Lasse Pedersen of New York University "However, now ...

... their effects. The focus is on potential "frictions" -- especially, lack of liquidity and credit -- that can keep the economy from working efficiently. "Economics used to ignore liquidity risk, like Newton's laws ignore friction in physics," says Lasse Pedersen of New York University "However, now ...

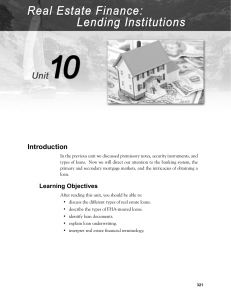

Introduction - I-Board Allied Schools

... During the Great Depression, the Glass-Steagall Act was passed that prohibited commercial banks from collaborating with full-service brokerage firms or participating in investment banking activities. In addition, before deregulation in the early 1980s, lending institutions were restricted on their a ...

... During the Great Depression, the Glass-Steagall Act was passed that prohibited commercial banks from collaborating with full-service brokerage firms or participating in investment banking activities. In addition, before deregulation in the early 1980s, lending institutions were restricted on their a ...

class9n4 - Duke University

... If the price of a stock has just gone up or down, then it does not follow that it will go up or down in the future. Reason: If technical rules worked, everyone would use them. As a result they would not work anymore. This does not imply: Prices are “uncaused”. Markets do not behave according ...

... If the price of a stock has just gone up or down, then it does not follow that it will go up or down in the future. Reason: If technical rules worked, everyone would use them. As a result they would not work anymore. This does not imply: Prices are “uncaused”. Markets do not behave according ...

Chapter 8 - The Market for Loanable Funds

... • When the economy is going well, it increases the confidence of investors and they become more inclined to make major investments. • When investors become more confident about the future of the economy, they demand more loans to invest in business projects and thus cause the demand for loanable fun ...

... • When the economy is going well, it increases the confidence of investors and they become more inclined to make major investments. • When investors become more confident about the future of the economy, they demand more loans to invest in business projects and thus cause the demand for loanable fun ...

HKEx to Consult Market on Infrastructure for Clearing and Settlement

... Since December 2002, HKEx has been working with the SFC and market participants to develop an STP model of the IP Account. Under that model, investors could be in a better position to directly settle their trades through the IP Account in respect of both securities and money. Such settlement service ...

... Since December 2002, HKEx has been working with the SFC and market participants to develop an STP model of the IP Account. Under that model, investors could be in a better position to directly settle their trades through the IP Account in respect of both securities and money. Such settlement service ...

Columbia Contrarian Core Fund

... Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA and managed by Columbia Management Investment Advisers, LLC. Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies. The v ...

... Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA and managed by Columbia Management Investment Advisers, LLC. Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies. The v ...

Nonagency MBS, CMBS, ABS

... Conduit Deals With such large deals, there are different servicing levels. For example, there may be subservicing by the local originators who are required to collect payments and maintain records, a master servicer responsible for overseeing the commercial MBS deal, and a special servicer respo ...

... Conduit Deals With such large deals, there are different servicing levels. For example, there may be subservicing by the local originators who are required to collect payments and maintain records, a master servicer responsible for overseeing the commercial MBS deal, and a special servicer respo ...