security analysis and portfolio management

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

Mutual Funds May 2012

... Grows tax-free $ not taxed when withdrawn in retirement (after age 59 ½) ...

... Grows tax-free $ not taxed when withdrawn in retirement (after age 59 ½) ...

MARKET REVIEW AND ECONOMIC OUTLOOK 2014 Q2 MARKET

... “I have always considered a bet on ever‐rising U.S. prosperity to be very close to a sure thing……..who has ever benefitted during the past 237 years by betting against America………America’s best days lie ahead” – Warren Buffet, Berkshire Hathaway 2013 Year‐End Letter to Shareholders The first quarte ...

... “I have always considered a bet on ever‐rising U.S. prosperity to be very close to a sure thing……..who has ever benefitted during the past 237 years by betting against America………America’s best days lie ahead” – Warren Buffet, Berkshire Hathaway 2013 Year‐End Letter to Shareholders The first quarte ...

BMS Finance completes its second senior debt financing of bfinance

... management team to buy-out bfinance from its private equity owners and has since been repaid in full. The new debt facility is structured as a senior, 3 year loan which will enable the senior management team to further execute on its growth strategy globally. bfinance is an independent, privately-ow ...

... management team to buy-out bfinance from its private equity owners and has since been repaid in full. The new debt facility is structured as a senior, 3 year loan which will enable the senior management team to further execute on its growth strategy globally. bfinance is an independent, privately-ow ...

The Case for Dividends - Franklin Templeton Investments

... Recent years have been tough for Canadian investors, who found their confidence tested by a faltering global economic recovery, ongoing worries about the European debt crisis, slowing growth in emerging markets and other geopolitical events. Such issues have increased market volatility, uncertainty ...

... Recent years have been tough for Canadian investors, who found their confidence tested by a faltering global economic recovery, ongoing worries about the European debt crisis, slowing growth in emerging markets and other geopolitical events. Such issues have increased market volatility, uncertainty ...

Links Between the Domestic and Eurobond

... whereby companies are controlled. The United States and the United Kingdom are often viewed as prototypes of a market-oriented financial system (frequently referred to as the Anglo-Saxon or AS model), whereas Germany, France, and Japan are generally regarded as typical representatives of bank-center ...

... whereby companies are controlled. The United States and the United Kingdom are often viewed as prototypes of a market-oriented financial system (frequently referred to as the Anglo-Saxon or AS model), whereas Germany, France, and Japan are generally regarded as typical representatives of bank-center ...

Grant versus Loans: from ex-ante to ex-post

... – Adverse selection can be addressed by including natural disaster insurance in all loans extended by these institutions. – Since IFIs’ lending rates are not affected by country-specific credit risk, they should not be affected by country-specific natural disaster risk. ...

... – Adverse selection can be addressed by including natural disaster insurance in all loans extended by these institutions. – Since IFIs’ lending rates are not affected by country-specific credit risk, they should not be affected by country-specific natural disaster risk. ...

Part III. Project Description

... provided by the applicant: Amount of co-investment (in your requested currency) provided by co-investors: ...

... provided by the applicant: Amount of co-investment (in your requested currency) provided by co-investors: ...

1st Half 2016 Newsletter - Harpswell Capital Advisors

... of current income exempt from federal income taxes; the secondary objective is total return. The fund invests at least 80% of its assets in lower quality municipal bonds. This is an area where we feel fundamental research can generate alpha (positive returns) for our clients. At the retail level, th ...

... of current income exempt from federal income taxes; the secondary objective is total return. The fund invests at least 80% of its assets in lower quality municipal bonds. This is an area where we feel fundamental research can generate alpha (positive returns) for our clients. At the retail level, th ...

1 Introduction 2 Analytical Framework

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

Document

... can reposition itself as a multiproduct food and beverage packaging company. They might have identified an acquisition target and need help on the transaction, or they might want us to look at their capital structure, not only to lower financing costs but also to match assets and liabilities in orde ...

... can reposition itself as a multiproduct food and beverage packaging company. They might have identified an acquisition target and need help on the transaction, or they might want us to look at their capital structure, not only to lower financing costs but also to match assets and liabilities in orde ...

credit evaluation from the corporate practitioners

... It is the Association's objective to help improve and widen members' professional skills in the area of Credit Management. While the theoretical aspects of each topic would be addressed, the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This ...

... It is the Association's objective to help improve and widen members' professional skills in the area of Credit Management. While the theoretical aspects of each topic would be addressed, the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This ...

Entrepreneurship and Public Policy

... Banking Industry Consolidation (M&As) • Larger organizations created by M&As may reduce the availability of credit to small businesses – Small banks devote a bigger share of loans to SMEs than big banks do – Studies compare small business lending by consolidating institutions before and after M&A a ...

... Banking Industry Consolidation (M&As) • Larger organizations created by M&As may reduce the availability of credit to small businesses – Small banks devote a bigger share of loans to SMEs than big banks do – Studies compare small business lending by consolidating institutions before and after M&A a ...

Project Finance Overview

... assets and signs the project contracts) because of the large debt liabilities and complex risk management associated with them 3. they involve some manner of revenuegenerating plant or structure being built 4. they are typically structured in two phases: ...

... assets and signs the project contracts) because of the large debt liabilities and complex risk management associated with them 3. they involve some manner of revenuegenerating plant or structure being built 4. they are typically structured in two phases: ...

Facts

... A better comprehension of the impact that building fabric and facilities may have on the productive performance of the built environment is beginning to change perceptions. For example, there is an increasing understanding of the phenomenon of sick building syndrome, and this is focusing attention ...

... A better comprehension of the impact that building fabric and facilities may have on the productive performance of the built environment is beginning to change perceptions. For example, there is an increasing understanding of the phenomenon of sick building syndrome, and this is focusing attention ...

Evolution of bank and non-bank corporate funding in Peru

... Bank lending remains the most important funding source for Peru’s non-bank private sector. However, the corporate bond market is slowly emerging as an additional source of funds for domestic firms. As in other emerging market economies, Peruvian domestic non-financial corporations have been issuing ...

... Bank lending remains the most important funding source for Peru’s non-bank private sector. However, the corporate bond market is slowly emerging as an additional source of funds for domestic firms. As in other emerging market economies, Peruvian domestic non-financial corporations have been issuing ...

By-Md Noor Solaiman Jewel

... General Index lost 660 points or 9 per cent and Chittagong Stock Exchange Selective Index ...

... General Index lost 660 points or 9 per cent and Chittagong Stock Exchange Selective Index ...

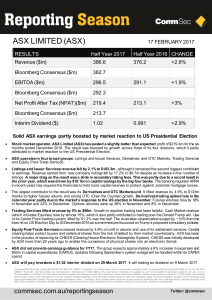

View PDF Report

... 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objecti ...

... 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objecti ...

Ghossoub, E., Laosuthi, T. and Reed, R. (2009)

... and private information generate a transactions role for money. The economy consists of two geographically separated islands and communication across islands is not possible. This friction limits trading opportunities so that private liabilities do not circulate. In this manner, liquidity risk is mo ...

... and private information generate a transactions role for money. The economy consists of two geographically separated islands and communication across islands is not possible. This friction limits trading opportunities so that private liabilities do not circulate. In this manner, liquidity risk is mo ...

Credit-driven busiuess cycles in the Eurace agent

... the housing market has been modelled as mainly random because we are more interested on the credit aspects of housing markets bubbles and bursts, and on their impact on the economy as a whole, than on the functioning and the microstructure of the market and the related behavioral aspects. However, w ...

... the housing market has been modelled as mainly random because we are more interested on the credit aspects of housing markets bubbles and bursts, and on their impact on the economy as a whole, than on the functioning and the microstructure of the market and the related behavioral aspects. However, w ...

Synopsis_2014_v3 ed 7 and 8

... Ch. 2-6 presents different financial institutions. Identify the major types of financial institutions, which are they? What do they do? We go through these chapter briefly in class. The material is meant for self-studies. It is important to understand the different institutions and what they do on t ...

... Ch. 2-6 presents different financial institutions. Identify the major types of financial institutions, which are they? What do they do? We go through these chapter briefly in class. The material is meant for self-studies. It is important to understand the different institutions and what they do on t ...

LIQUIDITY

... - Brokered Deposits – any deposit that is obtained from or through the mediation or assistance of a deposit broker. For insured banks that are not well capitalized, brokered deposits include any deposit solicited by offering rates that significantly exceed market rates. - Broker deposits are highly ...

... - Brokered Deposits – any deposit that is obtained from or through the mediation or assistance of a deposit broker. For insured banks that are not well capitalized, brokered deposits include any deposit solicited by offering rates that significantly exceed market rates. - Broker deposits are highly ...