Module History and Alternative Views of

... Rational Expectations, Real Business Cycles, and New Classical Macroeconomics • RBC theory is widely recognized as having made valuable contributions to our understanding of the economy, and it serves as a useful caution against too much emphasis on aggregate demand. • But many RBC theorists themse ...

... Rational Expectations, Real Business Cycles, and New Classical Macroeconomics • RBC theory is widely recognized as having made valuable contributions to our understanding of the economy, and it serves as a useful caution against too much emphasis on aggregate demand. • But many RBC theorists themse ...

The Great Crash of 2008: Are governments or markets to blame

... to zero, asked Wicksell? His answer was that, if the Bank rate were set at the natural rate of interest, which balances productivity with thrift, the price level could be kept constant. This is, of course, the theory underlying inflation targeting, as embodied in the Taylor rule. As John Taylor h ...

... to zero, asked Wicksell? His answer was that, if the Bank rate were set at the natural rate of interest, which balances productivity with thrift, the price level could be kept constant. This is, of course, the theory underlying inflation targeting, as embodied in the Taylor rule. As John Taylor h ...

518297-LLP-2011-IT-ERASMUS-FEXI The impact of the translations

... Moreover, the efficiency wages models prove why corporate salaries are interdependent: the optimal salary for any firm depends on the salary paid by all the other firms on the market. This interdependence may lead to multiple balance states, in which no firm changes its salaries, not even when it mo ...

... Moreover, the efficiency wages models prove why corporate salaries are interdependent: the optimal salary for any firm depends on the salary paid by all the other firms on the market. This interdependence may lead to multiple balance states, in which no firm changes its salaries, not even when it mo ...

Quantity Theory Calculations 1. The Quantity Theory is an equation

... 2 The idea here is that the quantity theory predictions may have more support in US data when the growth rates computed are based on longer horizons. Thus, (1) looks at ”high frequencies”, whereas (2) looks at “lower frequencies”. ...

... 2 The idea here is that the quantity theory predictions may have more support in US data when the growth rates computed are based on longer horizons. Thus, (1) looks at ”high frequencies”, whereas (2) looks at “lower frequencies”. ...

The Telegraph

... but there is a risk of exhausting interest rate ammunition too soon. The cut will have limited impact unless the financial system starts to function normally. The MPC is hoping to shock money and credit markets back to life but the Fed's rate-slashing failed to avert a US credit crunch. UK policy-ma ...

... but there is a risk of exhausting interest rate ammunition too soon. The cut will have limited impact unless the financial system starts to function normally. The MPC is hoping to shock money and credit markets back to life but the Fed's rate-slashing failed to avert a US credit crunch. UK policy-ma ...

The Subprime Crisis - The University of Texas at Dallas

... of savings and its impact on a low natural rate of interest should prevail for some time. These relatively low interest rates and the consequent economic growth they allow, should be sustainable over time, being the result of a secular shift in the savings (consumption) rate. How does one then expla ...

... of savings and its impact on a low natural rate of interest should prevail for some time. These relatively low interest rates and the consequent economic growth they allow, should be sustainable over time, being the result of a secular shift in the savings (consumption) rate. How does one then expla ...

Classical Theory - McGraw Hill Higher Education

... • The Great Depression was a stunning blow to Classical economists. • John Maynard Keynes provided an alternative to the classical theory. • Keynes argued that the Great Depression was not a unique event. • It would recur if reliance on the market to “self-adjust” continued. ...

... • The Great Depression was a stunning blow to Classical economists. • John Maynard Keynes provided an alternative to the classical theory. • Keynes argued that the Great Depression was not a unique event. • It would recur if reliance on the market to “self-adjust” continued. ...

Dynamic Lag Structure of Deposits and Loans Interest Rates and

... investors of economic firms and the earnings of labor force. When the economy has a high employment rate, the labor demand increases but the workers cannot ask for higher wages as the labor contracts are annual or have fixed periods and wages can only be changed after the end of the contract period. ...

... investors of economic firms and the earnings of labor force. When the economy has a high employment rate, the labor demand increases but the workers cannot ask for higher wages as the labor contracts are annual or have fixed periods and wages can only be changed after the end of the contract period. ...

Day Two - Southwestern

... power than I borrowed. If inflation is 5%, then I am paying back ______ purchasing power that I borrowed. If inflation is 3%, then I am paying back ______ purchasing power than I borrowed. If inflation is -8%, then I am paying back ______ purchasing power than I borrowed. ...

... power than I borrowed. If inflation is 5%, then I am paying back ______ purchasing power that I borrowed. If inflation is 3%, then I am paying back ______ purchasing power than I borrowed. If inflation is -8%, then I am paying back ______ purchasing power than I borrowed. ...

How to conduct monetary policy

... For the most part, the demand for goods and services is not related to the market interest rates quoted on the financial pages of newspapers, known as nominal rates. Instead, it is related to real interest rates—that is, nominal interest rates minus the expected rate of inflation. How do real intere ...

... For the most part, the demand for goods and services is not related to the market interest rates quoted on the financial pages of newspapers, known as nominal rates. Instead, it is related to real interest rates—that is, nominal interest rates minus the expected rate of inflation. How do real intere ...

Tom Allen, Head of Economics, Eton College

... • C Monetary policy involves the manipulation of interest rates, the money supply and the exchange rate. • C Students today associate UK monetary policy with the Bank of England’s Monetary Policy Committee, MPC, which sets the Bank Rate. • C It also directly influences the size of the money supply t ...

... • C Monetary policy involves the manipulation of interest rates, the money supply and the exchange rate. • C Students today associate UK monetary policy with the Bank of England’s Monetary Policy Committee, MPC, which sets the Bank Rate. • C It also directly influences the size of the money supply t ...

Mankiw 5/e Chapter 19: Advances in Business Cycle Theory

... Top reasons for sticky prices: results from surveys of managers 1. Coordination failure: firms hold back on price changes, waiting for others to go first 2. Firms delay raising prices until costs rise 3. Firms prefer to vary other product attributes, such as quality, service, or delivery lags 4. Im ...

... Top reasons for sticky prices: results from surveys of managers 1. Coordination failure: firms hold back on price changes, waiting for others to go first 2. Firms delay raising prices until costs rise 3. Firms prefer to vary other product attributes, such as quality, service, or delivery lags 4. Im ...

the combined cycle theory

... rigidity shown by prices and wages, generates a recession followed by a subsequent recovery, which could be helped or not by applied expansionary demand policies. Since in the ‘plucking model’ artificial booms are not possible, cyclical fluctuations in economic activity are only produced below its g ...

... rigidity shown by prices and wages, generates a recession followed by a subsequent recovery, which could be helped or not by applied expansionary demand policies. Since in the ‘plucking model’ artificial booms are not possible, cyclical fluctuations in economic activity are only produced below its g ...

Advances in Business Cycle Theory

... Results from surveys of managers 1. Coordination failure: firms hold back on price changes, waiting for others to go first 2. Firms delay raising prices until costs rise 3. Firms prefer to vary other product attributes, such as quality, service, or delivery lags 4. Implicit contracts: firms tacitly ...

... Results from surveys of managers 1. Coordination failure: firms hold back on price changes, waiting for others to go first 2. Firms delay raising prices until costs rise 3. Firms prefer to vary other product attributes, such as quality, service, or delivery lags 4. Implicit contracts: firms tacitly ...

1 The Great Depression (1929 – 1941

... – Foreign trade, government spending and taxes were too small – No exogenous consumption shock From I? – Investment decline was the major shock. – Mechanism is unclear, but probably due to shift to “bad bad equilibrium equilibrium” (panics, risk, high risk premiums, low investment, unstable dynamics ...

... – Foreign trade, government spending and taxes were too small – No exogenous consumption shock From I? – Investment decline was the major shock. – Mechanism is unclear, but probably due to shift to “bad bad equilibrium equilibrium” (panics, risk, high risk premiums, low investment, unstable dynamics ...

Business Cycle ppt

... The internal theories look for mechanism within the economic system itself (selfgenerating business cycles). ...

... The internal theories look for mechanism within the economic system itself (selfgenerating business cycles). ...

Keynesian Economics

... ⇒ And because it showed that full employment could be maintained only with the help of government spending. ...

... ⇒ And because it showed that full employment could be maintained only with the help of government spending. ...

Economics 330 (Kelly)

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

- Bogazici University, Department of Economics

... Q4- Consider a Cobb-Douglas production function with three inputs. K is capital (the number of machines), L is labor (the number of workers), and H is human capital (the number of college degrees among the workers). The production function is Y=K1/3L1/3H1/3 a. Derive an expression for the marginal p ...

... Q4- Consider a Cobb-Douglas production function with three inputs. K is capital (the number of machines), L is labor (the number of workers), and H is human capital (the number of college degrees among the workers). The production function is Y=K1/3L1/3H1/3 a. Derive an expression for the marginal p ...

Top of Form Political Economy 1. The main indicator of economic

... that the state finds productive. A) True B) False 18. The two main problems with authority-based policy-making are (1) the state does not allocate optimally and (2) there is little incentive to use resources efficiently. Add to this that it can be abrasive to classic ideological liberals. A) True B) ...

... that the state finds productive. A) True B) False 18. The two main problems with authority-based policy-making are (1) the state does not allocate optimally and (2) there is little incentive to use resources efficiently. Add to this that it can be abrasive to classic ideological liberals. A) True B) ...

Y 1

... for money increases. Households sell bonds to increase money holdings Increase in IR increases cost of holding money. Therefore, quantity of money demanded decreases. Decreasing IR decreases cost of holding money, so money demand increases As a result, Money Demand curve slopes downwards 3. Equilibr ...

... for money increases. Households sell bonds to increase money holdings Increase in IR increases cost of holding money. Therefore, quantity of money demanded decreases. Decreasing IR decreases cost of holding money, so money demand increases As a result, Money Demand curve slopes downwards 3. Equilibr ...

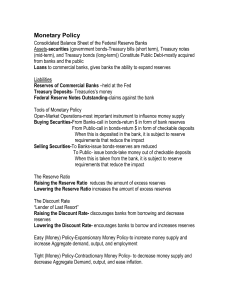

Monetary Policy

... Cyclical Asymmetry: Easy money policy is not as easy to affect! Banks are not forced to make loans when excess reserves rise. This may mean that moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will ...

... Cyclical Asymmetry: Easy money policy is not as easy to affect! Banks are not forced to make loans when excess reserves rise. This may mean that moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will ...

Keynesian theory

... policy actions by the central bank and fiscal policy actions by the government to stabilize output over the business cycle.The theories forming the basis of Keynesian economics were first presented in The General Theory of Employment, Interest and Money, published in 1936. The interpretations of Key ...

... policy actions by the central bank and fiscal policy actions by the government to stabilize output over the business cycle.The theories forming the basis of Keynesian economics were first presented in The General Theory of Employment, Interest and Money, published in 1936. The interpretations of Key ...