* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 1 The Great Depression (1929 – 1941

Exchange rate wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Fear of floating wikipedia , lookup

Economic bubble wikipedia , lookup

International monetary systems wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Business cycle wikipedia , lookup

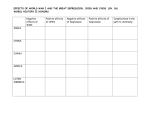

Monetary policy wikipedia , lookup

The Great Depression (1929 – 1941) 1 Housekeeping Midterm on Wed October 12 11:35-12:50 pm DL 220, ML 211, Rosenfeld Hall as per assignment. assignment Remember open TF office hours and review sessions (see class web site). Final questions? 2 1 Gilded era of the 1920s Stability restored to U.S. economy in 1920s after WW I. Problems surfaced with real estate and stock market booms. The Great Crash, October 1929 2 Key Elements in the Great Depression 1929-1933 • • • • • • • • • • Started as asset price bubble and standard recession Remember world was on gold standard (fixed exchange rate system) Multiple p bank failures through g 1933 ((standard p panic model)) Breakdown of Gold Standard, particularly with Britain’s leaving gold in 1931. Collapse of investment and international trade after 1929 No effective fiscal policy until 1940 Fed took hesitant steps to stimulate the economy – Federal government wanted to balance the budget (like several candidates today…) today ) – Fed was serving too many masters (more on this later) Output kept falling, and unemployment kept rising Trough finally reached in 1933, but no sharp recovery Remember that Keynes’s General Theory not published until 1935: macroeconomics was born a decade too late. 5 Bank failures and panics, 1931-1933 3 Real GDP then and now [= 100 at beginning of first year] 108 104 100 96 92 88 84 80 76 72 68 I II III IV I II III IV I II III IV I II III IV 1929 1930 1931 1932 2008 2009 2010 2011 I II III IV 1933 High unemployment for a decade 4 Unemployment rate (% of labor force) 30 25 20 15 10 Great Depression Today's recession 5 0 1930 1932 1934 1936 1938 1940 2008 2009 2010 2011 9 Growth in Key Indicators Period 1927:10-1929:8 1929:8-1931:12 1931:12-1933:4 H M1 Real M1 Ind. Prod. 42.7% 2.0% 6.5% 1.1% -8.1% -10.5% 1.4% -0.9% 0.6% 11.6% -22.4% -10.2% Real GDP Inflation 3.8% -6.7% -11.9% -0.3% -7.3% -11.0% H = high powered money. Periods are: 1. Pre-crash boom 2. From crash to Britain’s leaving gold in October 1931 3. From gold crisis to trough Note: rates of change at annual rates. 10 5 Alternative views of the sources of the GD Classical theories: exist but are in my view defective too long g a digression g to explain p why y at this stage; g ; will mention when we do real business cycles Keynesian theories: - “Expenditure view”: IS or spending shocks - Financial market distress: MP or financial shocks 11 IS interpretation of the depression interest rate (i) IS1929 IS1933 MP Y1929 Y1933 0 Real output (Y) 12 6 I. The Expenditure Approach: IS Shocks Were shocks in the IS curve responsible? – Foreign trade, government spending and taxes were too small – No exogenous consumption shock From I? – Investment decline was the major shock. – Mechanism is unclear, but probably due to shift to “bad bad equilibrium equilibrium” (panics, risk, high risk premiums, low investment, unstable dynamics ?) 13 II. Financial Markets and the Depression • Central banks generally have to serve three masters in different mixes over time. This was the Fed’s trilemma in 1928-33. 1. exchange rates (gold standard and convertibility) 2 macroeconomy (inflation 2. (inflation, output output, and employment) 3. financial market stability (asset prices, panics, liquidity) • Fed was primarily concerned about (#3) speculation in 1928-29 and tightened money at that point. • When depression was underway, Fed was primarily concerned with defending the gold standard (#1) until 1933 and didn’t expand M sufficiently. • From 1933 on, after US depreciated and others left gold, Fed was divided about how strongly to stimulate the economy because of poor macro understanding (#2). 14 7 Friedman and Schwartz and the Monetarist Argument • Classic study of the Great Depression is Milton Friedman and Anna Schwartz, Monetary History of the United States, which held the “monetarist” view. “Throughout the near-century examined, we have found that: Changes in the behavior of the money stock have been closely associated with changes in economic activity, money income, and prices. The interaction between monetary and economic change has been highly stable. Monetary changes have often had an independent origin; they have not been simply a reflection of economic activity.” (p. 676) • F&S view the depression p as p primarily y driven by y “incompetent” p monetary policy caused by decline in money supply. • Argue that rise in M1 could have prevented Y fall and nipped GD in bud Monetarism, the Depression, and IS-MP interest rate (i) MP‘ MP i** i* IS Y** Y* Real output (Y) 16 8 Interest Rates 1920-39 Problem with monetarist interpretation: Safe interest rates fell in GD!!! Intterest rate (% per year) 10 8 6 4 2 0 20 22 24 26 28 30 3-month T-bill Fed discount rate (low) 32 34 36 38 40 Corporate bond rate Commercial paper rate 17 IS-MP model for abnormal times: The liquidity trap 9 6 US short-term interest rates, 1929-45 (% per year) Liquidity trap in US in Great Depression 5 4 3 2 1 0 1930 1932 1934 1936 1938 1940 1942 1944 Japan short-term interest rates, 1994-2010 Liquidity trap from 1996 to today: 15 years and d counting. ti 10 US in current recession Federal funds rate (% per year) 20 Policy has hit the “zero lower bound” three years ago. 16 12 8 4 0 1975 1980 1985 1990 1995 2000 2005 2010 Fiscal policy in liquidity trap r = real interest rate IS IS’ MP re Y = real output (GDP) 11 Monetary policy in liquidity trap interest rate (i) IS1933 MP1933 MP1939 Y1929 Y1933 0 Y1939 Real output (Y) 23 Great Depression and Great Recession 7 Federal funds rate (2005-2011) Fed discount rate (1926-1937) 6 5 4 3 2 Compare then and now! 1 0 1926 1928 1930 1932 2005 2007 2009 2011 1934 1936 24 12 Bad equilibrium view of Great Depression A final approach: 1. Began with h asset price b bubble bbl and dh high h lleverage. 2. Then had huge IS shock due to risk, panics, deflation, and the result was high risky real interest rates. 3. This forced economy into a liquidity trap (like today), so that monetary policy was ineffective. 4. Government was too small to have effective fiscal policy. 5 Got 5. G llocked k d iinto “b “bad d equilibrium” ilib i ” off deflation, d fl i high hi h risk i k premiums, fear, low investment, and low spending. 6. And that lasted until 1940! 25 interest rate (i) IS1933 IS1929 MP1929 = MP1933 MP1939 Y1929 Y1933 0 Y1939 Real output (Y) 26 13 Recovery from the Great Depression • The end of the Great Depression: – Milit Military mobilization bili ti ffor W World ld W War II led l d tto ENORMOUS increase in G starting in 1940. – Recovery took off in 1940. • This Standard IS shift … no puzzle here! 27 The rise of the dictators (1917 - ) 14 World War II (1931-1945) Military spending takes off… 15 The end of the depression … 30 .6 Germ. invastion Poland G WW II 15 10 Pearl H Harb or Germ invast ion Austria, Czec h 20 .5 Germ in nvasion F rance 25 .4 .3 .2 5 .1 1 0 .0 30 32 34 36 38 40 42 44 46 48 Unemployment rate Defense spending/GDP F ederal expenditures/GDP interest rate (i) IS1939 31 IS1945 WW II Y1945 0 Y1939 MP Real output (Y) 32 16 Can you see why macroeconomists emphasize the importance of fiscal policy in the current environment? “Our policy approach started with a major commitment to fiscal stimulus. Our judgment was that in a liquidity trap-type scenario of d f l financial f l system, and d zero interest rates, a dysfunctional expectations of protracted contraction, the results of monetary policy were highly uncertain whereas fiscal policy was likely to be potent.” Lawrence Summers, July 19, 2009 Implication of the Recovery • Recovery from GD required an increase in high-employment federal deficit of 20-25 percent of GDP – Would be equivalent of $3 trillion deficit today! • The magnitude of the fiscal shock required for recovery suggests that no minor M or F expansion would cure GD quickly. 34 17 Summary • The depth and severity of the Great Depression remains one of the continuing debates of macroeconomics. • Probably no simple approach can explain the entire story – Warning: avoid the seduction simplicity of monocausal approaches. • Perhaps a complex situation where combination of factors piled up to produce a “perfect storm” of macroeconomics: – began with asset price bubble (boom of 1920s and bust of 1929) – poor institutions (gold standard and fragile banking system) – poor international coordination (legacy of WW I) – inadequate understanding of macroeconomics (before Keynes’s theory) – inept policy response (cling to gold standard, no fiscal response) – bad dynamics (panic, high risk premia, deflation, and liquidity trap) • Can it happen again? To answer need to understand how macroeconomic theory and institutions have evolved. 35 18