Chapter 9: Sources of Capital

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

Financial institutions

... Financial markets bring together people and organizations needing money with those having surplus funds. 1.Physical asset & financial markets 2.Spot markets and futures markets: on- thespot 3.Money markets & capital market 4.Mortgage markets (loans on residents, agri. Etc) & Consumer credit markets ...

... Financial markets bring together people and organizations needing money with those having surplus funds. 1.Physical asset & financial markets 2.Spot markets and futures markets: on- thespot 3.Money markets & capital market 4.Mortgage markets (loans on residents, agri. Etc) & Consumer credit markets ...

Asset allocation - Foresters Financial

... minimize your exposure to any particular class. Economic, financial, and political changes generally affect each asset category differently. Therefore, an event such as an economic slowdown may hurt returns to one asset class – stocks – but may ...

... minimize your exposure to any particular class. Economic, financial, and political changes generally affect each asset category differently. Therefore, an event such as an economic slowdown may hurt returns to one asset class – stocks – but may ...

Introduction to Emergency Management - CDHS

... will discuss the historical context of emergency management, the cycles of emergency management, and learn the functions of an emergency management program. Additionally, the candidates will analyze natural and technological hazards and assessment. This course is part one of a 5-course program desig ...

... will discuss the historical context of emergency management, the cycles of emergency management, and learn the functions of an emergency management program. Additionally, the candidates will analyze natural and technological hazards and assessment. This course is part one of a 5-course program desig ...

PowerPoint-presentatie - EESC European Economic and Social

... • Longer-term refinancing operation (LTRO): ECB loans with a maturity of 3 years at 1% • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO targ ...

... • Longer-term refinancing operation (LTRO): ECB loans with a maturity of 3 years at 1% • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO targ ...

Franklin Quotential Balanced Income Portfolio Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

Dry Associates Investment Newsletter

... It is also a fact that African stocks represent less than 1.5% of world market capitalization. In other words, 98.5% of the worlds’ stocks trade outside Africa. That being the case, wouldn’t it make sense to invest some portion, say 50% of one’s portfolio, out of Africa? And that is what our individ ...

... It is also a fact that African stocks represent less than 1.5% of world market capitalization. In other words, 98.5% of the worlds’ stocks trade outside Africa. That being the case, wouldn’t it make sense to invest some portion, say 50% of one’s portfolio, out of Africa? And that is what our individ ...

Active Vs. Passive - Jentner Wealth Management

... market predictions and name the hottest stocks. But is this the best way? The debate remains: Does implementing an active or a passive approach yield more lucrative long-term returns? Today, societal pressure calls us to act now, do not just stand by, make things happen. These catch phrases penetrat ...

... market predictions and name the hottest stocks. But is this the best way? The debate remains: Does implementing an active or a passive approach yield more lucrative long-term returns? Today, societal pressure calls us to act now, do not just stand by, make things happen. These catch phrases penetrat ...

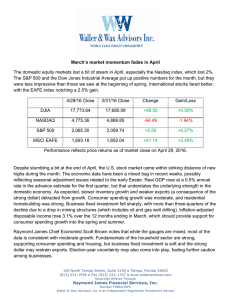

March`s market momentum fades in April The domestic equity

... and there is no assurance that any of the forecasts mentioned will occur. Investors cannot invest directly in an index. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National ...

... and there is no assurance that any of the forecasts mentioned will occur. Investors cannot invest directly in an index. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National ...

TopLine-Management-Introduction

... TopLine Management is a regionally owned company specializing in managing all aspects of Homeowners’ Associations and Special Districts’ needs. Our goal is to take the burden off the Board of Directors and owners to create a management style unique to each company. Homeowners’ Associations and Speci ...

... TopLine Management is a regionally owned company specializing in managing all aspects of Homeowners’ Associations and Special Districts’ needs. Our goal is to take the burden off the Board of Directors and owners to create a management style unique to each company. Homeowners’ Associations and Speci ...

overview

... Soon after Shannon developed the entropy theory of information, researchers try to provide a more intuitive understanding of information that is less abstract. Kelly, J. L., Jr. (1956), "A New Interpretation of Information Rate", Bell System Technical Journal 35: 917–926. Provide a link to investmen ...

... Soon after Shannon developed the entropy theory of information, researchers try to provide a more intuitive understanding of information that is less abstract. Kelly, J. L., Jr. (1956), "A New Interpretation of Information Rate", Bell System Technical Journal 35: 917–926. Provide a link to investmen ...

wells fargo/ galliard ultra short bond fund

... ·· Defined contribution plan investment option ·· Fixed income component of custom target date/balanced strategies ·· Secondary liquidity source for stable value strategies ·· Enhanced cash component for defined benefit plan ...

... ·· Defined contribution plan investment option ·· Fixed income component of custom target date/balanced strategies ·· Secondary liquidity source for stable value strategies ·· Enhanced cash component for defined benefit plan ...

DavidNussbaum-FinalCitation

... training in the commercial sector was reaping its rewards both for Oxfam, and those it supported. This was not management theory – ...

... training in the commercial sector was reaping its rewards both for Oxfam, and those it supported. This was not management theory – ...

Invest to Transform Fund Investment Proposals

... 5.1.1 The County Council supports 2,520 people with learning disabilities to live at home with parents or in their own home. 780 more people are tenants of ‘supported living’ which provides 24hr care to those who are not able to live alone in the community (increased by a further 80 placements in 20 ...

... 5.1.1 The County Council supports 2,520 people with learning disabilities to live at home with parents or in their own home. 780 more people are tenants of ‘supported living’ which provides 24hr care to those who are not able to live alone in the community (increased by a further 80 placements in 20 ...

Chilean tax ruling may affect foreign institutional investors

... the non-resident investor must apply interim withholding of 5% on the price paid or withhold the final tax rate of 10% on the actual gain. The regulation provides a tax advantage for investors in foreign markets through a regulated investment fund in Chile, such as a non-Chilean insurance company th ...

... the non-resident investor must apply interim withholding of 5% on the price paid or withhold the final tax rate of 10% on the actual gain. The regulation provides a tax advantage for investors in foreign markets through a regulated investment fund in Chile, such as a non-Chilean insurance company th ...

investments for the new “normal”Finance

... • December - Newham ranked 7th of 107 authorities, with three year average investment income growth of 22.53% (three year average investment income growth ) ...

... • December - Newham ranked 7th of 107 authorities, with three year average investment income growth of 22.53% (three year average investment income growth ) ...

Download Document

... efficient, the expectation of benchmark (or peer) relative excess returns will be zero. An expectation of expected return is then formulated as Bayesian combination of the manager’s actual belief about expected returns and the prior belief of zero. Let us consider the concept of active management as ...

... efficient, the expectation of benchmark (or peer) relative excess returns will be zero. An expectation of expected return is then formulated as Bayesian combination of the manager’s actual belief about expected returns and the prior belief of zero. Let us consider the concept of active management as ...

Consultation Summary - Treasury archive

... losses on the disposal of certain assets (primarily shares, units and real property) on capital account for taxation purposes, subject to appropriate integrity rules. This measure was included in Tax Laws Amendment (2010 Measures No. 1) Bill 2010, which was introduced into Parliament on 10 February ...

... losses on the disposal of certain assets (primarily shares, units and real property) on capital account for taxation purposes, subject to appropriate integrity rules. This measure was included in Tax Laws Amendment (2010 Measures No. 1) Bill 2010, which was introduced into Parliament on 10 February ...

Fact Sheet:SSgA Enhanced Emerging Markets Equity Fund, May2017

... applicable Swiss regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor's or potential investor's particular investment objectives, strategies, tax status, risk appetite or in ...

... applicable Swiss regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor's or potential investor's particular investment objectives, strategies, tax status, risk appetite or in ...

Revisiting the Relationship Between Time Management and Job Performance:

... Revisiting the Relationship Between Time Management and Job Performance Sarath A. Nonis*, Grant H. Fenner**, & Jeffrey K. Sager**1 According to popular belief, individuals who manage their time well are expected to have less stress resulting in higher levels of job satisfaction and performance. Howe ...

... Revisiting the Relationship Between Time Management and Job Performance Sarath A. Nonis*, Grant H. Fenner**, & Jeffrey K. Sager**1 According to popular belief, individuals who manage their time well are expected to have less stress resulting in higher levels of job satisfaction and performance. Howe ...

Report 52 - Fixed Maturity EUR Industrial Bond Funds

... Portfolios of less than 5 million EUR assets under management, do not contribute to the performance calculation of the composite to which they belong, based on the investment process. There is a six‐month period applied, before portfolios are removed from or entered into the composite. This rule d ...

... Portfolios of less than 5 million EUR assets under management, do not contribute to the performance calculation of the composite to which they belong, based on the investment process. There is a six‐month period applied, before portfolios are removed from or entered into the composite. This rule d ...