Emerging Market Equity Fund Investor: SEMNX SEMNX | Advisor: SEMVX SEMVX

... basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute any kind of investment decision and may not be relied on as such. Sector/Securities: Securities holdings, sector and c ...

... basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute any kind of investment decision and may not be relied on as such. Sector/Securities: Securities holdings, sector and c ...

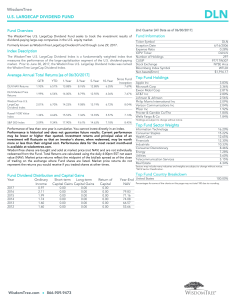

Richmond ETF update

... The material contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, o ...

... The material contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, o ...

Fund Details Ulland AUM : $200 million Strategy Assets : $140

... Performance is shown on a time-weighted basis as calculated in Axys portfolio software. Performance is presented gross of fees. Calculations are based on the reinvestment of dividends and gains unless these amounts were paid out to the client. Employee accounts are included in performance figures. P ...

... Performance is shown on a time-weighted basis as calculated in Axys portfolio software. Performance is presented gross of fees. Calculations are based on the reinvestment of dividends and gains unless these amounts were paid out to the client. Employee accounts are included in performance figures. P ...

Activity 2:

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

riskman - VTT Virtual project pages

... • More flexible than the more traditional rule-based regulations • Risk analyses can help prove that new solutions are acceptable and even safer than traditional ones – but taking into account how people view risks is a challenge • Regulatory authorities able to concentrate efforts on areas were the ...

... • More flexible than the more traditional rule-based regulations • Risk analyses can help prove that new solutions are acceptable and even safer than traditional ones – but taking into account how people view risks is a challenge • Regulatory authorities able to concentrate efforts on areas were the ...

Presentation to a conference celebrating Professor Rachel McCulloch: “Is... Optimal in the 21

... domestic and foreign markets as indicated by a number of investment strategies. For example, here in the U.S., the rapid rise of lending at variable rates in the subprime mortgage market may have reflected an unduly benign view of the underlying risks, and some lenders have paid a high price for thi ...

... domestic and foreign markets as indicated by a number of investment strategies. For example, here in the U.S., the rapid rise of lending at variable rates in the subprime mortgage market may have reflected an unduly benign view of the underlying risks, and some lenders have paid a high price for thi ...

Nigeria`s financial services industry is booming

... macroeconomic stability," said Okey Enelamah, chief executive of African Capital Alliance, a private-equity and alternative-investment firm in Lagos that manages $178 million in assets. These reforms include international-debt relief, banking consolidation (from 89 banks down to 25 megabanks), pensi ...

... macroeconomic stability," said Okey Enelamah, chief executive of African Capital Alliance, a private-equity and alternative-investment firm in Lagos that manages $178 million in assets. These reforms include international-debt relief, banking consolidation (from 89 banks down to 25 megabanks), pensi ...

Golden rules of investing in stock market

... An investor who has spent the last ten years as a checker at a supermarket would have an advantage when analyzing the financial statements of a grocery store chain. He or she would be able to pinpoint the strengths and weaknesses of the business, evaluate the competitive climate of the industry and ...

... An investor who has spent the last ten years as a checker at a supermarket would have an advantage when analyzing the financial statements of a grocery store chain. He or she would be able to pinpoint the strengths and weaknesses of the business, evaluate the competitive climate of the industry and ...

The constant asset allocation comparison

... and small stocks; foreign large company, foreign small company, and emerging markets; and intermediate term government bonds, short term government bonds and inflation protected treasuries. They are presented as averages for the entire period during which BF existed (top line) and for the beginning ...

... and small stocks; foreign large company, foreign small company, and emerging markets; and intermediate term government bonds, short term government bonds and inflation protected treasuries. They are presented as averages for the entire period during which BF existed (top line) and for the beginning ...

Financial Analysts Journal : Determinants of Portfolio Performance

... than 80 per cent of all corporatepension ment process-investment policy, market timplans with assets greater than $2 billion ing and security selection.2 The relative importance of policy, timing and have more than 10 managers, and of all plans with assets greater than $50 million, less than selecti ...

... than 80 per cent of all corporatepension ment process-investment policy, market timplans with assets greater than $2 billion ing and security selection.2 The relative importance of policy, timing and have more than 10 managers, and of all plans with assets greater than $50 million, less than selecti ...

Sample Investment Policy 2

... It is anticipated that the services of a registered investment manager may be sought to manage portions of the Long-term Reserve and/or Endowment Funds. The following procedure shall be followed to engage a new or replace a current investment manager: A. The Treasurer and the Finance Committee will ...

... It is anticipated that the services of a registered investment manager may be sought to manage portions of the Long-term Reserve and/or Endowment Funds. The following procedure shall be followed to engage a new or replace a current investment manager: A. The Treasurer and the Finance Committee will ...

Allocation in High

... Diminishing quantitative expertise I see only the USA investing seriously in succession for the baby-boomer cohort ...

... Diminishing quantitative expertise I see only the USA investing seriously in succession for the baby-boomer cohort ...

Prudential QMA Stock Index Fund Fact Sheet

... excludes outliers that can easily skew results. Standard deviation depicts how widely returns vary around its average and is used to understand the range of returns most likely for a given fund. A higher standard deviation generally implies greater volatility. Turnover Ratio is the rate of trading i ...

... excludes outliers that can easily skew results. Standard deviation depicts how widely returns vary around its average and is used to understand the range of returns most likely for a given fund. A higher standard deviation generally implies greater volatility. Turnover Ratio is the rate of trading i ...

The Benefits of Diversification with Real Estate

... Investors who might not be able to purchase commercial property on their own can invest in real estate investment trusts (REITs), limited partnerships, real estate mutual funds or exchange-traded funds. As an illustration of its unique benefits, institutional investors such as pension funds and endo ...

... Investors who might not be able to purchase commercial property on their own can invest in real estate investment trusts (REITs), limited partnerships, real estate mutual funds or exchange-traded funds. As an illustration of its unique benefits, institutional investors such as pension funds and endo ...

Capital Group

... The Capital Group companies manage equities through three investment divisions that make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organisation; however, for securities with eq ...

... The Capital Group companies manage equities through three investment divisions that make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organisation; however, for securities with eq ...

presentation - Kinetics Mutual Funds

... The Fund may also invest in exchange traded funds (“ETFs”), that seek to track a specified securities index or a basket of securities. As a shareholder in an ETF, the Fund will bear its pro rata portion of an ETFs expenses, including advisory fees, in addition to its own expenses. The Fund may inves ...

... The Fund may also invest in exchange traded funds (“ETFs”), that seek to track a specified securities index or a basket of securities. As a shareholder in an ETF, the Fund will bear its pro rata portion of an ETFs expenses, including advisory fees, in addition to its own expenses. The Fund may inves ...

Guaranteed Accumulation funds

... You may decide to fully or partially cash in your policy before its end date or switch out of GAF to another fund. When working out the value of your policy, we’ll take account of the dividends we have already allocated to your account but we may reduce the value of your policy when you move out of ...

... You may decide to fully or partially cash in your policy before its end date or switch out of GAF to another fund. When working out the value of your policy, we’ll take account of the dividends we have already allocated to your account but we may reduce the value of your policy when you move out of ...

minimum endowment administrative fees investment management

... • Informational sessions and activities on charitable organizations and issues • Donor may recommend investment manager (Subject to approval by The Pittsburgh Foundation Investment Committee) ...

... • Informational sessions and activities on charitable organizations and issues • Donor may recommend investment manager (Subject to approval by The Pittsburgh Foundation Investment Committee) ...

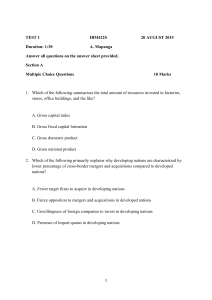

TEST 1 IBM422S 20 AUGUST 2015

... A. are public investment funds that invest in corporate bonds and shares B. make long bets rather than short bets C. are investment funds managed by the government D. make short bets on assets that they think will decline in value ...

... A. are public investment funds that invest in corporate bonds and shares B. make long bets rather than short bets C. are investment funds managed by the government D. make short bets on assets that they think will decline in value ...

Information Technology Investment Proposal - IT Governance

... Note – This form is to be submitted for the review of IT investment proposals where the direct cost is greater than $10,000 and less than $50,000 (not including staff time) and the solution requirements are Low Complexity (refer to the IT Governance Web site, Forms, Complexity Calculation Worksheet. ...

... Note – This form is to be submitted for the review of IT investment proposals where the direct cost is greater than $10,000 and less than $50,000 (not including staff time) and the solution requirements are Low Complexity (refer to the IT Governance Web site, Forms, Complexity Calculation Worksheet. ...

Are You Taking Too Much Risk?

... free, no obligation, independent analysis of your current financial portfolio. Simply fax 419-536-5401 or email [email protected] a copy of your most recent statement(s) and we will evaluate your holdings based on risk, cost, and performance. Over the past year we have been seeing the average invest ...

... free, no obligation, independent analysis of your current financial portfolio. Simply fax 419-536-5401 or email [email protected] a copy of your most recent statement(s) and we will evaluate your holdings based on risk, cost, and performance. Over the past year we have been seeing the average invest ...