Mutual Funds - Iowa State University Extension and Outreach

... this comes annual management fees,” Swanson adds. In addition there may be other fees. “Avoid load funds that either charge an up-front sales fee or a redemption fee when you redeem your shares within a certain number of years. Also avoid funds that charge 12b-1 marketing fees.” ...

... this comes annual management fees,” Swanson adds. In addition there may be other fees. “Avoid load funds that either charge an up-front sales fee or a redemption fee when you redeem your shares within a certain number of years. Also avoid funds that charge 12b-1 marketing fees.” ...

Expected Return Standard Deviation

... diversification. Investors all invest for the same period of time. There is a risk _ _ _ _ investment, and investors can borrow and lend any amount at the risk-free rate. Capital markets are completely competitive ...

... diversification. Investors all invest for the same period of time. There is a risk _ _ _ _ investment, and investors can borrow and lend any amount at the risk-free rate. Capital markets are completely competitive ...

Career Opportunities in International Finance

... country. Today, these flows, sometimes called "hot money," are created in large part by "institutional investors," entities that pool the money of many individuals seeking to buy the securities of foreign equities (companies) and/or bonds (governments). Foreign Direct Investment Much of what is enta ...

... country. Today, these flows, sometimes called "hot money," are created in large part by "institutional investors," entities that pool the money of many individuals seeking to buy the securities of foreign equities (companies) and/or bonds (governments). Foreign Direct Investment Much of what is enta ...

The Investment Climate (IFC/World Bank Group)

... rate and nature of private sector growth in a country is affected by many factors, including macroeconomic and political stability, traditions and culture, physical infrastructure, availability of capital, and human resources. Institutional, policy, and regulatory factors also play an important role ...

... rate and nature of private sector growth in a country is affected by many factors, including macroeconomic and political stability, traditions and culture, physical infrastructure, availability of capital, and human resources. Institutional, policy, and regulatory factors also play an important role ...

UK current account - November 2016

... (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 15 November 2016. (b) The estimate for the change in the holding of shares in 2016 Q4 is based on data up to 15 November 2016. Both the 2016 Q3 and Q4 changes in the holding of shares are show ...

... (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 15 November 2016. (b) The estimate for the change in the holding of shares in 2016 Q4 is based on data up to 15 November 2016. Both the 2016 Q3 and Q4 changes in the holding of shares are show ...

Business Case Appendix C Management principles DOCX 30 KB

... This paper outlines the requirements for management principles for CDC and SNC to ensure the effective implementation of organisational transformation as set out in the business case for collaborative working. The business case covers all council services with the potential to ultimately move toward ...

... This paper outlines the requirements for management principles for CDC and SNC to ensure the effective implementation of organisational transformation as set out in the business case for collaborative working. The business case covers all council services with the potential to ultimately move toward ...

Direct marketing of funds

... • Higher minimum requirements for individual bonds (usually $25,000; T-bonds $1,000). Lot size is usually $100,000. One $25,000 bond lacks diversification. •Cost : 2% - 4% of value. ...

... • Higher minimum requirements for individual bonds (usually $25,000; T-bonds $1,000). Lot size is usually $100,000. One $25,000 bond lacks diversification. •Cost : 2% - 4% of value. ...

Paulson`s plan was not a true solution to the crisis

... Second, it would minimise damage to incentives. Third, it would come at minimum cost and risk to the taxpayer. Not least, it would be consistent with ideas of social justice. The fundamental problem with the Paulson scheme, as proposed, is then that it is neither a necessary nor an efficient solutio ...

... Second, it would minimise damage to incentives. Third, it would come at minimum cost and risk to the taxpayer. Not least, it would be consistent with ideas of social justice. The fundamental problem with the Paulson scheme, as proposed, is then that it is neither a necessary nor an efficient solutio ...

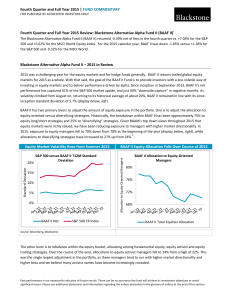

Fourth Quarter and Full Year 2015

... strategies that have the potential to capitalize on trends in foreign exchange rates, interest rates and cross‐border relative value trades. We also expect to increase allocations to trading oriented managers that may be able to capitalize on market volatility and reduce our allocation to activist ...

... strategies that have the potential to capitalize on trends in foreign exchange rates, interest rates and cross‐border relative value trades. We also expect to increase allocations to trading oriented managers that may be able to capitalize on market volatility and reduce our allocation to activist ...

GEORGE MASON UNIVERSITY

... wish to tolerate some interim financial fluctuations in market values and rates of return in order to achieve their overall investment objectives. Due to the different investment horizons that individual Plan participants may face, this IPS recognizes that Plan participants will seek various combina ...

... wish to tolerate some interim financial fluctuations in market values and rates of return in order to achieve their overall investment objectives. Due to the different investment horizons that individual Plan participants may face, this IPS recognizes that Plan participants will seek various combina ...

Equity Investment Themes

... *Company Examples are for illustrative purposes only. They are not an endorsement or recommendation of any particular holdings in our respective portfolios. This presentation is for informational purposes and should not be considered a solicitation to buy, or an offer to sell, a security. Certain in ...

... *Company Examples are for illustrative purposes only. They are not an endorsement or recommendation of any particular holdings in our respective portfolios. This presentation is for informational purposes and should not be considered a solicitation to buy, or an offer to sell, a security. Certain in ...

Managing Rising Interest Rate Fears

... Nonetheless, rising interest rates can affect the value of a bond portfolio. Fortunately, the risk can be managed. One of the most effective ways is to remove the shackles from a fund manager’s ability to handle bond duration. A bond strategy with flexible duration can mitigate interest-rate risk an ...

... Nonetheless, rising interest rates can affect the value of a bond portfolio. Fortunately, the risk can be managed. One of the most effective ways is to remove the shackles from a fund manager’s ability to handle bond duration. A bond strategy with flexible duration can mitigate interest-rate risk an ...

Philanthropy + Finance= Mission Investing for Private Foundations

... in the types of investment vehicles available to those interested in impact investing. Currently, these vary from socially targeted venture capital to community investing and microfinance. However, as interest in this type of investment grows, we would expect to see an increase in the availability of ...

... in the types of investment vehicles available to those interested in impact investing. Currently, these vary from socially targeted venture capital to community investing and microfinance. However, as interest in this type of investment grows, we would expect to see an increase in the availability of ...

Summer 2017 Internship Opportunity

... that aims to transform management and leadership capacity at the woreda (district) level to build a culture of performance management and accountability and prepare the woreda to lead the primary health care units of the future. This work also involves collaboration with partners to build a quality ...

... that aims to transform management and leadership capacity at the woreda (district) level to build a culture of performance management and accountability and prepare the woreda to lead the primary health care units of the future. This work also involves collaboration with partners to build a quality ...

April 24, 2017 JNL/American Funds Blue Chip

... is not affiliated in any manner with Prudential Financial Inc., a company whose principal place of business is in the United States of America. Through its ownership structure, the Adviser has a number of global financial industry affiliated entities. As a result of this structure, and the asset man ...

... is not affiliated in any manner with Prudential Financial Inc., a company whose principal place of business is in the United States of America. Through its ownership structure, the Adviser has a number of global financial industry affiliated entities. As a result of this structure, and the asset man ...

55-Internal Audit for Treasury Market Risk Management

... XI. Investment in Debt Securities • Frequency of interest payments. • Information about the issuer and the credit rating. • Terms of issue such as use of issue proceeds, monitoring agency, formation of trustees, secured or unsecured nature of bonds, assets underlying the security and credit-worthine ...

... XI. Investment in Debt Securities • Frequency of interest payments. • Information about the issuer and the credit rating. • Terms of issue such as use of issue proceeds, monitoring agency, formation of trustees, secured or unsecured nature of bonds, assets underlying the security and credit-worthine ...

provisional agenda - RULG-Ukrainian Legal Group, PA

... NB: Euromoney Conferences reserves the right to amend the program and is not responsible for cancellations due to unforeseen circumstances. Euromoney Conferences accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addi ...

... NB: Euromoney Conferences reserves the right to amend the program and is not responsible for cancellations due to unforeseen circumstances. Euromoney Conferences accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addi ...

BethAnn Weaver is the Global Recruiting and Staffing Manager for

... and possesses a Professional in Human Resources (PHR) certification. She is a member of the Society for Human Resources Management and prior Staffing Management Chair for IndySHRM; Indiana’s largest chapter. She is currently Vice Present of the Board of Directors for DirectEmployers Foundation and a ...

... and possesses a Professional in Human Resources (PHR) certification. She is a member of the Society for Human Resources Management and prior Staffing Management Chair for IndySHRM; Indiana’s largest chapter. She is currently Vice Present of the Board of Directors for DirectEmployers Foundation and a ...

Ex Ante Assessment of Community-based Wildlife Management: A

... experienced mixed success. This paper examines the case of the Himalayan musk deer (Moschos chrysogaster), an evolutionarily primitive deer-like species indigenous to the Himalayan Mountains that is listed as endangered under the CITES convention. While habitat loss is a factor, poachers who kill ad ...

... experienced mixed success. This paper examines the case of the Himalayan musk deer (Moschos chrysogaster), an evolutionarily primitive deer-like species indigenous to the Himalayan Mountains that is listed as endangered under the CITES convention. While habitat loss is a factor, poachers who kill ad ...

DESCRIPTION OF FINANCIAL INSTRUMENT TYPES AND

... General information about the risks Please note that the current list of risks is not exhaustive and includes only the most important of them, and other risks may occur to the investor in the course of the transaction. The investor's primary goal is to get a positive return on the investments. Howev ...

... General information about the risks Please note that the current list of risks is not exhaustive and includes only the most important of them, and other risks may occur to the investor in the course of the transaction. The investor's primary goal is to get a positive return on the investments. Howev ...

resolution no - Village of Schaumburg

... Require state-funded fiscal impact assessments on 25-50 selected municipalities before any proposed pension legislation can move beyond the committee stage. Additionally, fiscal notes should be enhanced to provide more specific data regarding fiscal impact. ...

... Require state-funded fiscal impact assessments on 25-50 selected municipalities before any proposed pension legislation can move beyond the committee stage. Additionally, fiscal notes should be enhanced to provide more specific data regarding fiscal impact. ...

Management Structures

... deciding on the most appropriate management structure. The first of these factors is the environment in which the company operates. This has two components: the external and the internal environment. The external environment impacts all businesses and includes factors such as taxation, the legal env ...

... deciding on the most appropriate management structure. The first of these factors is the environment in which the company operates. This has two components: the external and the internal environment. The external environment impacts all businesses and includes factors such as taxation, the legal env ...