Risk transfer mechanisms

... Compensated for illiquidity, possible model inaccuracies and newness premiums. – Diversification effects: Risk profile that is less correlated with the credit cycle or traditional insurance products. __________________________________________________ – Concentration:Investor reluctance to build up e ...

... Compensated for illiquidity, possible model inaccuracies and newness premiums. – Diversification effects: Risk profile that is less correlated with the credit cycle or traditional insurance products. __________________________________________________ – Concentration:Investor reluctance to build up e ...

LiquidHub Business Strategy

... Fueling Business Transformation™ Profile Rapidly growing management technology consultancy & systems integrator 500 associates fueling business transformation for clients internationally from offices in Philadelphia, Boston & our Global Delivery Center in Hyderabad, India Experts in Technology ...

... Fueling Business Transformation™ Profile Rapidly growing management technology consultancy & systems integrator 500 associates fueling business transformation for clients internationally from offices in Philadelphia, Boston & our Global Delivery Center in Hyderabad, India Experts in Technology ...

download soal

... Does this soudn familiar? If you have not been in on this conversation, chances are you will. Each one of us involved in using or deploying IT will probably face the question of this justification issue in one form or other. It is really no different than the questions we ask ourselves wen buying a ...

... Does this soudn familiar? If you have not been in on this conversation, chances are you will. Each one of us involved in using or deploying IT will probably face the question of this justification issue in one form or other. It is really no different than the questions we ask ourselves wen buying a ...

Storebrand`s environmental and social investment criteria

... As the largest life insurance company and pension fund manager in Norway, Storebrand Livsforsikring AS (life insurance) recognises its responsibility to contribute to sustainable development. In March 2001 Storebrand introduced environmental and social criteria for the management of its life insuran ...

... As the largest life insurance company and pension fund manager in Norway, Storebrand Livsforsikring AS (life insurance) recognises its responsibility to contribute to sustainable development. In March 2001 Storebrand introduced environmental and social criteria for the management of its life insuran ...

Listed vs Unlisted rgc - RARE Infrastructure Limited

... Government ownership. Public private partnerships and privatizations have increased the number of investment opportunities to investors, whilst creating a choice of asset holding structures (direct investment verses public listed equity). RARE believes that since the advantages of infrastructure inv ...

... Government ownership. Public private partnerships and privatizations have increased the number of investment opportunities to investors, whilst creating a choice of asset holding structures (direct investment verses public listed equity). RARE believes that since the advantages of infrastructure inv ...

Revolutionizing DC Plan Design

... certain smaller plan providers that have packaged white-label f unds on their platf orm. As the technology advances, this idea surely will continue to evolve. But whether or not the plan has white-label capabilities, more plans are looking to f ollow and consolidate their core menu lineups. In addi ...

... certain smaller plan providers that have packaged white-label f unds on their platf orm. As the technology advances, this idea surely will continue to evolve. But whether or not the plan has white-label capabilities, more plans are looking to f ollow and consolidate their core menu lineups. In addi ...

Operations Management Financial Dimensions

... Slow growth in U.S. economy Funding sources Mergers, consolidations, spinoffs Bankruptcies and liquidations Questionable accounting and financial reporting practices ...

... Slow growth in U.S. economy Funding sources Mergers, consolidations, spinoffs Bankruptcies and liquidations Questionable accounting and financial reporting practices ...

Falls Creek Alpine Resort appoints a new CEO

... Mr Smythe comes to the role with not just a passion for the outdoors, the environment and sustainability, but supplements this with a diverse and global business background. He has a demonstrable track record of establishing, building and growing new entities into outstanding businesses, together wi ...

... Mr Smythe comes to the role with not just a passion for the outdoors, the environment and sustainability, but supplements this with a diverse and global business background. He has a demonstrable track record of establishing, building and growing new entities into outstanding businesses, together wi ...

MSF-CHP25

... DCs are defined as developed (high income) countries with per capital exceeding $9,300 (in year 2000). EMs; Active portfolios will include many stocks and indexes of EMs. 20 EMs made up of 16% of the world GDP, together with 25 DCs make 95% of GDP.China, Brazil and Korea are the largest EMs in the w ...

... DCs are defined as developed (high income) countries with per capital exceeding $9,300 (in year 2000). EMs; Active portfolios will include many stocks and indexes of EMs. 20 EMs made up of 16% of the world GDP, together with 25 DCs make 95% of GDP.China, Brazil and Korea are the largest EMs in the w ...

Unconstrained Investing: Unleash Your Bonds

... exposures. These include rates, curve, volatility and currency exposures. These positions are taken primarily through derivative exposures and can vary significantly in both size and direction over short periods of time. The positions can also persist for longer periods of time if deemed appropriate ...

... exposures. These include rates, curve, volatility and currency exposures. These positions are taken primarily through derivative exposures and can vary significantly in both size and direction over short periods of time. The positions can also persist for longer periods of time if deemed appropriate ...

Type Title Here (20-pt Arial bold)

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... The SP relating to the offering of units or shares of the Funds is hereby amended as set out below. Northwest & Ethical Investments L.P. (“NEI Investments”), the manager of the Funds, has announced the following changes to the Funds: A. SUMMARY OF AMENDMENTS ...

... The SP relating to the offering of units or shares of the Funds is hereby amended as set out below. Northwest & Ethical Investments L.P. (“NEI Investments”), the manager of the Funds, has announced the following changes to the Funds: A. SUMMARY OF AMENDMENTS ...

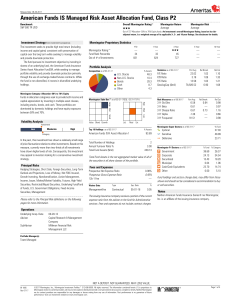

American Funds IS Managed Risk Asset Allocation Fund

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

Morgan Stanley Newsletter

... International investing involves certain risks, such as currency fluctuations, economic instability and political developments. These risks are magnified in countries with emerging markets, since these countries may have relatively unstable governments and less established markets and economics. An ...

... International investing involves certain risks, such as currency fluctuations, economic instability and political developments. These risks are magnified in countries with emerging markets, since these countries may have relatively unstable governments and less established markets and economics. An ...

Chapter 17: Investment

... of goods whenever consumer demand changes Firms maintain inventories of parts and materials, like a production factor, to increase output quickly Firms maintain inventories to avoid running out of stocks Firms maintain inventories of parts and materials when the product requires a number of steps in ...

... of goods whenever consumer demand changes Firms maintain inventories of parts and materials, like a production factor, to increase output quickly Firms maintain inventories to avoid running out of stocks Firms maintain inventories of parts and materials when the product requires a number of steps in ...

Why We Ladder Short- and Intermediate-Term Bonds

... Basis Point – A unit equal to 1/100th of 1%. 1% = 100 basis points (bps) Duration – A bond’s sensitivity to interest rates. Bonds with longer durations experience greater price volatility than bonds with shorter durations. Yield Curve – A line that plots the interest rates, at a set point in time, o ...

... Basis Point – A unit equal to 1/100th of 1%. 1% = 100 basis points (bps) Duration – A bond’s sensitivity to interest rates. Bonds with longer durations experience greater price volatility than bonds with shorter durations. Yield Curve – A line that plots the interest rates, at a set point in time, o ...

quantitative finance after the recent financial crisis

... Spatial interaction has been well studied in the spatial econometrics literature. Instead of studying prices of houses and apartments that are illiquid and difficult to be sold short, we study the risk and return of real estate securities that are liquid and can be easily shorted, such as futures co ...

... Spatial interaction has been well studied in the spatial econometrics literature. Instead of studying prices of houses and apartments that are illiquid and difficult to be sold short, we study the risk and return of real estate securities that are liquid and can be easily shorted, such as futures co ...

Emerging Markets Equity

... discretionary and technology stocks led market gains. Commodity-related stocks fell. A few emerging markets currencies depreciated against the U.S. dollar, prompting countries such as Turkey and Russia to raise interest rates. The ruble declined more than 6% against the dollar. Meanwhile, the Chines ...

... discretionary and technology stocks led market gains. Commodity-related stocks fell. A few emerging markets currencies depreciated against the U.S. dollar, prompting countries such as Turkey and Russia to raise interest rates. The ruble declined more than 6% against the dollar. Meanwhile, the Chines ...

Finding Opportunities — Tackling today`s uncertain

... Finding Opportunities — Tackling today’s uncertain financial environment Backed by more than 100 years of experience, Columbia Management is one of the nation’s largest asset managers. At the heart of our success — and, most importantly, that of our investors — are highly talented industry professio ...

... Finding Opportunities — Tackling today’s uncertain financial environment Backed by more than 100 years of experience, Columbia Management is one of the nation’s largest asset managers. At the heart of our success — and, most importantly, that of our investors — are highly talented industry professio ...

Absa Africa Frontier Portfolio - Absa | Wealth And Investment

... FAIS Act Notice and Disclaimer This brochure/document/material/report/communication/commentary (“this commentary”) has been prepared by Absa Wealth, a division of Absa Bank Limited (Registration No: 1986/004794/06) (“Absa Wealth”). Any reference to Absa Wealth includes its affiliates. Absa Wealth ha ...

... FAIS Act Notice and Disclaimer This brochure/document/material/report/communication/commentary (“this commentary”) has been prepared by Absa Wealth, a division of Absa Bank Limited (Registration No: 1986/004794/06) (“Absa Wealth”). Any reference to Absa Wealth includes its affiliates. Absa Wealth ha ...

Risk and Return: Extensions

... expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thinking about risk and return. ...

... expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thinking about risk and return. ...

Dismal Decade Offers Cautionary Lessons for Retirees

... The model assumes no month-tomonth correlations among asset class returns. It does not reflect the average periods of “bull” and “bear” markets, which can be longer than those modeled. Inflation is assumed constant, so variations are not reflected in our calculations. The analysis does not use all a ...

... The model assumes no month-tomonth correlations among asset class returns. It does not reflect the average periods of “bull” and “bear” markets, which can be longer than those modeled. Inflation is assumed constant, so variations are not reflected in our calculations. The analysis does not use all a ...