Financialization of the global economy

... market as a basis for speculatively guessing the future had become as comprehensive as it was ever likely to get, the amount invested in futures trading was probably tiny compared with the amount invested in pigs, pig sties, pig feed, pig transporters, pig veterinarians, pig psychologists, and pig b ...

... market as a basis for speculatively guessing the future had become as comprehensive as it was ever likely to get, the amount invested in futures trading was probably tiny compared with the amount invested in pigs, pig sties, pig feed, pig transporters, pig veterinarians, pig psychologists, and pig b ...

Role of ELSS in Retirement Planning while Savings Tax

... Since these funds invest 65% in equity, there is some element of risk. Moderate risk and High risk investors can consider this as a tax saving investment option. Also the past performance may or may not repeat in future. Hence investors should consider this risk element and consider investing in suc ...

... Since these funds invest 65% in equity, there is some element of risk. Moderate risk and High risk investors can consider this as a tax saving investment option. Also the past performance may or may not repeat in future. Hence investors should consider this risk element and consider investing in suc ...

CHAPTER 10

... evidence of market inefficiency, because most tests of such “anomalies” are in fact joint tests of two elements: (1) an asset pricing model (e.g., the CAPM or APT) which reflects the risk-return tradeoff; and (2) market efficiency, in the sense of prices reflecting some set of information. If a test ...

... evidence of market inefficiency, because most tests of such “anomalies” are in fact joint tests of two elements: (1) an asset pricing model (e.g., the CAPM or APT) which reflects the risk-return tradeoff; and (2) market efficiency, in the sense of prices reflecting some set of information. If a test ...

Figure 7 Grain yields continue to improve despite winter rainfall

... positive returns and for well-run businesses some very high returns. Many grain growers have experienced returns in excess of the ASX All Ordinaries with significantly less volatility. In addition to providing positive yearly returns, every region over the past decade has also provided land owners w ...

... positive returns and for well-run businesses some very high returns. Many grain growers have experienced returns in excess of the ASX All Ordinaries with significantly less volatility. In addition to providing positive yearly returns, every region over the past decade has also provided land owners w ...

Capital Asset Pricing Model

... be justified under the assumption of normally distributed returns, but for general return distributions other risk measures (like coherent risk measures) will likely reflect the investors' preferences more adequately. Indeed risk in financial investments is not variance in itself, rather it is the p ...

... be justified under the assumption of normally distributed returns, but for general return distributions other risk measures (like coherent risk measures) will likely reflect the investors' preferences more adequately. Indeed risk in financial investments is not variance in itself, rather it is the p ...

Notre Dame - Asia Pacific Fund

... This document is provided as a service to professional investors/advisers. It is issued in the United Kingdom by Baring Asset Management Limited and/or by its investment adviser affiliates in other jurisdictions. The affiliate serving as the Asia Pacific Fund’s investment adviser is Baring Asset Man ...

... This document is provided as a service to professional investors/advisers. It is issued in the United Kingdom by Baring Asset Management Limited and/or by its investment adviser affiliates in other jurisdictions. The affiliate serving as the Asia Pacific Fund’s investment adviser is Baring Asset Man ...

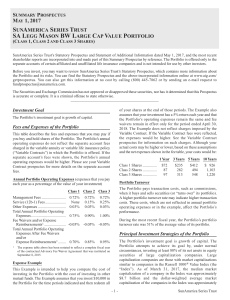

SAST - SA Legg Mason BW Large Cap Value

... shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not intended for use by other investors. Before you invest, you may want to r ...

... shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not intended for use by other investors. Before you invest, you may want to r ...

An intangible asset

... 2 At cost, providing that the recognition criteria are met, i.e: (a) It is probable that the future economic benefits that are attributable to the asset will flow to the entity. (b) The cost can be measured reliably. ...

... 2 At cost, providing that the recognition criteria are met, i.e: (a) It is probable that the future economic benefits that are attributable to the asset will flow to the entity. (b) The cost can be measured reliably. ...

Venture Capital Market in Poland and Polish government activities

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

Money Market Regulations

... transparency for investors to prevent runs on money market accounts. These new reforms are the second stage of reforms that were put into effect in 2010 that require money market funds to disclose their holdings to the SEC and allow money market funds lacking liquidity to suspend investor redemption ...

... transparency for investors to prevent runs on money market accounts. These new reforms are the second stage of reforms that were put into effect in 2010 that require money market funds to disclose their holdings to the SEC and allow money market funds lacking liquidity to suspend investor redemption ...

IMPORTANT NOTE

... For plan years beginning after December 31, 2006, the Plan must allow you to elect to move any portion of your account that is invested in company stock from that investment into other investment alternatives under the Plan. This right extends to all of the company stock held under the Plan, except ...

... For plan years beginning after December 31, 2006, the Plan must allow you to elect to move any portion of your account that is invested in company stock from that investment into other investment alternatives under the Plan. This right extends to all of the company stock held under the Plan, except ...

PowerShares Dynamic US Market UCITS ETF 31 May 2017

... Italy, the Netherlands, and Qualified Investors in Switzerland only and is not for consumer use. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/ ...

... Italy, the Netherlands, and Qualified Investors in Switzerland only and is not for consumer use. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/ ...

Biggest Player

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

LONG TERM PORTFOLIO - American Psychological Association

... responsible for directing and monitoring the investment management of the Long Term Portfolio. Specifically, Section 210-1.1 of the Association Rules states: “It is the responsibility of the Finance Committee to (a) recommend overall investment strategy, including, but not limited to, amounts to be ...

... responsible for directing and monitoring the investment management of the Long Term Portfolio. Specifically, Section 210-1.1 of the Association Rules states: “It is the responsibility of the Finance Committee to (a) recommend overall investment strategy, including, but not limited to, amounts to be ...

Title of Presentation Here - University of Utah Continuing Education

... Source: ILO (International Labor Organization), U.S. Bureau of Labor Statistics, Ministry of Labor-Mexico, EM Advisors Group, Thailand National Statistical Office, General Statistics Office of Vietnam, Statistics Indonesia, IMF, FactSet, J.P. Morgan Asset Management. Chinese wages are those of rural ...

... Source: ILO (International Labor Organization), U.S. Bureau of Labor Statistics, Ministry of Labor-Mexico, EM Advisors Group, Thailand National Statistical Office, General Statistics Office of Vietnam, Statistics Indonesia, IMF, FactSet, J.P. Morgan Asset Management. Chinese wages are those of rural ...

2003 - Magyarorszag

... a 1.0 percentage point increase in the rate of industrial output growth due to higher export sales dynamics stronger competition and drive for innovation increase competitiveness use of EU funds will boost the construction industry ...

... a 1.0 percentage point increase in the rate of industrial output growth due to higher export sales dynamics stronger competition and drive for innovation increase competitiveness use of EU funds will boost the construction industry ...

Document

... though the availability of real estate financing was relaxed during 2013 and is more readily available than a year before, particularly in Europe which is still undergoing the deleveraging process, we expect development capacity to be very specific and de-risked, and we do not expect that targeted d ...

... though the availability of real estate financing was relaxed during 2013 and is more readily available than a year before, particularly in Europe which is still undergoing the deleveraging process, we expect development capacity to be very specific and de-risked, and we do not expect that targeted d ...

Document - Oman College of Management & Technology

... constructing a portfolio, investors attempt to spread risk by not putting all their eggs into one basket. Thus diversification of investment tend to reduce risk by spreading risk over many assets. What is involved in Portfolio Analysis? Portfolio analysis is broadly carried out for each asset at two ...

... constructing a portfolio, investors attempt to spread risk by not putting all their eggs into one basket. Thus diversification of investment tend to reduce risk by spreading risk over many assets. What is involved in Portfolio Analysis? Portfolio analysis is broadly carried out for each asset at two ...

What Is An Investment

... caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium when determining their required rate of return ...

... caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium when determining their required rate of return ...

Transamerica ONE and Transamerica ALPHA Digital

... Transamerica Financial Advisors (TFA) Investment Advisor Representative (IAR) can offer you. Through the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program (Transamerica ALPHA), a wealth of financial tools are at your and your TFA Representative’s dispo ...

... Transamerica Financial Advisors (TFA) Investment Advisor Representative (IAR) can offer you. Through the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program (Transamerica ALPHA), a wealth of financial tools are at your and your TFA Representative’s dispo ...

US Long Duration Full

... © Western Asset Management Company 2017. This publication is the property of Western Asset Management Company and is intended for the sole use of its clients, consultants, and other intended recipients. It should not be forwarded to any other person. Contents herein should be treated as confidential ...

... © Western Asset Management Company 2017. This publication is the property of Western Asset Management Company and is intended for the sole use of its clients, consultants, and other intended recipients. It should not be forwarded to any other person. Contents herein should be treated as confidential ...

Navigating the Fixed Income Universe

... lower rates remains intact. According to research provided by BARRA (now part of MSCI), active duration managers are not prevalent, as their strategies tend to produce very low information ratios: While a top quartile manager in general has an information ratio of 0.5 before expenses, a top quartile ...

... lower rates remains intact. According to research provided by BARRA (now part of MSCI), active duration managers are not prevalent, as their strategies tend to produce very low information ratios: While a top quartile manager in general has an information ratio of 0.5 before expenses, a top quartile ...

chapter 27 powerpoint abridged for students

... The high and low returns average out, so the portfolio is likely to earn an intermediate return more consistently than any of the assets it contains. THE BASIC TOOLS OF FINANCE ...

... The high and low returns average out, so the portfolio is likely to earn an intermediate return more consistently than any of the assets it contains. THE BASIC TOOLS OF FINANCE ...