MS-Word, RTF - Maine Legislature

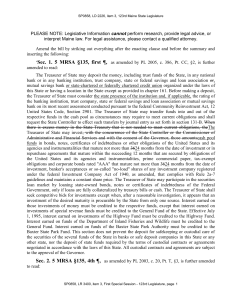

... PLEASE NOTE: Legislative Information cannot perform research, provide legal advice, or interpret Maine law. For legal assistance, please contact a qualified attorney. Amend the bill by striking out everything after the enacting clause and before the summary and inserting the following: ‘Sec. 1. 5 MR ...

... PLEASE NOTE: Legislative Information cannot perform research, provide legal advice, or interpret Maine law. For legal assistance, please contact a qualified attorney. Amend the bill by striking out everything after the enacting clause and before the summary and inserting the following: ‘Sec. 1. 5 MR ...

DIVERSIFICATION PRINCIPLES OF REAL ESTATE PORTFOLIOS

... The real estate market portfolio is described as a selected set of legal rights to property, resulting from undertaken investments that were sectorally and geographically diverse (HOESLI, LEKANDER 2007). By allocating resources, the investor acknowledges the adopted principles of the investment poli ...

... The real estate market portfolio is described as a selected set of legal rights to property, resulting from undertaken investments that were sectorally and geographically diverse (HOESLI, LEKANDER 2007). By allocating resources, the investor acknowledges the adopted principles of the investment poli ...

5th of February 2017 A Trading Shift: Back To Basics Last week was

... More generally, I will watch closely market developments and allocate risk accordingly. As I said before, we might be at some kind of turning point. What I also know is that I have for almost each single asset class a long list of PROs and CONs and sometimes the best trading is to watch and get the ...

... More generally, I will watch closely market developments and allocate risk accordingly. As I said before, we might be at some kind of turning point. What I also know is that I have for almost each single asset class a long list of PROs and CONs and sometimes the best trading is to watch and get the ...

Fastators holding Offentliga Hus acquires three community service

... properties in Norrtälje One of Fastator’s holding, Offentliga Hus i Norden, has acquired and taken possession of three properties in Norrtälje: Jungfrun 2, Jungfrun 3 and Hallsta 2:229, from a private property company. The total leasable area of the properties is 12,745 sqm. The tenants are mainly p ...

... properties in Norrtälje One of Fastator’s holding, Offentliga Hus i Norden, has acquired and taken possession of three properties in Norrtälje: Jungfrun 2, Jungfrun 3 and Hallsta 2:229, from a private property company. The total leasable area of the properties is 12,745 sqm. The tenants are mainly p ...

Form 8-K - Value Line

... 19. The Company is making this special distribution from its Retained Earnings. Value Line is exceptionally strong financially, with $208,464,000 of Shareholders' Equity as of our last reporting date, January 31, 2004. "The purpose of the dividend is to return to all shareholders, in the form of cas ...

... 19. The Company is making this special distribution from its Retained Earnings. Value Line is exceptionally strong financially, with $208,464,000 of Shareholders' Equity as of our last reporting date, January 31, 2004. "The purpose of the dividend is to return to all shareholders, in the form of cas ...

joe rizzi resume 2013 Size: 34.5kb Last modified: Mon

... Specialty consulting firm focusing on the financial services industry with an emphasis on developing growth and restructuring strategies including capital planning; mergers and acquisitions and risk management. CapGen Financial, New York City, NY 2008-2012 Senior Investment Strategist at $500 millio ...

... Specialty consulting firm focusing on the financial services industry with an emphasis on developing growth and restructuring strategies including capital planning; mergers and acquisitions and risk management. CapGen Financial, New York City, NY 2008-2012 Senior Investment Strategist at $500 millio ...

Relationship Disclosure

... Aggressive Growth Profile This profile is suited to the assertive investor. The Aggressive investor is attempting to achieve maximum returns by seeking investments that will grow at an aboveaverage rate compared to its industry or the overall market and is willing to take on additional risk. Emphasi ...

... Aggressive Growth Profile This profile is suited to the assertive investor. The Aggressive investor is attempting to achieve maximum returns by seeking investments that will grow at an aboveaverage rate compared to its industry or the overall market and is willing to take on additional risk. Emphasi ...

new market tax credits - Massachusetts Institute of Technology

... The New Market Tax Credit (NMTC) is a complicated program. That said, by working with an existing organization, the Massachusetts Housing and Investment Corporation (MHIC), the process is greatly simplified. The following explains how this program works behind the scenes, and what it means to our pr ...

... The New Market Tax Credit (NMTC) is a complicated program. That said, by working with an existing organization, the Massachusetts Housing and Investment Corporation (MHIC), the process is greatly simplified. The following explains how this program works behind the scenes, and what it means to our pr ...

Brainerd Memorial Library Association

... has the responsibility for the development, review and implementation of the investment policy in consultation with investment advisors selected by the Budget and Finance Committee. This responsibility includes (1) determining acceptable levels of market risk, and (2) determining the allocation of a ...

... has the responsibility for the development, review and implementation of the investment policy in consultation with investment advisors selected by the Budget and Finance Committee. This responsibility includes (1) determining acceptable levels of market risk, and (2) determining the allocation of a ...

INTRODUCTION: When We Hear the Term "Marketing," We Likely Think of

... Personal branding and the ability to market ourselves is an essential ingredient for successful career management. Learn how to create a framework to embrace and develop this core competency. ...

... Personal branding and the ability to market ourselves is an essential ingredient for successful career management. Learn how to create a framework to embrace and develop this core competency. ...

Chapter 11

... Municipal bonds - sometimes called munis. Issued by a state or local government, including cities, counties, school districts, and special taxing districts. Use funds for ongoing costs and to build major projects such as schools, airports, and bridges. General obligation bonds are backed by ...

... Municipal bonds - sometimes called munis. Issued by a state or local government, including cities, counties, school districts, and special taxing districts. Use funds for ongoing costs and to build major projects such as schools, airports, and bridges. General obligation bonds are backed by ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... system has been based mainly on a PAYGO scheme and has crowed-out the private market • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fa ...

... system has been based mainly on a PAYGO scheme and has crowed-out the private market • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fa ...

impact of global financial crisis on investors` psychology : an analysis

... reasonable-price (GARP), and aggressive, or momentum, growth. Disciplined growth style managers concentrate on companies that they believe can grow their earnings at a rate higher than the market average and that are selling for an appropriate price. Aggressive growth styles tend not to rely on trad ...

... reasonable-price (GARP), and aggressive, or momentum, growth. Disciplined growth style managers concentrate on companies that they believe can grow their earnings at a rate higher than the market average and that are selling for an appropriate price. Aggressive growth styles tend not to rely on trad ...

Evolution by Region - Pennsylvania State University

... about by a bankruptcy; sometimes by an avowed one, but always by a real one, though frequently by a pretended payment [in a depreciated currency]...When it becomes necessary for a state to declare itself bankrupt, in the same manner as when it becomes necessary for an individual to do so, a fair, op ...

... about by a bankruptcy; sometimes by an avowed one, but always by a real one, though frequently by a pretended payment [in a depreciated currency]...When it becomes necessary for a state to declare itself bankrupt, in the same manner as when it becomes necessary for an individual to do so, a fair, op ...

Lesson 11-1 Guided Reading Activity

... Directions: Read each main idea and complete the statements below. Refer to your textbook as you write the answers. A. Saving and Economic Growth Main idea: When people save, they make funds available for others to use. Businesses can borrow these savings to produce new goods and services, build new ...

... Directions: Read each main idea and complete the statements below. Refer to your textbook as you write the answers. A. Saving and Economic Growth Main idea: When people save, they make funds available for others to use. Businesses can borrow these savings to produce new goods and services, build new ...

2017 Q1 Industry Investment Report - Private Equity Growth Capital

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

Wealth Management – Strategic Opportunities for Growth

... z Wealth Management – strong business model z Our challenge and opportunity z Key strategies to retain & grow existing customers z Key strategies to acquire new customers z Outlook and summary ...

... z Wealth Management – strong business model z Our challenge and opportunity z Key strategies to retain & grow existing customers z Key strategies to acquire new customers z Outlook and summary ...

My LV= Pension Plan Mixed Asset Fund Fund Factsheet 4th Quarter

... exceed any growth meaning you could get back less than you invest. Cautious Managed These funds will hold investments in shares and other non-money market investments so there may be potential risk to the amount you invest. You are looking for an investment where the return over the long term is exp ...

... exceed any growth meaning you could get back less than you invest. Cautious Managed These funds will hold investments in shares and other non-money market investments so there may be potential risk to the amount you invest. You are looking for an investment where the return over the long term is exp ...

Submission 1 - Peter Mair - Alternative Default Fund Models

... To appreciate the point being made, consider that, these days, the 4pillars are holding some $ one-trillion – one thousand billions – in deposits on which no material interest is paid. Next ponder what would be happening if interest rates were anything like even 5% p.a. – let alone the 10% and 15%+ ...

... To appreciate the point being made, consider that, these days, the 4pillars are holding some $ one-trillion – one thousand billions – in deposits on which no material interest is paid. Next ponder what would be happening if interest rates were anything like even 5% p.a. – let alone the 10% and 15%+ ...

12-1

... – Can only borrow from banks and limits fund loans to 33.3% of funds assets. – With the SEC’s recent interpretation of the act, mutual funds have access to other sources of short-term borrowing provided that stockholders and directors approve of such sources. Copyright © 2000 by Harcourt, Inc. ...

... – Can only borrow from banks and limits fund loans to 33.3% of funds assets. – With the SEC’s recent interpretation of the act, mutual funds have access to other sources of short-term borrowing provided that stockholders and directors approve of such sources. Copyright © 2000 by Harcourt, Inc. ...

2017 market predictions. Find out what to expect

... kets are closer to their median valuation levels. Our expectation is for US equity market returns to be below long-term averages for 2017 with the S&P 500 returning ~6%. Movement on corporate tax reform and fiscal stimulus could improve market gains, but we will believe it when we see it. We expect ...

... kets are closer to their median valuation levels. Our expectation is for US equity market returns to be below long-term averages for 2017 with the S&P 500 returning ~6%. Movement on corporate tax reform and fiscal stimulus could improve market gains, but we will believe it when we see it. We expect ...

Financing Non-P3 Infrastructure Projects

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

MedTech ”Made in Germany”

... This June we celebrated 20 years of SHS. We would like to take this opportunity to thank you once again for the many kind wishes received on the occasion of this anniversary. Looking back, we can say that we have gone through a lot in this period, with booms, bubbles, crises and capital crunches. We ...

... This June we celebrated 20 years of SHS. We would like to take this opportunity to thank you once again for the many kind wishes received on the occasion of this anniversary. Looking back, we can say that we have gone through a lot in this period, with booms, bubbles, crises and capital crunches. We ...