harvard, yale, and alternative investments: a post

... The endowment model is typically characterized by a large allocation to alternative investments and a low allocation to fixed income and cash While endowments with over $1 billion AUM allocate 59% to alternative investments, the average endowment allocates less ...

... The endowment model is typically characterized by a large allocation to alternative investments and a low allocation to fixed income and cash While endowments with over $1 billion AUM allocate 59% to alternative investments, the average endowment allocates less ...

Corporate Senior Loans Role Model US?

... This Material is indicative only. It is not a valuation and it contains, on a non exhaustive basis, information on the High Yield Loans Expertise, AXA Investment Managers and track record of several transactions managed by the Corporate Credit team.This Material is indicative only and is not to be c ...

... This Material is indicative only. It is not a valuation and it contains, on a non exhaustive basis, information on the High Yield Loans Expertise, AXA Investment Managers and track record of several transactions managed by the Corporate Credit team.This Material is indicative only and is not to be c ...

Managing Partner

... IDG is the world's leading IT media, research and exposition company with revenue of $3.01 billion (2001) and 13,000 employees worldwide. IDG Asia has 60 IT-related newspapers and magazines in 16 Asian countries and regions with a total combined readership exceeding 20,000,000, produces 40 tradeshow ...

... IDG is the world's leading IT media, research and exposition company with revenue of $3.01 billion (2001) and 13,000 employees worldwide. IDG Asia has 60 IT-related newspapers and magazines in 16 Asian countries and regions with a total combined readership exceeding 20,000,000, produces 40 tradeshow ...

Personal Finance - Adventist Education

... Be able to understand, apply, and evaluate money-management decisions. PFIN.5.1 PFIN.5.2 PFIN.5.3 PFIN.5.4 ...

... Be able to understand, apply, and evaluate money-management decisions. PFIN.5.1 PFIN.5.2 PFIN.5.3 PFIN.5.4 ...

Risk Allocation, Debt Fueled Expansion and Financial Crisis Paul Beaudry Amartya Lahiri

... All portfolios o¤ered for repackaging are pooled and repackaged by an intermediary ...

... All portfolios o¤ered for repackaging are pooled and repackaged by an intermediary ...

NBI Municipal Bond Plus Private Portfolio - Series

... The fund's investment objective is to provide high income. The fund invests directly, or through investments in securities of other mutual funds, in a portfolio composed mainly of Canadian municipal bonds denominated in Canadian dollars. The fund also invests in other fixed income securities in orde ...

... The fund's investment objective is to provide high income. The fund invests directly, or through investments in securities of other mutual funds, in a portfolio composed mainly of Canadian municipal bonds denominated in Canadian dollars. The fund also invests in other fixed income securities in orde ...

Harnessing FDI for Sustainable Development

... Latin America tops growth rate and amount of FDI inflows By group of economies, 2011 (H1) – 2012 (H2) (Percent and billions of US dollars) ...

... Latin America tops growth rate and amount of FDI inflows By group of economies, 2011 (H1) – 2012 (H2) (Percent and billions of US dollars) ...

OPTIMUM MARKET PORTFOLIOS With Experience

... conducts ongoing evaluation and monitoring of the fund sub-advisors in the Optimum Funds.2 Delaware Investments is a member of the Macquarie Group, and with its affiliates, provides investment services along all asset classes to some of the largest institutional entities. Please review the Models & ...

... conducts ongoing evaluation and monitoring of the fund sub-advisors in the Optimum Funds.2 Delaware Investments is a member of the Macquarie Group, and with its affiliates, provides investment services along all asset classes to some of the largest institutional entities. Please review the Models & ...

Financial Intermediaries

... government retirement funds, which transform corporate bonds and stocks into annuities, and mutual funds and money market mutual funds, which transform diverse portfolios of capital and money market instruments, respectively, into nonnegotiable but easilyredeemable “shares.”+ As Figure 2.4, “Share o ...

... government retirement funds, which transform corporate bonds and stocks into annuities, and mutual funds and money market mutual funds, which transform diverse portfolios of capital and money market instruments, respectively, into nonnegotiable but easilyredeemable “shares.”+ As Figure 2.4, “Share o ...

Irrational Exuberance?

... expectations on Wall Street and Main Street but it will deliver a better performance than last year. While the Fed never bought into the post-election euphoria, it should have enough justification to stay on its gradual rate-hiking course. ...

... expectations on Wall Street and Main Street but it will deliver a better performance than last year. While the Fed never bought into the post-election euphoria, it should have enough justification to stay on its gradual rate-hiking course. ...

EVL_event_RIO+20 - Global Environment Facility

... natural resource use and other land-based activities remain key to livelihoods, income and employment for all African nations. The ability of the surrounding land to sustain our existence is an important aspect of sustainability. Clearly, we rely on healthy ecosystems for a multitude of benefits—fro ...

... natural resource use and other land-based activities remain key to livelihoods, income and employment for all African nations. The ability of the surrounding land to sustain our existence is an important aspect of sustainability. Clearly, we rely on healthy ecosystems for a multitude of benefits—fro ...

MAR 2016 Your FP/CM Newsletter - Financial Partners Capital

... As we review our FPCM investments in the pharma sector and reflect on the increased political rhetoric surrounding drug prices, we thought it might be helpful to examine how pharma stocks have done over multiple presidential cycles. This is neither an endorsement nor a rejection of any political par ...

... As we review our FPCM investments in the pharma sector and reflect on the increased political rhetoric surrounding drug prices, we thought it might be helpful to examine how pharma stocks have done over multiple presidential cycles. This is neither an endorsement nor a rejection of any political par ...

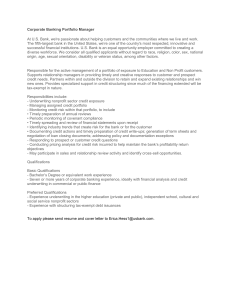

At US Bank, we`re passionate about helping customers and the

... Corporate Banking Portfolio Manager At U.S. Bank, we're passionate about helping customers and the communities where we live and work. The fifth-largest bank in the United States, we’re one of the country's most respected, innovative and successful financial institutions. U.S. Bank is an equal oppor ...

... Corporate Banking Portfolio Manager At U.S. Bank, we're passionate about helping customers and the communities where we live and work. The fifth-largest bank in the United States, we’re one of the country's most respected, innovative and successful financial institutions. U.S. Bank is an equal oppor ...

Ted Bernhard - Stoel Rives

... “Tax-Hungry Corporate Investors” • There simply aren’t very many of them • Here’s why they are few and far between: – Corporation, not a pass through entity – Enough taxable income to utilize PTC credits and depreciation – Unless they are an owner of virtually all of the project for a period of time ...

... “Tax-Hungry Corporate Investors” • There simply aren’t very many of them • Here’s why they are few and far between: – Corporation, not a pass through entity – Enough taxable income to utilize PTC credits and depreciation – Unless they are an owner of virtually all of the project for a period of time ...

Ebix Stands Out in the Insurance Software and Services Industry

... current and quick ratio less than one and, looking at its history, the decline in these ratios seems to coincide with their increase in debt over the last couple of years. This stands in contrast to EBIX, which had less than optimal current and quick ratios the past few years but has significantly i ...

... current and quick ratio less than one and, looking at its history, the decline in these ratios seems to coincide with their increase in debt over the last couple of years. This stands in contrast to EBIX, which had less than optimal current and quick ratios the past few years but has significantly i ...

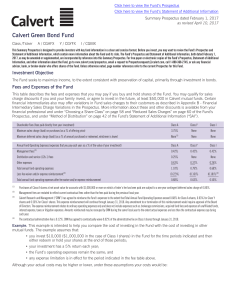

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

Derivatives Market Risk Related to Certain Variable

... prices. Further, our contract provisions provide that, although participants may withdraw funds at book value, contractholder withdrawals may only occur at market value immediately or at book value over time. These factors, among others, result in these contracts experiencing minimal changes in fair ...

... prices. Further, our contract provisions provide that, although participants may withdraw funds at book value, contractholder withdrawals may only occur at market value immediately or at book value over time. These factors, among others, result in these contracts experiencing minimal changes in fair ...

information

... 4. Opportunities for further research Find out about the companies included in the different FTSE Indices which the BGI investments track. There are certain funds which I have been unable to find a contact for JF Pacific Equity Fund Cedar Rock Capital Fund Did the original response from the uni cont ...

... 4. Opportunities for further research Find out about the companies included in the different FTSE Indices which the BGI investments track. There are certain funds which I have been unable to find a contact for JF Pacific Equity Fund Cedar Rock Capital Fund Did the original response from the uni cont ...

Michael Dimelow, VP Business Development, ARM

... • Long-term, secular growth markets Approximately 1000 licenses Growing by ~100 every year Over 330 potential royalty payers 8.7bn ARM-based chips in ‘12 ~25% CAGR over last 5 years ...

... • Long-term, secular growth markets Approximately 1000 licenses Growing by ~100 every year Over 330 potential royalty payers 8.7bn ARM-based chips in ‘12 ~25% CAGR over last 5 years ...

the evaluation of active manager returns in a non

... work in the area of behavioural finance concludes that investors much more dislike losses than they like gains (see De Bondt and Thaler (1994)) suggesting that outperformance in a down market is valued much more highly than outperformance in an up market. This paper examines the active return distri ...

... work in the area of behavioural finance concludes that investors much more dislike losses than they like gains (see De Bondt and Thaler (1994)) suggesting that outperformance in a down market is valued much more highly than outperformance in an up market. This paper examines the active return distri ...

PXP Vietnam Emerging Equity Fund

... Fundamental, bottom-up, research-driven approach Broadest coverage of Vietnamese listed equities Multi-year track record of index and peer group outperformance Flagship fund PXP Vietnam Emerging Equity Fund: AUM of US$ 150mn (June 2017); ...

... Fundamental, bottom-up, research-driven approach Broadest coverage of Vietnamese listed equities Multi-year track record of index and peer group outperformance Flagship fund PXP Vietnam Emerging Equity Fund: AUM of US$ 150mn (June 2017); ...

How markets work - USU Sustainability

... Purchasing offsets today provides a hedge against increasing prices and uncertainty about the availability of offset supply A secondary voluntary market exists today for offsets that are not eligible for compliance purposes in the future ...

... Purchasing offsets today provides a hedge against increasing prices and uncertainty about the availability of offset supply A secondary voluntary market exists today for offsets that are not eligible for compliance purposes in the future ...