eMAXX Bond Holders Market Intelligence for

... fingertips. eMAXX Bond Holders quickly displays reports showing owners of a chosen bond or a group of bonds as well as pinpoints the managing firms and portfolio managers responsible for portfolio trading decisions. With eMAXX Bond Holders you can increase your trade activity by routing axes through ...

... fingertips. eMAXX Bond Holders quickly displays reports showing owners of a chosen bond or a group of bonds as well as pinpoints the managing firms and portfolio managers responsible for portfolio trading decisions. With eMAXX Bond Holders you can increase your trade activity by routing axes through ...

Investment Analysis (FIN 383)

... You should show your work how to get the answer for each calculation question to get full credit. The due date is Thursday, Feb 14, 2008. Late homework will not be graded. ...

... You should show your work how to get the answer for each calculation question to get full credit. The due date is Thursday, Feb 14, 2008. Late homework will not be graded. ...

Marketing Management

... (concentric diversification) • Diversification into unrelated businesses (conglomerate diversification) ...

... (concentric diversification) • Diversification into unrelated businesses (conglomerate diversification) ...

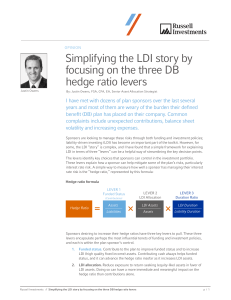

Simplifying the LDI story by focusing on the three DB hedge ratio

... Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining s ...

... Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining s ...

New risks. New insights.

... the real-time risk profile of the portfolio — based on current holdings instead of past returns. This technique is designed to complement other returns-based methodologies and help advisors in two keys ways: 1) to more clearly understand total portfolio risk and 2) to more confidently and accurately ...

... the real-time risk profile of the portfolio — based on current holdings instead of past returns. This technique is designed to complement other returns-based methodologies and help advisors in two keys ways: 1) to more clearly understand total portfolio risk and 2) to more confidently and accurately ...

User Guide and Portfolio Overview

... information on the reconciliation between total available appropriation and outcome attribution, the re-phasing and use of appropriations, special account flows and Australian Government Indigenous Expenditure. • It should also be noted that the capital budget statement and the property, plant, equi ...

... information on the reconciliation between total available appropriation and outcome attribution, the re-phasing and use of appropriations, special account flows and Australian Government Indigenous Expenditure. • It should also be noted that the capital budget statement and the property, plant, equi ...

Public Risk, Private Gain Public Risk, Private Gain By Steven

... Dimon may have made the deal of a lifetime, picking up a prime brokerage and half-dozen other profitable operations while getting the Federal Reserve to take on all the risks from its heavily discounted financial holdings until they can be sold at a more reasonable price. In that sense, it's more do ...

... Dimon may have made the deal of a lifetime, picking up a prime brokerage and half-dozen other profitable operations while getting the Federal Reserve to take on all the risks from its heavily discounted financial holdings until they can be sold at a more reasonable price. In that sense, it's more do ...

OP 4.03: World Bank Performance Standards for Private Sector

... Bank Group (e.g. a common approach for WB Group staff and Borrowers, for jointly financed projects) The actual PS (1-8) are the same as for IFC and MIGA; some differences in how they are applied Interim Guidance Note for WB staff on implementation procedures (closely parallels IFC procedures)… f ...

... Bank Group (e.g. a common approach for WB Group staff and Borrowers, for jointly financed projects) The actual PS (1-8) are the same as for IFC and MIGA; some differences in how they are applied Interim Guidance Note for WB staff on implementation procedures (closely parallels IFC procedures)… f ...

News release - EY`s 2016 study on direct investment in Europe

... building materials. Such investments are frequently made in eastern Europe – nearly one in every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and ...

... building materials. Such investments are frequently made in eastern Europe – nearly one in every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and ...

Municipal Bond Monthly

... Credit Risk - The risk that the issuer might be unable to pay interest and/or principal on a timely basis. Widely recognized rating agencies, such as Moody's Investor Services and Standard & Poor’s, offer their assessment of an issuer’s creditworthiness. U.S. Treasury securities are considered the “ ...

... Credit Risk - The risk that the issuer might be unable to pay interest and/or principal on a timely basis. Widely recognized rating agencies, such as Moody's Investor Services and Standard & Poor’s, offer their assessment of an issuer’s creditworthiness. U.S. Treasury securities are considered the “ ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... pensions. The client may have temporary expenses, such as a nearly paid mortgage, and one-time windfalls, perhaps from downsizing their housing. The complexity of the cash flows makes it nearly impossible for a planner to apply a simple rule of thumb like the 4% strategy, even if he or she wanted to ...

... pensions. The client may have temporary expenses, such as a nearly paid mortgage, and one-time windfalls, perhaps from downsizing their housing. The complexity of the cash flows makes it nearly impossible for a planner to apply a simple rule of thumb like the 4% strategy, even if he or she wanted to ...

Media Contact: Ellen Seaver / / (201) 796-7788

... ROCHELLE PARK, N.J., Feb. 25, 2015 – Commercial real estate will remain an attractive investment throughout 2015 with returns on competitive asset classes like stocks and bonds staying relatively low, according to the investment and origination principals of Case Real Estate Capital, LLC (Case). A n ...

... ROCHELLE PARK, N.J., Feb. 25, 2015 – Commercial real estate will remain an attractive investment throughout 2015 with returns on competitive asset classes like stocks and bonds staying relatively low, according to the investment and origination principals of Case Real Estate Capital, LLC (Case). A n ...

Private Offerings to U.S. Investors by Non

... general public (individually or taken as a whole) with regard to an investment in a fund. If a fund or its agents make statements that could be viewed as a “general advertising” or “general solicitation”, the SEC could impose a “cooling-off period” with respect to U.S. investors (typically a cessati ...

... general public (individually or taken as a whole) with regard to an investment in a fund. If a fund or its agents make statements that could be viewed as a “general advertising” or “general solicitation”, the SEC could impose a “cooling-off period” with respect to U.S. investors (typically a cessati ...

Updating Accounting Standards

... for real estate mortgage, the name of the mortgagee and the aggregate fair value of the investment liabilities with each mortgagee, ...

... for real estate mortgage, the name of the mortgagee and the aggregate fair value of the investment liabilities with each mortgagee, ...

Notes: All index returns exclude reinvested dividends, and the 5

... If you would like to opt-out of future emails, please reply to this email with UNSUBSCRIBE in the subject line. Content Provided by Platinum Advisor Marketing Strategies, LLC.These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or ...

... If you would like to opt-out of future emails, please reply to this email with UNSUBSCRIBE in the subject line. Content Provided by Platinum Advisor Marketing Strategies, LLC.These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or ...

Figure 3

... specifies that the seller, who has the short position, will deliver some quantity of a commodity or financial instrument to the buyer, who has the long position, on a specific date, called settlement or delivery date, for a predetermined price. No payments are made initially when the contract is agr ...

... specifies that the seller, who has the short position, will deliver some quantity of a commodity or financial instrument to the buyer, who has the long position, on a specific date, called settlement or delivery date, for a predetermined price. No payments are made initially when the contract is agr ...

Fundamentals of Investing Chapter Fifteen

... Evaluate potential investments. Monitor the value of your investments. Keep accurate and current records. Be aware of tax considerations, including tax deferred and tax exempt investments. Keep track of capital gains and losses, interest income, rental income, and ...

... Evaluate potential investments. Monitor the value of your investments. Keep accurate and current records. Be aware of tax considerations, including tax deferred and tax exempt investments. Keep track of capital gains and losses, interest income, rental income, and ...

Effective Manager Programme

... A reference to the accounting treatments that companies in the UK would generally be expected to apply in the preparation of their financial statements. ...

... A reference to the accounting treatments that companies in the UK would generally be expected to apply in the preparation of their financial statements. ...

year-end portfolio company valuation

... the financial statements, all the information that becomes available prior to the issuance of the financial statements should be used by the management in its evaluation of the conditions on which the estimates were based. Therefore, the financial statements should be adjusted for any changes in est ...

... the financial statements, all the information that becomes available prior to the issuance of the financial statements should be used by the management in its evaluation of the conditions on which the estimates were based. Therefore, the financial statements should be adjusted for any changes in est ...

Requests for Information PUB-94 NP 2. Database and Development Software

... Requests for Information ...

... Requests for Information ...

Finance Committee

... BACKGROUND: Organizational Excellence is Strategy 14 in the Strategic Plan under Pillar 5: Steward the University’s Resources to Promote Academic Excellence and Affordable Access. Organizational Excellence seeks to enable the achievement of institutional strategic goals and priorities - excellence i ...

... BACKGROUND: Organizational Excellence is Strategy 14 in the Strategic Plan under Pillar 5: Steward the University’s Resources to Promote Academic Excellence and Affordable Access. Organizational Excellence seeks to enable the achievement of institutional strategic goals and priorities - excellence i ...

TrustSM Target Date Collective Investment Funds

... • Extensive diversification across core and specialty asset classes. • A structured investment strategy, with disciplined risk management at each stage of the process. • Multiple underlying investment managers representing a range of asset classes and investment styles. The investment advisor’s p ...

... • Extensive diversification across core and specialty asset classes. • A structured investment strategy, with disciplined risk management at each stage of the process. • Multiple underlying investment managers representing a range of asset classes and investment styles. The investment advisor’s p ...

private credit for insurers

... The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any pro ...

... The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any pro ...