Global Economic and Financial Markets Summary

... strengthening economy, US corporate profits should continue to improve, albeit at a more moderate pace. In addition, high cash balances should allow companies to continue returning capital to shareholders in the form of dividends and buybacks; see Appendix E. As a result, we believe the risk-return ...

... strengthening economy, US corporate profits should continue to improve, albeit at a more moderate pace. In addition, high cash balances should allow companies to continue returning capital to shareholders in the form of dividends and buybacks; see Appendix E. As a result, we believe the risk-return ...

2014 USAID Power Africa Marketing Document

... Participants are invited from regulatory authorities, investment and planning units, utility operators, and other related public entities from Kenya, Ethiopia, and Tanzania. Basic knowledge of computer operation (Word and Excel) are sufficient to participate in the course. It is recommended that par ...

... Participants are invited from regulatory authorities, investment and planning units, utility operators, and other related public entities from Kenya, Ethiopia, and Tanzania. Basic knowledge of computer operation (Word and Excel) are sufficient to participate in the course. It is recommended that par ...

“Risk-On” Sentiment Leads to Rally in 4th Quarter

... The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “safe” assets. These p ...

... The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “safe” assets. These p ...

Two Ways to Calculate the Rate of Return on a Portfolio

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

Part B: Examining the possibilities of future 401K balances

... finds the number corresponding to that percentile. The average and standard deviation depend upon the asset allocation choice you make. For your next set of 30 returns, copy the columns in #3 above but replace each return with the norminv() function so that you get a random return for each entry. Wi ...

... finds the number corresponding to that percentile. The average and standard deviation depend upon the asset allocation choice you make. For your next set of 30 returns, copy the columns in #3 above but replace each return with the norminv() function so that you get a random return for each entry. Wi ...

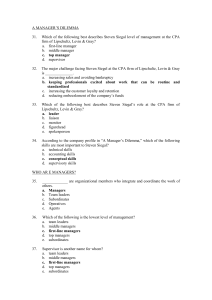

A MANAGER`S DILEMMA

... Whereas _____________ is concerned with the means of getting things done, _____________ is concerned with the ends, or attainment of organizational goals. a. effectiveness; efficiency b. efficiency; effectiveness c. effectiveness; goal attainment d. goal attainment; efficiency ...

... Whereas _____________ is concerned with the means of getting things done, _____________ is concerned with the ends, or attainment of organizational goals. a. effectiveness; efficiency b. efficiency; effectiveness c. effectiveness; goal attainment d. goal attainment; efficiency ...

Are your bonds really `green`?

... under FSMA. Potential investors in the United Kingdom should be aware that most of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the fund and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme. ...

... under FSMA. Potential investors in the United Kingdom should be aware that most of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the fund and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme. ...

ESG Briefing September 2014 - Melbourne Energy Institute

... These forward-looking statements are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contain ...

... These forward-looking statements are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contain ...

150528 ISDS CAMs final

... treatment of European investors in the US on account of existing agreements of Member States; to ensure that foreign investors are treated in a non-discriminatory fashion and have a fair opportunity to seek and achieve redress of grievances while benefiting from no greater rights than domestic inves ...

... treatment of European investors in the US on account of existing agreements of Member States; to ensure that foreign investors are treated in a non-discriminatory fashion and have a fair opportunity to seek and achieve redress of grievances while benefiting from no greater rights than domestic inves ...

Terms of Reference for the Audit Committee Purpose Composition

... Recommend to the board for its approval • Annual IT strategic plan, and any subsequent material changes to that plan • Changes to IT policies, including to the IT governance policy Internal controls Meet with management and the external auditor at least once a year, and with management and the inter ...

... Recommend to the board for its approval • Annual IT strategic plan, and any subsequent material changes to that plan • Changes to IT policies, including to the IT governance policy Internal controls Meet with management and the external auditor at least once a year, and with management and the inter ...

Land Market - Property News

... April 2012, residential developers began the process of consolidation, as only the largest and most financially stable companies will be able to meet the requirements imposed by the legislator. As a result, some of the smaller development companies may be offered for sale or will seek joint venture ...

... April 2012, residential developers began the process of consolidation, as only the largest and most financially stable companies will be able to meet the requirements imposed by the legislator. As a result, some of the smaller development companies may be offered for sale or will seek joint venture ...

Wells Fargo announces effective dates for changes to certain money

... our money market portfolios. For more than 25 years, the Wells Fargo Money Market Funds have maintained a discipline of rigorous credit analysis and steadfast attention to preservation of capital and liquidity. Our security selection process has long emphasized conservative investment choices driven ...

... our money market portfolios. For more than 25 years, the Wells Fargo Money Market Funds have maintained a discipline of rigorous credit analysis and steadfast attention to preservation of capital and liquidity. Our security selection process has long emphasized conservative investment choices driven ...

Can International Capital Standards Strengthen Banks

... allowed to invest in instruments which in some cases may not be publicly offered or traded in exchanges, provided that adequate disclosure and operational transparency allow for appropriate external auditing. (see = www.claaf.org) The reality of corporate structure in Latin America is quite differen ...

... allowed to invest in instruments which in some cases may not be publicly offered or traded in exchanges, provided that adequate disclosure and operational transparency allow for appropriate external auditing. (see = www.claaf.org) The reality of corporate structure in Latin America is quite differen ...

Competency Standard

... legal issues that impact on the management of physical assets to specific tourism and hospitality workplace situations and problems; and access to workplace standards, procedures, policies, guidelines, tools and current financial data and regulations. Assessment Methods The following methods may be ...

... legal issues that impact on the management of physical assets to specific tourism and hospitality workplace situations and problems; and access to workplace standards, procedures, policies, guidelines, tools and current financial data and regulations. Assessment Methods The following methods may be ...

(Fiduciary) Fund

... are nearly identical in form and content to financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

... are nearly identical in form and content to financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

Chapter 1 Foreign Direct Investment

... initiative to attract FDI to country make such policy and form regulation that have an influence on the foreign investors and they look at our country as the investment destination. ...

... initiative to attract FDI to country make such policy and form regulation that have an influence on the foreign investors and they look at our country as the investment destination. ...

Positioning Your Portfolio for Rising Interest Rates

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

Energy Marketing

... • Increases depth of market knowledge (fundamental linkages between markets) • Profits from crude, gas, and power marketing are not correlated; decreasing risk and helping avoid “boom-bust” financial results B. Multi-region Presence (but allocate resources based on level of opportunity in each regio ...

... • Increases depth of market knowledge (fundamental linkages between markets) • Profits from crude, gas, and power marketing are not correlated; decreasing risk and helping avoid “boom-bust” financial results B. Multi-region Presence (but allocate resources based on level of opportunity in each regio ...

Former Mare Island Naval Shipyard

... Chlorinated solvents found during 2009/2010 cleanup action and investigated in 2012. ...

... Chlorinated solvents found during 2009/2010 cleanup action and investigated in 2012. ...

- Schroders

... So, how do we develop confidence that valuations have moved to extremes? The real answer is that we rarely identify when “booms” morph into “bubbles”, and that valuations of businesses exposed to the boom may range from reasonable to totally unreasonable, with many in between. The logic which we app ...

... So, how do we develop confidence that valuations have moved to extremes? The real answer is that we rarely identify when “booms” morph into “bubbles”, and that valuations of businesses exposed to the boom may range from reasonable to totally unreasonable, with many in between. The logic which we app ...

Journal of Public Administration Research and Theory

... Abstract: This study applies the Advocacy Coalition Framework (ACF) to developments in Swedish nuclear energy policy in the 1970s and 80s. In an effort to contribute to the refinement and debate regarding the generalizability of ACF theory, the objective is to assess the utility of ACF assumptions w ...

... Abstract: This study applies the Advocacy Coalition Framework (ACF) to developments in Swedish nuclear energy policy in the 1970s and 80s. In an effort to contribute to the refinement and debate regarding the generalizability of ACF theory, the objective is to assess the utility of ACF assumptions w ...

Environmentally responsible firms experience lower stock market

... • Firms are now given clear reasons for being perceived by others as being responsible, in particular, lower company-specific risk. This will give them easier access to equity capital. • For those firms seen as already being environmentally responsible, it is best for these firms to not tout their g ...

... • Firms are now given clear reasons for being perceived by others as being responsible, in particular, lower company-specific risk. This will give them easier access to equity capital. • For those firms seen as already being environmentally responsible, it is best for these firms to not tout their g ...

Seeing Beyond the Tragedy of Horizons

... long term existential issues to many of the companies listed in stock markets around the world today, including insurance. ...

... long term existential issues to many of the companies listed in stock markets around the world today, including insurance. ...

Weekly Commentary 01-20-14 PAA

... Predict, forecast, divine, foresee… Each year, pundits, analysts, and authorities from around the world offer investors insight to what the year may hold. While prognosticating brings to mind the words of British Prime Minister Winston Churchill who said, “It is always wise to look ahead, but diffic ...

... Predict, forecast, divine, foresee… Each year, pundits, analysts, and authorities from around the world offer investors insight to what the year may hold. While prognosticating brings to mind the words of British Prime Minister Winston Churchill who said, “It is always wise to look ahead, but diffic ...