Still No One Wants to Play

... managers were repositioning to become more defensive, and hedge funds were bearish on equities. If the economy is indeed in a late cycle, then the consensus could be wrong-footed. The 2nd longest bull market in the post-war era has been largely missed by most investors. The fear of repeating 2008's ...

... managers were repositioning to become more defensive, and hedge funds were bearish on equities. If the economy is indeed in a late cycle, then the consensus could be wrong-footed. The 2nd longest bull market in the post-war era has been largely missed by most investors. The fear of repeating 2008's ...

private investment management - The Lindsey Group at Umpqua

... options, exchange-traded funds, and unit trusts — all within ...

... options, exchange-traded funds, and unit trusts — all within ...

Weekly Market Flash

... The 1987 event, of course, was driven by the one‐day freak crash of October 19. This was of an even bigger magnitude than that of May 28, 1962; major indexes closed down more than 20 percent from where they opened. All told, the S&P 500 would lose 33.5 percent from peak to trou ...

... The 1987 event, of course, was driven by the one‐day freak crash of October 19. This was of an even bigger magnitude than that of May 28, 1962; major indexes closed down more than 20 percent from where they opened. All told, the S&P 500 would lose 33.5 percent from peak to trou ...

dynamic analysis of hedge funds - Markov Processes International Inc.

... technique (3) appears to be inadequate to capture rapid changes in portfolio structure. In addition, model (1) loses much of its advantage when it is applied to the analysis of portfolios which are allowed to take short (negative) positions. In such cases, the nonnegativity constraints β( i ) ≥ 0 ha ...

... technique (3) appears to be inadequate to capture rapid changes in portfolio structure. In addition, model (1) loses much of its advantage when it is applied to the analysis of portfolios which are allowed to take short (negative) positions. In such cases, the nonnegativity constraints β( i ) ≥ 0 ha ...

RFP Questionnaire - Meketa Investment Group

... What is the firm’s ownership structure? Note any recent (within the last five years) or pending changes in ownership structure. ...

... What is the firm’s ownership structure? Note any recent (within the last five years) or pending changes in ownership structure. ...

x. strategic management

... communicate broadly formulated basic rules worked out by the organization for internal use to everyone who makes strategic decisions in the company. Declaration of the mission should leave a sufficient space for people to apply their own initiatives. If the declaration does not inspire people or wor ...

... communicate broadly formulated basic rules worked out by the organization for internal use to everyone who makes strategic decisions in the company. Declaration of the mission should leave a sufficient space for people to apply their own initiatives. If the declaration does not inspire people or wor ...

PowerPoint - Columbia University

... •Even though investors are only quasi-rational, it is very hard to exploit lack of rationality. •Active portfolio managers have trouble keeping up with the market indexes they track. •Private partnerships managed by people with high performance quotients are accessible only to investors with at leas ...

... •Even though investors are only quasi-rational, it is very hard to exploit lack of rationality. •Active portfolio managers have trouble keeping up with the market indexes they track. •Private partnerships managed by people with high performance quotients are accessible only to investors with at leas ...

Portfolio Management

... • Bottoms up approach – X amount of units and Y price – X*Y=Revenue • Other line items as % of revenue ...

... • Bottoms up approach – X amount of units and Y price – X*Y=Revenue • Other line items as % of revenue ...

PDF - EMM Wealth Management

... reach too far or too high. High yields in this environment of low, risk-free rates often point to speculative, highly risky assets as opposed to a “free lunch.” Low-risk securities should have an appropriate allocation within investor portfolios, while higher- yielding assets should be chosen on a s ...

... reach too far or too high. High yields in this environment of low, risk-free rates often point to speculative, highly risky assets as opposed to a “free lunch.” Low-risk securities should have an appropriate allocation within investor portfolios, while higher- yielding assets should be chosen on a s ...

Guest Viewpoint “If China were to be classified as an emerging

... Managing director governance, risk & compliance, FTSE Russell ...

... Managing director governance, risk & compliance, FTSE Russell ...

4683 Complete contracts and obtain authorities to manage

... Agents Authority covering an agency agreement and a sale and purchase agreement. These are available from http://www.reaa.govt.nz. Client means the person on whose behalf an agent carries out real estate agency work and is commonly known in the industry as a vendor or seller. Reflecting back underst ...

... Agents Authority covering an agency agreement and a sale and purchase agreement. These are available from http://www.reaa.govt.nz. Client means the person on whose behalf an agent carries out real estate agency work and is commonly known in the industry as a vendor or seller. Reflecting back underst ...

Introduction

... – A long-term investment strategy in which the source of funds establishes financial control, making FDI a stabilizing influence on a nation’s economy. ...

... – A long-term investment strategy in which the source of funds establishes financial control, making FDI a stabilizing influence on a nation’s economy. ...

Wisconsin`s Uniform Prudent Management of Institutional Act

... and with the care an ordinarily prudent person in a like position would exercise under similar circumstances. May incur only costs that are appropriate and reasonable in relation to the assets, the purposes of the institution, and the skills available to the institution. Shall make a reasonable effo ...

... and with the care an ordinarily prudent person in a like position would exercise under similar circumstances. May incur only costs that are appropriate and reasonable in relation to the assets, the purposes of the institution, and the skills available to the institution. Shall make a reasonable effo ...

Chapter 6

... TR, RR, and CWI are useful for a given, single time period What about summarizing returns over several time periods? ...

... TR, RR, and CWI are useful for a given, single time period What about summarizing returns over several time periods? ...

Detroit default exposes lie of phantom returns

... federal government. Constitutional lawyers already know this; soon members of the public will as well. Yes, they will be incandescently angry with both political parties for deceiving them. That anger will also, justifiably, extend to what we could call the portfolio management class. After all, por ...

... federal government. Constitutional lawyers already know this; soon members of the public will as well. Yes, they will be incandescently angry with both political parties for deceiving them. That anger will also, justifiably, extend to what we could call the portfolio management class. After all, por ...

Dynamic Asset Allocation Through the Business Cycle: A Macro

... sometimes expensive markets delivered good returns over three years, while sometimes cheap markets delivered poor returns. Further, when the time horizon is shortened to one month, valuation gives us barely any predictive power. Exhibit 2 Valuation is less helpful over the short term because it is i ...

... sometimes expensive markets delivered good returns over three years, while sometimes cheap markets delivered poor returns. Further, when the time horizon is shortened to one month, valuation gives us barely any predictive power. Exhibit 2 Valuation is less helpful over the short term because it is i ...

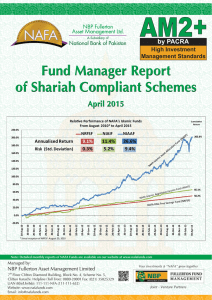

Islamic FMR- April 2015_(Complete)

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

United Nations and leading investors launch Coalition to

... climate action. Climate change is more and more recognized as a financial risk and it is our duty, as trustees, to take concrete steps to reduce this risk. “USD 100 billion is a significant amount but it is absolutely feasible. And we hope that by reaching this target, investors can show that a diff ...

... climate action. Climate change is more and more recognized as a financial risk and it is our duty, as trustees, to take concrete steps to reduce this risk. “USD 100 billion is a significant amount but it is absolutely feasible. And we hope that by reaching this target, investors can show that a diff ...

“Abenomics 2.0: the New Three Arrows”

... = The recipient of this report must make its own independent decisions regarding investments. = The opinions, outlooks and estimates in this report do not guarantee future trends or results. They constitute SMAM’s judgment as of the date of this material and are subject to change without notice. = T ...

... = The recipient of this report must make its own independent decisions regarding investments. = The opinions, outlooks and estimates in this report do not guarantee future trends or results. They constitute SMAM’s judgment as of the date of this material and are subject to change without notice. = T ...

Colbar Completes $7.25 Million Series D Financing Round

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...