1/ Global stockmarkets initially fell this week as investors - E-SGH

... 2/ Dow Chemical and DuPont, two chemical giants, won approval from the European Union for their $130bn merger, after making concessions including the sale of large parts of DuPont’s pesticide business. The European Commission is yet to rule on two more big agrochemical deals: Bayer’s proposed takeov ...

... 2/ Dow Chemical and DuPont, two chemical giants, won approval from the European Union for their $130bn merger, after making concessions including the sale of large parts of DuPont’s pesticide business. The European Commission is yet to rule on two more big agrochemical deals: Bayer’s proposed takeov ...

glossary

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

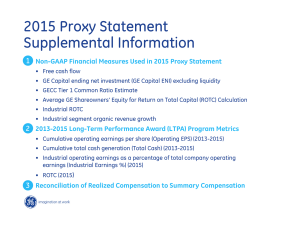

GE 2015 Proxy - Supplemental Information

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... asymmetric information problem takes the market illiquid. Comments BL ...

... asymmetric information problem takes the market illiquid. Comments BL ...

Press Release

... previous three quarters of 2015, in which there was a cumulative increase of about $7.9 billion (12.2 percent). The decline in the surplus during the fourth quarter derived mainly from price changes and changes in the exchange rate that increased the value of outstanding liabilities. For the full ye ...

... previous three quarters of 2015, in which there was a cumulative increase of about $7.9 billion (12.2 percent). The decline in the surplus during the fourth quarter derived mainly from price changes and changes in the exchange rate that increased the value of outstanding liabilities. For the full ye ...

over confidence amongst us

... expectations and their attitudes to risk. Expecting double digit returns within the next 12 months, while only placing less than a quarter (21%) of their investment portfolio in higher risk assets ...

... expectations and their attitudes to risk. Expecting double digit returns within the next 12 months, while only placing less than a quarter (21%) of their investment portfolio in higher risk assets ...

Extraordinary General Meeting 2004

... are not settled in a stock exchange in India. » If it is determined that the selling shareholders are not entitled to the preferential tax treatment then the short term capital gains will be taxed at 30% plus applicable surcharges and the long term capital gains will be taxed at 10% plus applicable ...

... are not settled in a stock exchange in India. » If it is determined that the selling shareholders are not entitled to the preferential tax treatment then the short term capital gains will be taxed at 30% plus applicable surcharges and the long term capital gains will be taxed at 10% plus applicable ...

Considerations on the financial structure of the company

... Besides the results, the fundamental contribution of their demonstration is that they do not rely too much on the proposed approach, which comprises three essential aspects: - it changes the evaluation problems of the company and the investments choice problems on the financial market; - it clearly ...

... Besides the results, the fundamental contribution of their demonstration is that they do not rely too much on the proposed approach, which comprises three essential aspects: - it changes the evaluation problems of the company and the investments choice problems on the financial market; - it clearly ...

Axis Long Term Equity Fund - Growth

... reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covere ...

... reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covere ...

ACCOUNTING

... and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with generally accepted auditing standards. Tho ...

... and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with generally accepted auditing standards. Tho ...

investment report - Brenthurst Wealth Management

... Newspapers are full of adverts offering substantially higher interest rates. One hotelbuilding scheme in the Cape, which I have personally investigated, is offering rates up to 18% per annum, more than double the going rate elsewhere in the market place. This alone should serve as a warning to poten ...

... Newspapers are full of adverts offering substantially higher interest rates. One hotelbuilding scheme in the Cape, which I have personally investigated, is offering rates up to 18% per annum, more than double the going rate elsewhere in the market place. This alone should serve as a warning to poten ...

(acc) USD - Fund Fact Sheet - Franklin Templeton Investments

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

Issues in relation to discounted cash flow valuation - Sci-Hub

... The current era of “convergence through connectivity” is slowly but certainly acknowledging the contribution of the so-called “intangibles” like brands, copyrights & patents, human & intellectual capital etc. to the bottomlines of companies. As an obvious corollary, issues relating to the valuation ...

... The current era of “convergence through connectivity” is slowly but certainly acknowledging the contribution of the so-called “intangibles” like brands, copyrights & patents, human & intellectual capital etc. to the bottomlines of companies. As an obvious corollary, issues relating to the valuation ...

3.3.3.8 Quantitative Finance

... professionals in the finance industry. The explosive growth of computer technology, globalisation, and theoretical advances in finance and mathematics have resulted in quantitative methods playing an increasingly important role in the financial services industry and the economy as a whole. New mathe ...

... professionals in the finance industry. The explosive growth of computer technology, globalisation, and theoretical advances in finance and mathematics have resulted in quantitative methods playing an increasingly important role in the financial services industry and the economy as a whole. New mathe ...

PRUDENTIAL MEDICAL AID INFLATION PLUS 5% Q4 2016

... combination of domestic and international assets, where the asset allocation is tactically managed. This product targets a long-term real return of 5% (CPI + 5%). It is managed in such a manner that the likelihood of capital loss over 12 months is reduced. However, no guarantee of capital over any p ...

... combination of domestic and international assets, where the asset allocation is tactically managed. This product targets a long-term real return of 5% (CPI + 5%). It is managed in such a manner that the likelihood of capital loss over 12 months is reduced. However, no guarantee of capital over any p ...

Institution: Vilnius College in Higher Education

... what proportions to take then forming investment portfolio according to investment goal, how to choose investment strategy according to investment goals and how to choose optimal instruments. This subject also analyses how to evaluate risk and return of investment portfolio and how to make adjustmen ...

... what proportions to take then forming investment portfolio according to investment goal, how to choose investment strategy according to investment goals and how to choose optimal instruments. This subject also analyses how to evaluate risk and return of investment portfolio and how to make adjustmen ...

Vanguard Developed All-Cap ex North America Equity Index Pooled

... Vanguard Index Pooled Funds, which sets out all of the features of the funds, including the fees and expenses associated with an investment in the funds, as well as the risks and conditions associated with an investment in the funds. This document does not provide disclosure of all information requi ...

... Vanguard Index Pooled Funds, which sets out all of the features of the funds, including the fees and expenses associated with an investment in the funds, as well as the risks and conditions associated with an investment in the funds. This document does not provide disclosure of all information requi ...

More Builders and Fewer Traders

... 9 Robert J. Shapiro, “Income growth and decline under recent U.S. presidents and the new challenge to restore broad economic prosperity,” Brookings, March 2015, page 3. 10 Bureau of Labor Statistics, “Labor Productivity and Costs,” accessed June 17, 2015. http://www.bls.gov/lpc. We are aware of th ...

... 9 Robert J. Shapiro, “Income growth and decline under recent U.S. presidents and the new challenge to restore broad economic prosperity,” Brookings, March 2015, page 3. 10 Bureau of Labor Statistics, “Labor Productivity and Costs,” accessed June 17, 2015. http://www.bls.gov/lpc. We are aware of th ...

Motivation - Center for IT and e

... cause smaller companies not to go public and some companies to withdraw from the public markets. No matter public or private, SOX impacts all companies through the provisions concerning to enforcement of federal laws and regulations. Therefore, a private company entrepreneur who hopes to be acquired ...

... cause smaller companies not to go public and some companies to withdraw from the public markets. No matter public or private, SOX impacts all companies through the provisions concerning to enforcement of federal laws and regulations. Therefore, a private company entrepreneur who hopes to be acquired ...

Tom Gores - Palace of Auburn Hills

... like Reggie Jackson, Marcus Morris, Tobias Harris, Jon Leur, Ish Smith and Boban Marjanovic, The rebuilding effort is clearly paying off. The Pistons returned to the NBA playoffs last year, competing hard against a Cavaliers team that went on to win the championship. As the youngest team in the post ...

... like Reggie Jackson, Marcus Morris, Tobias Harris, Jon Leur, Ish Smith and Boban Marjanovic, The rebuilding effort is clearly paying off. The Pistons returned to the NBA playoffs last year, competing hard against a Cavaliers team that went on to win the championship. As the youngest team in the post ...

ABA Discussion Paper - American Bankers Association

... in many banks newly qualifying as PBEs. Banks that may otherwise be viewed as a private entity are, thus, urged to review FASB’s definition of a PBE with their auditors to determine whether their corporate structure or product offerings will disallow the private entity GAAP definition. Banks that ma ...

... in many banks newly qualifying as PBEs. Banks that may otherwise be viewed as a private entity are, thus, urged to review FASB’s definition of a PBE with their auditors to determine whether their corporate structure or product offerings will disallow the private entity GAAP definition. Banks that ma ...

NBER WOIKING PAPER SERIES RISK OF DEBT REPUDIATION Jeffrey Sachs

... assuming that the loan can be predicated on the investment decision each period. We refer the reader to our previous work (1984) for further discussion. ...

... assuming that the loan can be predicated on the investment decision each period. We refer the reader to our previous work (1984) for further discussion. ...

Rate of return = $2317.24 / $20000 = 11.59% per

... worthless shares. There is no limit to what you can make because there is no maximum value for your shares – they can increase in value without limit. ...

... worthless shares. There is no limit to what you can make because there is no maximum value for your shares – they can increase in value without limit. ...

Click to download IMVA Opportunity November 2014

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

Chapter 5

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.