No Slide Title

... basis of publicly available information, internally developed data and other sources believed to be reliable. All reasonable care has been taken to ensure the facts stated are accurate and opinions given are fair and reasonable, but no guarantee, warranty or representation expressed or implied is gi ...

... basis of publicly available information, internally developed data and other sources believed to be reliable. All reasonable care has been taken to ensure the facts stated are accurate and opinions given are fair and reasonable, but no guarantee, warranty or representation expressed or implied is gi ...

Reporting Form SRF 536.0 Repurchase Agreements Instructions

... management, increasing income generated from a security, and/or to minimise the cost of borrowing. Securities lending/borrowing tends to take place to cover ‘short’ positions in a security, and/or to increase income generated from a security. Repos and securities lending/borrowing are very similar, ...

... management, increasing income generated from a security, and/or to minimise the cost of borrowing. Securities lending/borrowing tends to take place to cover ‘short’ positions in a security, and/or to increase income generated from a security. Repos and securities lending/borrowing are very similar, ...

Answers to Concepts Review and Critical

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...

2017 Q1 Industry Investment Report - Private Equity Growth Capital

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

15-1 CHAPTER 15 Capital Structure: Basic Concepts

... MM Proposition III that there is no risk associated with leverage in a no tax world. Difficulty level: Medium HOMEMADE LEVERAGE d 26. Bryan invested in Bryco, Inc. stock when the firm was financed solely with equity. The firm is now utilizing debt in its capital structure. To unlever his position, B ...

... MM Proposition III that there is no risk associated with leverage in a no tax world. Difficulty level: Medium HOMEMADE LEVERAGE d 26. Bryan invested in Bryco, Inc. stock when the firm was financed solely with equity. The firm is now utilizing debt in its capital structure. To unlever his position, B ...

FCA Smaller Business Practitioner Panel Response to HMT EU

... level. While the ESAs work to date has been good, any move to concentrate greater supervisory or rule-making power at the ESAs risks creating a regulatory environment that is less attuned to the domestic market than one created by a domestic regulator. 8. Does the UK have an appropriate level of inf ...

... level. While the ESAs work to date has been good, any move to concentrate greater supervisory or rule-making power at the ESAs risks creating a regulatory environment that is less attuned to the domestic market than one created by a domestic regulator. 8. Does the UK have an appropriate level of inf ...

Banque de Luxembourg

... and control of risks are the main concerns for investors seeking to invest in equities. Against this backdrop, BLI - Banque de Luxembourg Investments S.A. will launch the BL-European Family Businesses fund, a new equities fund that invests in around 60 listed European family businesses. The current ...

... and control of risks are the main concerns for investors seeking to invest in equities. Against this backdrop, BLI - Banque de Luxembourg Investments S.A. will launch the BL-European Family Businesses fund, a new equities fund that invests in around 60 listed European family businesses. The current ...

I. Supervision of Asset Management Companies Based on Risk

... 3. Customer relationship risk: Assessment the risk of investor relations if investment advice given to investors is accurate, adequate, up-to-date and in a timely manner. Assessment the effectiveness of the asset management companies’ subscription and redemption system and their complaint handling ...

... 3. Customer relationship risk: Assessment the risk of investor relations if investment advice given to investors is accurate, adequate, up-to-date and in a timely manner. Assessment the effectiveness of the asset management companies’ subscription and redemption system and their complaint handling ...

The production of financial corporations and price/volume

... deflator) adjusted for quality change in the output of financial services (ii) the output indicator method which involves breaking down the different characteristics linked to financial services (numbers and values of loans and deposits, savings, money transfers, etc). For each of the characteristic ...

... deflator) adjusted for quality change in the output of financial services (ii) the output indicator method which involves breaking down the different characteristics linked to financial services (numbers and values of loans and deposits, savings, money transfers, etc). For each of the characteristic ...

Financial Management: Principles and Applications

... Principles: Principle 3: Cash Flows Are the Source of Value 6) Colin, a private individual, sold one thousand shares of stock in DEF Corporation to Colleen, also a private individual. This represents a secondary market transaction. Answer: TRUE Diff: 2 Topic: 2.3 The Financial Marketplace: Securitie ...

... Principles: Principle 3: Cash Flows Are the Source of Value 6) Colin, a private individual, sold one thousand shares of stock in DEF Corporation to Colleen, also a private individual. This represents a secondary market transaction. Answer: TRUE Diff: 2 Topic: 2.3 The Financial Marketplace: Securitie ...

Working in partnership with financial intermediaries

... Our discretionary services Managed portfolio solutions Our risk rated models offer a fully transparent portfolio provided via a variety of marketleading platforms and wrappers. With six models, including an income option, there is a solution to suit most risk appetites. Portfolios will provide expo ...

... Our discretionary services Managed portfolio solutions Our risk rated models offer a fully transparent portfolio provided via a variety of marketleading platforms and wrappers. With six models, including an income option, there is a solution to suit most risk appetites. Portfolios will provide expo ...

Sponsors Address - UWI St. Augustine

... Ladies and gentlemen in order to restore confidence we must promote the principles of trust, clarity, equity, transparency and good governance. You may recall a couple years ago when food price inflation was rampant that there were allegations of price gouging on the part of “middle men”. I made the ...

... Ladies and gentlemen in order to restore confidence we must promote the principles of trust, clarity, equity, transparency and good governance. You may recall a couple years ago when food price inflation was rampant that there were allegations of price gouging on the part of “middle men”. I made the ...

View Document

... Flexibility to take calculated but relatively controlled risks. Effective risk management is about more than limits; it’s about seeking better outcomes and reducing downside risk. We have measures in place to help guide and monitor the process, but provide investment teams leeway to take on a certai ...

... Flexibility to take calculated but relatively controlled risks. Effective risk management is about more than limits; it’s about seeking better outcomes and reducing downside risk. We have measures in place to help guide and monitor the process, but provide investment teams leeway to take on a certai ...

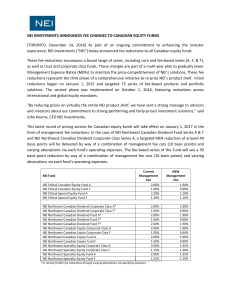

NEI Investments announces fee changes to Canadian equity funds

... NEI INVESTMENTS ANNOUNCES FEE CHANGES TO CANADIAN EQUITY FUNDS [TORONTO, December 14, 2016] As part of an ongoing commitment to enhancing the investor experience, NEI Investments (“NEI”) today announced fee reductions to all Canadian equity funds. These fee reductions encompass a broad range of seri ...

... NEI INVESTMENTS ANNOUNCES FEE CHANGES TO CANADIAN EQUITY FUNDS [TORONTO, December 14, 2016] As part of an ongoing commitment to enhancing the investor experience, NEI Investments (“NEI”) today announced fee reductions to all Canadian equity funds. These fee reductions encompass a broad range of seri ...

Chapter 3. Security Markets Powerpoints File

... commitment on proceeds to the issuing firm – Best Efforts: banker(s) helps sell but makes no firm commitment • Negotiated vs. Competitive Bid – Negotiated: issuing firm negotiates terms with investment banker – Competitive bid: issuer structures the offering and secures bids ...

... commitment on proceeds to the issuing firm – Best Efforts: banker(s) helps sell but makes no firm commitment • Negotiated vs. Competitive Bid – Negotiated: issuing firm negotiates terms with investment banker – Competitive bid: issuer structures the offering and secures bids ...

Emerging Markets – Income Opportunities

... It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the prod ...

... It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the prod ...

award from institutional investor magazine

... performance track record, risk management, investment discipline and selection, portfolio management, stability of investment team, investor relations and reputation with GP’s according to Institutional Investor magazine criteria. Michael Rees, Head of Dyal Capital Partners said, “The fact that thes ...

... performance track record, risk management, investment discipline and selection, portfolio management, stability of investment team, investor relations and reputation with GP’s according to Institutional Investor magazine criteria. Michael Rees, Head of Dyal Capital Partners said, “The fact that thes ...

Shining a light

... Network on Climate Risk and other global investors called on the SEC to improve disclosure of climate change and other material sustainability risks in securities filings. This summer also saw the UN Environment Programme Finance Initiative, with the backing of investment managers representing $2 tr ...

... Network on Climate Risk and other global investors called on the SEC to improve disclosure of climate change and other material sustainability risks in securities filings. This summer also saw the UN Environment Programme Finance Initiative, with the backing of investment managers representing $2 tr ...

Impact on SAA - Insurance Top 10 Australia

... focusing on monetary stimulus has created an abundance of capital seeking higher investment returns. This has led to a reduction in the yields available on the assets traditionally used by insurers, and even though we expect yields in some markets to gradually start ticking up (e.g. the US), they ar ...

... focusing on monetary stimulus has created an abundance of capital seeking higher investment returns. This has led to a reduction in the yields available on the assets traditionally used by insurers, and even though we expect yields in some markets to gradually start ticking up (e.g. the US), they ar ...

inland western - SNL Financial

... Safe Harbor Statement Forward-looking statements are statements that are not historical including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, and are typically identified by such words as “believe,” “expect,” “anticipate,” ...

... Safe Harbor Statement Forward-looking statements are statements that are not historical including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, and are typically identified by such words as “believe,” “expect,” “anticipate,” ...

Boost FTSE 250 2x Leverage Daily ETP (2MCL)

... are willing to magnify potential losses Investors can lose the full value of their initial investment, however they cannot lose more than their initial investment Losses are magnified due to the nature of leveraged returns. Therefore, Short and Leveraged ETPs are only suitable for investors willing ...

... are willing to magnify potential losses Investors can lose the full value of their initial investment, however they cannot lose more than their initial investment Losses are magnified due to the nature of leveraged returns. Therefore, Short and Leveraged ETPs are only suitable for investors willing ...

AEGON repays one third of government support

... THE HAGUE - AEGON yesterday repaid one third of the EUR 3 billion in core capital the company secured last year through its largest shareholder, Vereniging AEGON and funded by the Dutch government. AEGON first announced its intention to repay the Dutch government in August when it raised EUR 1 billi ...

... THE HAGUE - AEGON yesterday repaid one third of the EUR 3 billion in core capital the company secured last year through its largest shareholder, Vereniging AEGON and funded by the Dutch government. AEGON first announced its intention to repay the Dutch government in August when it raised EUR 1 billi ...

New Venture Financing

... to remedy market failure – incomplete markets occur when the risk perceived by the entrepreneur is significantly lower than the risk perceived by the financing institution Market failure is usually more serious at the very early stage of development of new business ideas, and in particular for ideas ...

... to remedy market failure – incomplete markets occur when the risk perceived by the entrepreneur is significantly lower than the risk perceived by the financing institution Market failure is usually more serious at the very early stage of development of new business ideas, and in particular for ideas ...

PRIVATE EQUITY FOR THE COMMON MAN

... A “blind pool” offering is the industry standard, meaning that there are no assets under management at the time of the initial offering. Lacking assets, the fund is externally managed by the Advisor at inception. It is generally disclosed that significant conflicts of interest exist due to the Advi ...

... A “blind pool” offering is the industry standard, meaning that there are no assets under management at the time of the initial offering. Lacking assets, the fund is externally managed by the Advisor at inception. It is generally disclosed that significant conflicts of interest exist due to the Advi ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.