PDF - 50 South Capital

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

Finding Value In Vertu Motors PLC

... underpinned by oil and gas industries, and a sizzling hot real estate market. Another structural challenge for AutoCanada is their inability to own specific manufacturer brands, like Ford. This is a symptom of them being public and ultimately the disproportionate influence manufacturers have on auto ...

... underpinned by oil and gas industries, and a sizzling hot real estate market. Another structural challenge for AutoCanada is their inability to own specific manufacturer brands, like Ford. This is a symptom of them being public and ultimately the disproportionate influence manufacturers have on auto ...

The Henderson Global Equity Income Fund is designed to generate

... The team strongly believes that, over the long term, dividend paying stocks which exhibit consistent dividend growth will significantly outperform the broader market. There are four key reasons why the team believes dividends are important. Cashflow – companies cannot sustain dividends without suf ...

... The team strongly believes that, over the long term, dividend paying stocks which exhibit consistent dividend growth will significantly outperform the broader market. There are four key reasons why the team believes dividends are important. Cashflow – companies cannot sustain dividends without suf ...

The time has come: Let's shut down the financial casino

... The crisis shows that markets left alone without political regulation and democratic accountability lead to disastrous results. Therefore, democratic control is required as well as international cooperation instead of destructive competition between national economies. In economic and financial deci ...

... The crisis shows that markets left alone without political regulation and democratic accountability lead to disastrous results. Therefore, democratic control is required as well as international cooperation instead of destructive competition between national economies. In economic and financial deci ...

Hindalco EGM Notice - 2015

... resolution by the Company enabling the Board to create, issue, offer and allot Equity Shares, GDRs, ADRs, Foreign Currency Convertible Bonds, Convertible or Nonconvertible Debentures and such other securities as stated in the resolution (the “Securities”), including by way of a qualified institution ...

... resolution by the Company enabling the Board to create, issue, offer and allot Equity Shares, GDRs, ADRs, Foreign Currency Convertible Bonds, Convertible or Nonconvertible Debentures and such other securities as stated in the resolution (the “Securities”), including by way of a qualified institution ...

Active vs. Passive Management in 12 Points

... differences between simulated results and the actual results. There are numerous factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for in the preparation of simulated results and all of which can adversely affect actu ...

... differences between simulated results and the actual results. There are numerous factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for in the preparation of simulated results and all of which can adversely affect actu ...

Understanding Life Science Partnership Structures

... by Pfizer’s announced acquisition of Wyeth), the partnership options described in this article offer options for pharmaceutical and device companies in these challenging economic times. Dramatic declines in the capital markets have been in part caused by, and accompanied by the credit crunch. This r ...

... by Pfizer’s announced acquisition of Wyeth), the partnership options described in this article offer options for pharmaceutical and device companies in these challenging economic times. Dramatic declines in the capital markets have been in part caused by, and accompanied by the credit crunch. This r ...

Management 5187 - Baylor University

... Allete Energy Inc. (ALE) is considering an expansion into wind farms. Currently, natural gas is its primary source for electricity production. However, several executives think that a wind farm venture would offer valuable diversification benefits. Other executives believe they could exploit the com ...

... Allete Energy Inc. (ALE) is considering an expansion into wind farms. Currently, natural gas is its primary source for electricity production. However, several executives think that a wind farm venture would offer valuable diversification benefits. Other executives believe they could exploit the com ...

Appendix - American Public Power Association

... The general idea of computing financial returns is to evaluate the returns earned by investors in a particular company relative to investments in other firms and relative to risks of the investment. In this study it is of particular interest to compare returns earned by investors from selling genera ...

... The general idea of computing financial returns is to evaluate the returns earned by investors in a particular company relative to investments in other firms and relative to risks of the investment. In this study it is of particular interest to compare returns earned by investors from selling genera ...

Statement of Risk - ACT Department of Treasury

... Currency Risk – Territory Banking Account and Superannuation Provision Account Investments and Territory Borrowings In relation to Territory borrowings, the Territory does not have any financial borrowings in non-Australian denominated currency and therefore is not exposed to any currency risk. The ...

... Currency Risk – Territory Banking Account and Superannuation Provision Account Investments and Territory Borrowings In relation to Territory borrowings, the Territory does not have any financial borrowings in non-Australian denominated currency and therefore is not exposed to any currency risk. The ...

MIGA in Kosovo

... Amounts can include interest principal for debt and future retained earnings for equity ...

... Amounts can include interest principal for debt and future retained earnings for equity ...

RFP Questionnaire - Meketa Investment Group

... 30. How do you ensure that your clients adhere to policies set forth for the protection of the firm’s other clients (e.g., prevention of market timing)? 31. How are violations of the firm’s ethics policies handled? 32. Is your firm represented by any third party firm or individual whose purpose is m ...

... 30. How do you ensure that your clients adhere to policies set forth for the protection of the firm’s other clients (e.g., prevention of market timing)? 31. How are violations of the firm’s ethics policies handled? 32. Is your firm represented by any third party firm or individual whose purpose is m ...

Entrepreneurial-Finance-3rd-Edition-Leach-Test-Bank

... plan is a written document that describes the proposed venture in all of the following terms except: a. the proposed product or service opportunity b. the accounting data for the last five years c. current resources available to the venture ...

... plan is a written document that describes the proposed venture in all of the following terms except: a. the proposed product or service opportunity b. the accounting data for the last five years c. current resources available to the venture ...

Irish Pension Schemes, new SORP (Statement of Recommended

... challenges James Fitzpatrick CPA and Padraig Osborne FCA highlight some of the key areas in Pension Scheme financial statements impacted by the new Pension SORP and FRS 102. ...

... challenges James Fitzpatrick CPA and Padraig Osborne FCA highlight some of the key areas in Pension Scheme financial statements impacted by the new Pension SORP and FRS 102. ...

Investment products risk and fees disclosure

... manager (management company). By purchasing a fund unit, the unit owner becomes the owner of the fund's pool of assets according to the value of his/her unit. The value of fund unit is generally calculated by the management company and it is based on the value of securities constituting part of fund ...

... manager (management company). By purchasing a fund unit, the unit owner becomes the owner of the fund's pool of assets according to the value of his/her unit. The value of fund unit is generally calculated by the management company and it is based on the value of securities constituting part of fund ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... common investors went into overdrive. Suddenly, real estate was faced with a credit crisis created by an extrageneous market. Floating rate investors overseas went on strike (according to the Financial Times), refusing to purchase any real estate structured finance instruments – viewing all bonds s ...

... common investors went into overdrive. Suddenly, real estate was faced with a credit crisis created by an extrageneous market. Floating rate investors overseas went on strike (according to the Financial Times), refusing to purchase any real estate structured finance instruments – viewing all bonds s ...

derivatives_general_paper

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

PRESSE-INFORMATION Press-Release I Tiskové zprávy

... which comprises equity financing, bonds and bank loans. By doing so, the NET4GAS group is replacing virtually the same amount of acquisition debt, which resulted from the change in ownership in 2013 and which was at that time also presented to the Czech regulator, by a less expensive and more transp ...

... which comprises equity financing, bonds and bank loans. By doing so, the NET4GAS group is replacing virtually the same amount of acquisition debt, which resulted from the change in ownership in 2013 and which was at that time also presented to the Czech regulator, by a less expensive and more transp ...

Strategy Guide - Standard Life Investments

... of multi-asset strategies that we expect not only to earn a positive return over a longer time horizon, but also to earn that return in a different way from GEM equities. These strategies – covering interest rates, currencies, relative value, inflation and opportunistic investments – contain a blend ...

... of multi-asset strategies that we expect not only to earn a positive return over a longer time horizon, but also to earn that return in a different way from GEM equities. These strategies – covering interest rates, currencies, relative value, inflation and opportunistic investments – contain a blend ...

REITs - Bivio

... total investment assets in real estate. Must receive at least 75% of their gross income from rents or mortgage interest Have no more than 20% of assets consist of stocks in taxable REIT subsidiaries. ...

... total investment assets in real estate. Must receive at least 75% of their gross income from rents or mortgage interest Have no more than 20% of assets consist of stocks in taxable REIT subsidiaries. ...

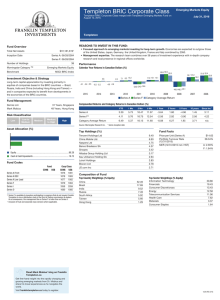

Templeton BRIC Corporate Class Series A

... rates of return are historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual ...

... rates of return are historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual ...

The Income Capitalization Approach

... competing investments suffer under the same inflation rate; therefore, competition will not allow the investor to adjust for this factor. Investors may want higher yields during high inflation periods but the alternatives may not allow it. ...

... competing investments suffer under the same inflation rate; therefore, competition will not allow the investor to adjust for this factor. Investors may want higher yields during high inflation periods but the alternatives may not allow it. ...

Indirect Investing

... Investors can purchase directly or indirectly Usually only require a small minimum investment Investors can redeem shares anytime Investors purchase/redeem at NAV plus or minus ...

... Investors can purchase directly or indirectly Usually only require a small minimum investment Investors can redeem shares anytime Investors purchase/redeem at NAV plus or minus ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.