* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download draft - York University

Survey

Document related concepts

Transcript

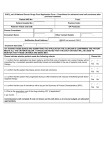

YORK UNIVERSITY MANAGEMENT DIRECTIVE Taxation Rules & Procedures Employee Employer Relationship vs. Consultant The purpose of this package is to provide information and assistance to York Managers regarding York University’s Taxation Rules and Procedures as they relate to the Employee Employer Relationship vs. Consultant status. Included in this package are two documents: 1. York University Taxation Rules & Procedures Employer/Employee Relationship vs. Consultants – Internal Management Directive. It is labeled as attachment #1. 2. York University Taxation Rules & Procedures Employer/Employee Relationship vs. Consultant – General Distribution. It is labeled as attachment #2. Attachment #1 is strictly to be used and distributed to York Managers and not for distribution to Consultants or Non York Employees. Attachment #2 can distributed to Consultants and Non York employees and is intended to clarify York’s position on the issue of the Employee Employer Relationship vs. Consultant at York University. With the increased use of consultants in Canada, Canada Revenue Agency is scrutinizing employers more diligently than in the past. The University must be extremely cautious in recognizing consultant status and take a formal position on payment policies. The Human Resources and Finance Divisions must process payments to persons providing personal services (consultants) to York University in a manner which complies with the Income Tax Act of Canada. Failure to appropriately withhold source deductions is an offence under the Act and related legislation, and results in substantial interest, penalties and fines for York. The classification and taxation treatment of workers considers two basic categories of employment relationships: (1) employee-employer and (2) consultant. The employee/employer classification requires withholding of source deductions (income taxes, Canada Pension Plan premiums and Employment Insurance premiums) by the employer. The consultant classification requires the consultant to collect and pay the GST if revenue exceeds $30,000 per year. Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Canada Revenue Agency uses four major tests to determine the appropriate classification. (a) Control tests that review who has control over the work and the individual doing the work. (b) Ownership tests that review who provides the equipment needed to create the output of the individual’s work. (c) Chance of profit/risk tests that review if there is a guarantee of payment or a risk of not receiving full payment if the work is not provided as required. (d) Integration tests that review whether the individual is fully part of University processes or has very limited interaction with University employees, perhaps only with whom they have contracted to do the work. If the University controls the individual’s work, owns the equipment used, pays for the hours worked and/or the individual is part of University processes, then an employee/er relationship exists in the view of Canada Revenue Agency, and source deductions must be withheld. In the past, York has allowed a registered business (i.e. not incorporated) to be one of the benchmarks to determine that a consultant relationship exists, and hence no requirement to withhold source deductions. However, based on recent decisions against York by both the Employment Health Tax and the Workers Safety & Insurance Board auditors, use of the “registered business test” exposes the University to a significant compliance risk and must cease. A registered business (but not incorporated) will no longer be a factor when considering whether an employment relationship exists. Current Canada Revenue Agency assessing practices do not view registered businesses as constituting a consulting relationship. To determine how individuals should be classified, the University has adopted the following rules. Note that individuals paid through Accounts Payable have no source deductions withheld. Individuals paid through Payroll will be subjected to source deductions. (a) Invoices from legally incorporated companies will be treated as payments to consultants and paid by Accounts Payable for the fiscal year 2000. In mid 2001, incorporated businesses being paid by York as consultants will be reassessed and will be treated as consultants only if the criterion for consultant status is met according to the questionnaires in this document (b) Individuals with a GST registration number or business registration number will not automatically be paid by Accounts Payable. The attached employee/consultant questionnaire will determine the results. 2 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures (c) Lawyers and Accountants, billing as sole proprietors, will be considered to be unincorporated and the employee/consultant tests will determine the results. (d) Lawyers and Accountants, billing as partnerships, may be considered incorporated and deemed to be consultants. The taxation of payments to researchers, assistant researchers and other individuals paid from grant revenue will not be covered in this document. Processing will continue as is until later this year when a report will be prepared in conjunction with the Research Division on taxation treatment of individuals. The adoption of the new procedures will be transitioned as follows: (a) New unincorporated service providers to York will be assessed, prior to first payment, on the new basis outlined in the attached document. (b) Course directors appointed for work commencing May 1, 2000 will adhere to this document and will be paid as employees if not incorporated. (c) Any person not paid in accordance with the guidelines of this document who does not have a written contract with the University will be switched to the appropriate payment method as soon as possible and not later than May 1, 2000. It will be the responsibility of the Manager authorizing the invoices for payment to initiate the transition to employee status. (d) Any person not paid in accordance with this document who does have a written contract with the University will be switched to the appropriate payment method by May 1, 2000. . It will be the responsibility of the Manager who authorized the contract to initiate the transition to employee status. Your assistance is required to ensure that York is in compliance with Canada Revenue Agency assessing practices and the law. If you require further information contact Sue Bulof, Director, Payroll & HRIM (22534) or Cameron Rogers, Assistant Comptroller (55877). 3 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Attachment #1 YORK UNIVERSITY TAXATION RULES AND PROCEDURES EMPLOYEE/ER – CONSULTANT Internal Management Directive APRIL 2000 4 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures INTRODUCTION The Canada Revenue Agency along with other governing agencies (Employment Standards, Employers Health Tax, WSIB) take a rigorous audit approach of companies and not-for-profit organizations with respect to the classification and taxation of employees versus consultants. York must be in compliance with current assessing practices and legislation. York must ensure that any individual classified as a consultant meets the requirements set out by Canada Revenue Agency. Otherwise these individuals must be classified as employees and taxed as such. In order to explain the classification and taxation treatment of workers, two basic categories of relationships must be reviewed. 1. Employee-Employer 2. Consultant Each of the above categories has specific tax treatment and responsibility for withholding tax. Generally, category 1 requires withholding of source deductions (income taxes, Canada Pension Plan premiums and Employment Insurance premiums) by the employer. Category 2 generally requires the consultant to collect and pay the GST. Historically at York, a number of factors were used to assess whether an individual was to be paid as an employee or as a consultant. One of the criteria used was based on the use of a registered business. A registered business (but not incorporated) is no longer to be used as a factor when considering whether an employment relationship exists. Current Canada Revenue Agency assessing practices do not view registered businesses as constituting a consulting relationship. All persons with responsibility for hiring and paying faculty, students and staff must be aware of, and comply with the Acts and the Regulations. The policies and guidelines outlined in this document are derived from Canada Revenue Agency assessing practices and regulations. There is little flexibility in these regulations. This manual provides guidance concerning the alternative methods of payment to individuals who provide services to the University. We have developed guidelines, examples and a questionnaire to assist you in understanding which individuals require the withholding and remitting of tax and which do not. The Assistant Comptroller (55877) will approve the classification of any individuals thought to be consultants. Topics discussed in the document are as follows: A) Examples and Taxation Status B) Guidelines B1) Consultants, Contractors Paid by Accounts Payable B2) Employees Paid by Payroll C) How to Determine if Employee or Consultant Status D) Questionnaire E) Part-time Instructors F) Honoraria G) Research Grants – Procedures to be issued later this year H) Payment Procedures 5 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures A) EXAMPLES AND TAXATION STATUS (Extracts from CAUBO Taxation Guide (Canadian Association of University Business Officers) – Prepared by Ernst & Young) Note that if an individual provides numerous services to York, and the individual is considered an employee for one of the services, then they will be treated as an employee for all services rendered to York. Taxation Status Definition (*): Employee - Payroll: reflects employee status and requires full withholding and reporting of statutory source deductions and paid by Payroll Invoice - Accounts Payable: reflects consultant status and withholdings are not required. EXAMPLES TAXATION STATUS (*) INSTRUCTORS 1 Part-time instructors of regular courses (i.e. 4 months, course directors) other than incorporated companies 2 Non-routine courses and special seminars of a few days Employee - Payroll 3 Guest lecturers • no ongoing responsibility to the participants or students attending • no marking or grading responsibility • lectures infrequent, usually non-credit and in most cases not part of a regular course • fee charged to those attending • no appointment with the university • no office facilities or support staff provided • university has little control over the content of the lecture other than with respect to topic • lecturer paid a single fee for giving the lecture and payment made at that time and • lecture or lecture series of limited duration. NON-INSTRUCTIONAL 4 Other miscellaneous non-instructional services • directors, managers, supervisors, executive officers, administration officers • any job function which is integrated into the University • cooperative liaison services • editorial writing assistance • invigilating • alumni consulting Invoice – Accounts Payable Invoice – Accounts Payable Employee - Payroll Employee - Payroll Employee - Payroll Employee - Payroll Employee - Payroll Employee - Payroll 6 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures • honorariums (See section (F) for details) • ongoing advisory services • marking exams and papers (applicable to CUPE Exempt only) NON-INSTRUCTIONAL (CONTINUED) 4 Other miscellaneous non-instructional services • grading correspondence courses (applicable to CUPE Exempt only) • preparing exams (applicable to CUPE Exempt only) • preparing course outlines • preparing graphic illustrations • preparing textbooks, done away from the University • typing, paid by the page • writing a computer program, but not integrated into operations • preparing stage props for a play • proposal development and write up • facilitation of Principals Qualifications Program • interpreting services • computerized note taking Non-Employee - Payroll Employee - Payroll Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable Invoice – Accounts Payable In those cases where services which otherwise would not be considered employment are also provided by a York employee, then those services would generally be considered to be rendered by an employee rather than an independent contractor. B) Guidelines B1) Consultants Paid by Accounts Payable The University may retain services from a service provider who is a separate and distinct business. These services are for specific work, services not integrated into York’s operations, for short time duration, and the consultant bears the financial risk of the work they provide to York. In those cases, where the consultant is performing valid services as a consultant, an invoice is processed through Accounts Payable and no income tax is withheld. These consultants are not to provide services that are normally provided by employees of the University as this would mean they are integrated into York’s 7 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures operations. Invoicing, purely to avoid the source deduction of income tax and employee deductions does not relieve the University from the legal liability to withhold and remit source deductions. Therefore, the assumption will be that a service provider is an employee first until proven to be a consultant. Service providers invoicing Account Payable are required to report this income in their personal income tax returns. York will not provide a T4A for this income. Therefore, the individual must retain copies of invoices, for use in completing their personal income tax return. If the consultant is incorporated, they will be paid by Accounts Payable. We should not be advising individuals to incorporate in order to avoid source deductions as these corporations could, in certain circumstances, be subject to challenge by Canada Revenue Agency and other assessing agencies (i.e. ESA, EHT, WSIB) as constituting “personal service businesses”. An unincorporated registered business will not be automatically given consultant status unless the function is included in the example chart above as “Invoice – Accounts Payable” and a completed questionnaire (contained later in this report) is completed. B2) Employees Paid by Payroll The University may obtain services by hiring an individual as an employee. Payments to employees are processed through Payroll and applicable withholding and reporting of taxes is made to Canada Revenue Agency. The University’s reporting requirements are separate and distinct from reporting requirements of the service provider/employee. Canada Revenue Agency has the power to make an income tax reassessment in respect of a payment to an individual, (however made), which it considers to be employment income. C) How to Determine if Employee or Consultant Status To determine if a service provider is an employee or a consultant, you need to examine and analyze the terms and conditions of the worker’s service/employment contract as it relates to four factors discussed below. 1. The Control Test The control test deals with the level of management prerogative, direction and control available to the service provider. If the individual/entity providing the service determines how, when and for what cost the services are to be offered and provided, they are more likely consultants/contractors. If University management exercises control over what is to be done, how and when and for what remuneration; it is more likely an employment relationship. 2. The Ownership Test 8 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures The ownership test relates to who generally supplies the tools to do the work. In an employer-employee relationship, the employer generally supplies the equipment required by the employee. In addition, the employer covers the costs related to their use, repairs, insurance, rental and operations. In a business relationship, workers generally supply their own equipment and supplies. Individuals who work at the University are generally supplied computers, telephones and desks. 3. The Chance of Profit/Risk of Loss In an employer-employee relationship, the employer alone assumes the risk of loss. The employer also covers operating expenses. The employee does not face financial risk and is entitled to his full salary regardless of the financial health of the business. The income of the employee does not depend on the results achieved at the end of the contract. 4. The Integration Test Where the worker integrates his activities into the University activities, he is considered an employee. If the worker integrates the University work into his commercial activities then a consultant role is being played. D) Table to assist in the Determining whether Income is that of a Consultant or Employee? See Attachment #2 Appendix A (Derived from the November 1998 Canada Revenue Agency Consultant or Employee Booklet) The questionnaire must be completed by the York manager hiring the worker and also signed by the same manager if the worker is to be classified as a consultant. A general guideline is that if 3 or more questions are answered by completing the “York Management” column, the individual is more likely to be an employee. The completed questionnaire is to be submitted to the Manager of General Accounting. (See Payment Procedures H). In determining how individuals should be classified, the University has adopted the following rules: 1) 2) 3) 4) Only invoices from incorporated companies will be automatically paid by Accounts Payable for the fiscal year 2000. By mid-year 2001 we will be reviewing the form of the income received by the incorporated company to assess employee or consultant status. Individuals with a GST registration number or business registration number will not automatically be paid by Accounts Payable. The employee/consultant tests above will determine the results and a completed questionnaire will be submitted for approval. Lawyers and accountants, who are sole proprietors, will be paid as employees if the service is of an employee nature. Lawyers and accountants, who are partnerships, will be paid as consultants. 9 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures 5) 6) If payroll has been advised by the Office of Research Administration (ORA) that the payment is from a research grant, then the amount will be paid through payroll and reported on a T4A. Formal application must be made through ORA and adjudicated by committee in order to be eligible. All others will be paid pursuant to a PAF through payroll. All payments made through Payroll will be considered taxable and reported on a T4. E) PART-TIME INSTRUCTORS Providers of part-time academic instruction are to be paid through payroll with applicable withholdings and reported on a T4. This is true for full courses and half courses. Only incorporated companies will be paid by Accounts Payable. This excludes unincorporated businesses. If those who teach part-time and decide to incorporate now in order to have York teaching money reported in the company, Canada Revenue Agency may question the reduced income on the personal income tax return and assess the corporation as carrying on a “personal service business”. F) HONORARIA An honorarium is a gift of an object or a small sum of money, normally less than $500.00 annually, in thanks for a favour done. Honorariums paid to individuals are processed by Payroll for both those classified as employee status and those classified as nonemployee status. For those classified as non-employee, such payments are not subjected to statutory source deductions and are reported on T4A. In the case where an individual is a York employee and is paid an honorarium, the payment is treated as employment income, subjected to all statutory withholdings of source deductions and as such is reported on a T4. G) RESEARCHERS The taxation of payments to researchers, assistant researchers and other individuals from grant revenue will not be covered in this document. Processing will continue as is until later this year when a report will be prepared in conjunction with the Research Division on taxation treatment of individuals. H) PAYMENT PROCEDURES 1. Payments processed by Accounts Payable are made after the department completes a Cheque Requisition form with the following: i) The service provider invoice must be attached. ii) Invoices from incorporated businesses should include the GST account number and GST amount charged; unless the service provider’s total revenue for the twelve-month period is less than $30,000. iii) Completed Consultant Questionnaire. iv) Completed Job Description Questionnaire. 2. Payments Processed through the Department of Human Resources. An ETF is completed in accordance with ETF Reference Manual and forwarded to Human Resources. 10 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures YORK UNIVERSITY TAXATION RULES AND PROCEDURES EMPLOYEE/EMPLOYER RELATIONSHIP General Distribution APRIL 2000 11 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures YORK UNIVERSITY Attachment #2 TAXATION RULES AND PROCEDURES EMPLOYEE/EMPLOYER RELATIONSHIP vs. CONSULTANT GENERAL DISTRIBUTION APRIL 2000 The Human Resources and Finance Divisions must process payments to persons providing personal services (consultants) to York University in a manner which complies with the Income Tax Act of Canada. Failure to appropriately withhold source deductions is an offence under the Act and related legislation, and results in substantial interest, penalties and fines for York. All persons with responsibility for hiring and paying faculty, students and staff must be aware of, and comply with the Acts and the Regulations. The policies and guidelines outlined in this document are derived from Canada Revenue Agency assessing practices and regulations. There is little flexibility in these regulations. General Classification The classification and taxation treatment of workers considers two basic categories of employment relationships: (1) employee-employer and (2) consultant. The employee/employer classification requires withholding of source deductions (income taxes, Canada Pension Plan premiums and Employment Insurance premiums) by the employer. The consultant classification requires the consultant to collect and pay the GST if revenue exceeds $30,000 per year. Exemptions The taxation of payments to researchers, assistant researchers and other individuals from grant revenue will not be covered in this document and processing will continue as is until later this year when a report will be prepared in conjunction with the Research Division on taxation treatment of individuals. Invoices from legally incorporated companies will be treated as payments to consultants and paid by Accounts Payable for the fiscal year 2000. In mid 2001, all incorporated businesses being paid by York as consultants will be reassessed and will be treated as consultants only if the criterion for consultant status is met according to questionnaires in this document. Employee of More than One Department or providing Numerous Functions If an individual provides numerous services to York, and the individual is considered an employee for one of the services, then they will be treated as an employee for all services rendered to York. 12 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Registered Businesses, (Not Incorporated) In the past, York has allowed a registered business (i.e. not incorporated) to be one of the benchmarks to determine that a consultant relationship exists, and hence no requirement to withhold source deductions. However, based on recent decisions against York the use of the “registered business test” exposes the University to a significant compliance risk and must cease. A registered business (but not incorporated) will no longer be a factor when considering whether an employment relationship exists. Current Canada Revenue Agency assessing practices do not view registered businesses as constituting a consulting relationship. Part-Time Instructors Providers of part-time academic instruction are to be paid through payroll with applicable withholdings and reported on a T4. This is true for full courses and half courses. Only incorporated companies will be paid by Accounts Payable. Those who teach part-time and decide to incorporate now in order to have York teaching income reported as revenue to a corporation should be advised that, Canada Revenue Agency may question the reduced income on their personal income tax returns and assess the corporation as carrying on a “personal service business”. Consultant Questionnaire to Determine Whether Income is that of a Consultant or Employee Individuals will be automatically classified as employees unless the completed questionnaire (Appendix A) indicates a consultant status. The questionnaire is to be completed by the York manager hiring the worker and also signed by the same manager if the worker is to be classified as a consultant. A general guideline is that, if the answer to 3 or more questions fall under the “York Manager” column, the individual is more likely to be an employee than a consultant. If an individual is performing teaching or they are integrated into the University’s daily operations, the taxing authorities are deeming these individuals to be employees and not consultants. The completed questionnaire is to be submitted to the Manager, Employee Compensation Services (22534) or the Comptroller (55799) for approval of the individual’s consultant status, prior to the first payment for new consultants or for continued payments to current consultants. The questions contained in the questionnaire are derived from the November 1998 Canada Revenue Agency Consultant or Employee Booklet. Job Description Questionnaire The attached Job Description Questionnaire (Appendix B) also needs to be completed, so that the appropriate employee classification can be determined. The completed questionnaire is to be submitted to the Manager, General Accounting for approval of the individual’s consultant status. 13 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Rules 1. Individuals with a GST registration number or business registration number must complete the questionnaires that will determine whether they are employees or consultants. 2. Lawyers and Accountants, billing as sole proprietors, will be considered to be unincorporated and the results of the questionnaire will be the determining factor. 3. Lawyers and Accountants, billing as partnerships, may be considered incorporated and deemed to be consultants. 4. Course directors appointed for work commencing May 1, 2000 will be paid as employees if not incorporated. 5. Any person not paid in accordance with the guidelines of this document who does not have a written contract with the University will be switched to the appropriate payment method as soon as possible and not later than May 1, 2000. 6. Any person not paid in accordance with this document who does have a written contract with the University will be switched to the appropriate method by May 1, 2000. Payment Procedures Payments processed by Accounts Payable are made after the department completes a Cheque Requisition form with the following: i) The service provider invoice must be attached. v) Invoices from incorporated businesses should include the GST account number and GST amount charged; unless the service provider’s total revenue for the twelve-month period is less than $30,000. vi) Completed Consultant Questionnaire. vii) Completed Job Description Questionnaire. Payments Processed through the Department of Human Resources. An ETF is completed in accordance with ETF Reference Manual and forwarded to Human Resources. Your assistance is required to ensure that York is in compliance with Canada Revenue Agency assessing practices and the law. 14 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Appendix A CONSULTANT QUESTIONNAIRE YORK UNIVERSITY Mgmt. Worker Control Tests Who is responsible for planning the work to be done? Who decides how much the worker is to be paid? Who decides on the time frame? Who decides how the work is to be done? Who decides the hours of work? Who decides the work location? Who supervises the tasks? Who sets the standards to be met, quality, volume and time frame? Who decides if the work needs to be redone and who bears the costs? If training is involved who pays the costs? Ownership Tests Who supplies the office equipment? Who supplies the materials? Who assumes the responsibility for the performance of the work? Chance of Profit/Risk of Loss Who covers the cost of damage to office equipment or material? Who covers the cost of liability insurance? Who covers office expenses? Who covers the cost incurred by the worker in carrying out the work? Integration Test Is the worker an integrated part of the University? Yes Do they work with students or other staff members on a regular basis? Yes Is the individual currently or have they been in the past 6 months an employee of York No No Yes No Completed By: ________________________________ ________________________________ YORK UNIVERSITY Manager (Print Name) Date _______________________________ YORK UNIVERSITY Manager Signature __________________ E-mail ___________ Extension 15 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Explanation of Key Headings in the Questionnaire The Control Test The control test deals with the level of management prerogative, direction and control available to the service provider. If the individual/entity providing the service determines how, when and for what cost the services are to be offered and provided, they are more likely consultants/contractors. If University management exercises control over what is to be done, how and when and for what remuneration; it is more likely an employment relationship. The Ownership Test The ownership test relates to who generally supplies the tools to do the work. In an employer-employee relationship, the employer generally supplies the equipment required by the employee. In addition, the employer covers the costs related to their use, repairs, insurance, rental and operations. In a business relationship, workers generally supply their own equipment and supplies. Individuals who work at the University are generally supplied computers, telephones and desks. The Chance of Profit/Risk of Loss In an employer-employee relationship, the employer alone assumes the risk of loss. The employer also covers operating expenses. The employee does not face financial risk and is entitled to his full salary regardless of the financial health of the business. The income of the employee does not depend on the results achieved at the end of the contract. The Integration Test Where the worker integrates his activities into the University activities, he is considered an employee. If the worker integrates the University work into his commercial activities then a consultant role is being played. 16 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Appendix B JOB DESCRIPTION QUESTIONNAIRE Surname: First Name: Department: Location: Title: Supervisor's Name/Title: Extension: General Information (a) Describe in detail the work performed for the University. ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ (b) Date work commenced. ______________________________________________ (c) End date of assignment.______________________________________________ (d) Hours and days of work.______________________________________________ (e) When the work is performed, is it physically done at the University or is the work performed at another location? Explain. _________________________________________________________________ _________________________________________________________________ (f) Is the work confined to a specific project or initiative or is it work of an on-going nature? _________________________________________________________________ _________________________________________________________________ 17 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Personnel Authority Does staff report to this individual? If yes, how many, what are their positions and employment categories (full time, part time, casual, work-study)? Employment Category Full time Position(s) Number supervised Part time Casual Work-study/Student With respect to the relationship with these employees, does this individual have the authority to? Hire Dismiss Discipline Evaluate performance Grant/deny requests for vacation, time off Approve overtime Assign and direct work Train/orient staff Provide general guidance 18 Issued: April 3, 2000 Modified: January 20, 2010 Taxation Rules and Procedures Information In the course of work, does this individual deal with confidential information? If yes, what is the nature of the information and the nature of involvement? ______________________________________________________________________ ________________________________________________________________ ______________________________________________________________________ Financial Responsibility Is this individual involved in the development and/or administration of budgets? If yes, explain the scope of involvement and the dollar value of the budget(s). ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ I hereby acknowledge that the information I have provided is true and accurate. ____________________________________ YORK UNIVERSITY Manager (Print Name) ______________________ Date ________________________________ YORK UNIVERSITY Manager Signature ________________ E-mail _________ Extension I have reviewed the information on this form and confirm that it is a true and accurate reflection of the work I perform at YORK UNIVERSITY. ________________________________ Consultant (Print Name) ________________________________ Consultant Signature ________________________________ Date __________________ E-mail ___________ Extension 19 Issued: April 3, 2000 Modified: January 20, 2010