* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Management & Engineering Company in China

Survey

Document related concepts

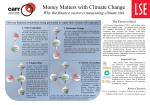

Climate change feedback wikipedia , lookup

Politics of global warming wikipedia , lookup

Climatic Research Unit documents wikipedia , lookup

Reforestation wikipedia , lookup

Climate-friendly gardening wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Carbon pricing in Australia wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Low-carbon economy wikipedia , lookup

Carbon capture and storage (timeline) wikipedia , lookup

Carbon emission trading wikipedia , lookup

Carbon Pollution Reduction Scheme wikipedia , lookup

Transcript

Management & Engineering 05 (2011) 1838-5745 Contents lists available at SEI Management & Engineering Journal Homepage: www.seiofbluemountain.com Carbon Information Disclosure Issues Research in the Listed Company in China Chen Zhang*, Chunbo Wang School of Economics and Management, Lanzhou University of Technology, Gansu 730050, P.R. China KEYWORDS Carbon emissions, Carbon information disclosure, Listed companies ABSTRACT The paper aims to study corporate carbon information disclosure in the listed companies in China and to provide theoretical basis for businesses to disclose carbon information better and reduce GHG emission. In addition to analyze the information data of Chinese companies provided by CDP, the paper also analyzes the carbon information disclosure of 85 listed companies from different industries in the SSE. The effective laws, regulations and guidelines related to the environmental information disclosure are examined as well. The findings are as follows. Firstly, how to disclose the carbon information is seldom considered in the effective laws, regulations and guidelines. Secondly, the valuable information is not fully disclosed. Thirdly, there is inconsistent as far as how companies address this subject in their filings of annual reports, social responsibility reports, sustainable development reports and CDP questionnaires is concerned. The practical implication is that the majority of listed companies in China do not voluntarily disclose carbon information makes it difficult for stakeholders to assess how the companies will be affected by risks related to climate change. Therefore, regulatory authorities should clarify the application of existing law to the disclosure of carbon information, the development of mandatory disclosure standards at the corporate level should be considered, and it is necessary for companies to develop carbon reduction strategy and realize the importance of carbon information disclosure. © ST. PLUM-BLOSSOM PRESS PTY LTD 1 Introduction Scientists believe that global warming caused by carbon emissions of human has made the natural ecological environment and human life getting worse. From the view of climate change there is no difference in carbon emissions, but from the standpoint of international political, carbon emissions is not only an economic problem but a political issue. So, carbon information disclosure of listed companies has characteristics of economic and political and the quality of disclosure has become increasingly important in larger scope. Many foreign institutions and industries have begun to disclose carbon emissions information actively, such as Carbon Disclosure Projects (CDP). Along with the influence expanding of CDP in the world, The CDP data has been used in several research papers (e.g., Ans Kolk, David Levy and Jonatan Pinkse; 2008; Stanny and Ely; 2008; Reid and Toffel; 2009; Freedman and Jaggi; 2009; Elizabeth Stanny; 2010). Kolk et al. (2008) examined the data of the 500 global companies from 2003 to 2007 provided by CDP and found that the CDP questionnaire response rate has larger, but it has been less successful in prompting firms to disclose * Corresponding author. E-mail address: [email protected] English edition copyright © ST. PLUM-BLOSSOM PRESS PTY LTD DOI: 10.5503/J. ME. 2011.05.013 91 comparable and reliable emissions data, the level of detail provided about emissions and carbon accounting is insufficient for investors needs. Elizabeth Stanny (2010) analyzes the information data of American s&p 500 companies from 2006 to 2008 provided by CDP and found that while the frequencies of all three disclosures increased from 2006 to 2008, a high percentage of firms opt to only answer the questionnaire and do not disclose emissions or methodology. Compared to many foreign research results, the research of carbon information disclosure has only just started, and research results are poor and most of which mainly introduce foreign experience in China. In practice, although in recent years more and more enterprises in our country begin to pay close attention to the emissions of greenhouse gases, for now the listed companies carbon information disclosure is not involved in the laws and regulations of our country, the quality of carbon information disclosure in listed companies is very poor. 2 The Current Law and Regulations for Environmental Information Disclosure People pay more and more attention to carbon information disclosure in many developed countries. In 2005, the Canadian Institute of Chartered Accountants released climate risk disclosure guidelines; this is the first guidelines in the world released by the accounting profession [1]. In 2007, five American electric powers were cited by New York State Attorney General's Office for inadequate disclosure of climate information [2]. In 2009, U.S. EPA released Mandatory Reporting of Greenhouse Gases Final Rule [3]. In 2009 Copenhagen Climate Summit, IFAC called on for a single and generally acceptable climate change disclosure rules made by an independent standard setting bodies [4]. Issue of Climate change may affect to the company financial supported by the IASB and FASB. In 2010, the SEC issued Commission Guidance Regarding Disclosure Related to Climate Change which directs the public company to disclose climate change information. The legal documents on listed company's environmental information disclosure in China mainly include Environmental Open Information Measures, The Listed Company Environment Information Disclosure Guidelines (drafts), Listed Company Environment Information Disclosure Guidelines in SSE, Listed Company of the Social Responsibility Guidelines in SZSE, etc. Of all, Environmental Open Information Measures is in the core and leading position. Environmental Open Information Measures is the first comprehensive department regulations about environment information disclosure. It requires all environmental information disclosure of the enterprise through the media, internet voluntarily or mandatorily. September 14, 2010, Environmental Protection Department issued the Listed Company Environment Information Disclosure Guidelines (drafts), it forces heavy pollution listed companies in SSE or SZSE to publish annual environment report, and it first points out the contents of report. But the documents have not been officially released so far. It informed from the above analysis that the provisions in our country about environmental information disclosure is too general, also not developing the carbon disclosure terms of the enterprise. Many scientific research and practice indicate that the companies’ risks and opportunities caused by climate change and information about carbon abatement should be analysis and disclose importantly. At the same time the listed companies should disclose carbon information for the international political and economic attributes of carbon information disclosure. 3 Application Situation Analysis of Listing Companies’ Carbon Information Disclosure This paper analyzes the application situation of listing companies’ carbon information disclosure from two aspects. One is the information provided by CDP, another is the information comes from the Financial Report, Corporate Social Responsibility Report, Sustainability Report and other ways. CDP China reports from 2008 to 2010 show that Chinese enterprises investigated by CDP response aren’t aggressive enough. Only 13 companies filled out and submitted the questionnaire, there are ten companies filled questionnaire for two or three years continuously†, but only 4 agreed to open questionnaire information ‡. All investors should enjoy equal rights to corporations’ information. If the survey results of CDP only offered to institutional investors, it will impact the investment decisions of the rational investors. Further compare and analyze questionnaire and find that the quality of carbon information disclosure of listing companies in China is very poor. (1) The related information disclosure is not full. First, the response rates to questionnaire are very low. In the three companies, China ShenHua Energy Company Limited answered the questionnaire of about 49%, but Bank of communications is less than 5%, Huaxin Cement is a high energy consumption and high pollution firms, and it is almost no answer; Second, The answer to the question is too simple. Even ShenHua Energy Company, the answer is too easy and no explaining. (2) The information revealed is too broad. It tends to disclose qualitative information, the † In 13 companies, for two years to fill in the questionnaire of companies from 2009 to 2010, including Bank of communications, China merchants bank, industrial bank, Lenovo group; for two years to fill from 2008 to 2010 including China merchants international, Shenhua energy, China national offshore oil corporation, ETE, Foxconn international holdings Co., LTD, Industrial and commercial bank of China; companies to fill in the questionnaire in The first time, including China merchants real estate holdings Co., LTD, China mobile, China ping an insurance Co., LTD. ‡ The four companies, China merchants bank provide the 2010 questionnaire but couldn't download, Shenhua energy, Huaxin cement, bank of communications provide in 2009, but don’t provide in 2010. 92 quantitative information and company special risks and opportunities and other information is insufficient. Although data of GHG emissions has disclosed, but lack of calculation basis, computational tool, the method of calculation, etc. (3) Comparability of information should be improved. Information is not identical of annual report and the social responsibility of the enterprise. Even for the same question, three ways to provide information also has a big difference. In order to understand carbon information of listed companies in China, This article chooses the samples of 85 listed companies. The companies belong to five industries respectively and listed on Shanghai stock exchange. They are financial insurance industry, petrochemical industry, food beverage industry, electric power industry and automobile industry. See table1. Table1 Sample constitute Industry Total Sample number Financial insurance industry 25 10 Petrochemical industry 79 30 Food beverage industry 33 15 Electric power industry 46 20 Automobile industry § - 10 Automobile industry ** - 85 According to the carbon disclosure of the international consensus, disclosure content should be included risks and opportunities, emissions data, governance, strategy, engagement with policy makers, etc. In form, it advocates and fuses financial reports. According to the above standard, information is further classified by content and way (table 2). Research indicates that characteristics of carbon information disclosure of listing companies in China are shown as follows: (1) Carbon information disclosed is very inadequate. On the one hand, enterprise number that discloses information is less; On the other hand, the carbon information that is disclosed is very simple, most of the carbon information is relevant to energy conservation and emission reduction. Other information such as risks and opportunities, quantitative information about GHG emissions, strategy and governance is not mentioned. (2) Quality of carbon information is poor. First, there is no simple carbon information disclosure, most of the information disclosed is in the board of directors of the report; Second, most information are just text description, and there is few quantitative information, such as index data, the standard, protocol or methodology used to collect activity data and calculate emissions, etc. Third, the understanding to the problem is mistake. From the information disclosed can learn that most enterprises understand carbon disclosure into energy saving and emission reduction. (3) Government policy has big effect to carbon information disclosure of enterprise. Enterprises more inclined to disclose information in the Social Responsibility Report. § Climate change risk and opportunity are analyzed in the annual reports of three companied; only policy risk of development a low carbon economy is analyzed in three other companies reports. ** Climate change risk and opportunity are analyzed in the annual reports of three companied; only policy risk of development a low carbon economy is analyzed in three other companies reports. 93 Table 2 Information classifications by content and way Food beverage industry 15 Electric power industry 20 Automobile industry sample total 10 Petrochemical industry 30 10 85 0 2 0 63 0 8 0 4 1 3 1 9 0 6 1 5 0 12 governance 0 6 0 2 0 8 financial reporting fusion 0 0 0 0 0 0 classify Industry Financial insurance samples Risks and opportunities Emissions data strategy 4 Countermeasures and Suggestions 4.1 Enterprise should be fully aware of the importance of the carbon disclosure Many research shows that climate change is the third risk most commonly mentioned and influencing shareholder value in the short term. So, enterprise should take the following action actively. First, clear climate change strategy and set up reasonable governance structure and internal control mechanism; Second, measure GHG emissions according to accepted technical standards. Third, reasonably evaluate all kinds of risks caused by climate change. Fourth, make scientific report of carbon management to disclose information better. 4.2 Set mandatory carbon disclosure rules As a typical representative of voluntary disclosure, decision usefulness of CDP information is under question for reliability, integrity, comparability and other characteristics[5][6]. The survey to investors signed agreement with CDP also indicates that most investors don’t integrate CDP information into the financial report yet. The lack of authority accounting standards and GHG diversity of quarantine standards also seriously influence the quality of carbon information [7]. So, it should formulate relevant laws and administrative rules and regulations to manage carbon information disclosure. Regulators of mandatory information disclosure system should be established also to improve the quality of information disclosure. 4.3 Authentication and audit is the important means to ensure information reliability The essence of the reliability is verification, it refers to the independent third party processes the same initial data according to the same program can draw the roughly same results. Authentication business means that information is audited by the independent third party using professional knowledge, skills and experience, aims to put forward audit opinion to the reliability, accuracy and integrity of audit matters. Authentication to carbon information should include the test to accuracy and completeness of quantitative information of carbon emission reduction, evaluation and test to production, summarizing, and reports of data; it can increase the credibility of the carbon report. For the enterprise itself, authentication is in favor of enterprises to improve the quality of carbon accounting and the report, recognition the status quo of enterprise carbon emissions, determine the improvement opportunities. 5 Conclusion Research shows that China’s current regulation system of environment information disclosure exists some problems, such as system is not complete, regulation is not perfect, cooperation mechanism of information disclosure is not perfect, etc; Overall situation of carbon information disclosure of listing companies is not optimistic and it exists many problems as quantity is insufficient, low quality, information not complete, attitude not positive etc. Now, we must take some measures to raise the quality of carbon information disclosure. Acknowledgement: The paper is the stage research result of Philosophy and Social Science Planning Project of Gansu Province (Project number: 0911ZSB141). 94 References [1]. Canadian Performance Reporting Board (2005). MD&A Disclosure About The Financial Impact Of Climate Change And Other Environmental Issues [EB/OL] http://www.cica.ca/client_asset/document/3/5/2/0/3/document_534147DD-E5C6-3AE659CB372755E43A4A.pdf [2]. Energy Companies Subpoenas: Letters from Attorney General Cuomo [EB/OL]. http://www.ag.ny.gov/media_center/2007/sep/sep17a_07.html [3]. EPA: Greenhouse Gas Reporting Program [EB/OL] http://www.epa.gov/climatechange/emissions/ghgrulemaking.html [4]. CICPA: International Accounting Professional News in 2009 [EB/OL]. http://www.cicpa.org.cn/international_exchange/international_developments/201002/t20100202_20977.htm [5]. Ans Kolk, David Levy & Jonatan Pinkse. Corporate Response in an Emerging Climate Regime: The Institutionalization and Commensuration of Carbon Disclosure [J]. European Accounting Review, 2008 (17): pp 719-745. [6]. Axel Hesse. (2006) Climate and corporations – right answers or wrong questions? Carbon Disclosure Project Data – Validation, analysis, improvements (Bonn/Berlin: German watch) [7]. Zhang Qiaoliang, Research on the Diversity of Accounting Treatment and Information Disclosure about Carbon Emission [J]. Contemporary Finance and Economics, 2010 (04): pp 110-115. (In Chinese) [8]. Kolk.A., Levee’s., Pinkse.J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure [J]. European Accounting Review, 2008, 17 (4):719-745. [9]. Elizabeth Stanny. Voluntary Disclosure by US Firms to the Carbon Disclosure Project [EB/OL]. Working Paper Series. 2010 (3), http://ssrn.com/abstract=1454808 [10]. Zhang Qiaoliang, Zhang Hua, Corporate Carbon Management Information Disclosure, Lanzhou: Lanzhou University Press, pp.40, September 2010 (In Chinese) 95