* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter13overheadsFall2015

Corporate venture capital wikipedia , lookup

Negative gearing wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Hedge (finance) wikipedia , lookup

Early history of private equity wikipedia , lookup

Interbank lending market wikipedia , lookup

Rate of return wikipedia , lookup

Systemic risk wikipedia , lookup

Stock trader wikipedia , lookup

Financial crisis wikipedia , lookup

International investment agreement wikipedia , lookup

Private money investing wikipedia , lookup

Internal rate of return wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Socially responsible investing wikipedia , lookup

Investment banking wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

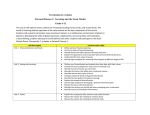

Investment in Financial Capital Objectives • Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. • Determine your own investment philosophy. • Recognize the variety of investments available. • Identify the major factors that affect the return on investment. • Specify some strategies of portfolio management for long-term investors. • List three guidelines to use when deciding the best time to sell investments. Establishing Investment Goals • • • • • • • Financial goals should be specific and measurable. Why are you accumulating these funds? How much do you need? How will you get it? How long will it take you to reach your goal? How much risk are you willing to assume? Are you willing to sacrifice current consumption to invest for the future? • Is it realistic to try and save this amount? What are your financial goals? • Financial Independence • Just starting your own financial life apart from your parent(s)/guardian(s) • Financial Stability • Managing all of your financial resources effectively, but unprepared to meet financial emergencies • Financial Security • The ability to manage and absorb financial emergencies • IMO, one of the best and easiest ways to attain Financial Security is to create passive income through investments Steps to Create a Personal Investing Plan Step 1 My investment goals are: ____________________ ____________________ Step 2 By ___________, I will have obtained $_______. Step 3 I have $__________ available to invest. Date _____________ Step 9 Continue evaluating choices. Step 4 Possible investment alternatives: 1._________________ 2._________________ 3._________________ 4._________________ Step 8 Final decision 1._______________ 2._______________ Step 7 Investment decision 1._______________ 2._______________ 3._______________ Step 6 Projected return on each alternative 1.__________ 2.__________ 3.__________ 4.__________ Step 5 Risk factors for each alternative 1.____________________ 2.____________________ 3.____________________ 4.____________________ Definitions: • Saving: setting money aside for future use • Investing: Putting the money to work for you or using your money to make more money • Borrowing: Using next year’s income this year. Investment Fundamentals ATTENTION! •Difference in return is a major distinction between savings and investing. •Successful investors begin to live off earnings, without spending wealth itself. Investment in Financial Capital • Investment - use of economic resources to make a profit. • Financial Capital - liquid resources of a government, business, or individual Preparations for Investing WHY PEOPLE INVEST: • Achieve financial goals • Increase current income • Gain wealth and financial security • Have funds available for retirement Preparations for Investing PREREQUISITES TO INVESTING: • Live within means • Continue savings program • Establish lines of credit • Carry adequate insurance • Establish investment goals Preparations for Investing INVESTMENT RETURNS: • Interest • Dividends • Rent • Capital gain/loss • Rate of return or yield Performing a Financial Checkup • Learn to live within your means • pay off high interest credit card debt • Provide adequate insurance protection • Start an emergency fund • three to nine months of living expenses • Have other sources of cash for emergencies • line of credit • cash advance Getting Money to Start an Investing Program • Pay yourself first • Participate in elective savings programs • Payroll deduction • electronic transfer • Make a special effort to save one or two months a year • Take advantage of windfalls • Invest half of your tax refund Value of Having a Long-Term Investing Program • Many people don’t start investing because they only have a small amount to invest but.... • Small amounts invested regularly become large amounts over time Personal Investment Philosophy • Handling risk • Ultraconservative strategies • Conservative • Moderate • Aggressive Personal Investment Philosophy • Handling risk • Ultraconservative strategies • Conservative • Moderate • Aggressive Investment Selection • Lend or own • Short-term or long-term • Choose a vehicle Two ways to invest • Lend: Promise of repayment of loan (principal) and interest • Deposit money in bank • Lending money to the government • Lending money to a business • Own: Purchase an asset or equity • Buy • Buy • Buy • Buy stock mutual funds real estate collectibles Factors That Affect Investment Decisions • Safety - minimal risk of loss • Risk - uncertainty about the outcome • inflation risk • interest rate risk • business failure risk • market risk Factors that influence the investment decision: Risk Tolerance • Risk represents the uncertainty that the yield on an investment will deviate from what is expected. • The amount of risk a household can tolerate will determine: • The • The • The • The decision to invest type of investment investment strategy amount of investment Types of Investment Risk • Inflation risk: investment returns will not keep up with inflation. • Default risk: the risk of losing a major portion of or all of your investment Types of Investment Risk • Interest rate risk: market interest rates rise devaluing fixed rate investments • Marketability risk: having to sell a certain asset quickly; not being able to get the price you want. Also called liquidity risk. Risk Tolerance Quiz • Take the quiz listed in notes…. http://njaes.rutgers.edu/money/riskquiz/ Income From Investments • Safest • CDs • savings bonds • T-bills • Higher potential income • municipal bonds • corporate bonds • preferred stocks • mutual funds • real estate Investment Pyramid High risk Commodities Junk bonds Options High Quality Stocks Mutual funds Utility stocks CDs Rental property Government Securities Money Market Corporate bonds Savings Accounts Cash Low risk Investment Growth and Liquidity • Growth • increase in value • common stock • growth stocks retain earnings • bonds, mutual funds and real estate • Liquidity • ease and speed to convert an asset to cash Major Factors That Affect Rate of Return • INVESTMENT RISK: • Pure • Speculative • Risk pyramid Major Factors That Affect Rate of Return • INVESTMENT RISK TYPES: • Inflation • Deflation • Interest rate • Financial • Market volatility • Political Major Factors That Affect Rate of Return • INVESTMENT RISK: • Random or unsystematic • Diversification • Market or systematic Major Factors That Affect Rate of Return • Leverage • Taxes • Marginal tax rate • Taxable vs. tax-free income • Buying and selling costs/commissions • Inflation Risk Tolerance ., REVIEW BOOK: Personal Finance. Retrieved Oct 1, 2009 from http://www.flatworldknowledge.com/node/50890 . Calculating Percentage Rate of Return Major Factors that Affect Rate of Return • CALCULATE REAL RATE OF RETURN: 1. Identify before-tax return 2. Subtract marginal tax rate 3. Obtain net return after taxes 4. Subtract estimate of inflation 5. Obtain real rate Real Rate of Return Example 1. You are in the 28 percent tax bracket. 2. 1.0 - .28 = .72 3. If the yield on your investment is 6.25% then: .0625 x .72 = .045 4. Your after tax return is 4.5% 5. If inflation is 5%, your real rate of return after inflation is 4.75% (.05 x (1-.05) = .0475 Management Strategies — Long-Term Investors • Business-cycle timing • Dollar-cost averaging • Portfolio diversification • Asset allocation Investment Alternatives • What is stock? • part ownership in a company • the money you pay for shares of stock provides equity capital for the business An Example of Asset Allocation ., REVIEW BOOK: Personal Finance. Retrieved Oct 1, 2009 from http://www.flatworldknowledge.com/node/50890 . Levels of Diversification ., REVIEW BOOK: Personal Finance. Retrieved Oct 1, 2009 from http://www.flatworldknowledge.com/node/50890 . Investment Alternatives (continued) • What is a bond? • a loan to a corporation, the federal government, or a municipality • The interest is paid twice a year, and the principal is repaid at maturity (1-30 years) • You can keep the bond until maturity or sell it to another investor Investment Alternatives (continued) • What is a mutual fund? • investors’ money is pooled and invested by a professional fund manager • you buy shares in the fund • provides diversification to reduce risk • funds range from conservative to extremely speculative • match your needs with a fund’s objective Monitor Your Investments • Read your account statements • Chart the value of your investments • Maintain accurate and current records • Calculate the current yield % annual income from investment market value of the investment Sources of Investment Information • Newspapers • Business Periodicals • Government Publications • Corporate Reports • Statistical Averages • Investor Services and newsletters • Standard and Poor’s stock reports • Value Line • Moody’s investment service Investment Philosophies Best Time to Sell • Take profits • Cut losses • “If wouldn’t buy it now, sell it” Mandatory Financial Investment for Retirement • Employer / Employee Social Security Contributions (15.3% of earnings up to a maximum taxable amount of $110,000 in 2012) • Defined Benefit Private Pension Plans Discretionary Financial Investment for Retirement • Defined Contribution Pension Plans • 401(k), 403(b), IRA • Roth IRA • Roth 401(k) Income and Consumption Over the Life Cycle $ 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Income Consumption 25 35 45 55 65 Age 75 85 Measures of Risk • Beta - measures the variability in the rate of return of a particular stock relative to the larger stock market. • Beta stock A = 3.0 means the variability in the rate of return of stock A is three times the market average • Bond ratings - Standard and Poor’s and Moody’s ratings of bonds for default risk only. The Relationship Between Rate of Return and Risk • Risk and average rate of return are positively correlated. • Risk and variance of rate of return are positively correlated. Measuring the Rate of Return • Typically think of rate of return in terms of interest paid per $1.00 invested. But, the timing of when you get this return varies depending on… • income return - situation where the principal that is invested remains the same but the investor periodically receives income based on this investment. • Certificates of deposit • money market funds • bond interest • stock dividends Calculating the Return on an Investment Rate of Return is the total income you receive on an investment over a specific period of time divided by the original amount invested. For example: Assume you invest $3,000 in a mutual fund. Also assume the mutual fund pays you $50 dividends this year and that the mutual fund is worth $3,275 at the end of the year. Step 1: Subtract the investment’s initial value from the investment’s value at the end of the year: $3,275 - $3,000 = $275 Step 2: Add the annual income to the amount calculated in Step 1. $50 + $275 = $325 Step 3: Divide the total dollar amount of return calculated in Step 2 by the original investment. $325/$3,000 = 0.108 = 10.8% Measuring the Rate of Return • Capital gain - situation where you get your return only when you sell the investment. • stocks • Real Estate • collectibles • Sometimes, you get a combination of income and capital gains… makes it even more difficult to calculate the rate of return. Measuring the Rate of Return • The risk-return trade-off can also be managed by having a variety of investments in your portfolio • BE DIVERSIFIED! • Statistically, you need between 6-15 stocks in different in different industries to be fully diversified in the market Annual returns for stocks, T Bonds, T Bills from 1981 - 2011 • http://huntingtonfunds.com/ftp/brochures/Real_Return_CDs.pdf Average $100 invested in 1981 was worth___ in 2011: Common Stocks-S&P 500 Small Company Stocks Treasury Bills 10.42% $2,160.13 9.55% $1,690.38 5.20% $481.38 Treasury Bonds 10.69% 2,330.02