* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download rPFM(02-RAR)08

Financialization wikipedia , lookup

Land banking wikipedia , lookup

Moral hazard wikipedia , lookup

Pensions crisis wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Credit rationing wikipedia , lookup

Systemic risk wikipedia , lookup

Internal rate of return wikipedia , lookup

Stock selection criterion wikipedia , lookup

Investment fund wikipedia , lookup

Harry Markowitz wikipedia , lookup

Investment management wikipedia , lookup

Beta (finance) wikipedia , lookup

Financial economics wikipedia , lookup

Rate of return wikipedia , lookup

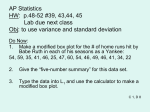

Personal Financial Management Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected] Reading Callaghan: McRae: Chapter 5 Chapter 2 Risk and Return Consider two work colleagues who share a £200,000 lottery win early in 1994 Each receives a total of £100,000 Each invests this sum What is their financial position ten years later? Investment Choices Investor 1 Studies the financial press Takes note of the share tips Chooses Marconi as a “hot tip” Investor 2 No time for studying investment Puts all money in a 90-day deposit account Investment Value up to 2000 350000 300000 250000 200000 Marconi 150000 Deposit 100000 50000 0 1 2 3 4 5 6 7 8 Entire Period 350000 300000 250000 200000 Marconi 150000 Deposit 100000 50000 0 1 2 3 4 5 6 7 8 9 For the story of the Marconi collapse, see: End of the Line for Marconi Shares 10 11 Lessons? Different investments, different outcomes Some are safe (deposit account), some are not (shares) Trends cannot be forecast Should diversify (hold a range of assets) This is portfolio construction How do we quantify these properties? Return The return on an investment is defined as the proportional (or percentage) increase in value Final Value - Initial Value Return (%) (100) Initial Value Return is defined over a fixed time period, usually 1 year but can be 1 month etc. It can be applied to any asset Return Example 1. £1000 is paid into a savings account. At the end of 1 year, this has risen in value to £1050. The return is: 1050 - 1000 Return 100 5% 1000 So the return can also be viewed as an interest rate Return Example 2. A share is bought for £4. One year later it is sold for £5 5-4 Return 100 25% 4 Example 3. A share is bought for £4 One year later it pays a dividend of £1 and is then sold for £5 5 1- 4 Return 100 50% 4 Return • Example 4. A share is bought for £12. One year later it is sold for £10. 10 - 12 2 Return 100 16 % 12 3 - The return can be negative • The definition of return can be applied to any asset or collection of assets • Classic Cars • Art Expected Return The previous calculations have been applied to past outcomes Can call this “realized return” When choosing an investment expected return is important Expected return is what is promised Realized return is what was delivered Expected Return Expected return is calculated by Evaluating the possible returns Assigning a probability to each Calculating the expected value Example 1 Toss a coin Receive £1 on heads, £2 on tails Expected value is (1/2) 1 + (1/2) 2 = 1 1/2 Expected Return Example 2 Buy a share Return 20% if oil price rises to $70 (prob. = 0.25) Return 5% if oil price remains below $70 (prob. = 0.75) Expected return (0.25) 20 + (0.75) 5 = 8.75% Expected Return Potential investments are compared on the basis of expected return The use of expected reminds us that nothing is certain Actual return may be far from the expected value The mean return (see later) is an estimate of the expected return Risk Risk measures the variation in return Return Mean Return Not much risk Period Risk Return Mean Return – Considerable risk Period General Motors 25 years General Motors 6 months General Motors 5 days General Motors 1 day General Motors 40 30 20 10 0 -10 -20 93- 94- 95- 96- 97- 98- 99- 00- 01- 0294 95 96 97 98 99 00 01 02 03 -30 -40 -50 Return on General Motors’ Shares 1993 – 2003 Measurement of Risk Need a number that is always positive (the least risk is zero) Must treat “ups” and “downs” equally Should be measured relative to average value: Sum of Observed Returns Mean Return Number of Observations Measurement of Risk Example. A share is observed for 5 years. In these years it earns returns of 2%, 6%, 3%, 8% and 1%. 2 6 3 8 1 Mean Return 4 5 Variance and Standard Deviation The risk is defined as the variance of return Sum of (Observation - Mean) Variance Number of Observations 2 Or, in brief n ri i 1 2 2 n 2 Variance and Standard Deviation Example 1. The returns on a share over the past five years are 5, 8, 4, -2, 1. The mean return is: 5 8 4 3 1 3 5 And the variance is: 2 5 3 8 3 4 3 3 3 1 3 2 2 2 5 4 10 5 2 2 Variance and Standard Deviation Example 2. The returns on a share over the past five years are 7, 10, 6, -6, -2. The mean return is: 7 10 6 6 2 3 5 And the variance is: 2 2 2 2 2 7 3 10 3 6 3 6 3 2 3 2 5 36 Standard Deviation The risk can also be measured by the standard deviation This is the square root of the variance Standard devation Square Root of Variance 2 The two are equivalent Return and Risk Asset 1-Mo T-bills Annualized Return (%) 1926 - 98 3.77 SD (%) Worst return for 1926 - a single year 98 (%) 1926 - 98 3.22 0.00 5-Yr Treas. 5.31 5.71 -2.65 20-Yr Treas. 5.34 9.21 -9.8 Large Stocks 11.22 20.26 -43.3 Small Stocks 12.18 38.09 -58.0 Table taken from: Risk and Return Market Implications The market (meaning the average of all investors’ attitudes) Likes returns Dislikes risks To accept risk, investors must be rewarded with higher return Assets with low risk give low returns Assets with high risk have the possibility of high return Market Implications This relationship will not be violated if it were, trades could be made that gave a profit for no investment Risk-free assets (meaning governmentbacked) have the lowest return Risky assets (such as shares) must promise higher returns Put Another Way “There is no such thing as a free lunch” if an asset offers a high return, there must be a risk involved Marconi shares offered a higher return than the deposit account but the collapse was the “risk” This should always be remembered an investment is judged on its combination of return and risk