* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download PowerPoint Presentation - University of Notre Dame

Survey

Document related concepts

Transcript

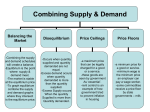

Markets and Competitive Equilibrium Lecture 5 In This Lecture • Market Equilibrium and the Forces Moving the Market Toward Equilibrium • The Hypothesis of a Single Price • Changes in Demand and Supply • Case Study--Gasoline Prices • Case Study--Scalping ND Football Tickets Demand and Supply Review • Demand Price – S – Given a price, how much will be demanded? Given a quantity, what is the maximum amount would the demanders be willing to pay? PH • Supply – – Given a price, how much will be supplied? Given a quantity supplied, what is the minimum price per unit would be acceptable to the suppliers? D • Is PH an Equilibrium Price? QD QS Donuts Too High of a Price Results in Excess Supply Price • At the price, PH, there is more of the good being supplied than demanded • Consequently, these suppliers who can’t sell at PH will offer their output at a slightly lower price -- have a sale. • The sale will take away purchases from competitors who will be forced to lower their prices to maintain sales • Price will fall! S PH D QD QS Donuts Too Low of a Price Results in Excess Demand Price S • At the price, PL, there is more of the good being demanded than supplied • Consequently, supplies will sell out and still have customers wanting to buy product at PL. • Price will rise! PL D QS QD Donuts Equilibrium Price Price • At PE, the quantity demanded is equal to the quantity supplied • At this price, everyone’s wishes are being met -- no one has incentive or desire to do something different • If nothing else changed, we would expect the price and amount of donuts produced and sold to be constant over time S PE D QE=QS=QD Donuts Social Function of Prices • Prices coordinate decisions between sellers and buyers • Will everyone be on the same page? Single Price In a significant number of situations, individuals are charged different amounts for the same good (car purchases). Yet we would expect there to be a single price in a competitive market. Why? IF everyone knew the rate (price) that others were trading, why would they every pay more than others were paying? Why would sellers accept less? If they did then the multiple prices could not be an equilibrium since they would want to do something else. We are assuming perfect information on the part of buyers and sellers of the goods. Alternatives to Price Rationing • Prices ration scarce goods to those who are willing and able to pay. • What other rationing mechanisms are there? • Can these alternatives produce outcomes equal in efficiency? Increase in Demand Price So • Increase in Demand • At existing price, Po, there is excess demand -- customers want more of the good • Both price and the quantity supplied rise, a movement along the supply curve • New Equilibrium P1 Po D1 Do Qo Q1 Donuts – Higher equilibrium price – Higher equilibrium quantity Decrease in Demand Price So Po • Decrease in Demand • At existing price, Po, there is excess supply -- there are goods on the shelf -- sale! • Both price and the quantity supplied fall, a movement along the supply curve • New Equilibrium P1 D1 Q1 Qo Do Donuts – Lower equilibrium price – Lower equilibrium quantity Decrease in Supply Price • Decrease in Supply • At existing price, Po, there is excess demand -- customers want more • Price rises and quantity demanded falls, movement along the demand curve • New Equilibrium S1 So P1 Po Do Q1 Qo Donuts – Higher equilibrium price – Lower equilibrium quantity Increase in Supply Price So • Increase in Supply • At existing price, Po, there is excess supply -- inventories rise -- sales • Price falls and quantity demanded increases, movement along the demand curve • New Equilibrium S1 Po P1 Do Qo Q1 Donuts – Lower equilibrium price – Higher equilibrium quantity Nominal Gasoline Prices Real Gasoline Prices Why has the price of gas risen? • Increase in the price of crude oil (supply consideration) – Decrease in oil reserves? – Instability in oil producing regions • No increase in the refinery capacity (supply considerations) • Increase in the demand for gasoline – Economic Growth in China and other developing nations – Our own growth Monthly Gas Prices (1992-1996) Explaining Monthly Changes • Summer Vacations -- Drive More (Demand Shift) • In May, refineries shut down for maintenance and shift over to seasonal blends (Supply Shift) Seasonal Changes SM Price SS SW PS PW DS DW Gallons Variation in Gas Prices over the Week 1. Why does the price of gas rise during the weekend? a. Demand considerations b. Supply considerations 2. Are the increases justified? That is, are they fair to the consumer? ND Football Ticket Policy • What is ND’s pricing strategy? – Tickets sales account for ~90% of athletic budget – Opposed to filling the stadium with season ticket holders; unfair to alums who live far away • 4,000 season ticket holders account for ~15,000 seats – Uses a lottery to fill remaining seats • Refundable Application fee per game: – 5 yrs < $50 < 50 yrs – $100 all other graduating classes • Application fees are sent to Development Office ND Football Ticket Policy • What are the determinants of ND’s printed ticket prices? – Explicit philosophy: Do NOT let ticket prices reach market price – Uniform price regardless of location • What is ND’s resale policy? – Resale above the printed ticket price is illegal and subject to penalty • Resale is “unethical.” The football game is “our product.” Others should not profit. The Secondary Market for ND Football Tickets • Why is ticket scalping inevitable? – Hint: Why are ticket available for resale? Who are the sellers • Who are the buyers in the secondary market? • Is the secondary market competitive? • Does the secondary market improve the allocative efficiency of the market for ND football tickets? Notre Dame Ticket Scalping • What we learned from interviews with scalpers – Scalpers are both buy and sell – Their strategy is to buy low and sell high – There are two categories of scalpers • Corporate brokers (PJ Tickets, Victory Tickets) • Amateurs (High school buddies) – Corporate brokers buy from ticket holders hoping to make a profit – Amateurs buy from ticket holders hoping to get their money back. Notre Dame Ticket Scalping Amateurs: – Their profit margin goal is $15 per sale – Take turns like car dealers. The lowest price is quoted by the up guy. – The reduce risk, they hold no more than 10 tickets at a time – Each amateur sells 50 to 100 tickets a game and pocket $750 TO $1,500 in profits. – Guesstimate of the number of tickets scalped per game: ~3,000 Assignment for Next Lecture • Do Homework 4 on ‘Homework Assignment’ by Wednesday at 5 pm • Read Chapter 4 • Topics Next Time – The Market Strikes Back (It’s difficult to control the market)

![[A, 8-9]](http://s1.studyres.com/store/data/006655537_1-7e8069f13791f08c2f696cc5adb95462-150x150.png)