* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download EXCHANGE RATES

International status and usage of the euro wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Bretton Woods system wikipedia , lookup

Foreign exchange market wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Purchasing power parity wikipedia , lookup

Currency war wikipedia , lookup

Reserve currency wikipedia , lookup

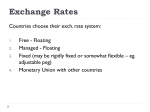

International monetary systems wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

EXCHANGE RATES The exchange rate is ... the value of another country’s currency a rate ....... which one ........ can be exchanged for another the price ........ which one currency can be bought. Currencies: the US dollar (US$) the euro (€) the yen(¥) the renminbi (yuan – units!) the British pound (£) the kuna (HRK) the dollar vs. 20,000 US dollars The British pound slipped by around 3.5% against the dollar and held steady against the euro in November. Which of the three rates are described below? FIXED, MANAGED FLOATING or FLOATING E.R.? 1. 2. 3. 4. 5. 6. 7. 8. 9. a rate which is set by the government (central bank) only........ a rate which is determined by the private market through supply and demand ............ its value will decrease only if demand is low (and viceversa) ................. it does not change before it is centrally decided ........... if the rate changes more than the central bank allows, the bank intervenes (buys or sells the currency) ...... based on the free market only........ its value will rise only if demand is high ................. a combination of the other two types ............ example of intervention in the economy ............ Based on: http://www.investopedia.com/articles/03/020603.asp Which of the three rates are described below? FIXED, MANAGED FLOATING or FLOATING E.R.? 1. 2. 3. 4. 5. 6. 7. 8. 9. a rate which is set by the government (central bank) only FIXED (PEGGED) EXCHANGE RATE a rate which is determined by the private market through supply and demand FLOATING E.R. its value will decrease only if demand is low (and vice-versa) FLOATING E.R. it does not change before it is centrally decided FIXED if the rate changes more than the central bank allows, the bank intervenes (buys or sells the currency) MANAGED FLOATING EXCHANGE RATE based on the free market only FLOATING EXCHANGE RATE its value will rise only if demand is high FLOATING E.R. a combination of the other two types MANAGED FLOATING E.R. example of intervention in the economy FIXED E.R., MANAGED FLOAT. http://www.investopedia.com/articles/03/020603.asp Which types of exchange rates are the following sentences likely related to? A currency appreciates/depreciates against another currency. If a currency is overvalued, it needs to be devalued. If a currency is undervalued, it needs to be revalued. Types of exchange rates FIXED EXCHANGE RATE FLOATING EXCHANGE RATE MANAGED FLOATING RATE Which types of exchange rates are the expressions below primarily related to? to be pegged against... gold convertibility speculation The Fed IMF supply & demand central banks freely determined M.Friedman intervene US dollar reflecting purchasing power parity The period of gold convertibility (MK: p.128) After World War II, an agreement established 1 2 rates, defined in terms of gold and the US dollar. Many currencies were 3 4 the US dollar, and the dollar was 5 against gold. One US dollar could be 6 for 1/35th of an 7 of gold. Under this system, 8 exchange rates could only be adjusted with the agreement of the 9 10 11. Such adjustments were called 11 or 12. The system of gold 13 and 14 against the dollar was abandoned in 1971 because 15 did not have enough gold to guarantee its currency. Pg. 2 (MK, p.128) Proponent Argue Underlying economic conditions, economic realities Underestimate Pg.3 (MK, p.129) PPP? 5% 95% 3 or 4 reasons for currency transactions? Match the words below: appreciating/depreciating currency purchasing power fixed/floating devalued/revalued common hedge raw gold futures currency central bank speculative fluctuations contracts currency exchange rate currency intervention materials transactions currency against fluctuations convertibility transactions parity How do the red words relate to Pg. 4? appreciating/depreciating currency purchasing power fixed/floating devalued/revalued common hedge raw gold futures currency central bank speculative fluctuations contracts currency exchange rate currency intervention materials transactions currency against fluctuations convertibility transactions parity Answer the questions: What was fixed in the fixed exchange rate system after WW II? What was Milton Friedman’s view of the exchange rates? Why was the euro introduced? To what extent is the managed floating rate a solution to currency fluctuations? Reading: MK (pp.128-129) Which pgs. deal with specific types of exchange rates? Find parts of the text that deal with the floating rate in terms of the following: a) theoretical expectations b) reality c) attempts to resolve problems A currency transaction tax (CTT) A CTT would be collected from dealers in international 1... markets, by financial clearing and settlement systems. The 2... was designed to slow down 3........ across borders, to make monetary 4...... more effective, and to prevent or manage exchange rate 5...... . The CTT is not designed to change FX market behaviour, but only to raise money without 6... the market. But of course taxing FX transactions would increase the spread (difference between the 7... and the 8... prices at which trades would be profitable, and so would reduce the number of transactions. The proposed tax 9… is 0.5 10 … . Such a CTT on all major currencies would 11 ... an annual 12... of over $33bn. Governments should think how to spend the 13.... of this tax. (MK: p.130) Tobin Tax vs. CTT A proposal has been made to … The idea behind … is to … The CTT, on the contrary, is not designed to …, but only to …