* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Monetary Policy

Survey

Document related concepts

Transcript

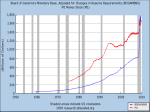

Monetary Policy I. Federal Reserve System 1913 12 District Reserve Banks (a la Federal District Courts) Janet Yellen (Chairman Federal Reserve Board of Governors) monetary policy: actions Fed takes to influence level real GDP and rate of inflation Goals of Monetary Policy Not profit motivated “assist in achieving a full-employment, noninflationary level of total output” 1960s: focus full-employment Post-1970s: focus inflation Alters M by altering excess reserves to affect output and prices Theory of Monetarism MV≡PY Money supply x Velocity = Price Level x Output = nominal GDP Assumes velocity relatively fixed (slow, predictable change) II. Tools 1) Open Market Operations Buying and selling of bonds in open market Buying From C. Banks: increases banks’ reserves by amount of purchase (if fully “loaned up” $1000 bond w/20% RR $5000 increase lending + M) From public: indirectly increases banks’ reserves (less the reserve requirement: $4000 in lending and $1000 in new demand deposit= $5000 increase M) Selling: just the reverse 2) Reserve Ratio Raise RR A) lose excess reserves diminish money creation through lending or B) reserves become deficient contract checkable deposits and therefore M Lowering has opposite effect ∆ RR: 1) ∆ excess reserves and 2) ∆ monetary multiplier (1/RR) 3) Discount Rate Commercial Bank borrowing from Fed increase reserves extension credit Discount rate: rate charged to borrow from Fed (cost of acquiring reserves) raise/lower discourages/encourages C. Bank borrowing to increase M 4) Moral Suasion Speeches, interviews, etc.: try to persuade people to change behavior so Fed doesn’t have to act “Irrational exuberance” Easy vs. Tight Policy Expand M: buy securities, reduce RR, lower discount rate Restrict M: sell, raise, raise Relative Importance of Tools #1 Open market operations (bonds) Discount rate: 1) C. Banks borrow only 2-3% of reserves from Fed (and OMO changes in borrowing); 2) DR effectiveness dependent on bank decisions (if banks unwilling, Fed unable) But, discount rate as “announcement effect”; but often to keep in line w/other rates Reserve ratio: used rarely bc impacts bank profits (reserves earn no interest) OMO: 1) flexible (scalpel > sledgehammer); 2) prompt (timing problems); 3) powerful: total sale could take reserves $22B $0 Washington Baby-Sitter Co-op Redux III. Monetary Policy, Real GDP, Price Level Money Demand Transaction demand: to use Asset demand: to hold Factors affecting: 1) cash needed on hand, 2) interest rates (opp’y cost of holding money), 3) price levels, 4) general level of income Investment Demand Amount investment w/rate of return greater than real rate of interest ∆M ∆i.r. ∆I ∆GDP + PL Effectiveness 1) Speed and flexibility 2) isolation from political pressure 3) “Success” in 1980s + 1990s (Greenspan the “maestro”) monetary policy primary stabilization tool in US Some now criticize Greenspan for allowing bubbles (stocks + housing) to form Shortcomings and Problems 1) Less control? ∆ banking + globalization undermine Fed policy power 2) Cyclical assymetry: easy money only works if willing to loan/borrow: Fed strong in expansions, weaker in recessions (when arguably most needed) ∆ biz confidence (movement of investment demand curve) may require enormous exertions by Fed to offset 3) Changes in velocity: total expenditures = M times velocity of money (how often spent) 4) Investment Impact: in reality borrowing small source investment (mostly retained earnings) 5) Interest as income: MP based on assumption expenditures inversely related i; but i also income, so direct relationship (probably only partly off-sets) 6) Zero-lower bound: what if interest rates are 0%? Federal Funds rate Rate banks charge other banks for shortterm loans (cover reserve requirements) “target”: not set by Fed (supply and demand), but buys/sells bonds to affect rate Prime rate follows Federal Funds Policy Multipliers Spending Multiplier: 1/MPS Actual multiplier estimated at 2x Taxing Multiplier: 1xMPC (=.95) Balanced Budget Multiplier (equal tax hike and spending hike): 1x change G Money Multiplier: Excess Reserves x 1/RRR Monetarism: MV=PY ∆M x V = ∆GDP