* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download FreeResponseAnalysis Money Unit-5

Business cycle wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Virtual economy wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Long Depression wikipedia , lookup

Early 1980s recession wikipedia , lookup

Monetary policy wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Real bills doctrine wikipedia , lookup

Interest rate wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Quantitative easing wikipedia , lookup

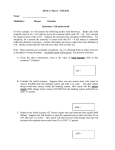

Free Response Macro Unit #5 1) The Bank of Redwood has 1,000,000 in total reserves and the reserve ratio is 20%. Draw a correctly labeled T-account which illustrates the current financial position at the Bank of Redwood assuming they have no excess reserves. Bob deposits $10,000 of currency into Bank of Redwood High School Show calculations for the change in money supply in the entire banking system caused from this deposit. (assume no excess reserves are kept in the banking system) The Federal Reserve purchases $20,000 worth of Government Securities (bonds) Show calculations for the change in money supply created by this purchase (assume no excess reserves are kept in the banking system) State how much money supply changes if the Fed purchases $10,000 in bonds with a 100% reserve requirement? Briefly explain your answer ============================================================================ 2) The U.S. economy is operating above full potential output Draw a correctly labeled AD/AS model to illustrate the economic situation described above show the current equilibrium price level & real GDP Draw a correctly labeled Money Market graph to illustrate a current equilibrium State the type of monetary policy the Federal Reserve should use in the described situation. State how the Fed would adjust each tool of monetary policy listed below to solve our current economic problem Reserve requirement Discount rateOpen Market Operations Modify both the AD/AS graph and the Money Market graph for the effect of this monetary policy Briefly Explain the reasons for any short run effect of this monetary policy on Aggregate Demand (AD) Briefly Explain the short run effect of this monetary policy on unemployment & inflation Clearly Explain how open market operations effects money supply and interest rates Hint: Be sure to discuss the type of interest rate in the money market & it’s role in our economy =================================================================================== 3) Monetarism Write the Equation of Exchange and state what each variable stands for Clearly Explain what a monetarist economist believes when they say “ money is neutral” Hint: describe what “monetarism” believes in…. Holding everything else constant, if the Velocity of Money suddenly fell by 50%, briefly explain how the Federal Reserve would most likely respond to this event. =================================================================================== Free Response Problem #1 25 pts a) Assets Required Reserves Loans b) $200,000 Liabilities $1,000,000 Deposits $800,000 d) Total Assets Total Liabilities $1,000,000 $1,000,000 $10,000 Deposit $8,000 Excess Reserves 1/.20 = 5 Multiplier $8,000 * 5 = $40,000 c) $20,000 Purchase by FED $16,000 Excess Reserves 1/.20 = 5 Multiplier $16,000 * 5 = $80,000 + 20,000 = $100,000 $10,000 i) Banks can not lend out money with a 100% r.r. so there is no expansion in loans However, Fed money used in purchase of bonds is not currently in the $ supply, so MS ↑ $10,000 (magic money!) Free Response Problem #2 30PTS A) Must show an inflationary Gap F) AD shifts left LRAS 1 SRAS 1 Price Level P2 ------------------- B ---------- P1 A Y2 Y1 C) Contractionary B) Must have nominal i-rate E) MS must shift left Nominal Interest Rate i2 AD2 Real GDP AD 1 4% MS 2 MS1 ----------------- ----------- MD Qty of $ D) i) R.R. increases ii) Disc. Rate increases iii) Sell Bonds F) When MS ↓ nominal interest rates ↑ => more expensive for business to borrow => business net investment (I) declines => decreases AD G) AD shifts left which lowers the price level and therefore inflation. Based on the short run Phillips Curve unemployment & inflation have an inverse relationship, so unemployment must ↑ H) Open Market Operations is when the Fed purchases or sell bonds in the open market. When they buy bonds money flows into the banking system from Fed’s vault & bonds flow into Fed. This “new” money causes MS to rise in the money market & nominal interest rates fall. Lower interest rates will make it less expensive to borrow money and therefore directly impact investment spending & AD. In this way, the Fed has an impact on the growth rate of an economy in the short run. Free Response Problem #3 20 pts a) MV = PY Money Supply Velocity Price Level Real GDP (must say real or -2) b) Monetarist economists believe that Money is Neutral. This means that money supply has no effect on real GDP. That is, printing money will not—by itself—increase a countries ability to produce goods and services (shift our PPF curve) Monetarist believe in the Quantity Theory of Money where Velocity is constant. Therefore an increase in money supply (M) of 20% in the above equation will increase price level by the same amount. (one ↑ 20%, the other must ↑ 20%) (Money is neutral meaning it has no affect on real variables) This increase will have no affect on real GDP as money is neutral! c) If the Velocity of money fell 50%, then the real money supply also declined by 50% So the Fed would double the money supply which would keep nominal output the same Example: M = 10 V =2 MV = 20 then V falls 50% so: M=20 V = 1 = MV = 20